Hazelle

in Memos & Musings · 3 min read

The Joyful Investors and AlphaInvest are proud to present the next instalment of our Corporate Highlight series, where we bring investors direct access to strategic insights from the leaders of listed companies.

In this feature, Mr. Lim Chung Chun, CEO of iFAST Corporation, shared with us on how the company is evolving from a digital wealth platform into a globally integrated banking and wealth management ecosystem.

At a Glance: What iFAST Does

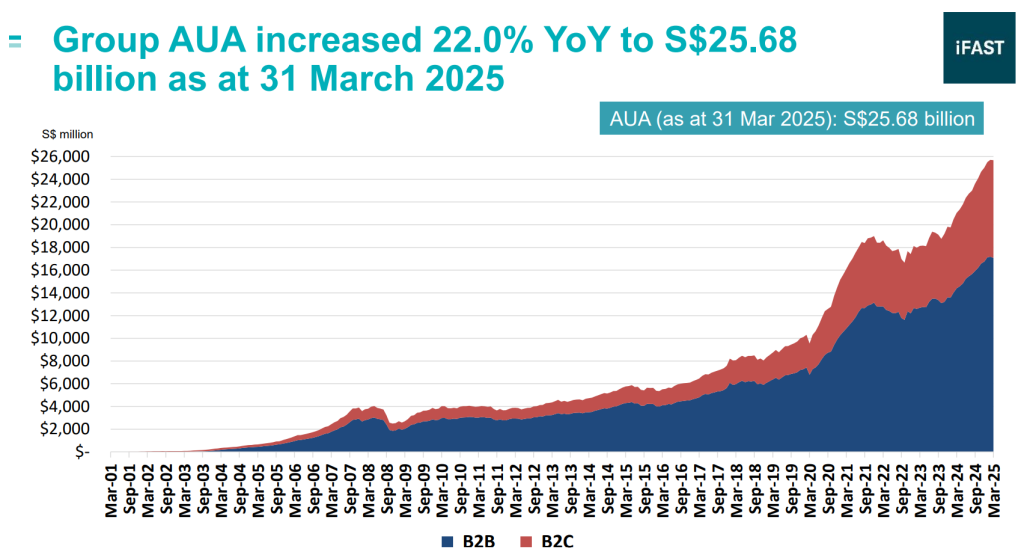

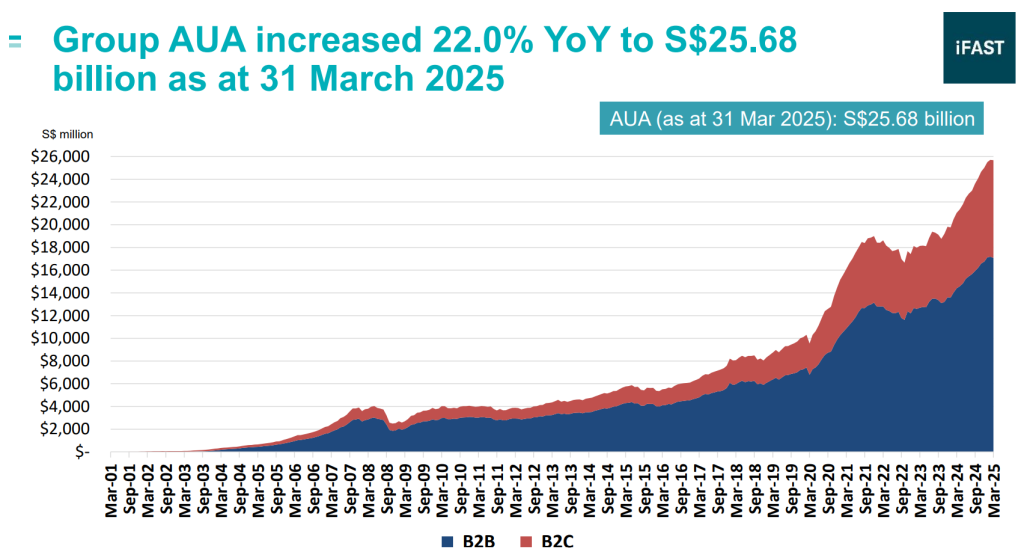

Founded with a vision to democratize investing, iFAST Corporation today operates as a global digital banking and wealth management platform with both B2B and B2C segments.

On the B2C side, retail investors use FSMOne to access a broad range of products, including unit trusts, ETFs, stocks, bonds, and multi-currency cash solutions.

On the B2B side, which accounts for around 70% of the wealth management platform business, iFAST works with financial advisors, offering them the tools needed for investment administration, custody services, and a full suite of digital tools to enhance their advisory capabilities.

The group also runs iFAST Global Bank, a digital multi-currency bank targeting global customers.

In Hong Kong, iFAST’s ePension team is responsible for executing scheme operation services and user delivery services for the eMPF (Mandatory Provident Fund) platform. The “ePension” name refers to iFAST’s broader pension-related business, which extends beyond its role in the eMPF system.

Embracing Growth While Managing Complexity

Lim described iFAST’s challenges as dynamic and evolving:

- Staying competitive in the fast-moving wealth management market

- Scaling operations in Hong Kong’s ePension system, including rapid onboarding and training of new staff

- Continuously enhancing digital tools to meet rising customer expectations

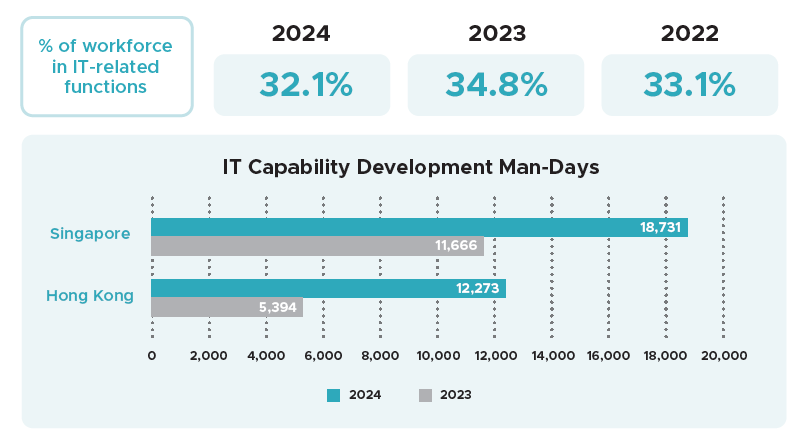

In the last 25 years, iFAST has been leveraging on technology and digital platforms. Today, it employs over 400 IT-related staff across the group to enable rapid product innovation and lean operational execution.

“We believe we are able to handle IT delivery better than most financial institutions, and at a lower cost — largely thanks to our in-house tech team,” said Lim.

In 2024, iFAST recorded a significant increase in man-days dedicated to IT development and maintenance across both Singapore and Hong Kong — a clear reflection of its ongoing investment in digital transformation and the strengthening of core infrastructure in key markets.

Credits: iFAST

What Sets iFAST Apart

iFAST’s competitive edge lies in its ability to continuously evolve in business model, technology, and strategic direction.

Lim highlighted that, “The business world changes all the time, from consumer expectations to revenue models. Many companies struggle to keep up and evolve. What sets us apart is our willingness and ability to adapt, while staying clear on where we want to be five or ten years down the road.”

Case in point: rather than relying on transactional revenue, the company has built a model centered on recurring income, aligning its growth with the long-term success of its clients and partners.

Its in-house technology team also gives iFAST the ability to deliver and iterate digital solutions more effectively than many larger financial institutions. This allows for continuous improvements in investor experience, operational efficiency, and advisor support.

Lim also emphasized the importance of staying ahead through proactive licensing. The acquisition of a UK-based bank over three years ago, the company’s largest investment to date, marked a significant strategic step. It enabled iFAST to expand beyond capital market services into digital banking, giving the group a foundational layer to build a more integrated global platform.

“That move wasn’t just bold — it was necessary,” he noted. “We now have the infrastructure to scale and serve clients globally, not just as a wealth platform, but as a complete financial services ecosystem.”

This mindset of long-term planning, strategic reinvestment, and forward-looking execution forms the core of iFAST’s identity — and positions it well for sustained growth in an increasingly borderless financial world.

Balancing Growth, Profitability, and Shareholder Returns

For iFAST, balancing growth investments with profitability and shareholder expectations isn’t about choosing one over the other — it’s about having the right time horizon.

“If you take a one-year view, any investment today hits the bottom line immediately. That creates a conflict between short-term profit and long-term competitiveness,” Lim explained.

Instead, iFAST adopts a medium- to long-term mindset, planning decisions with a three-, five-, or even ten-year view. This perspective enables the company to make strategic moves that may weigh on near-term profitability but lay the groundwork for sustainable returns.

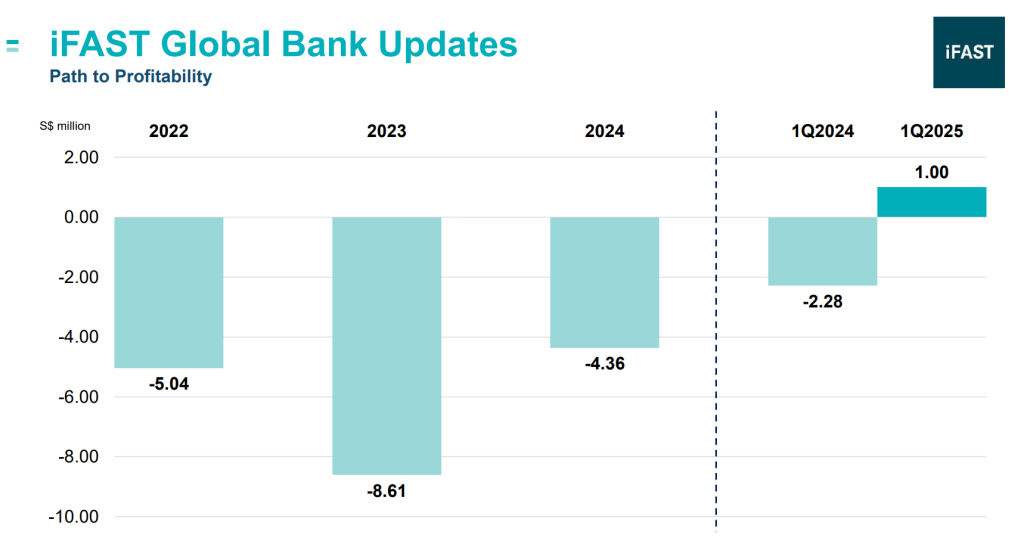

One clear example is the acquisition of the UK bank — a major investment of around S$70 million. While the bank operated at a loss during its initial years under iFAST, it has since turned the corner and is now contributing positively to the Group’s performance. In 1Q 2025, the bank recorded a S$1 million profit, marking its second consecutive quarterly profit and a significant reversal from the S$2.28 million loss in the same period a year ago.

Credits: iFAST

“Once you think long term, the decision-making becomes clearer,” said Lim. “The returns may take time, but if you communicate your vision and rationale clearly, shareholders will understand and support the journey.”

This philosophy of long-term value creation — paired with strategic transparency — underpins how iFAST aligns growth, profitability, and shareholder interests.

A Bold Global Vision for the Future

Lim outlined a compelling vision: to become a truly global digital wealth and banking platform — serving retail and mass affluent investors worldwide.

“Just like how Netflix or Spotify operate globally from a few key countries, we see the same possibility for wealth and banking services — and that’s the space iFAST is moving into,” Lim shared.

Unlike global private banks serving only high-net-worth individuals, iFAST aims to deliver borderless, accessible financial services to a broader segment of the population.

The company’s goal is to grow assets under administration (AUA) from S$25.68 billion today to S$100 billion by 2028–2030. This follows consistent growth from S$6.1 billion AUA in 2016 to over S$25.68 billion in Q1 2025, reflecting strong platform scalability and regional expansion.

Credits: iFAST

About iFAST Corporation

iFAST Corporation Ltd. is a Singapore-headquartered and SGX-listed wealth management fintech platform, incorporated in 2000. The Group has an international footprint spanning Singapore, Hong Kong, Malaysia, China, and the United Kingdom.

iFAST offers access to over 25,000 investment products, including unit trusts, bonds, Singapore Government Securities (SGS), stocks, ETFs, and insurance products. In addition to its investment offerings, the Group provides a broad suite of services such as wealth management solutions, multi-currency banking, pension administration, research, fintech solutions and more.

This corporate highlight is brought to you by a joint collaboration between AlphaInvest and The Joyful Investors.

About Hazelle

Chief trainer of The Moneyball Investors Playbook program and founder of The Joyful Investors, a financial education firm that seeks to help avid investors learn to invest better and make the journey a joyful one. I graduated with a first class honors in Bachelor of Accountancy from Nanyang Technological University (NTU) and started my auditing career in one of the Big Four. I believe that once we know how to build our wealth sustainably, we can then live our best lives ever.

Important Information

This document is for information only and does not constitute an offer or solicitation nor be construed as a recommendation to buy or sell any of the investments mentioned. Neither The Joyful Investors Pte. Ltd. (“The Joyful Investors”) nor any of its officers or employees accepts any liability whatsoever for any loss arising from any use of this publication or its contents. The views expressed are solely the opinions of the author as of the date of this document and are subject to change based on market and other conditions.

The information provided regarding any individual securities is not intended to be used to form any basis upon which an investment decision is to be made. The information contained in this document, including any data, projections and underlying assumptions are based upon certain assumptions and analysis of information available as at the date of this document and reflects prevailing conditions, all of which are accordingly subject to change at any time without notice and The Joyful Investors is under no obligation to notify you of any of these changes.

· · ·

Have you enjoyed this article? We’d be grateful if you would share this useful content to your friends who may benefit from it as well.