What is the best investing strategy to adopt? This is one of the most popular questions that resurfaces repeatedly over the years.

Naturally, when we use the term “best” in this context, we’re essentially talking about the portfolio’s performance and returns from a logical perspective. We are not focusing on the one that’s just simplest to execute or demands the least immediate time and effort.

It’s essential to grasp that there isn’t a single stock market investing strategy that consistently outperforms all others. Various strategies function diversely depending on the market situation.

We understand that some of you may strongly believe in specific strategies. However, to make this article more balanced and constructive, we will cover both the advantages and disadvantages, including aspects where the strategies we personally employ might not fare as effectively.

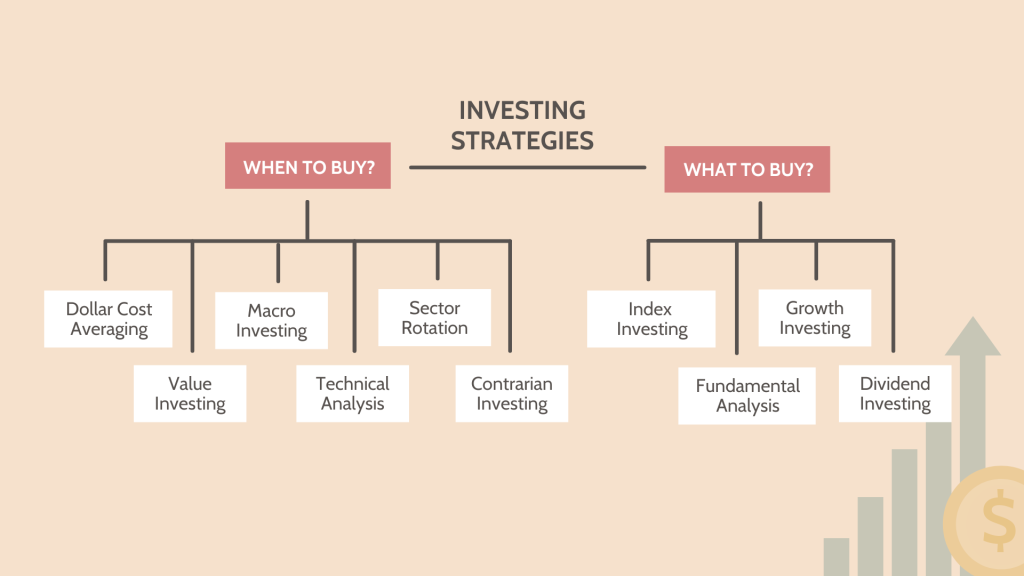

The different investing strategies

Broadly speaking, we can categorise the strategies into 2 categories. Strategies that guide us on when to buy a stock or ETF and strategies that guide us on what investment to buy.

Let’s kick things off with the strategy that is most recognizable to many of us.

Dollar Cost Averaging (DCA)

This strategy involves investing a fixed amount of money at regular time intervals, regardless of the market conditions. Whether we are in a severe crash, or whether the markets are at an all time high, the investor continues to invest into the markets without question. This approach is supposed to help investors to take their emotions out of the picture by sticking to a fixed time interval to invest.

All sounds perfect in theory, but in practice this strategy may or may not work.

The first reason is because DCA requires an underlying instrument that has a general upward trend, so that your portfolio value eventually is somewhat higher than the previous purchase levels. We have shared before that many investors have performed badly with DCA because they were investing into cyclical stocks or into unsound stocks that perform badly over time without a nice price uptrend.

Secondly, even if you DCA into an ETF or stock that is poised to go up over the long term like the S&P 500, investors may not necessarily do well because some find it challenging to stay the course. It is easy to DCA when the market is heading upwards but when the market eventually crashes with your investment portfolio declining in value, it becomes psychologically difficult for some investors to continue to pump in money. This makes DCA less easily executable and may not necessarily take emotions out of the picture.

Even if we can take such behavioral biases out of the picture, the essence of DCA simply assumes that market timing is futile. This is of course a sensible strategy for retail investors who know nothing about technical analysis and it is the next best thing they can do to get invested. If the underlying stock or ETF is sound and goes up over the long term, a DCA investor can do well although it is not exactly the most risk efficient method.

Value Investing

Value investors only buy a stock when the current share price is below the intrinsic value of the stock. A stock’s intrinsic value is computed using the discounted cash flow model (DCF), which is supposed to give us a good sense of how much a stock is potentially worth based on certain assumptions. Usually, value investors apply this on quality stocks, which overlaps with the Fundamental Analysis strategy that we will touch on later in the video.

The downside of this strategy is that while the theory of DCF is sound, in practice many assumptions are involved, such as the discount rate, and the future growth rate of the business. It is like, can you predict how much money you can make for the next 10 years? There are often too many variables at play and assumptions being made where we don’t even know what we don’t know. It is probably more useful for the more traditional and stable businesses where their business models are less likely to be disrupted and less useful for the tech companies for example.

Another problem is that in practice DCF works better over the very long run where the markets follow the earnings of the company. But in the short run, the stock market is largely about emotions. Investors can still lose money while waiting for the calculations to materialize. Stocks can well stay below or above their intrinsic values for many many years. In practice it has been proven to be challenging for some value investors to stay in the game after they see that the stock prices haven’t picked up after 3-5 years. Everyone thinks they can have a long term investing horizon but if something doesn’t work for 3-5 years there is a danger that most people give up halfway.

Personally do we follow these DCF calculations? No, we do not. Personally we feel that these calculations, while valid in theory, merely provide an illusory sense of control that things should turn out fine eventually. We prefer to be more in tune with the market’s movement, understand the crowd sentiment and look at where prices are trending. It does not matter how good a stock is, how high its intrinsic value is, if the markets do not yet believe in it for the short to mid term.

Macroeconomic investing

Macroeconomic investing focuses on identifying and capitalizing on broad macro trends that influence financial markets, asset classes, and economies. Instead of analyzing individual stocks or companies in isolation, macro investors study the global economics and politics to make investment decisions, such as when to buy and sell stocks.

It’s worth noting that macro investing can be challenging and risky due to the unpredictable nature of macroeconomic events and their effects on financial markets.

Are there people who excel at Macro Investing? Very far and few while not impossible. In a consistent manner, it is even harder.

Which is why Warren Buffett, one of the greatest investors in the world, says he approaches macro investing with a high degree of skepticism. He says that investing successfully is about looking for the pieces that are “important and knowable”. Even if something is important but not reliable enough to know how it will pan out, it is still useless.

Technical Analysis

Technical analysis is the study of stock price trends, price action, candlesticks and market indicators to anticipate possible future price movements. This strategy is more focused on short-to mid-term time frames to invest in stocks at appropriately low prices based on the current price trend. Investors who employ this believe that asset prices tend to move in persistent trends over extended periods.

For investors it can be used as a risk management tool to time your entries deliberately to lower your weighted average cost or to decide when to take profits off the table. There are no emotions involved because you look for clues that the market is trying to tell you objectively.

What is the drawback of this type of investing? Again, it is not a 100% failproof method so do not buy all in at one go. Add in tranches. But the good thing is that you don’t need to be correct 100% of the time to make money.

One of the bigger issues with technical analysis, if you ask me, is that it is often more of an art than a science. You throw the same charts to 10 investors who claim to do TA, and you can have half of them being bullish while the other being bearish. Hence, it matters how you are able to interpret the stock charts.

Sector Rotation

This strategy involves allocating funds to sectors of the economy that are expected to perform well in the upcoming investing environment. It requires staying informed about market cycles and adjusting your portfolio accordingly. Investors doing this strategy will tend to underweight and overweight in certain sectors so as to possibly bring about the greatest gains and minimum losses. It is more of getting the most bang for your buck and getting better risk-adjusted returns for the portfolio.

The downside to this strategy is that because these investors shift things around more frequently, higher transaction costs are expected, but generally if they are good with it, the capital gains can more than easily cover these costs.

Contrarian Investing

Contrarian investors will go against prevailing market sentiment. They can be on the sidelines for a long period of time, for months or years and try to go in big when others are selling desperately. This can also be called crash investing where these contrarian investors only buy when there is blood on the streets.

For the most part they usually have a lower average cost compared to someone who simply dollar cost average because they are more selective in timing their purchases. The good thing about such a way of investing is that normally you don’t need to watch the markets so much, as there will be enough alerts from the financial media reporting on how bleak the future will be to prompt you to start buying.

The drawback is that, contrarian investing without technical analysis reduces the probability of timing it better to lower down average costs during a crash. So some investors may find themselves buying only in the middle of the crash and have to be underwater and sit through a large part of the crash before it eventually recovers.

The important thing for such a strategy is that you must only be buying the good stocks or an index ETF which will go up over the long term. Crash investing does not help for unsound companies that may no longer recover. Contrarian investing simply means you lose less if you buy the wrong companies but your upside is still going to be limited if you don’t buy the good companies.

These are some of the common strategies that investors adopt to decide when to buy. Moving on, let us now take a look at the common strategies that investors use to determine what to buy.

Index Fund and ETF Investing

Passive investing through index funds or exchange-traded funds (ETFs) involves investing in a diversified portfolio that tracks a specific market index or sector. This is good because usually an ETF or index fund will self-select the better companies in their holdings. The strategy aims to match the performance of the overall market or sector rather than outperform it.

But an ETF being an ETF, it is just like buying a basket of fruits that is already packed for you, so you might get some of the rotten ones along with it but you can’t reject those. As a result, you would have some of the poorer performing stocks putting a drag on the portfolio performance.

Fundamental Analysis

On the other hand, some investors prefer active stock selection and adopt the strategy of Quality Investing or Fundamental Analysis. These investors aim to invest in companies that have strong financials, solid management teams, and a competitive edge, so that the companies are more likely to weather economic downturns and deliver consistent results. They do what we call fundamental analysis and study the financial statements of the companies. Hence, even if they did not purchase the stocks at the best price, the sound fundamentals would likely bring about stock price appreciation over the long term and make a profit.

Growth Investing

Growth investors focus on companies that are expected to experience above-average earnings or revenue growth. They are willing to pay a premium for stocks with the potential for significant future expansion, even if the current valuation might be high.

On the downside, a growth investor must be ready to accept greater volatility to their portfolio. These stocks often have a higher beta which means that if the market falls by 1%, theoretically the stock may fall by more than just 1%.

A growth investor must also be careful not to buy growth stocks that have been too hyped up and out of touch with their valuations.

Dividend Investing

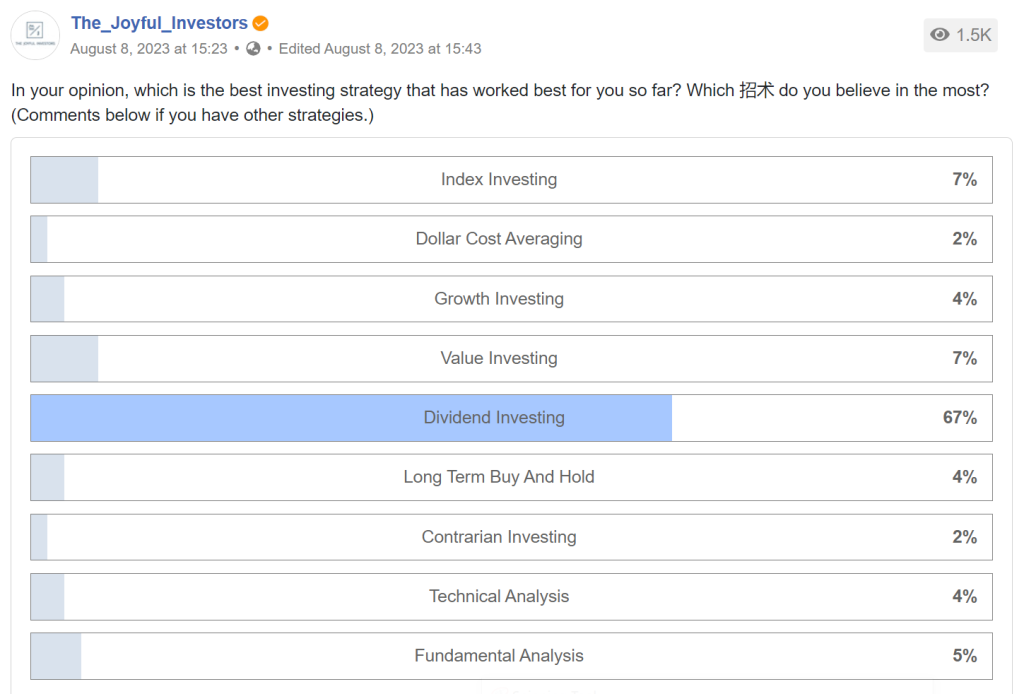

From a poll that we did earlier, it seems that most Singaporean investors are actually dividend seekers. Dividend investors invest in stocks of companies that regularly distribute dividends to generate a steady stream of passive income.

If you have a sizable sum of money like say $2 million, at 5% dividend yield, you can receive $100k of passive income a year. Hence, it may not matter to you whether the stock price goes up or down. It can feel like having a machine that prints money every quarterly or half yearly.

But a word of caution. Even though dividend investors largely focus on the dividends received, at some point in time some of them may need to liquidate their investments. Hence, the price that they buy and sell their investments at, in other words the capital gain or loss matter as well. Just ask dividend investors who had invested in SPH, Singtel or Comfortdelgro. If you buy the wrong stock or the right stock at a wrong price, dividends collected may not be sufficient to cover the capital losses.

What are the strategies that The Joyful Investors employ?

At this point, we have covered a comprehensive overview of the investment strategies commonly employed by retail investors. Now, you might be wondering which approach does The Joyful Investors adopt?

The answer is not just 1 single strategy but a blend of strategies! In particular, Fundamental Analysis, Technical Analysis, Contrarian Investing, and Sector Rotation for both our growth and dividend portfolios. And we coin our unique investment methodology as “Moneyball investing.” While the term “Moneyball” itself isn’t an original creation, the intricacies of our approach are entirely of our own making.

It takes its inspiration from the concept of “Moneyball” in sports, particularly baseball. The term “Moneyball” originated from Michael Lewis’s book “Moneyball: The Art of Winning an Unfair Game,” which discusses how the Oakland Athletics baseball team used data analysis and statistical methods to identify undervalued players and build a competitive team on a limited budget. In the context of investing, the Moneyball methodology applies similar principles to identify undervalued or overlooked investments in financial markets.

Similar to how the Oakland Athletics used statistical analysis to identify undervalued players, Moneyball investors rely on technical analysis and fundamental metrics to uncover companies with quality performance but the market is undervaluing them currently. The Moneyball methodology acknowledges that market inefficiencies can arise due to investor behavior and biases. By capitalizing on these inefficiencies, investors can identify opportunities that are not fully reflected in market prices.

Like value investing, Moneyball investing can have a long-term perspective and is willing to hold onto undervalued assets until the market recognizes their true value. However, there exist significant distinctions between Moneyball investing and the conventional value investing approach.

For value investors, the margin of safety is primarily rooted in buying stocks below their intrinsic value. In contrast, the margin of safety for Moneyball investing comes from buying stocks at support levels by analysing the stock price movement. The reason is that stock price movements represent a collective manifestation of the sentiments of the market participants, whether bullish or bearish. For example, stock market recovery happens when there is a shift in collective market psychology, and most investors have capitulated with no more sellers left, which we can observe through stock chart analysis.

Finally, Moneyball investing dictates that we are more selective in our investment choices. We usually do not buy index ETFs, instead we would carefully evaluate and invest in only a handful of stock opportunities which are more likely to do well. The exception would be during market crashes where almost all stocks are at low valuations, then buying an index ETF is just as sensible. And as the stock prices rally up, some ongoing positions may become less appealing over time, and that is when we may trim off some of these positions to recycle the capital into other stocks with better ongoing risk to reward opportunities.

In short, our Moneyball approach of investing at The Joyful Investors aims to capitalize on opportunities to invest in good stocks at good prices due to market inefficiencies and behavioural biases. The use of historical data, statistical analysis, and probabilities increases the chances of achieving an asymmetric payoff profile.

Limitations of Moneyball Investing Methodology

As shared at the onset of the article, there is no perfect strategy that has no limitations at all. As technical analysis plays a significant component of our Moneyball investing, while it can yield a high success rate, it is not 100% failproof.

To give an example, during a market pullback, we may have added positions of a stock at an identified support level but the stock price continues to decline after we bought.

In order to address this, employing risk management techniques such as proper position sizing, buying in stages instead of one lump sum and occasional options strategies can play a pivotal role in managing potential losses. Over time, prices should gradually recover, especially given our focus on fundamentally strong companies.

To sum it up, we have covered the various strategies that are commonly employed by investors, their respective advantages and downsides as well as which ones we personally employ ourselves. In the second part of the blog post series, we will share with you the thought process on how you can identify the investing strategies that are appropriate for your investments.