Keith

in Getting Started · 3 min read

What’s the deal with the Supplementary Retirement Scheme (SRS)?

Let us break it down for you. The Supplementary Retirement Scheme (SRS) is part of Singapore’s Government’s policy for Singaporeans, Singapore Permanent Residents (PR), and foreigners to save for retirement needs.

It’s open to Singaporeans, PRs, and even foreigners. If you’re 18 or older, you’re eligible. Unlike CPF, where contributions are compulsory, SRS is completely voluntary and comes with a bonus perk: tax relief.

Tax savings while planning for retirement—yes, please!

Here’s the magic: every dollar you put into your SRS account reduces your taxable income by the same amount (up to the contribution cap of course).

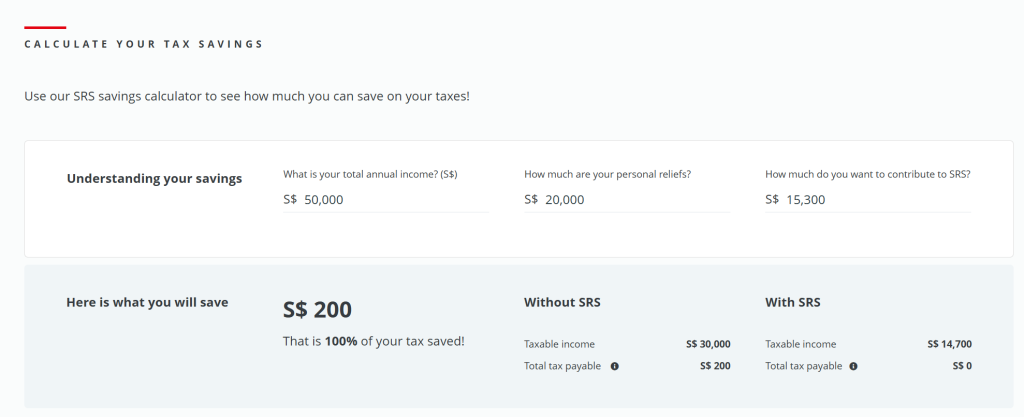

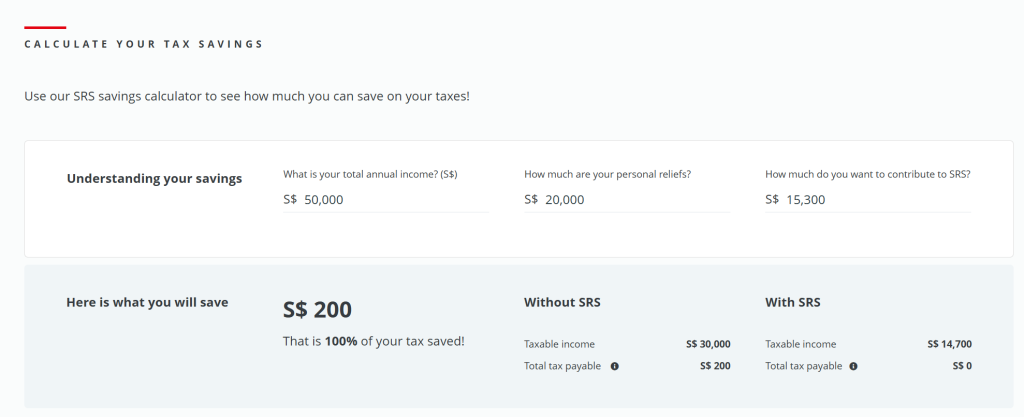

Image credit: OCBC

The illustration above shows how the SRS contribution reduces our taxable income by the amount of SRS we contribute for the year.

To put things in perspective, let’s simply crunch some numbers to see just how much tax savings SRS could bring to the table. Here’s an example based on a Singaporean contributing $15,300 to SRS with personal reliefs of $20K and annual incomes of $50K, $80K, and $120K respectively.

Image credit: OCBC

Here’s the deal: From these calculations, we can see that we could be saving at least 30% in taxes! (Though this percentage drops as our income climbs.) But SRS isn’t for everyone—it honestly shines brighter and easier for higher income earners.

Let’s say your annual income is $50K. If you contribute over $10,000 to SRS, you might save just around $200 in taxes. Not exactly life-changing, right? You’d have to ask yourself—does it even make sense to lock up that much cash for such a small benefit?

Now, flip the script for someone earning $120K a year. Contributing the max of $15,300 to SRS could save them a juicy 31% at $1,760 in tax savings while they still get to keep a majority of the annual income after contribution.

Bottom line? SRS may work better for those in higher tax brackets. But if you’re earning a healthy paycheck, it’s definitely worth running the numbers and making your money work smarter and harder.

Let your money hustle harder while having tax perks

It’s a win-win. Save on taxes now and stack up funds for your future self. Every year, you decide how much to contribute (up to $15,300 for locals and $35,700 for foreigners).

Got some extra cash sitting around? Consider parking it in your SRS? Not only will you enjoy tax relief now, but you’ll also give your money the chance to grow over time. With a wide range of investment options like equities, unit trusts, or endowment plans, you can make your funds work harder for your future.

How can I withdraw from my SRS account tax-free at retirement?

And the cherry on top: you can make penalty-free withdrawals from your SRS account starting from the statutory retirement age (currently 63 if you started contributing from 1 July 2022 onward). The retirement age applicable to you is locked in based on when you made your first SRS contribution, so any future changes won’t affect you. 😉

Once you begin, you have up to 10 years to spread out your withdrawals. These withdrawals are subject to tax in the Year of Assessment following the year you make them. But don’t worry—your SRS operator will handle the reporting, so you won’t need to declare the withdrawal in your tax return.

Now, here’s the tax-saving tip: only 50% of your SRS withdrawals are taxable. This means that if you withdraw a dollar from your SRS, only 50 cents will be considered as chargeable income.

Here’s where it gets interesting. With the current tax rates, recall that the first $20,000 of chargeable income remains tax-free. Effectively, this means one can withdraw up to $40,000 per year from the SRS account without paying any taxes.

Image credit: IRAS

Over the maximum 10-year period, this allows you to withdraw a total of $400,000 completely tax-free, based on the current tax brackets.

However, if your SRS account balance exceeds $400,000, the excess will still be taxed—but at a much lower rate than when you originally contributed. Pretty neat, right?

About Keith

Keith is an investment mentor at The Joyful Investors and is the originator behind the Moneyball Investing methodology, a strategy that facilitated his attainment of financial independence by the age of 35. He is a licensed senior wealth adviser who has more than 18 years of experience in working with asset managers to deliver wealth advisory services to private clients, with a focus on retirement planning. His expertise in portfolio management has not only enabled many clients to retire early but has also earned him accolades, including the iFast Symposium Top Wealth Advisers award, among others.

Important Information

This document is for information only and does not constitute an offer or solicitation nor be construed as a recommendation to buy or sell any of the investments mentioned. Neither The Joyful Investors Pte. Ltd. (“The Joyful Investors”) nor any of its officers or employees accepts any liability whatsoever for any loss arising from any use of this publication or its contents. The views expressed are solely the opinions of the author as of the date of this document and are subject to change based on market and other conditions.

The information provided regarding any individual securities is not intended to be used to form any basis upon which an investment decision is to be made. The information contained in this document, including any data, projections and underlying assumptions are based upon certain assumptions and analysis of information available as at the date of this document and reflects prevailing conditions, all of which are accordingly subject to change at any time without notice and The Joyful Investors is under no obligation to notify you of any of these changes.

Thanks for sharing! Actually I am curious if you guys offer investment solutions for investors as well via SRS?