Kathy

in Memos & Musings · 6 min read

Goodbye Q1 and Hello Q2. 👋🏽

It was a fulfilling quarter filled with activities where we conducted several REITs investing primer workshops and our flagship Moneyball Investing courses, working on new areas of content for our viewers as well as fine tuning the last bits of our options masterclass syllabus after doing a couple of dry runs with our inner community.

And what a dramatic start we had in the financial markets in 2023! From the ongoing inflation worries, the escalating geopolitical tensions, 🎈 the fears of recession to the bank failures we saw in Silicon Valley Bank and Credit Suisse, investors were in for another yet thrilling ride in the stock markets. 🎢

Despite all the volatility and developing stories we were glad to see that our mentees and our portfolios in US, China and Singapore stood well and gave some good returns. 💪🏽

Portfolio Performance

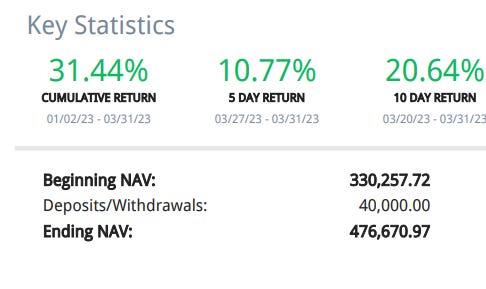

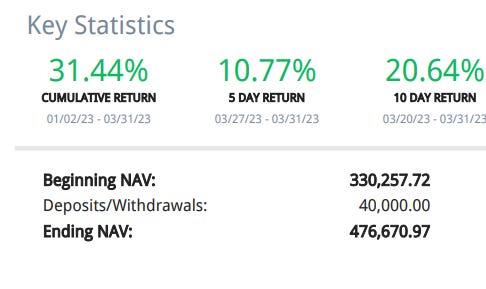

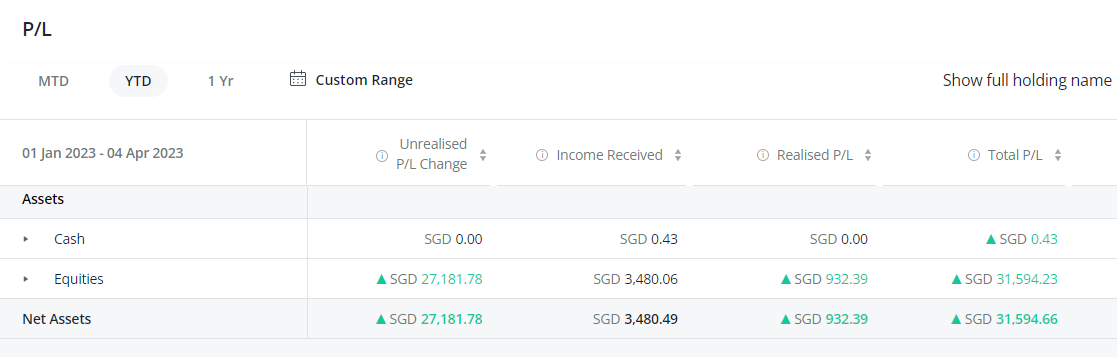

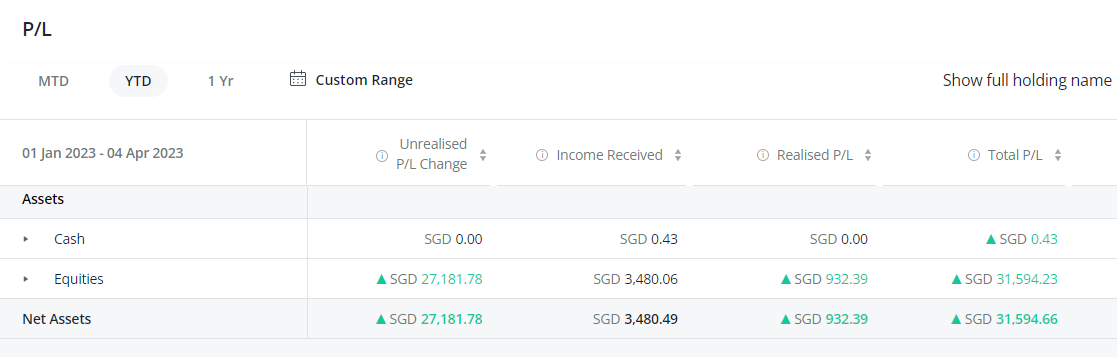

For our growth investing portfolio for US and China markets in Interactive Brokers, we were up by about 31% while the S&P 500 was up by about 7.5%. The screenshot below taken from one of our portfolios at Interactive Brokers. It is always easier to have a robust platform to be doing the calculations for us like in the case of Interactive Broker. Our time should be wisely spend on evaluating investing decisions or for leisure.

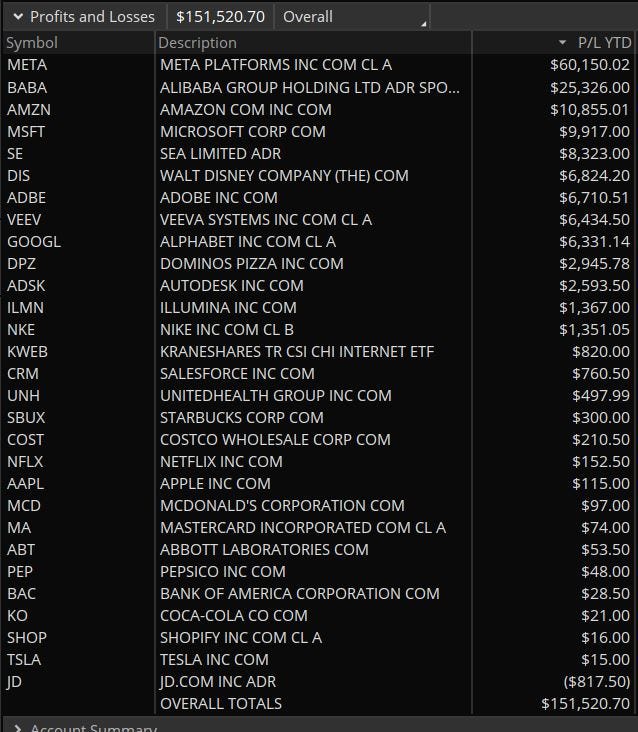

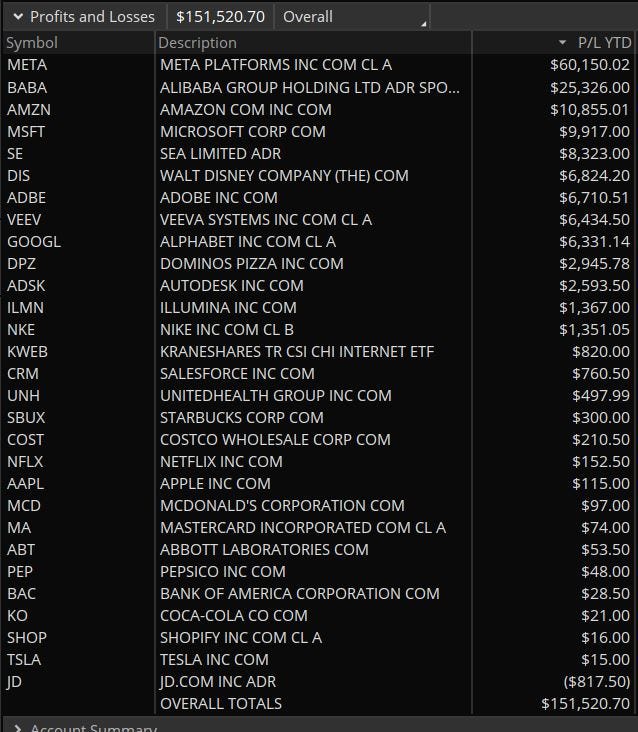

On the other hand, another broker that we use is TD Ameritrade. A quick calculation showed that the ROI was slightly higher than the one in Interactive Brokers this quarter. But there is work involved which you need to do the sums on your own. But the good thing is that for TD Ameritrade, at one glance, it allows us to quickly have a visual of the P/L of all our positions year to date. It is important that generally most of our positions are in a good shape and ideally not to be doing well just because of that a few positions holding up the entire portfolio. It is good to be able to make money from most stocks and not because of that “one good tip” you had.

Our most compelling ideas which became our biggest winners were Facebook and Alibaba among the many other tech firms which saw capital rotating into them this year. The only position that we were underwater for the year still is from JD.com. No complains here, but nonetheless a clean sheet is better still. 😆 It is always important to be able to contain your losses while letting your winners run as far as they can.

The market goes where it wants to go but as an investor, we must be able to manage our downside while not compromising on the gains. Screenshot below taken from one of our portfolios at TD Ameritrade showing all our positions in it. For this quarter this account had realized gains of about USD $150K.

As you may see, most of these companies are known to most investors and not because of some hidden gems that we unearth. I think this screenshot is also particularly helpful because doubters may suggest that we can always “cherry pick” portfolios that are doing well for showcase purpose. But when one can really probe further below and examine that every position we took up are more or less done in a prudent manner, perhaps then it is quite unfathomable to think that we would have actually messed up the other accounts isn’t it? 😉

Generally, we invest in large-cap companies with solid fundamentals. So should there be companies that are slightly less than ideal or have a shorter track record, our positions in them could be miniscule such that its gains or losses are not that significant but more for the “fun” of it.

Apart from the usual buy and sell trades, we do employ the relevant options strategy occasionally to create asymmetrical bets that favor us. This is how we were still able to make some money or mitigate our losses despite some counters like Bank of America (-13%), UnitedHealth Group (-10%), JD.com (-24%), Dominos Pizza (-5%), Abbott Laboratories (-10%) which are still negative overall for Q1 in terms of performance.

This is what defensiveness look like for us in our portfolio based on our investing methodology when we have to defend, while concurrently ensuring that we can still counter-attack aggressively when pockets of opportunities present themselves like in the case of Facebook and Alibaba.

At its core, it is designed to withstand the volatile market conditions and allow us to confidently make our investment decisions against the threatening macros of a possible looming recession among many other worries. As investors we must not be solely problem-minded but also be opportunity-minded to see how we can leverage on the volatility to make outsized returns.

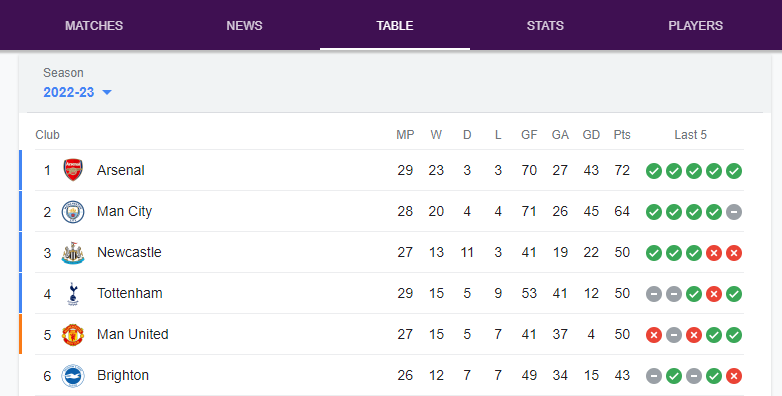

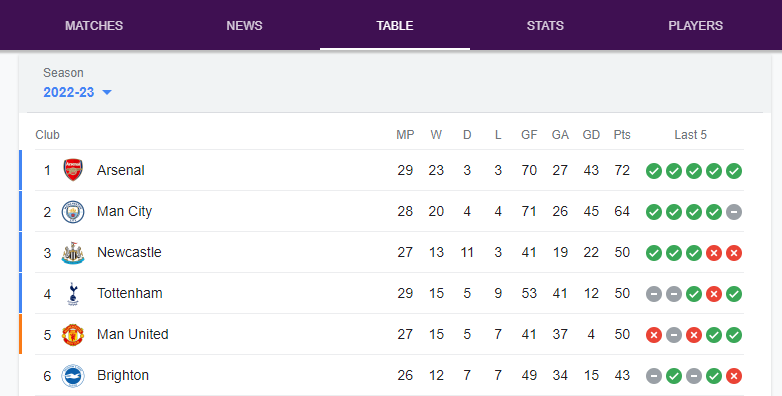

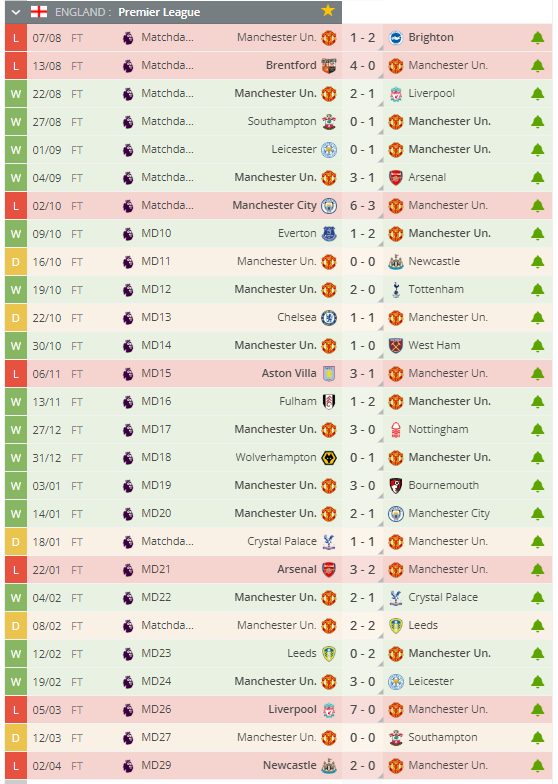

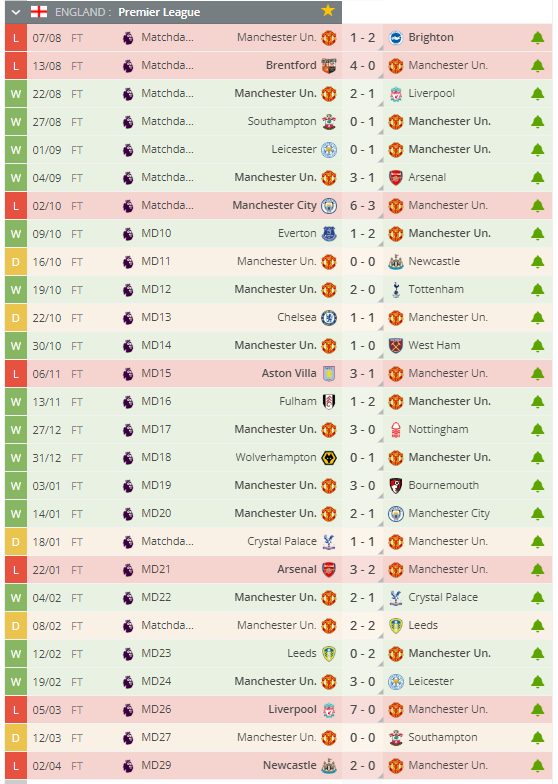

Just like Arsenal and Manchester City, (although I am not a fan of both 😁) the way to win the Championship of investing is to concede little (GA-Goal Against) and score many (GF- Goal Fared) like the table below.

And we will take some profits off the table whenever it is time to do so where the risk to reward is no longer in our favor. This is also what we termed as the Moneyball way of investing. As long as we have a situation where the marketplace undervalues or overvalues assets, we can find opportunities to profit from it. 💰 By realizing gains, we had more firepower to accumulate more REITs and plough them back to the Singapore markets during the last quarter when they were going for a sale.

In other words, the only time money falls freely from the sky for us is during the payment dates for our respective REITs. Otherwise we earn our keep and build up our war chest largely through active Moneyball investing. This is critical for anyone who wishes to do say 1M45 instead of a much later age. The idea is to be able to be financially free at a much younger age where you still have the time and energy to enjoy the world or start living the life you desire much earlier.

Over to Singapore, our dividend portfolio consisting of Singapore REITs also shot up from the capital gains in addition to the dividends collected. Below is the screenshot of one of our dividend portfolio performance for Q1 2023. We were up by our 12% for this account while one of the popular REIT ETF, the CSOP iEdge S-REIT Leaders Index ETF was up by about 5% during this period.

The good thing about building a dividend portfolio is that your money will not just grow from the reinvested dividends but also from long term price appreciation. While collecting passive income is pretty, the bigger money can often come from capital gains when executed correctly. The key thing is to be ONLY buying at reasonable price points and selecting ONLY the sound REITs. Otherwise the dividends collected may not even be able to cover the capital losses over the long term as shared in one of our previous YouTube video.

Some of the REITs we added in February and March this year were also shared respectively with our community on Telegram and in InvestingNote, a local platform where like-minded investors gather together.

Risk Analysis

However returns are just one part of the story. It is equally important to understand at what costs it took to derive those gains. Let’s take a look to see the amount of risk we undertook during the same period. To do so, we pulled out data such as the Sharpe and Sortino ratio which is easily available in Interactive Brokers.

For those who may be new to these terms, basically these ratios help to measure risks in a portfolio. The Sharpe ratio measures the volatility of an investment’s returns while the Sortino ratio measures the additional return for each unit of downside risk. The most useful and logical ratio to look at is therefore the Sortino ratio as we should not be penalizing volatility on the upside. As an investor we are only concerned about downside risks.

This means that if today The Joyful Investors is a soccer team ⚽, we will roughly concede a goal for every 4 goals we score for this quarter. The simplified “Sortino ratio” for Arsenal and Manchester City if we do the math, ranges from 2.5-2.7 at this current juncture for this season by using GF/GA. This means that we every 2.5 goals they score, they concede 1 goal. Which logically will enable them to win most games. This means that they have found an edge on the field and play the game in a way that the odds will be in their favor over a reasonable period of time.

Similarly let’s see what I can say about my favorite team, Manchester United. I hate to say this but please don’t be like Manchester United this season. When they win, the margins are seldom big wins (in green). But when they lose, (in red) occasionally those goal deficits can go really big. In the investing world you would be severely punished (because GD- Goal Difference is what truly matters!) and not be as lucky as Manchester United to still be in top 5 measured by points. 😆

The Beauty and Problem of Technical Analysis

Technical analysis is a way of examining price movements by using historical price charts and market statistics. When done properly, it can help us as investors to time our entries that give us a favorable risk to reward ratio, 🎯 resulting in potential gains in the short term with a higher probability. It can help us to identify major trends and possible turning points of all the markets (e.g. US, China, Singapore) that we have been invested in. The financial markets are after all, are nothing more than a voting machine with emotions at play which we can see on the charts. 💙

However here’s the interesting thing: The tricky part is that when you show the same stock chart to a room of investors, you can bet that there will be as many buy as sell calls. Hence, technical analysis is often said to be more of an art than a science and different people will draw different conclusions although they are staring at the same thing and are doing “technical analysis”. Which in my opinion is fine. There are many ways to skin a cat but the same rule applies. Make sure that when you lose, you lose a little, and when you win, you can win big.

Hence it is important that an investor must develop his own way of interpreting the charts that he should then follow consistently after that and not be swayed by the opinions of others afterwards. This may take countless hours of trial and error but I would say that it is a worthy pursuit for an investor who wants to level up his investing game.

Forge Your Own Path

Also at this point, we would also like to highlight that please do not take what we do or use our positions as possible “stock tips” to enter a trade without knowing why you want to be in it or if now is the right time. This is also why we only occasionally share trades that we make because without understanding the full context on how the decisions were made, it can do one more harm than good as most people may be blindly following them. If subsequently Warren Buffett or Charlie Munger sells whatever holdings we hold (e.g. Alibaba) or someone renowned like Michael Burry tells you to sell everything, we trust that you will trust them more and do accordingly as they say.

The takeaway message here instead should be that as an investor, while you can look up to these investing greats as inspiration models to learn from, eventually you must make your own independent judgement even if they seemingly go against what you are doing. This is because none of us know the exact scenario which warrant them to take a certain action. When they sell something, it may not imply that they believe that company is doomed, but perhaps because he might be over leveraged/facing margin calls, or that he spotted another more compelling opportunity which is worth betting on. Or that he could be using derivatives to still have a stake in the bullish movement of the stock but just prefer not to own the underlying shares directly. The reasons are countless and it does not matter to us.

Below is a snippet of the transcript of the 2022 Daily Journal Annual Meeting. Charlie Munger neither confirms nor deny these possibilities regards to Alibaba.

But not that it matters to us as investors. 🤷🏼♂️

What matters are that we stick to our own game plan and manage our own risks. This is also the reason why we share that there is a danger in over-worshipping or looking up to the investing legends as your heroes, gods or whatever-other-names-you-got because as humans we will tend to follow them blindly if we accord them such a status in our minds. Eventually, you got to be the hero in your own story.

Speaking of which, a quick throwback to the day we visited The World Of DC Superhero Exhibition in Kuala Lumpur. Loving all the brilliant concept art shown and the authentic movie props coming alive. ⚔️

Since young, I enjoy watching DC superhero films because in the midst of our daily struggles, they help us to expand our perspective beyond the “here and now” and onto becoming something much bigger than ourselves, transcending what we think is normally possible. While not exactly the super powers that they have that I am referring to, but more so to wake up a part of our soul to have us believe that we can be like them and become the best version of ourselves that our future self will thank us for.

@endless.weekends Here at the DC exhibition at Kuala Lumpur. #nocrowd #dcheros #dcheroesunited #batman #superman #wonderwoman #aquaman #kualalumpurtravel #kualalumpurtiktok ♬ A Time for Heroes (DC Super Hero Theme) [DC Fandome Version] - Blake Neely

There is a hero inside everyone of us who can bring us to the other side of our struggles. I’m glad I found mine early in my life. I hope you can find yours soon if you hasn’t and live your fullest potential. Let’s continue to make the best of this year and continue to inch towards better investing outcomes.

We hope that this portfolio update may shed some light on the things that our mentees and us do and we hope that it will be helpful for the larger public community to have a glimpse of what we are doing personally in our pursuit towards financial freedom.

About Kathy

Co-Founder of The Joyful Investors and Co-CIO of InvestingNote Portfolio. I graduated with a degree in Economics in National University of Singapore (NUS). My previous experience with traders at the Merrill Lynch enable me to realize many counter-intuitive truths about how the financial markets work and to uncover the challenges faced by many new investors. Investing can be astoundingly simple, and my goal is to make financial education accessible and easy to understand for everyone.

Important Information

This document is for information only and does not constitute an offer or solicitation nor be construed as a recommendation to buy or sell any of the investments mentioned. Neither The Joyful Investors Pte. Ltd. (“The Joyful Investors”) nor any of its officers or employees accepts any liability whatsoever for any loss arising from any use of this publication or its contents. The views expressed are solely the opinions of the author as of the date of this document and are subject to change based on market and other conditions.

The information provided regarding any individual securities is not intended to be used to form any basis upon which an investment decision is to be made. The information contained in this document, including any data, projections and underlying assumptions are based upon certain assumptions and analysis of information available as at the date of this document and reflects prevailing conditions, all of which are accordingly subject to change at any time without notice and The Joyful Investors is under no obligation to notify you of any of these changes.

· · ·

Have you enjoyed this article? We’d be grateful if you would share this useful content to your friends who may benefit from it as well.