Hazelle

in Memos & Musings · 9 min read

On the day of the earnings call on 29 October, Starbucks’ share price took a hit and plunged down more than 7% on that trading day. As I was watching the US markets that night, I thought about how I could share this with my investing community as a good learning lesson.

Q4 2021 Earnings Call

Let me do a quick sum up of the latest earnings call release. Starbucks delivered record revenue in Q4 but still fell short of the analysts’ estimates. Comparable store sales in the North America segment increased 22%, with 27% increase in net revenue quarter on quarter (q-o-q). Net revenue for the International segment grew 18% q-o-q though the China comparable store sales was down by 7% due to COVID-related volatilities.

Starbucks further expects its near-term operating margin in fiscal year 2022 to temper a little due to the rising costs and wage increases for its store partners.

My Thoughts

Investors may seem to have been wary of Starbucks’ growth with the rising costs ahead. The 7% or more plunge in share price, however, is just another irrational action in the markets in my opinion. Have the fundamentals of Starbucks changed? No.

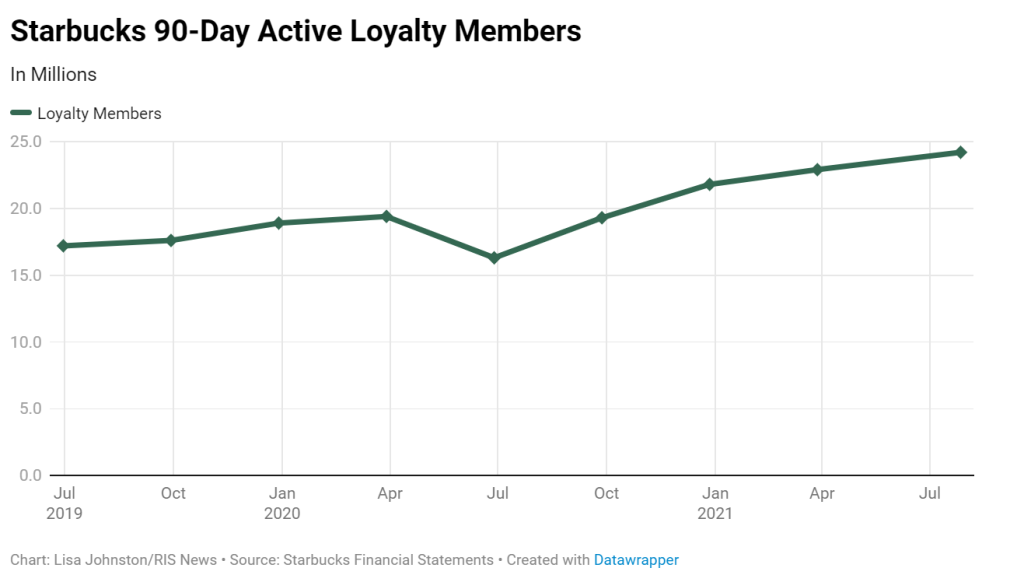

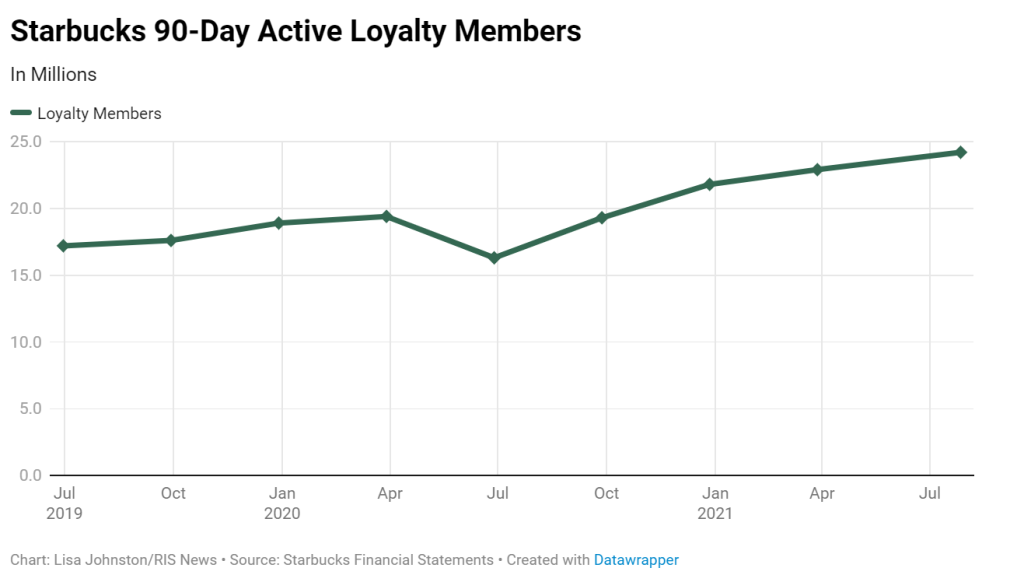

Credits: risnews.com

Over the past quarters, Starbucks has seen a steady increase in the number of 90-day active Rewards members. In the latest earnings call, it was revealed that the number of active 90-day active Starbucks Rewards members in the US grew by 30% to a record 24.8 million members in 2021. This is a result of Starbucks continued investment to leverage on the digital mobile and data-powered AI capabilities to accelerate the growth in the rewards membership to increase customer loyalty base and to drive sustainable growth over the long term.

In China, the next largest market for Starbucks after the US, the 90-day active members count hit 17.9 million in Q4 2021 which is a 33% increase over the prior year. Though the Q4 sales in China have been hit by the COVID restriction volatilities, there is still much room for growth in the China market. In 2021 alone, a net total of 654 new stores were opened in China, giving a total of 5,360 stores in China as Starbucks heads towards its goal of opening 6,000 stores by 2022.

We always focus on the long term, sustainable growth and performance of the companies in investing. There can be many economic or market events taking place in the short term, but companies with strong fundamentals will eventually be able to tide through the near-term volatilities.

While we can’t expect a growth rate that is comparable to those of the technology companies, Starbucks is still a quality company with strong financials and brand establishment. In fact, it is one of the companies with strong pricing power that can be a beneficiary as inflation looms.

The pricing team at Starbucks uses machine learning to determine their pricing plans, the magnitude of price hikes and on which products. For instance, in one of previous price hikes, Starbucks had taken a strategic approach to apply price increase only to the tall size brews while maintaining the pricing for grande and venti brews. Given the premium brand positioning of Starbucks, it has built a loyal customer base who are relatively less price sensitive for the premium beverages. This allows Starbucks to take a dynamic approach at managing its pricing while growing its customer base.

Recovery of the sales affected by the pandemic has also been driven by Starbucks’ effort to expand its portfolio of drive-thrus and delivery service. The continued evolvement and adaptability of Starbucks allows the company to stay ahead of challenges.

For an investor who does not have strong conviction in Starbucks, he might have freaked out when he saw the 7% decline in stock price. Or he might have well been part of the selling movement that day. But for us, The Joyful Investors, we would be happy to jump at such an opportunity. This is what we always tell our investing community, find the opportunities among the irrationalities.

Disclosure: We have stock, option or similar derivative position in Starbucks Corporation. We wrote this article ourselves, and it expresses our own opinions. We are not receiving compensation and have no business relationship with any company whose stock is mentioned in this article.

About Hazelle

Chief trainer of The Moneyball Investors Playbook program and founder of The Joyful Investors, a financial education firm that seeks to help avid investors learn to invest better and make the journey a joyful one. I graduated with a first class honors in Bachelor of Accountancy from Nanyang Technological University (NTU) and started my auditing career in one of the Big Four. I believe that once we know how to build our wealth sustainably, we can then live our best lives ever.

Important Information

This document is for information only and does not constitute an offer or solicitation nor be construed as a recommendation to buy or sell any of the investments mentioned. Neither The Joyful Investors Pte. Ltd. (“The Joyful Investors”) nor any of its officers or employees accepts any liability whatsoever for any loss arising from any use of this publication or its contents. The views expressed are solely the opinions of the author as of the date of this document and are subject to change based on market and other conditions.

The information provided regarding any individual securities is not intended to be used to form any basis upon which an investment decision is to be made. The information contained in this document, including any data, projections and underlying assumptions are based upon certain assumptions and analysis of information available as at the date of this document and reflects prevailing conditions, all of which are accordingly subject to change at any time without notice and The Joyful Investors is under no obligation to notify you of any of these changes.

· · ·

Have you enjoyed this article? We’d be grateful if you would share this useful content to your friends who may benefit from it as well.

Thanks for the article. I saw the crazy price decline on the earnings day and was scared off by it too haha although the stock has been in my stock list. If only I read your article earlier then I could have bought in the next day.

Hi James, do not be too worried! There are always opportunities in the markets for us to add some positions of our favourite stocks. Be patient and keep a look out in the markets.