Kathy

in Memos & Musings · 4 min read

What happened?

U.S. stock markets took a sharp nosedive on 10th March 2025 as mounting fears over President Donald Trump’s tariff policies rattled investors, raising concerns that the world’s largest economy could be heading toward a recession.

Worries about an impending downturn have triggered a massive sell-off, leading to a staggering $1.7 trillion being wiped off the S&P 500—widely regarded as the most important benchmark for global equities. The index tumbled 2.7% in a single session, extending its losses to 9% from its record high reached on February 19. This steep decline underscores the deepening anxiety among investors, who fear that escalating trade tensions could derail economic growth and shake financial markets even further.

At this moment, what investors and market participants desperately need is a sense of clarity and direction. Unfortunately, the markets seem to be offering anything but that. Instead of providing reassurance or stability, they continue to be clouded by uncertainty, leaving traders and analysts struggling to make sense of the ever-changing landscape. With volatility running high and sentiment shifting rapidly, the lack of clear signals only adds to the prevailing anxiety, making it even more challenging to navigate the current economic environment.

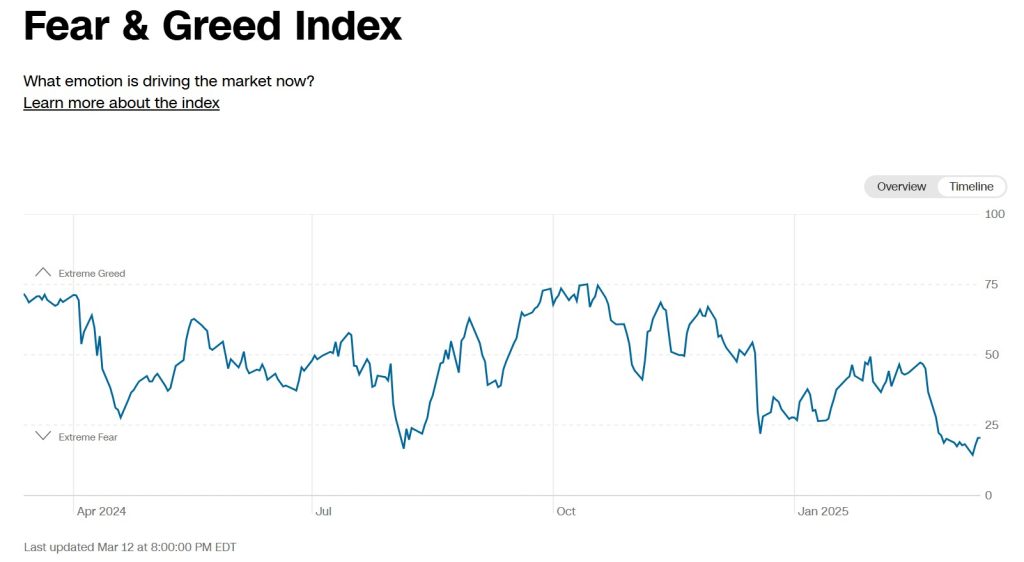

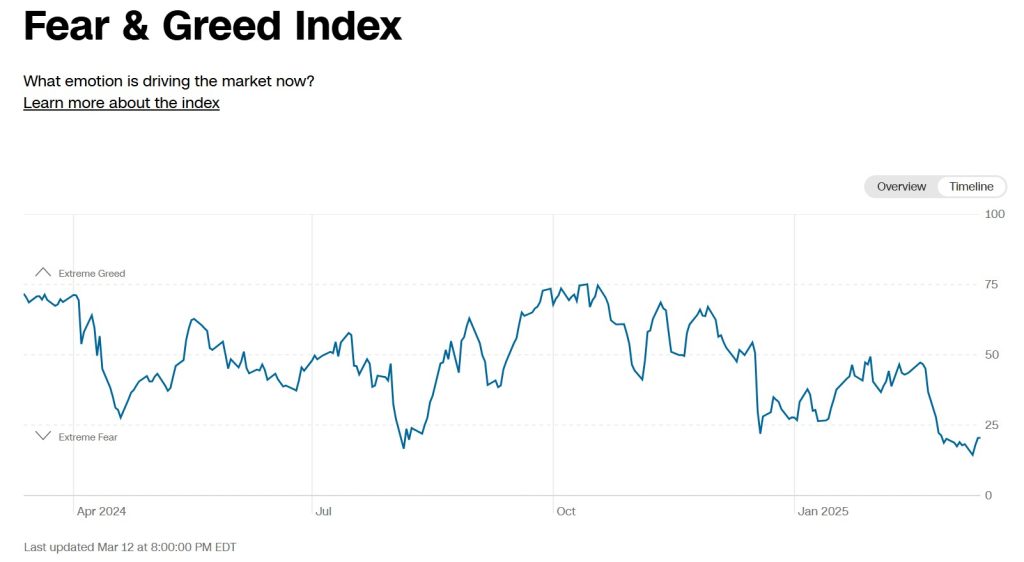

To further underscore the prevailing sense of dread, the Fear & Greed Index stands at a mere 18—at the extreme “fear” end of the spectrum. This reading highlights the intense pessimism gripping the market, amplifying concerns and adding to the sense of unease that many are currently experiencing.

In times like these, it’s essential to recognize that investors are not a homogenous group. As we turn to forums and the financial media, we see four distinct types of investors emerging in response to this turmoil, each navigating the storm in their own way.

Broadly speaking, there are four types of people in the stock markets right now or at any time:

1️⃣ Those who have no clue what’s happening and are searching for guidance.

2️⃣ Those who have no clue what’s happening but are giving guidance anyway.

3️⃣ Those who know just enough to realize they can’t rely on anyone and are at the market’s mercy.

4️⃣ Those who know just enough to think in bets and find an edge.

Most people in the investing world belong to the first two groups—the creators of the content and the viewers who follow them. These are the individuals who are either actively producing content, sharing their analysis, opinions, and predictions, or passively consuming content, hoping to find guidance or the “secret” to success.

Let’s read on to understand all the 4 types of investors in the stock markets:

Type 1: The Followers – Always Searching, Never Finding

Most investors fall into this category. They believe that successful investing is simply about staying updated on the latest market news and following the right expert. Their journey typically starts with YouTube videos, financial blogs, or books, gravitating toward influencers with large followings. But when the advice they receive doesn’t yield the results they expect, they quickly move on, searching for someone else who seems to have the “holy grail” to investing success.

This endless cycle of searching and switching keeps them in a perpetual state of learning—but not progressing. They consume financial content for years, sometimes even a decade, yet their portfolio performance remains stagnant. They convince themselves that they’re improving, but in reality, they’re just accumulating information without a real understanding of how to apply it.

Many in this group blindly accept mainstream financial wisdom, such as the idea that compounding will magically generate wealth over time. They’ll see a chart showing a steady 10% annual return and take it at face value, believing that simply staying invested will guarantee them long-term success. Yet, they fail to grasp the nuances of risk, market cycles, or the fact that real-world investing is far messier than a neatly plotted line on a graph.

Type 2: The “Gurus” – Masters of Hindsight

This group of investors firmly believes they have cracked the code of the stock market. Armed with economic theories or some trading strategies, they can confidently predict how events will unfold. They often introduce themselves as economists, traders, or market analysts—titles that add weight to their opinions. But their view of the market is overly simplistic, built on “if A, then B” logic.

These individuals often create content—whether in the form of YouTube videos, blog posts, or Twitter threads—explaining why a stock just soared or crashed. Their breakdowns are articulate and logical, but there’s one catch: their analysis only comes after the event has already happened. They excel at fitting past events into neat narratives, making it seem as though the outcome was inevitable all along. But ask them to predict the future with the same level of certainty, and the clarity suddenly fades.

To be fair, many in this category are highly knowledgeable. They understand macroeconomics, company financials, and trading indicators. But in investing what matters is whether that knowledge can be used in a manner that translates into actual results—whether it moves the needle for their portfolio.

As Warren Buffett wisely puts it:

“Knowledge must be knowable and important.”

Buffett’s point is simple but profound: not all knowledge is created equal. Many investors consume an endless amount of information, from economic reports to every other market developments, believing that more knowledge automatically leads to better results. But in reality, much of this information falls into one of two categories:

- Unknowable Knowledge – These are things that no one can accurately predict, such as where interest rates will be in five years, whether a recession is coming next quarter, or which stock will be the next big winner. Many so-called experts pretend to have answers to these questions, but the truth is, they don’t. Acting on unknowable information often leads to poor investment decisions based on speculation rather than sound strategy.

- Unimportant Knowledge – This includes information that may be interesting or intellectually stimulating but does little to improve investment outcomes. For example, knowing the intricate details of global trade policy or following every minor market fluctuation might make someone sound informed, but does it actually help them make better investment decisions? Often, the answer is no.

Buffett’s approach to investing is grounded in focusing only on knowledge that is both knowable and important—information that can actually give an investor an edge. This includes understanding business fundamentals, identifying durable competitive advantages, and having the discipline to stick to a sound investment strategy over time.

These “gurus” may sound convincing, but true investing wisdom lies not in post-event explanations but in the ability to make decisions that create real financial outcomes.

The issue with many of the so-called experts in Type 2 is that while they possess a wealth of knowledge, much of it fails to pass Buffett’s test. They’re excellent at explaining past events but often fall short when it comes to making decisions that drive meaningful financial outcomes. What we’ve observed with Type 2 investors is that it’s not what they don’t know that causes trouble, but rather the things they believe they know that turn out to be false. In investing, true wisdom isn’t about sounding smart—it’s about understanding what truly matters and taking decisive action based on that insight.

Type 3: The Enlightened, Yet Passive Investor

These investors have reached an important realization—markets are unpredictable, and simplistic “if A, then B” thinking does not work in the stock market. They understand that what looks good today can turn bad tomorrow, and what seems disastrous now might be forgotten in a month. Because of this awareness, they remain emotionally detached from market swings, refusing to get overly excited during rallies or too fearful during downturns.

They tend to adopt a long-term approach, believing that if their investment thesis is sound, time will eventually prove them right. This makes them cautious, patient, and less reactive to short-term noise. They don’t chase the hottest stock or panic during a sell-off. Instead, they wait for the right conditions, trusting that market cycles will work in their favor over time.

However, their strength can also be their greatest weakness—inaction. Unlike Type 1 investors who are constantly searching for guidance or Type 2 investors who confidently (but often mistakenly) predict the market, Type 3 investors are reluctant to act too soon. They want to let things “develop” before committing. But in many cases, by the time they finally decide to enter, they are either late to the party or buying in the middle of an already established trend.

This passivity often results in missed opportunities. While their mindset protects them from emotional trading mistakes, it also keeps them on the sidelines longer than necessary. When they do act, it’s often when a trend is already well underway, meaning they miss the biggest early gains or find themselves entering just as momentum begins to fade.

The enlightened investor understands that markets are uncertain—but without the ability to take decisive action when the odds are favorable, they risk being mere spectators in a game where timing and execution still matter.

Type 4: The Strategic Investor – Thinking in Probabilities, Playing to Win

The only way to truly outperform the market is to think like a Type 4 investor. These individuals recognize that absolute certainty in investing is a myth, and yet, within the uncertainty, they must make decisions. Unlike passive investors who wait for perfect clarity, Type 4 investors understand that clarity is expensive—by the time the market gives it to you, the best opportunities are gone.

Instead of seeking certainty, they embrace probabilistic thinking. Every decision is framed in terms of risk, reward, and the likelihood of different outcomes. They don’t fixate on being right all the time. They know that in investing, you don’t have to be right on every trade—you just have to be right more often than you’re wrong, and when you’re right, you need to make much more than you lose when you’re wrong.

Type 4 investors think like professional gamblers or casino owners. They don’t need to predict every single market move correctly; they only need an edge—a small but consistent advantage that compounds over time. It’s like card counting in blackjack. They don’t need to know the result of every single hand, but if they play with a slight statistical edge, they will win in the long run.

They understand that:

- Not knowing the outcome doesn’t mean you can’t play. They assess probabilities and act when the risk-reward setup is favorable.

- Playing the long game matters more than short-term wins or losses. Even if they lose a few rounds, they stay in the game long enough to let their edge work in their favor.

- Pulling the trigger is key. They don’t just analyze—they act when the odds are in their favor, taking calculated risks instead of waiting for the perfect moment.

This Type 4 mindset separates them from other investors. Where Type 1 chases trends, Type 2 explains the past, and Type 3 watches from the sidelines, Type 4 is the one actually making moves that lead to long-term success.

Most Investors Are Better Off Sticking to Index Funds

The cold hard truth is that most investors fall into Type 1, Type 2, or Type 3 and the best approach for them is simple: invest in an index fund or dollar-cost average into the market. Why? Because these investors either:

- (Type 1) Don’t know what they don’t know – They are constantly looking for the “right” person to follow, hopping from one guru to another, but never developing real conviction in their own investment decisions.

- (Type 2) Think they know, but don’t actually have an edge – They analyze the past perfectly but struggle to predict the future with consistency.

- (Type 3) Understand the uncertainty of the market but hesitate to act – They wait for perfect conditions, often entering too late or missing opportunities entirely.

The problem? Most people fall into these three categories. And because they have all tried different approaches and failed miserably, they come together and reinforce the belief that the only “smart” way to invest is to passively buy the index.

They tell each other:

- “Timing the market doesn’t work.”

- “Active investing is just gambling.”

- “No one can beat the market consistently.”

And while this advice is not wrong, it also comes from a place of self-justification. Since they haven’t been able to beat the market themselves, they conclude that no one can. Instead of admitting their own shortcomings, they assume the system itself is unbeatable.

In reality, Type 4 investors prove otherwise. The rare few who develop their craft, think in probabilities, and take calculated risks can outperform the market over time. But for those unwilling to put in the effort to develop that skill, indexing is indeed the safest bet.

Do What Fits You

Index investing and dollar-cost averaging are great strategies for those who prefer a hands-off approach. These methods are designed to match market returns, and outperforming the markets may not always be the goal.

But for those ready to take their investing to the next level and seek better risk-adjusted returns, the key lies in learning to think and act like a Type 4 investor—someone who understands probabilities, takes calculated risks, and positions themselves for asymmetric rewards.

That’s exactly what we aim to help investors achieve with the Moneyball Investors Playbook course. Our carefully crafted modules are designed to sharpen your ability to think critically, assess opportunities with a probabilistic mindset, and make investment decisions that go beyond simply following the crowd.

If you’re tired of feeling stuck, endlessly cycling through market narratives, or waiting for the “perfect” moment, it’s time to take control and level up. Learn how to make decisive actions, spot high-probability setups, and develop a strategy that gives you a real edge in the market. If this sounds like the breakthrough you’re looking for, drop us your contact details, and we’ll let you know when the next enrollment opens.

Because at the end of the day, real wealth isn’t built by simply keeping pace with the market—it’s built by knowing when and how to take the right risks.

More insights from The Joyful Investors

🤜🏽 Like what you read? Get more investing ideas and market updates by joining our community at bit.ly/FireWithTJI

About Kathy

Co-Founder of The Joyful Investors and Co-CIO of InvestingNote Portfolio. I graduated with a degree in Economics in National University of Singapore (NUS). My previous experience with traders at the Merrill Lynch enable me to realize many counter-intuitive truths about how the financial markets work and to uncover the challenges faced by many new investors. Investing can be astoundingly simple, and my goal is to make financial education accessible and easy to understand for everyone.

Important Information

This document is for information only and does not constitute an offer or solicitation nor be construed as a recommendation to buy or sell any of the investments mentioned. Neither The Joyful Investors Pte. Ltd. (“The Joyful Investors”) nor any of its officers or employees accepts any liability whatsoever for any loss arising from any use of this publication or its contents. The views expressed are solely the opinions of the author as of the date of this document and are subject to change based on market and other conditions.

The information provided regarding any individual securities is not intended to be used to form any basis upon which an investment decision is to be made. The information contained in this document, including any data, projections and underlying assumptions are based upon certain assumptions and analysis of information available as at the date of this document and reflects prevailing conditions, all of which are accordingly subject to change at any time without notice and The Joyful Investors is under no obligation to notify you of any of these changes.

· · ·

Have you enjoyed this article? We’d be grateful if you would share this useful content to your friends who may benefit from it as well.