The Moneyball Newsletters were first shared with our graduates of The Moneyball Investors Playbook course. They serve as a polished compendium of what we believe to be the most critical things an investor needs to know to understand what is happening with the stock market and how to navigate things over the next few months. However, enough time has now passed that they can be distributed to the general public. Note that certain portions of text or images may be blurred out or omitted altogether in this post that are covered during the courses.

Market Views And Updates

From The Desk Of TJI

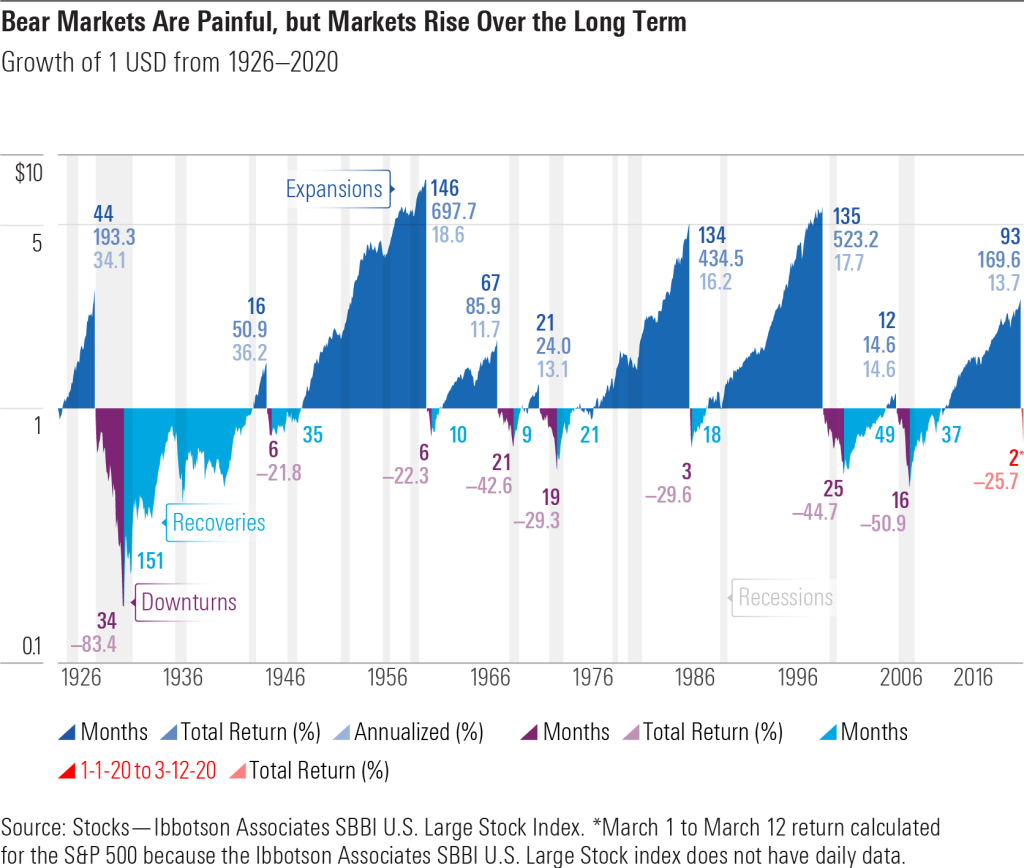

Forget the short term – only long term goal matters

The persistence of inflation concerns in 2022 has surprised many. The combination of strong demand and weak supply has pushed inflation rates high across most parts of the world. As a result, global GDP growth projections are expected to revise lower into 2023. Investors have been mainly sitting on cash after the relentless selloff. Many questions have been weighing on the back of their minds: When will inflation start to peak? When will the FED stop raising interest rates to fight against inflation? Will a recession be on the cards? When will the war in Ukraine end?

These are valid concerns from most investors’ point of view because in the short term they do play a part in affecting the market sentiment. The source of information that these investors get are often from the mainstream media and they may make irrational decisions. Being our Moneyball Investing students, you will know that the movement of the prices are in fact the things that move the news. This means that any major macro developments would then be already priced in. Hence as always, we stick on to what we do best which is using technical analysis to pinpoint possible entry points where we may have a turnaround. Obviously there is no 100% hit rates, but as time passes, we have repeatedly seen that in most instances, following our methodology, the prices which we enter have some form of buffer or limited downside. But nonetheless in the short term, noises can cause a good stock to continue to decline before it recovers. It is only in the long term that the stock prices will gravitate to its true worth.

In a protracted bear market, low can get lower and where the drawdowns can be painful and it can be psychologically difficult to do the right things. Even with our methodology of entering positions at prudent levels, we may still get a ‘sea of red’ in our portfolio. So take this opportunity to remind yourself again to always enter into any stock in tranches and at different periods. This doesn’t mean that your portfolio will not be in the red, but at least you will take lesser time to breakeven and eventually profit.

Over the years we also come to the conclusion that we would prefer to have less paper losses than missing out on possible huge turnarounds. This is important because any investor must be properly capitalized in order to stay in the game long enough. Remember to never invest using margin or borrowed money from other sources to avoid financial ruin. Many big institutions have collapsed because they were highly leveraged and while the markets moved against them. The market can remain irrational much longer than most investors can remain solvent.

Invest in a manner that in the worst case scenario (which can and will happen again), you are prepared to hold the good stocks for a good period of time so that things can work in your favor again eventually.

Focus on what matters

Understand that short term scenarios are simply too difficult to predict. Most investors cannot make helpful macro predictions or forecasts. Even analyst do not get it right and for those that do so this time, rarely get it correct for the rest of the time. There are only two groups of analysts—those who know they don’t know and those who don’t know that they don’t know. It is very difficult to deduce which expectations regarding events are already incorporated into the stock prices.

We do not have to wait for zero Covid numbers or the war to end before we accumulate or initiate our positions. It may not be exactly necessary for inflation to peak before the market can turn around. One biggest mistake we see in investors is that they make long term buy or sell decisions based on the short term unpredictable events that happen.

They believe that positive news will cause stock prices to rise while negative news will cause stock prices to fall. The fact is that the thing that really matters is how the market participants react (or choose not to react) to the news and not the news itself.

When Meta announced their plans to lay off 13% of their staff, its shares rallied by about 5%. The layoffs happen because of the slow down in in digital ad spend against the backdrop of a weakening economy. However the analyst justified the rally by explaining that investors are pleased to see that the layoffs are a sign that Meta understand how important it is to be capital efficient by cutting down on their operating costs although they probably have not seen it coming.

We see the same thing repeating in other companies as well where a seemingly negative news led to a positive outcome for the stock prices or that a seemingly positive news led to a bad outcome for the stock prices. Investors who buy or sell based on news may well be doing the worst possible thing at that point in time.

Hence focus on what matters as we always reiterate. The macro events and the near term movements of the stocks prices are unpredictable including their outcome on the stock prices. Often times, they are also not indicative of the long term prospects of the companies. So it is pointless to spend too much time on those.

Instead, we should fall back to the fundamentals of the business to see if their long term earnings potential can continue to be sustainable. And we wait for the right moment when the chart analysis has a possible turnaround moment and buy only with a good margin of safety. Invest in companies with the mindset of holding them over the long term. If the short term happens to make good enough money, indeed we can capitalize on them and take profits off the table. Otherwise the right mindset is to be only investing in companies that you believe are going to be more valuable and are comfortable to hold them for the long run.

Since it is the World Cup season, let us use an analogy that is fitting of what we are trying to bring across. Invest in the teams that you believe have the best odds of winning the World Cup, and focus less time and attention on the minute to minute happenings such as who is winning the ball now. Just like the World Cup champions is not necessarily going to win every single game in the group stages at times, good companies can have their bad moments occasionally which no doubt are still a fundamentally sound team.

Bright spots around U.S, China and Singapore markets

For U.S, the price increases seem to have peaked from the latest inflation readings in October which sent stocks surging in the last couple of weeks. Investors are cheering that perhaps the FED’s interest rate hikes may finally be cooling inflation. The Nasdaq was up decisively by 7% in a single day which marked the daily biggest percentage gain since 2020. Investors probably expect the FED to ease up further after the better-than-expected inflation report going forth. Notice the market manipulation pattern in SPY with the

Meanwhile, stocks like Adobe, Microsoft and Meta are still 30-60% down from their all time highs which offer attractive long-term upside. Their fundamentals are pretty much intact and they still have very viable business that are poised to continue to do well in many years to come.

China looks to be in a better shape to rebound back than it was in 2022. Its recent plan to reopen would help the economy to gain momentum. While zero Covid policy remains, the rules have begun to be more relaxed which ultimately improve the overall sentiment. The narrative that China wants to bring across seems to bode help for its markets nowadays. China just granted its tech giant Tencent 70 new computer game titles also signals a relaxing of China’s attitude towards tech firms.

Closer to home in Singapore, for those of you who are building your dividend portfolio, some of our favorite REITs like Mapletree Industrial REIT, CapitaLand Integrated Commercial Trust, Frasers Centrepoint Trust are yielding 5-6% at current price levels. Less capital would be required to build the amount of dividends you need as compared to the last couple of years where yield was closer to 4% or so. The potential upside for capital appreciation is also very attractive.

We capitalized on the current sentiment to nibble on the strong stocks that we have always wanted but were out of reach the last couple of years. Patience pays a lot in the stock markets and good things come to those who wait. Lastly, as we approach into the new year, here’s wishing everyone a happy 2023 and may your portfolio soar to greater heights.

Onward And Upward,

The Joyful Investors

The Moneyball Newsletters are published for graduates of The Moneyball Investors Playbook. Our graduates have access to more in-depth trade alerts and actionable insights in our private Telegram chat group. For the general public, you may join us on our free Telegram channel and follow us on our socials @thejoyfulinvestors for more frequent market updates and investing tips as well.

Important Information

This document is for information only and does not constitute an offer or solicitation nor be construed as a recommendation to buy or sell any of the investments mentioned. Neither The Joyful Investors Pte. Ltd. (“The Joyful Investors”) nor any of its officers or employees accepts any liability whatsoever for any loss arising from any use of this publication or its contents. The views expressed are solely the opinions of the author as of the date of this document and are subject to change based on market and other conditions.

The information provided regarding any individual securities is not intended to be used to form any basis upon which an investment decision is to be made. The information contained in this document, including any data, projections and underlying assumptions are based upon certain assumptions and analysis of information available as at the date of this document and reflects prevailing conditions, all of which are accordingly subject to change at any time without notice and The Joyful Investors is under no obligation to notify you of any of these changes.

· · ·

Have you enjoyed this article? We’d be grateful if you would share this useful content to your friends who may benefit from it as well.