In investing, you definitely would have seen words like ‘leverage’ or ‘margin’. Or when you first opened your brokerage account, you can also choose whether you want to open a cash account or a margin account. There are many new investors who do not really know the mechanics behind leverage and margin but it can be very dangerous if you do not know what it really means!

What is leverage?

Leverage in the finance field is using borrowed capital for an investment to maximise your profits.

Here is how it works. When you buy stocks on margin, you are only paying a portion of the total amount that you would otherwise have to pay if there had not been a leverage. The remaining amount is paid by the brokerage firm in the form of credit extension to you. But of course this is no free money in the world! Your account will be charged a monthly interest charge on the amount that you borrowed.

Why do some investors like to buy securities on margin?

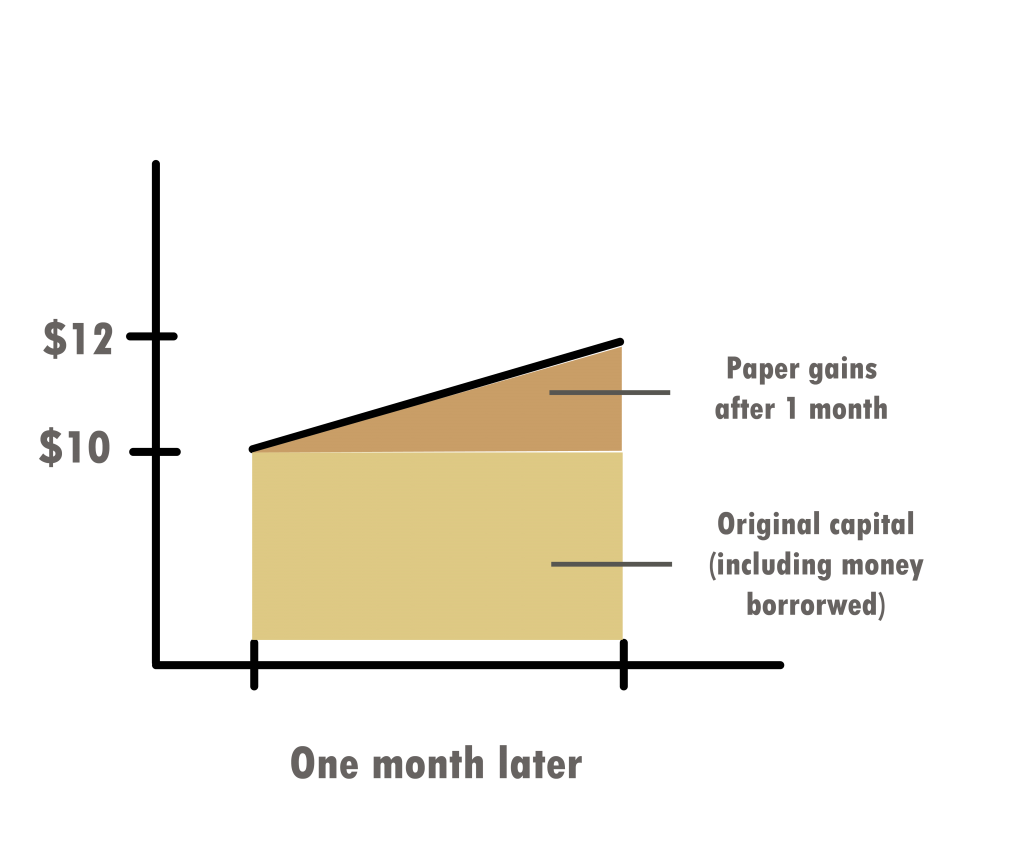

Let’s understand this better through an example. In this example, we assume a margin requirement of 50% for easy illustration and a margin account with $5,000 cash. Let’s say you want to buy 1,000 units of stock A at $10 per share and you decide to buy those stocks on margin by taking a margin loan of $5,000 from your brokerage firm.

One month later, the stock price rose to $12 per share. The stocks in your portfolio now stand at $12,000 in total and you wish to sell the shares now to realise the paper gains.

Recall that you borrowed $5,000 from the brokerage firm at the start, so after repaying that amount, your take home money becomes $7,000. Accordingly, you earned a profit of $2,000 ($7,000 – $5,000) which gives a ROI of 40% ($2,000/$5,000)!

Comparatively, if you had bought those shares entirely out of your own pocket, you still earn a profit of $2,000 but at a ROI of 20% ($2,000/$10,000).

Buying on margin allows you to double your return on investment by starting off with a smaller capital. It allows investors to leverage and to buy stocks that they would otherwise not be able to afford to. This is the same reason as why businesses choose to take up bank loans to inject more funds so that they can capitalise on a larger pool of funds to expand their business through ways that would not have been possible without the loan.

Furthermore, it allows investors to utilise their money more efficiently. Sometimes, it is not that these investors have no money to buy the shares. It is that they see this as an opportunity to grow their money. By borrowing $5,000 from the brokerage firm, they can put their own $5,000 into another investment stock B to earn returns.

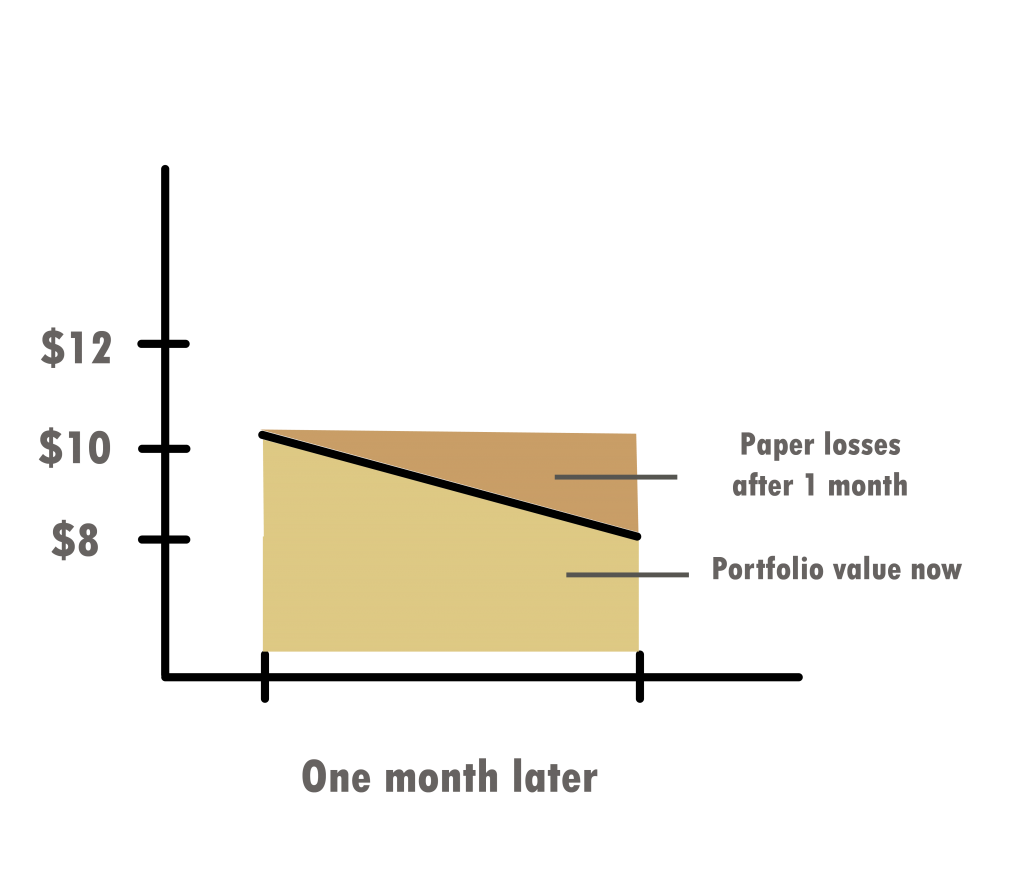

Of course it comes with risks. In our previous example, we show how the ROI can double with leverage. But what if the share price drops to $8 instead and you sold off the shares?

With leveraging, you take home $3,000 ($8,000 – $5,000), which is 40% loss on investment. Without leveraging, you take home $8,000, and that is 20% loss on investment. Thus you may see that when you are on margin, it can potentially double your ROI or even double your losses!

Well, some people may opine that the absolute amount of losses is the same in both scenarios so we are not really worse off. And not to forget that the other $5,000 that we used to buy Stock B may yield good returns that offset the losses for Stock A.

Margin call

What if the stock B investment is also making paper losses? There is a risk that you do not meet the margin requirement set by the brokerage firm and you will then be issued a margin call.

A margin call is a situation whereby the value of your margin account falls below the account’s maintenance margin requirement.

What happens when you are issued a margin call?

You can either top up money into the brokerage account or you sell off some of your holdings in your portfolio. If you do not have the required amount of cash to top up, you will be forced to go by the second option which is to liquidate some or even all of your holdings.

This is really risky because oftentimes, you would be selling off some of these stocks at a loss. And what happens right after that? The next thing you often see is that the stock prices increase just right after you are forced to let go of the stocks at a disadvantaged price. How frustrating is that!

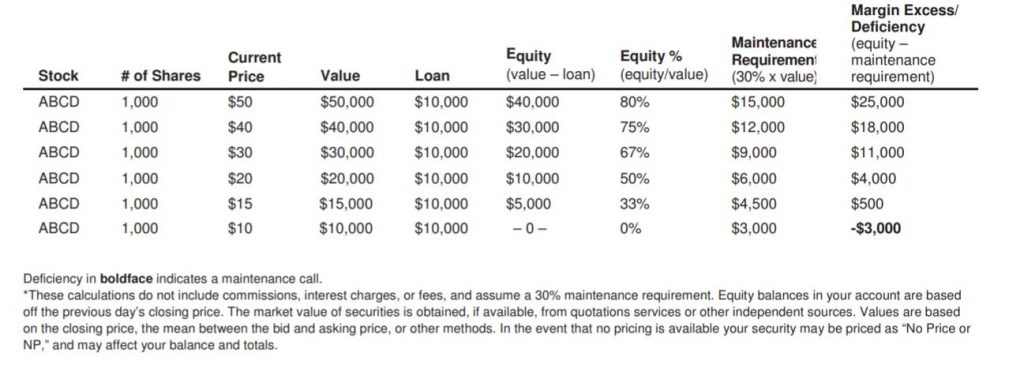

How do you see if you are meeting the margin requirement?

The best and easiest way is to contact your respective brokerage firms to find out the quickest way for you to check. For example, even though TD Ameritrade published a guidance with a clear illustration on how to compute whether a maintenance call will be issued, the easiest way according to their customer service, is to just navigate to your account summary to check that the ‘Available Funds For Trading’ is maintained above $0 balance. You will also be given around 4 days to top up cash to your account after you are issued a margin call but the time given may be shortened according to the urgency of the margin call.

Extracted from: TD Ameritrade Margin Handbook

So...should we buy stocks on margin?

Personally I am a rather conservative investor, so I try not to buy stocks on margin. Even if sometimes I do have to tap on the credit extended by the brokerage firm, I always make it a habit to top up with cash within the next few days. But I’m not saying that it is wrong to buy on margin. It really boils down to your risk appetite. If you are an investor who is alright to take up more risk for more returns, you can always tap on the margin.

My advice is to always do the administrative work upfront such as understanding how to do a self-check to ensure you will not be issued a margin call or finding out the time buffer to top up cash. You definitely would not want to be caught in a panic when issued a margin call.

Such information can be found easily on the websites of the brokerage firms or can be obtained with just a call. But do note that the requirements of each brokerage may differ slightly. Always ensure that you have some free cash ready on the sidelines anytime, to protect yourself as you do not want to be forced to liquidate your positions at poor prices at the worst possible time.

The bottom line is not to meddle in things that you are not familiar with. If you do not know anything about leverage, then do some research on it and if you want to see how it works in practice, you can always try on a demo account to see how it works. If you know what you are doing and have a more aggressive risk profile, margin will help you to increase your ROI meaningfully.