Income investing looks to be one of the solutions to financial independence. As long as your income generated is enough to offset your living expenses. Most often than not, those stocks are usually stable investments that pay out dividends reliably. And to sweeten things up, Singaporeans are fortunate to be exempted from any taxes for their dividend income.

While income investing sounds like a great path to pursue as we work towards financial independence, there are in fact, some untold truths that are rarely mentioned in mainstream media or financial trainers. Let’s find out what are some of these important but less known truths about income investing.

As usual, the purpose why we are doing so is to paint a more accurate picture to wanna-be income investors so that they know what they are signing up for. In order to be able to stay joyfully invested over the long term, we must be able to embrace everything that comes along, including the negative parts.

Untold Truth #1. The worth of the same dividend gains diminish with time.

The costs of living can, and will only increase over time. In a short time period, this may not be obvious, but when we talk about retirement planning, it is reasonable to picture something that is at least 15-20 years down the road.

A dollar received today is not the same dollar value 10 years later. It would be reasonable to assume that inflation may be 2 or 3% annually, which is normally the basis in CFP programs. What this means is that the purchasing power of our same dollar will diminish to some extent over time.

Hence, to get an even more accurate projection of retirement planning using the expense method, you have to calculate in terms of the future value of the living expenses you need, by incorporating the inflation rate to future expenses instead of using just a fixed expense of say $2k a month to project into the future. So in practice, you may only need say $24k of annual dividends right now to live off dividends, but in the future time to come, you will need more than this figure for future consumption due to inflation.

Untold Truth #2. Dividends may not be constant nor guaranteed.

Companies are not obligated to pay a dividend and they are also not obligated by when they need to pay. When times are tough, companies can definitely cut dividends or choose not to pay any. For retirees depending on that regular income, they will suffer.

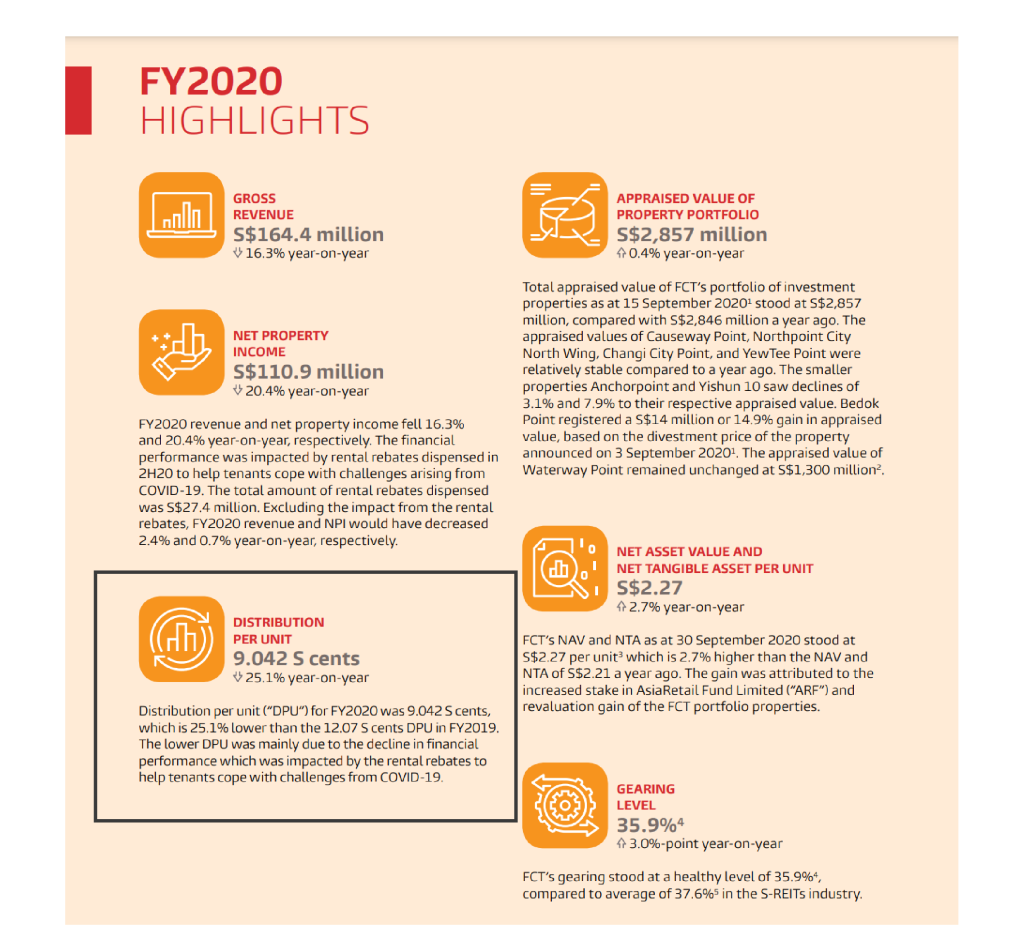

During COVID-19, some of the Singapore REITs either lowered or delayed their dividend payouts to meet the ongoing operating challenges. Investors who are relying on this recurring dividend income will be affected. This also comes at a time where most people are probably facing other challenges in their business or job security.

Source: Frasers Centrepoint Trust Annual Report 2020

For Singapore bank stocks, which is a favorite among Singapore retirees for dividends, the Monetary Authority of Singapore (MAS) stepped in to impose dividend restrictions on our local banks. Banks are told to set aside a portion of their earnings in order to absorb further economic shocks. They have to cap their total dividends per share for 2020 at 60%. By mid 2021, the cap has been thankfully lifted, but these are events that transpired and can always happen again in the future.

How then will these investors be able to finance their ongoing expenses at that point in time? If you are a retiree who purely just lives off dividends, you could be in for a rude awakening. If you were to liquidate part of their investments to finance your expenses, the shares at that point in time are likely to be sold at a very unfavorable price. Some may suffer more in capital losses than what they got in dividends over the years. And for some other investors, seeing that dividends are going to be slashed, they may be tempted to sell away their shares, leading to more selling pressure.

Untold Truth #3. The initial capital you put in is at risk of loss too.

Just like other stocks, dividend stocks themselves are subjected to reasonable volatility as well. They have often been portrayed to be supposedly more resilient and stable.

During the COVID-19 stock market crash, the paper loss suffered from the crash at that point in time would have easily outweighed say 5 years of collected dividends. But of course, if it is a good reit, and you allow the price to recover over time, it will eventually be fine. The problem comes in that most retail investors may just panic sell during those times too. It is also not just black swan events that cause volatility or huge swings.

Being stocks and being cyclical in nature, barring any black swan event, there will still be volatility. If we were to look at one of the good retail REIT, Frasers Centrepoint Trust (J69U), pullbacks of 10-20% are not uncommon. Imagine if you have just bought into this REIT and have only collected 1 year of 5% dividends but the stock price fell by 15%, you are still down by 10% net.

Basically investors must grapple with the fact that a REIT portfolio is not a sure gain 5% kind of proposition without any other drawbacks. REIT stocks can be just as volatile as other types of stocks.

That said, of course some investors, especially retirees, they may not even have the intention to sell off their investments and have strong hands, hence this may be less impactful to them. With their sizable amount of investments, they are happy to live on their dividends, forever.

So bear in mind that dividend investing is not necessarily safer or more stable. It still depends on the underlying that is bought and whether it is bought at a good margin of safety.

Untold Truth #4. Building a REIT portfolio is a reasonably long building process.

Building a REIT portfolio is a reasonably long building process for most people and not as easy as a money printing machine as it is touted to be. Most beginners start off with a small pool of funds available for investing. Anything less than $50k is not a very significant amount. At 5% yields, it’s just $2.5k a year or $200+ a month. It’s good extra pocket money to have but surely not life changing. It only becomes sizable at say $500k portfolio which may generate $25k a year which works out to be $2k+ a month.

That said, all big things have small beginnings. It never hurts to start small, but most importantly is to have the right expectations and not lose sight of the bigger picture even if the current dividends may seem paltry.

Untold Truth #5. Dividends come somewhat at the expense of capital gains.

By paying out dividends actually means that a company has less money to expand. (of course it may not want to or may not have to expand, but that is what it means.) Dividends are derived from a company’s profits. Thus instead of using money to expand, the firm will reward its shareholders by paying out dividends. In some sense, one will be sacrificing some capital gains with a dividend portfolio.

For younger investors who have a longer investment time horizon and do not need regular income, chances are, they would probably end up with more money by investing in the right growth stocks over a long period of time as compared to pure dividend stocks. This is a trade off which investors with a long runway should be aware of.

Untold Truth #6. When seeking high dividends, some fall into high yield traps.

When talking about receiving dividends, naturally, most new investors will want to look for something that supposedly gives the highest yield. And what happens is that they may fall into what we call a high yield trap.

Most often than not, yields are high for a reason. The yields are high to commensurate certain aspects of risks that may be associated with the underlying stock. Some of you may recall that there is this specialized business trust called the First Ship Lease Trust that used to pay really good yields. But it was short lived as the financial crisis of 2008 broke out and they could not pay their dividends. Certain stocks may pay higher than usual yields that come with country or industry specific risk which can happen when you least expect it.

The higher yields could also be a result of a lower share price based on the formula (Dividend yield = Dividend per share / Price per share). When investors are concerned about a company’s future performance, or its ability to sustain its dividend payout, there’s going to be selling pressure which leads to a fall in the share price. But when we calculate the previous distributions based on the lower share prices, the yield is going to be high for sure but it is not necessarily a good investment.

Hence, buying a stock or REIT based on yield alone is very dangerous. In short, there is no free lunch in the financial markets most of the time.

So...do we invest in dividend stocks?

With all these being said, the question is, do we still invest in dividend yielding stocks ourselves?

The answer is….YES WE DO! There are many merits for dividend investing as we have shared in our previous blog posts.

But at the same time, we feel that it is very important for us to paint a realistic picture so that you know what you signed up for if you decide to go for dividend investing. Problems happen when most investors do not know what they are in for, and some financial media very often only portray the benefits until investors are in for a rude shock when the inevitable happens.

At The Joyful Investors, we believe in empowering investors to have the right kind of expectations for the financial markets, whether you are looking for growth investing or income investing. Investing should be a simple and joyful process, but that is, if we learn to appreciate what is going to happen, with all the good and bad things that can happen altogether.

If you are keen to learn more on how you can construct your own income investing portfolio, you may check out our upcoming workshops here.

![Read more about the article [SIAS Webinar] REITs 101 – Navigating the Singapore REITs Landscape](https://thejoyfulinvestors.com/wp-content/uploads/2024/07/SIAS-Webinar-REITs-101_-768x432.png)