Retail investors should learn to keep a portion of their funds liquid so that when a good investment opportunity comes along, they will be in a position to take advantage of it. They are usually in a loaded up condition, meaning fully invested at all times.

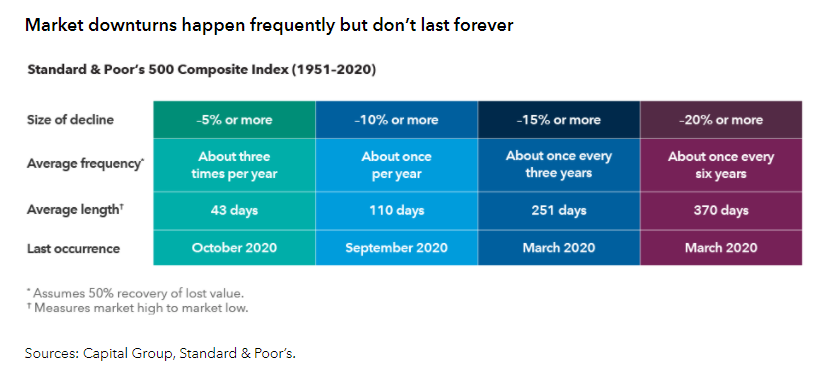

Well, I can understand the rationale for them doing so. Because the premise is that since the market will more likely than not be higher than now, every dollar should be used to grow it. They are not wrong to assume so, but they will also have maximum exposure to market drawdowns that happen from time to time that erode their gains. And sometimes, they may be sitting on paper losses which mean that in order not to realize the losses, they have to commit the cash on those existing positions and forgo other upcoming opportunities. And this may take a pretty long time.

In our Moneyball Investing methodology, we look at our investing capital just like the way merchandising works. For goods that become slow moving and cannot be clean out in the departmental stores, it is actually holding up our capital to produce the goods. Not only are we not able to make a profit out of those produced goods, we are also forgoing the chance to make more profits from other possible new products that could have been on the shelf. This is something that many retail investors do not realize. You would always want to leave some shelving space and capital around, because opportunities come pretty often.

The ability to turn over our working capital many times over is one of the secrets to our portfolio performance in TJI. And this is only made possible by minimizing the risk and time taken for our investing trades to play out. We have a couple of examples that we illustrate in our YouTube channel under the series, Moneyball Investing. We shared how we enter and exit trades with minimal risk entries and time taken to profit from. This is done through our proprietary technical analysis methodology.

Till date there has only been one occasion in which we had our capital fully deployed which was during March 2020 as we believed that the bottom was pretty much around there based on our analysis. During the normal course of events, we usually have about 15-25% of cash in the account waiting for opportunities which is often just around the corner.

We answer this question based on what we really do, however let’s say for investors who may be less adept at market timing, there is totally nothing wrong to be fully invested. In the long run, with the right stocks or ETF, there will still be respectable returns to be made.

–

Are you new to investing or have you been grappling with some unanswered questions in your investing journey? Send your burning questions to us at Ask Me Anything with TJI here.