Kathy

in Memos & Musings · 6 min read

After conducting some of our usual flagship courses and workshops at the start of October, we found some time this week to do a recap of our growth and dividend portfolio’s year to date results as 2023 Q3 ends. Reflecting on it, it seems to be an opportune moment to be able to share our portfolio’s performance, given the significant challenges most markets have faced. While it is relatively easy to achieve remarkable returns during bull markets, it requires a different kind of skill and resilience in times like these.

In our previous July 2023 portfolio update, we used the image metaphor of a flying elephant to subtly suggest that the markets were more likely to experience a downturn in the third quarter rather than continuing to rally upwards. The S&P 500 reached its peak at the end of July and retraced by more than 8% in early October. The most affected sectors during this recent pullback were in the consumer defensive and consumer cyclical industries.

Portfolio Performance

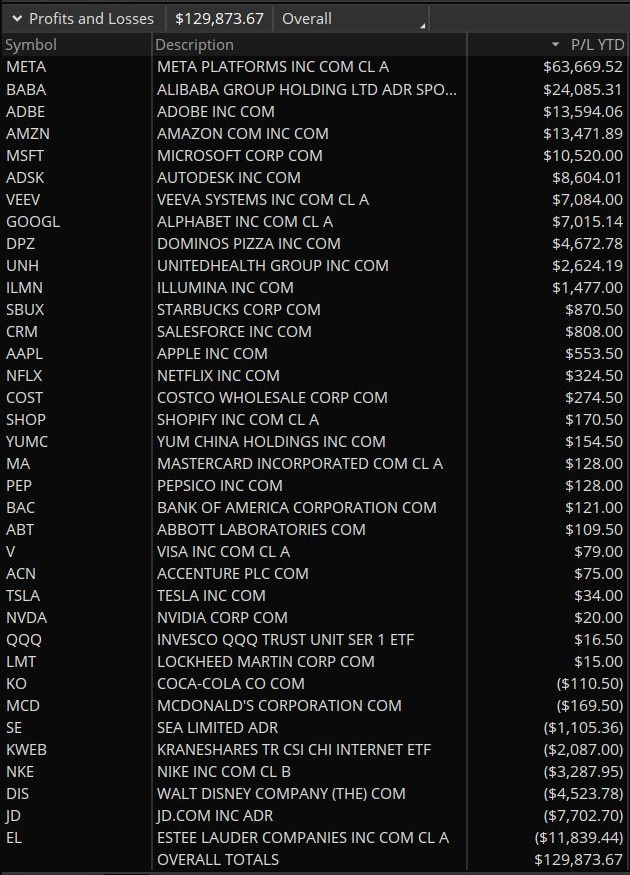

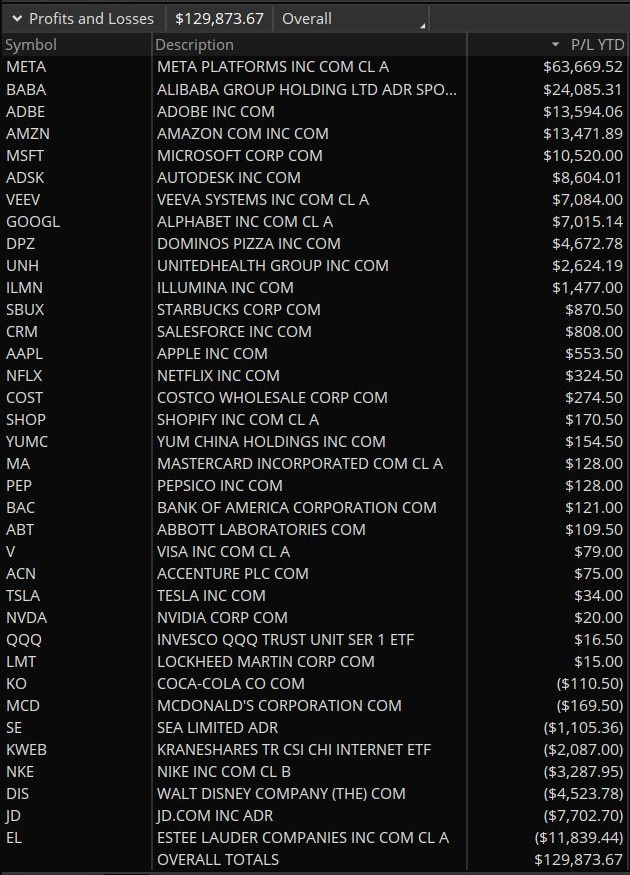

During the close of the market for Q3 2023, the SPDR S&P 500 ETF (SPY) was up by 11% roughly year to date. Whereas for iShares MSCI China ETF (MCHI) it was down by 11%. For our growth investing portfolio consisting of both US and China markets, it was up by 59% during this same period.

The screenshot below was captured from one of our growth portfolios in TD Ameritrade. Notably, we faced significant paper losses from holdings such as Estee Lauder Companies and JD.com, which had fallen by a whopping 44% and 53%, respectively this year. We managed to cushion some of these huge declines by investing only when the risk to reward was in our favor using technical analysis. Additionally, we employed occasional options strategies to generate additional gains without relying solely on stock price appreciation.

As investors, it’s impossible to entirely eliminate paper losses or perfectly time all our trades. The crucial aspect lies in how much we gain when our decisions are correct and how effectively we manage drawdowns when we don’t make the right calls. As long as we stay mindful in this aspect, we can still achieve overall success, even if we encounter setbacks in individual positions. 🏅

YTD performance of our US/China growth portfolio

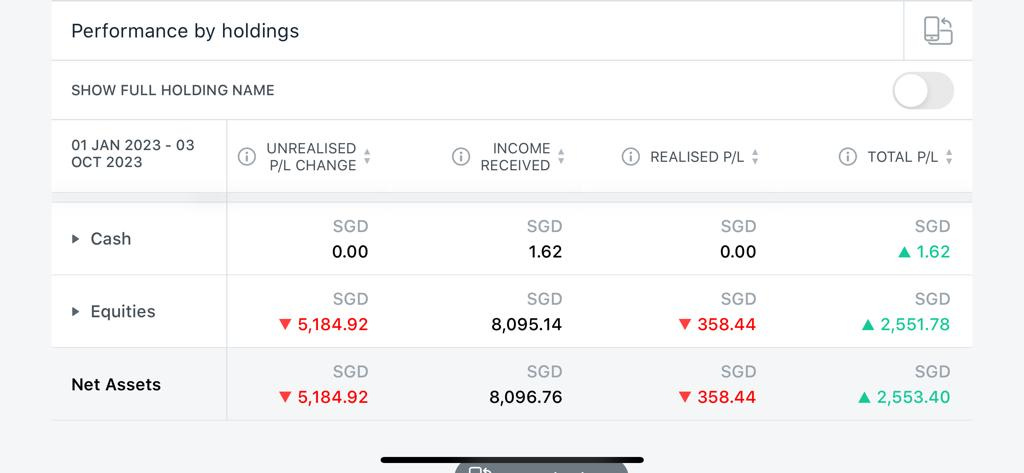

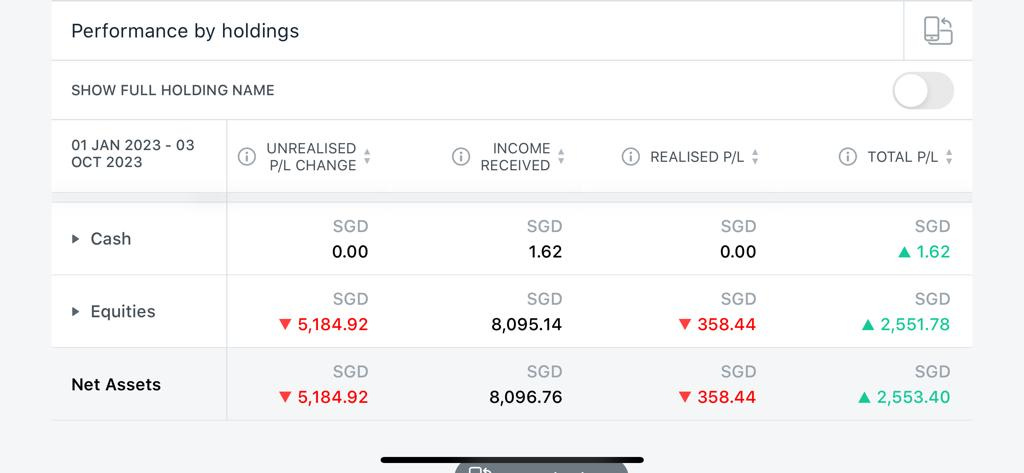

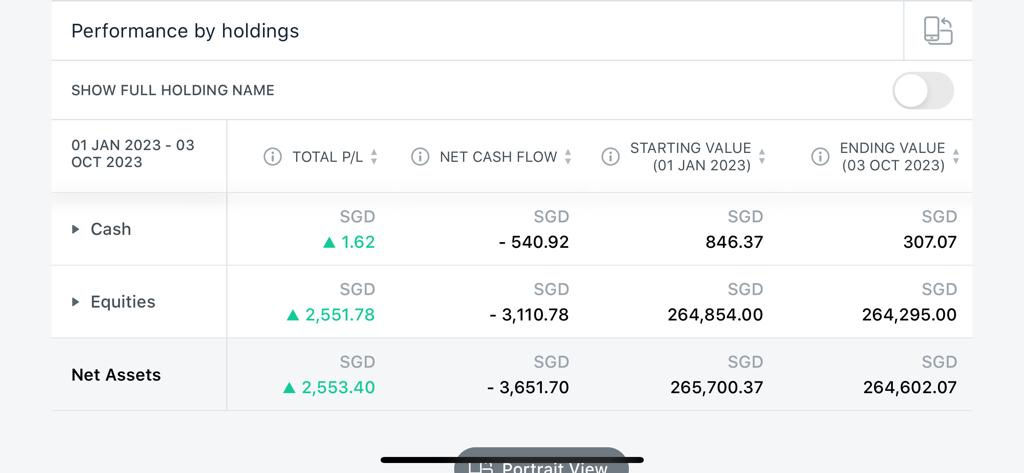

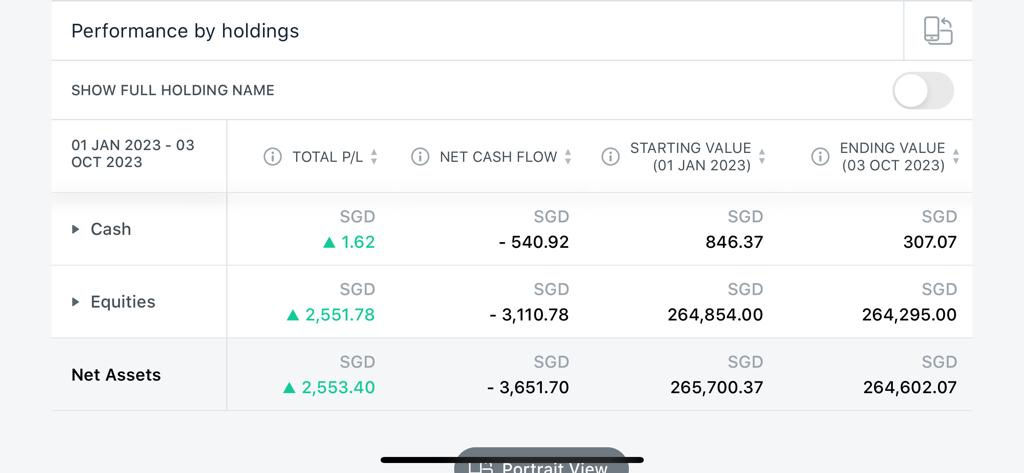

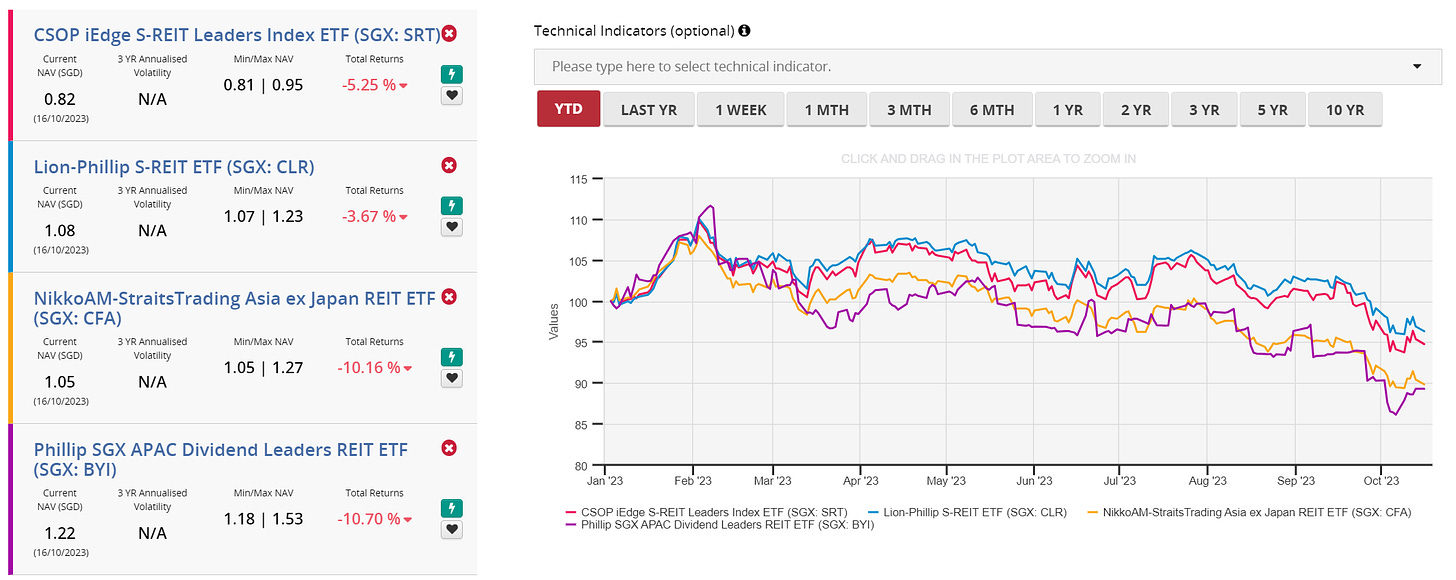

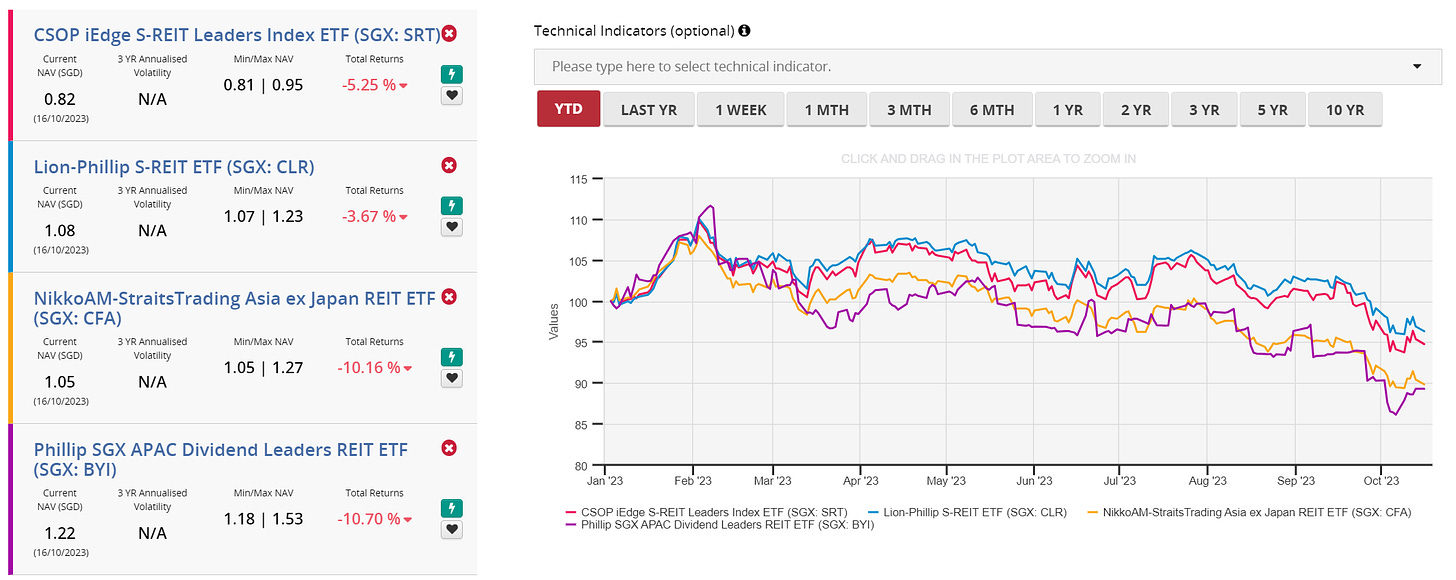

Regarding our dividend portfolio, which primarily consists of Singapore REITs, we were able to capture a screenshot on October 3rd, 2023, from DBS. The screenshot below revealed that our year-to-date performance, encompassing both dividends received and accounting for capital gains or losses, had increased by approximately 1%, or rather largely unchanged. This comes after the severe downturn in REITs over the past few months. In comparison, the REITs ETFs, on average, have experienced a decrease of 7.4% in their year-to-date performance.

Several individual REITs underwent significant corrections throughout the year. For instance, Mapletree Pan Asia Commercial Trust saw a 20% decline, CapitaLand China Trust experienced a 25% drop, and Lendlease Global Commercial REIT plummeted by 27%.

Even some of the well-established and popular REITs, such as CapitaLand Ascendas REIT, showed a 7% decline, CapitaLand Integrated Commercial Trust was down by 14%, Mapletree Logistics Trust decreased by 4%, and CapitaLand Ascott Trust registered a 15% decline.

Things have since worsened we last did an article on “Are REITs supposed to be stable and safe investments” back in August 2023.

Our dividend portfolio managed to weather the turbulence primarily due to our Moneyball investing approach. This strategy involved securing gains on some of the high-performing REITs earlier in the year, disregarding analyst reports, and selectively choosing fundamentally strong REITs to invest in, all at attractive price points where the risk-to-reward ratio favored us.

In situations like the current one, we view a draw as a victory. By minimizing our losses at this point, we may position ourselves to potentially achieve greater gains when the REIT market eventually rebounds.

YTD P/L of our Singapore REITs portfolio

YTD performance of the REITs ETF

Don’t take what you see at face value

At this juncture, we think it would be nice to caution investors that sometimes we need to look under the hood with the things that are showcased on social media. It’s quite common to focus on one aspect while overlooking the rest, and it’s particularly easy to be swayed by what is right in front of our eyes. 🕶️

For example, on the topic of REITs investing, some investors who share their substantial dividend earnings may tend to downplay or omit any mention of the accompanying capital losses. This becomes evident when reviewing the price charts of the stocks in their portfolios. Some of the more seasoned folks in our InvestingNote community were quick to point out some of the hard truths that are less obvious to most retail investors. (Watch: The Untold Truths Of Income Investing)

In our introductory workshops on REITs investing, one of the initial lessons we always emphasize is the importance of factoring in both capital gains and losses, rather than relying solely on dividends to calculate profits.

It is important to look beyond dividend yield when calculating the profits.

Accumulating dividends can be straightforward, especially by investing a significant sum of money and falling into the trap of high dividend yields. The case with most investors who have amassed substantial dividend income which we personally know, have done so because of substantial employment earnings or inheritance and they’ve subsequently allocated these funds to dividend-paying stocks. Having a huge sum of dividends is almost guaranteed as long as one has an ample amount of capital. On the other hand, to generate solid overall returns, by considering both capital gains and losses, requires a skill set that goes beyond just having the mere capital to invest.

Furthermore, it is also important for one to recognize that having a sizable portfolio is essential for a comfortable retirement with REITs. (Watch: How Big A Portfolio Do You Need To Live On Dividends?) If you don’t have the advantage of inherited wealth, like most of us do, it becomes equally important to explore growth investing as a means to grow your capital.

Simply relying on dollar-cost averaging into a REITs ETF, as it’s sometimes advocated, isn’t a reliable path to achieving financial independence and retiring early (FIRE). REITs are inherently cyclical and making substantial gains can be challenging if you consistently purchase them at every phase of the business cycle. Nevertheless, understanding how REITs can eventually work in your favor as you amass wealth enables you to concurrently build your dividend portfolio while accelerating your capital growth in your growth portfolio. 🚀

Navigating market volatility

Most mainstream advice on managing volatility is to simply diversify and ignore the market swings altogether. This advice is reasonable and can be effective for investors with extended investment horizons. However, it may not be suitable for those striving to achieve Financial Independence, Retire Early (FIRE). Achieving FIRE necessitates an investment approach that seeks outsized returns and consistently relies on possessing a competitive edge in the market.

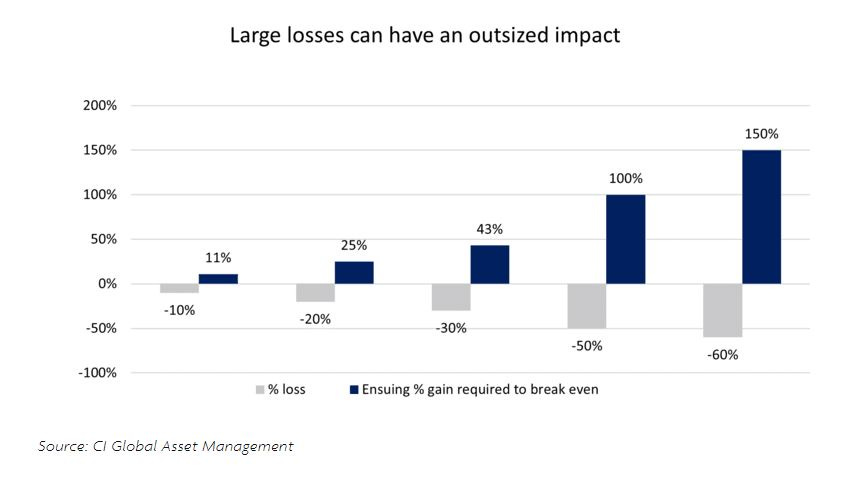

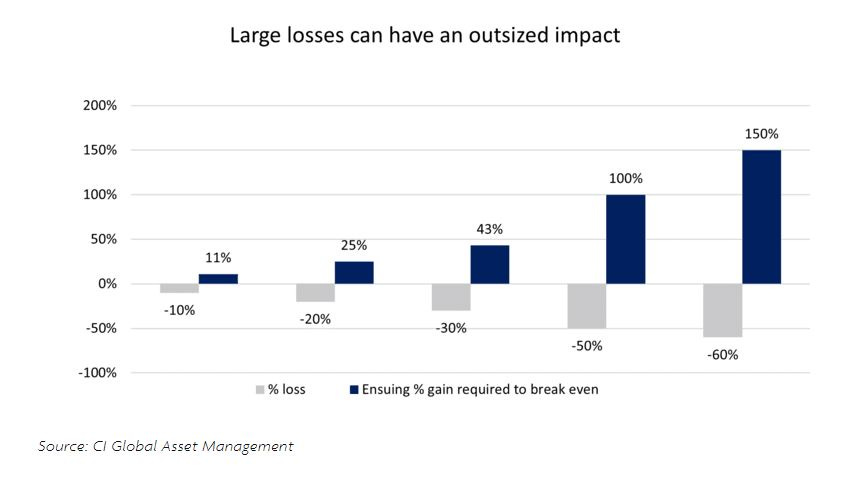

Consequently, it is equally crucial to be aware of potential downside risks since significant losses can significantly affect the long-term health of our investment portfolio. The image below emphasizes this concept.

During InvestFair 2023, we also discussed strategies for mitigating losses and effectively handling downside market volatility. We discussed the importance of investing exclusively in high-quality companies, acquiring them at advantageous prices, and adopting asymmetrical investment strategies.

For those of you who have attended the talk, you can now witness how the principles we presented in theory have translated into real-world outcomes. We do walk the talk and practice what we preach together with our mentees and the community.

As shared above, our Moneyball investing methodology fared reasonably fine in the diverse market conditions year to date. Our growth portfolio is up by 59% so far, while the US market has seen an 11% increase and the Chinese market has declined by 11%. Our dividend portfolio has gained 1%, in contrast to the REITs ETF, which has fallen by 7.4%.

As investors, we should be opportunity minded and not problem minded. Never let a good crisis that comes along go to waste and when possible, turn them into profitable opportunities. The markets can be chaotic but our results don’t necessarily have to be.

About Kathy

Co-Founder of The Joyful Investors and Co-CIO of InvestingNote Portfolio. I graduated with a degree in Economics in National University of Singapore (NUS). My previous experience with traders at the Merrill Lynch enable me to realize many counter-intuitive truths about how the financial markets work and to uncover the challenges faced by many new investors. Investing can be astoundingly simple, and my goal is to make financial education accessible and easy to understand for everyone.

Important Information

This document is for information only and does not constitute an offer or solicitation nor be construed as a recommendation to buy or sell any of the investments mentioned. Neither The Joyful Investors Pte. Ltd. (“The Joyful Investors”) nor any of its officers or employees accepts any liability whatsoever for any loss arising from any use of this publication or its contents. The views expressed are solely the opinions of the author as of the date of this document and are subject to change based on market and other conditions.

The information provided regarding any individual securities is not intended to be used to form any basis upon which an investment decision is to be made. The information contained in this document, including any data, projections and underlying assumptions are based upon certain assumptions and analysis of information available as at the date of this document and reflects prevailing conditions, all of which are accordingly subject to change at any time without notice and The Joyful Investors is under no obligation to notify you of any of these changes.

· · ·

Have you enjoyed this article? We’d be grateful if you would share this useful content to your friends who may benefit from it as well.