Kathy

in Memos & Musings · 5 min read

Since now is the World Cup season, let us write something for some of our soccer fans who are in our investing community as well.

I recently watched “The Playbook – Ep 3” on Netflix which features Jose Mourinho who is one of the most successful football coaches of this modern era. The documentary details of his battles and the methods he uses to find success. In his words “I’m only going to risk when I feel it’s the right moment. You need to find the right moment to be aggressive”, pretty much encapsulates the topic that we would like to touch on today. Similarly as the manager of our own portfolio, perhaps we also need to find the right moment to be bullish (or bearish).

Let’s touch on this interesting topic of when should we play it safe or take on more risk?— this is the same overarching question that people in the competitive arena like soccer players or investors constantly ask of themselves.

During a game, a soccer player may ask himself if it is the right time now to go on the offensive or should he stay put to help out with the defense? In an attempt to score a goal, might he lose the ball and concede a goal instead?

Likewise for investors pursuing portfolio growth, by taking a long position today, it means that their portfolio will face drawdowns should the market retrace tomorrow. By taking on risk, it can lead to positive outcomes but also carries with it the possibilities of bad ones. In this regard, this got us thinking that there are lots of striking resemblances between investing and soccer.

The point is that you can never be absolutely sure of any move you make but you can only do so with the best educated decision that you can make based on your experience, judgment, intuition and what is at stake. You probably should be asking yourself questions like how much is there to win if I win and how much is there to lose if I lose. And if I do lose (e.g. conceding a goal), is it something that I can possibly recover from eventually before the game ends?

So there can be a few scenarios. Let’s say if we are nearing the 90 minutes and if your team is leading by a goal to nil, you probably want to be holding onto as much possession as possible while being cautious on your advances. You would opt for safety over risk and not give your opponents the chance to make a comeback. On the other hand, if you are already 5 goals up and in the dying minutes, you can continue to choose to be aggressive even if that means inadvertently conceding one. And lastly for important games where we are into stoppage time, even sending the goalkeeper to the opponent’s penalty box is not considered that risky because the downside is little as the final whistle is likely to be blown once the ball gets cleared away. All of them sound like a logical way to manage the level of aggression in their own context. You should make your moves according to the situation and what you need.

The problem comes only when a team plays it too safe all the time and does not take on any risk to score goals. They may concede little or none, but neither will they ever win. Conversely, a team that is too aggressive may score a handful but also concede just as much. However in practice, thankfully we don’t exactly see too many of such cases. But the same cannot be said when it comes to investing.

For the retail investors who have opted for robo-advisories or human financial advisors, they are made to typically decide on either adopting a defensive (e.g. 5-4-1 formation), balanced or aggressive stance (4-3-3 formation) at the onset and that mentality stays constant throughout their investing journey. Taking a risk profile of “balanced” might at first glance, seem like a sweet spot of not being at the extremes. But by being a “balanced” investor, is akin to a soccer manager ensuring that he has an equal number of outfield players on each side no matter what happens in the game. So what that means to your portfolio as an investor is that you do not have the chance to maximize the probabilities of scoring while attacking and neither can you do your best to defend with only half of the team. When your team is taking a corner, half of your team remains in your defending half. Likewise when your opponent team takes a corner in your own half, half of your team remains at the attacking half. That may sound ridiculous for any soccer team to be playing like that, but it is what it is for most retail investors when it comes to their “advisory portfolios”.

This is not to say that adopting the same stance without regard for market conditions is wrong. In fact, when it comes to investing, there is a good likelihood that over the very long term, a conservative, balanced or aggressive investor may still make money with different degrees of volatility in their own portfolio. These investors would still likely be better off with an advisory portfolio than not growing their money at all.

But perhaps this article will be food for thought if being able to reposition your portfolio based on the market conditions could be useful to you as an investor as opposed to purely “sticking to the plan” that robo or financial advisors have for you in terms of maximizing your portfolio returns and minimizing your downside risks. We have come to realize over the years that it is helpful to view investing and sports as games in which we must consciously and consistently aim to increase the odds of success.

Similar to soccer players, as investors we can also be in the process of defining the odds to see what we should be doing. Could we be mostly holding good stocks at the early innings of a bull market and to be raising cash at the early declines of a bear market? Yes we can. But the answer to these lies in the ability to read the markets just like how the manager and players read the game. Obviously no one gets it right all the time, but with experience and the knowhow, one can learn to make better judgment calls and be more right often than wrong. And most of the time, this is all that is necessary to build a winning team or portfolio that is a cut above the rest.

There is a reason why professional sports teams don’t necessarily adopt the same defensive or offensive mentality throughout the game. They tend to defend only when it is necessary and attack once the odds are in their favor. Similarly, investors who are seeking long term growth and capital appreciation should also do so in our opinion. For investors who believe they can be more and become better, ought to invest and play like a soccer team. Understanding that every move should be made in tandem with the risk to reward mindset instead of being overly defensive when you should be on the offensive or being too overly offensive when you should be defending.

This is at the very heart of what we do in our Moneyball investing methodology. We stay mindful of the evolving market conditions and position our portfolio accordingly by tilting the odds of success to our side with the right strategies. When the odds favor us, we take a position. And when it doesn’t we either do nothing or trim down our positions.

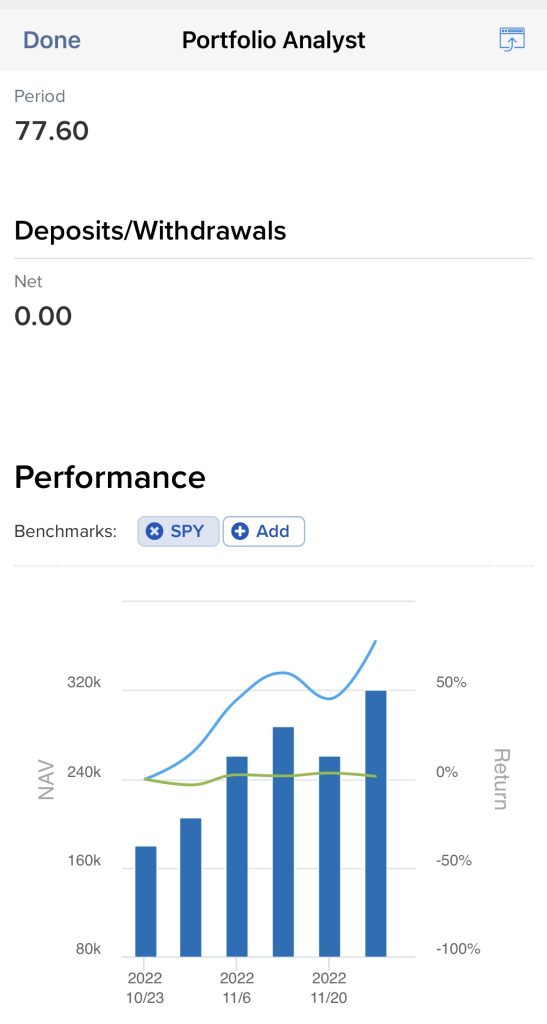

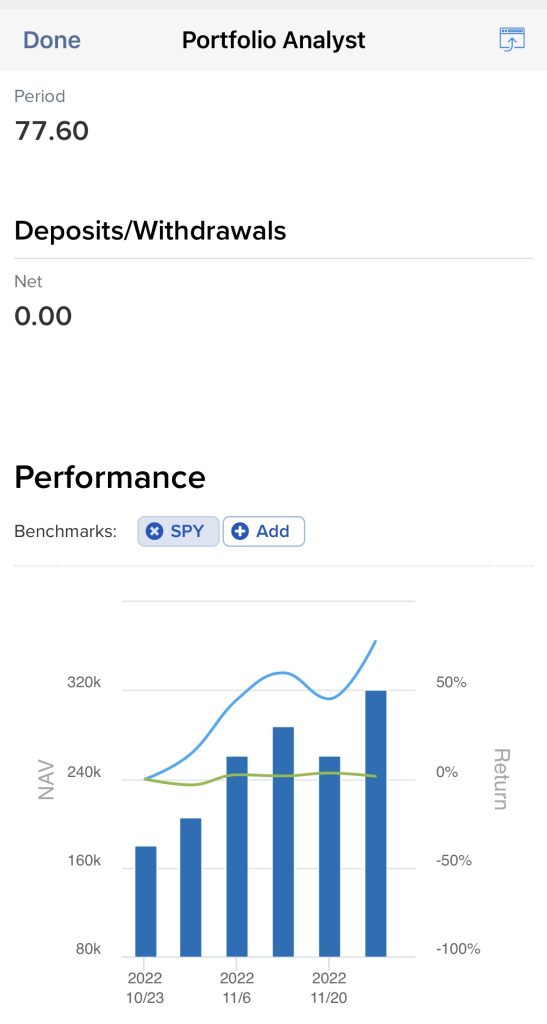

Such methodology allows us to possibly beat the markets from time to time. It has allowed us to transform the stock market where most people perceive it to be a game of luck into a lucrative game of math. Investing need not be like gambling if we learn to do it correctly. In the recent recovery during the month of November, one of our US/China portfolios made outsized gains of approximately 77% while the SPY, QQQ and KWEB were up by 6%, 6.5% and 38% respectively.

Separately, we have also received some feedback from the last couple of months that a simple workshop on the topic of Technical Analysis would be useful for some of us in the community. We have noted that and the good news is that we would probably be rolling them out in the weeks to come. For investors who are keen to learn how to better read the financial markets and get a grasp of how to really interpret the stock market, the workshop will be helpful to you. Stay tuned for updates in our telegram channel.

Here’s wishing all the world cup fans to have a great time watching the remaining matches and to all investors a good 2023 ahead!

Latest Update:

You may check out our upcoming workshops here. Discover the tools of the trade on how we can read the financial markets like a pro.

Seats are available only on a first come first serve basis. See you there.

About Kathy

Co-Founder of The Joyful Investors and Co-CIO of InvestingNote Portfolio. I graduated with a degree in Economics in National University of Singapore (NUS). My previous experience with traders at the Merrill Lynch enable me to realize many counter-intuitive truths about how the financial markets work and to uncover the challenges faced by many new investors. Investing can be astoundingly simple, and my goal is to make financial education accessible and easy to understand for everyone.

Important Information

This document is for information only and does not constitute an offer or solicitation nor be construed as a recommendation to buy or sell any of the investments mentioned. Neither The Joyful Investors Pte. Ltd. (“The Joyful Investors”) nor any of its officers or employees accepts any liability whatsoever for any loss arising from any use of this publication or its contents. The views expressed are solely the opinions of the author as of the date of this document and are subject to change based on market and other conditions.

The information provided regarding any individual securities is not intended to be used to form any basis upon which an investment decision is to be made. The information contained in this document, including any data, projections and underlying assumptions are based upon certain assumptions and analysis of information available as at the date of this document and reflects prevailing conditions, all of which are accordingly subject to change at any time without notice and The Joyful Investors is under no obligation to notify you of any of these changes.

· · ·

Have you enjoyed this article? We’d be grateful if you would share this useful content to your friends who may benefit from it as well.