Hazelle

in Memos & Musings · 5 min read

This article was created in partnership with Societe Generale (Singapore branch), but the opinions are our own.

Nvidia’s Earnings Roared Higher to Record Levels

Last week, NVIDIA (NASDAQ: NVDA) posted fourth-quarter revenue of $39.3 billion for the period ending January 26, 2025 — marking a 12% increase quarter-on-quarter and a staggering 78% jump year-on-year. CEO Jensen Huang reaffirmed his confidence in sustained strong demand for NVIDIA’s GPUs, driven in part by the soaring popularity of DeepSeek’s compute-efficient models. This upbeat outlook came right after NVIDIA delivered better-than-expected results, easing concerns that new AI model efficiencies could dampen GPU demand.

The rise of DeepSeek, which developed large language models at a fraction of the cost and computing resources of Western counterparts, initially led to speculation that demand for NVIDIA GPUs could slow. NVIDIA experienced a nearly US$600 billion drop in market value last month in the largest single-day drop for any U.S company, before it started to rebound the next day.

NVIDIA’s Momentum Continues Across Key Segments

Since its previous earnings report, NVIDIA has made impressive strides across its core businesses.

Data Center revenue hit a record $35.6 billion in the fourth quarter — up 16% quarter-on-quarter and soaring 93% year-on-year. NVIDIA became a key partner in the $500 billion Stargate Project and teamed up with major cloud players like AWS and Google to roll out NVIDIA GB200 systems worldwide. The company also strengthened its footprint in healthcare through new partnerships with IQVIA and Mayo Clinic, launched AI Blueprints and Llama Nemotron models, and opened its first R&D center in Vietnam.

In Gaming, NVIDIA introduced the GeForce RTX 50 Series, built on the new Blackwell architecture, delivering up to 2x performance gains. However, fourth-quarter Gaming revenue came in at $2.5 billion, down 22% from the previous quarter and 11% lower than a year ago — though full-year revenue still rose 9% to $11.4 billion. NVIDIA also unveiled DLSS 4 and Reflex 2, advancing gaming performance and lowering latency.

In Professional Visualization, fourth-quarter revenue reached $511 million, up 5% sequentially and 10% year-over-year, with full-year revenue climbing 21% to $1.9 billion. Key launches included Project DIGITS, a personal AI supercomputer, and expanded Omniverse capabilities, integrating generative AI for robotics and autonomous vehicles.

The Automotive segment delivered $570 million in fourth-quarter revenue, up 27% from the previous quarter and a remarkable 103% year-over-year. For the full year, revenue surged 55% to $1.7 billion. NVIDIA deepened its partnerships with Toyota and Hyundai to power next-gen vehicles and robotics, launched the Cosmos platform for generative AI, and introduced the Jetson Orin Nano Super, offering 1.7x AI performance gains.

Across every segment, NVIDIA continues to cement its leadership in AI and accelerated computing — driving innovation, expanding partnerships, and shaping the future of technology.

NVIDIA’s Economic Moat

NVIDIA enjoys a strong economic moat, built on the exceptional value its products deliver to customers. This high value proposition has not only boosted customer stickiness, but also allowed NVIDIA to lock in a commanding share of the global GPU market — a position that competitors have struggled to challenge.

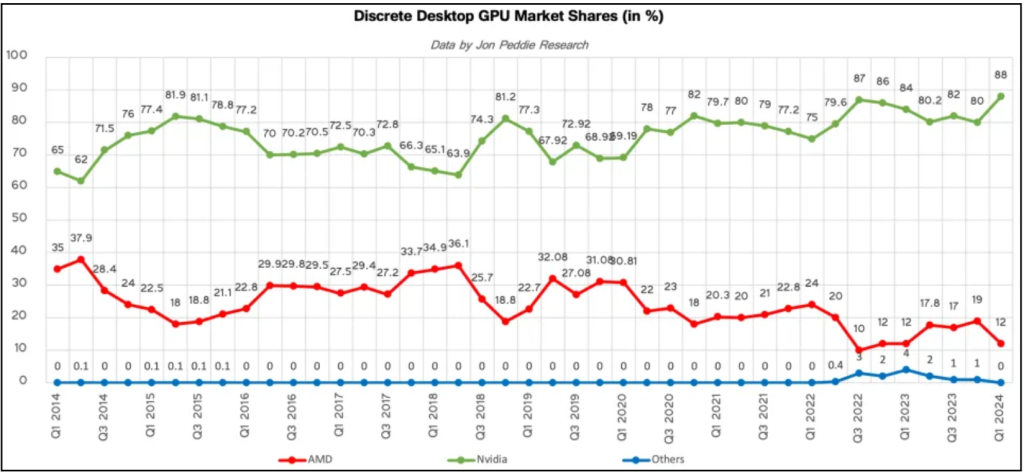

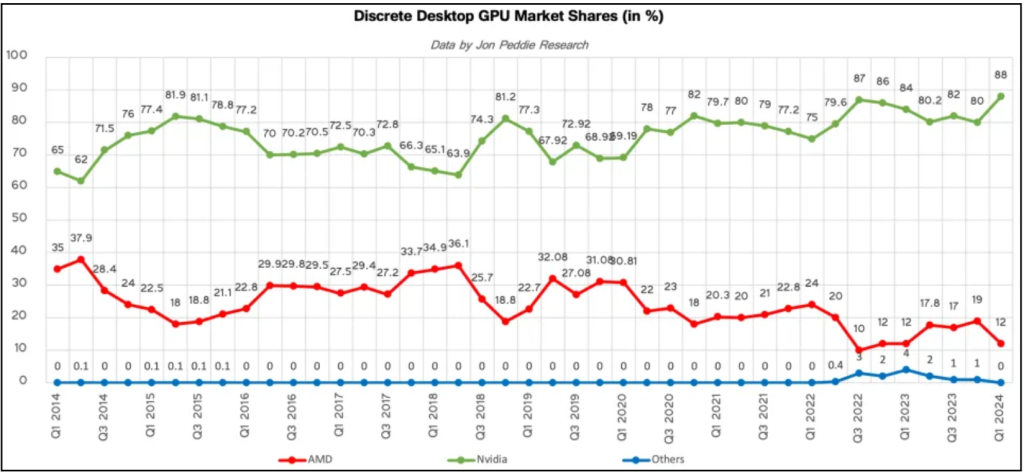

The company’s dominance stems from its early mover advantage. NVIDIA initially set out to design GPUs specifically for graphic processing in PCs and gaming consoles, giving it a crucial head start in technology development and ecosystem building. By 2023, this first-mover edge translated into an 88% market share in discrete desktop GPUs, cementing NVIDIA’s status as the undisputed leader in the space.

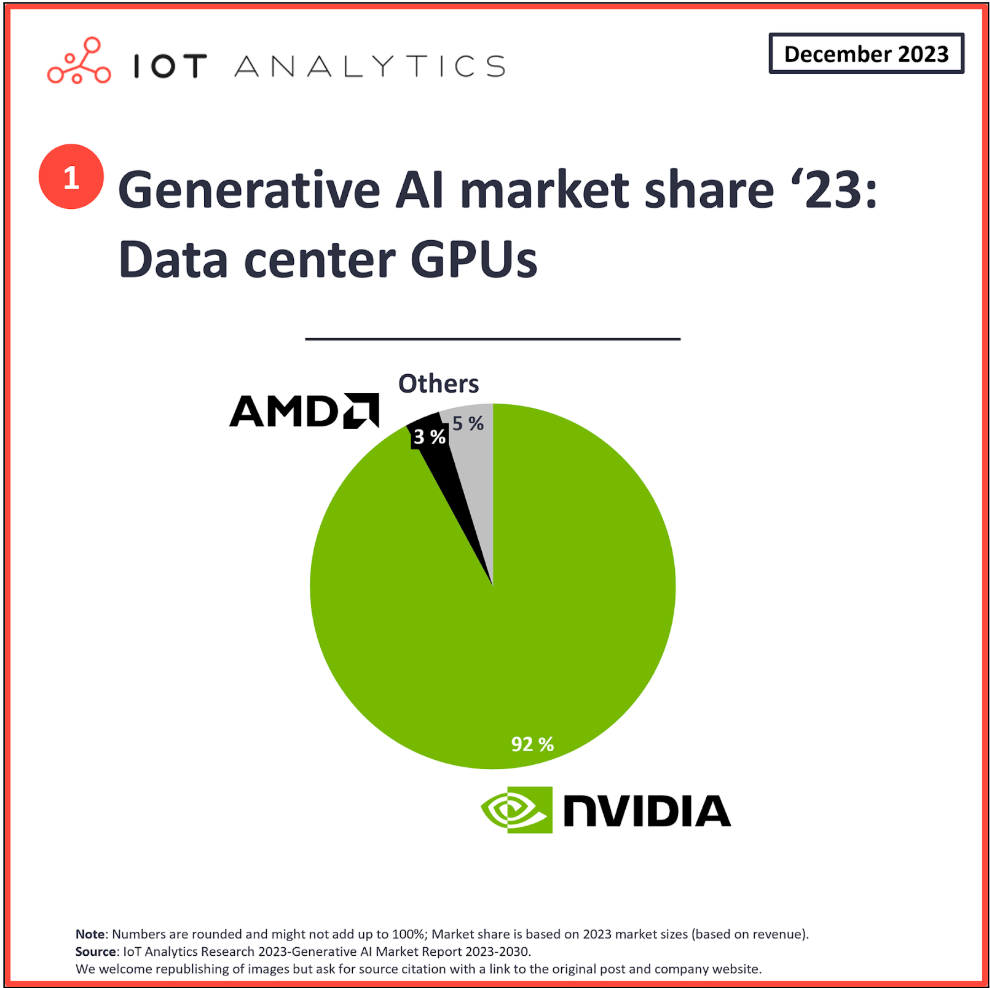

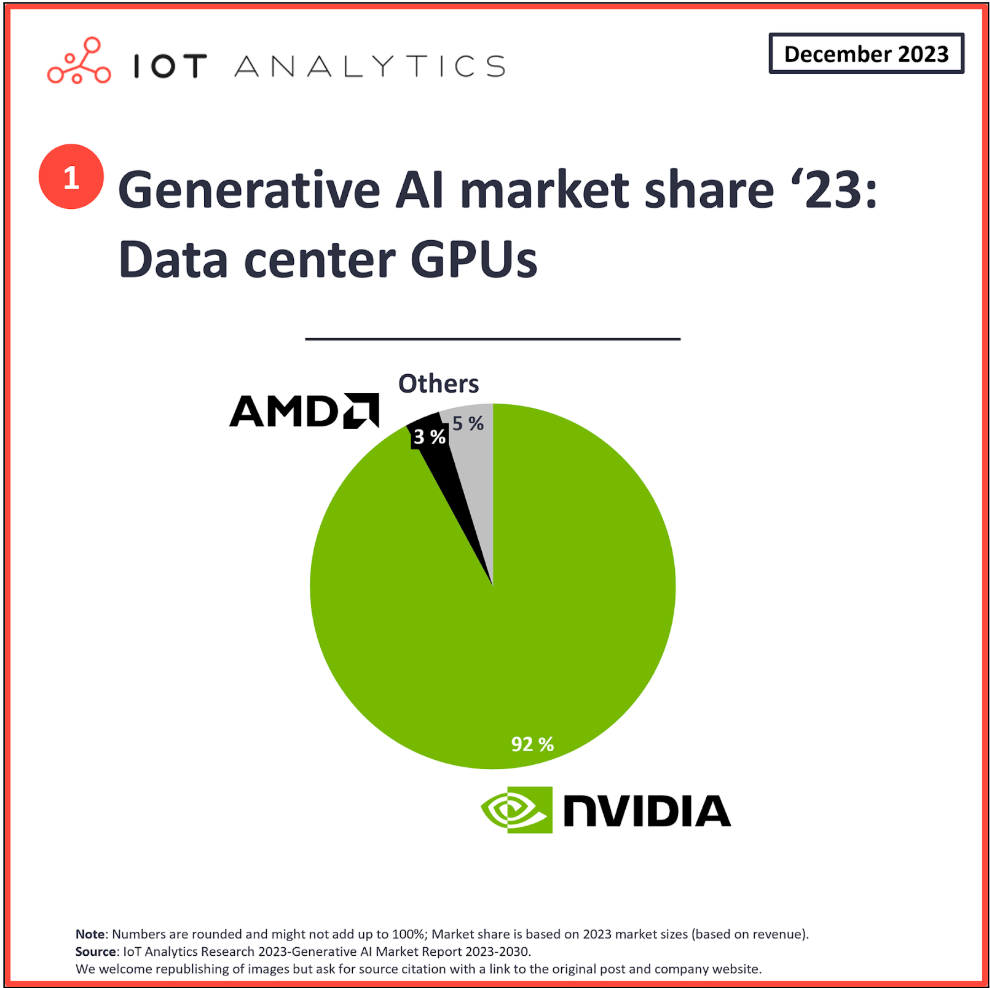

NVIDIA hasn’t simply relied on its early success — the company has consistently reinvested in research and development, ensuring it stays at the cutting edge of AI innovation. By leveraging its stronghold in gaming GPUs, NVIDIA smartly channeled profits into advancing high-performance computing and AI technologies. This relentless focus on innovation has paid off handsomely, allowing NVIDIA to capture more than 90% of the data center GPU market for AI applications — a level of dominance that’s virtually unrivaled.

NVIDIA’s economic moat is further fortified by its Hopper and Blackwell GPUs, which serve as the backbone of modern data centers, powering the training of large language models (LLMs) and driving breakthroughs in AI applications. These cutting-edge innovations have reinforced NVIDIA’s dominance in both the AI and data center markets, giving the company a critical competitive edge as demand for accelerated computing skyrockets.

The H100 AI chip, built on Hopper architecture, has been a cornerstone of NVIDIA’s ascent to a multitrillion-dollar valuation. But NVIDIA isn’t stopping there. The recent unveiling of its Blackwell architecture marks yet another game-changing leap in AI and high-performance computing. The new B200 GPU, built on Blackwell, packs 208 billion transistors and delivers up to 20 petaflops of FP4 performance. Pairing two B200 GPUs with a single Grace CPU, the GB200 achieves 30x the performance for LLM inference workloads, while cutting costs and energy consumption by up to 25 times compared to the H100.

To put this into perspective — training a 1.8 trillion parameter model once required 8,000 Hopper GPUs consuming 15 megawatts of power. With Blackwell, NVIDIA’s CEO claims the same model can now be trained with just 2,000 GPUs using only 4 megawatts, showcasing an unprecedented leap in efficiency and performance. This relentless pace of innovation keeps NVIDIA well ahead of the competition, securing its position as the de facto leader in AI infrastructure.

Potential Growth Drivers

Expansion of the AI Data Center Accelerator Market

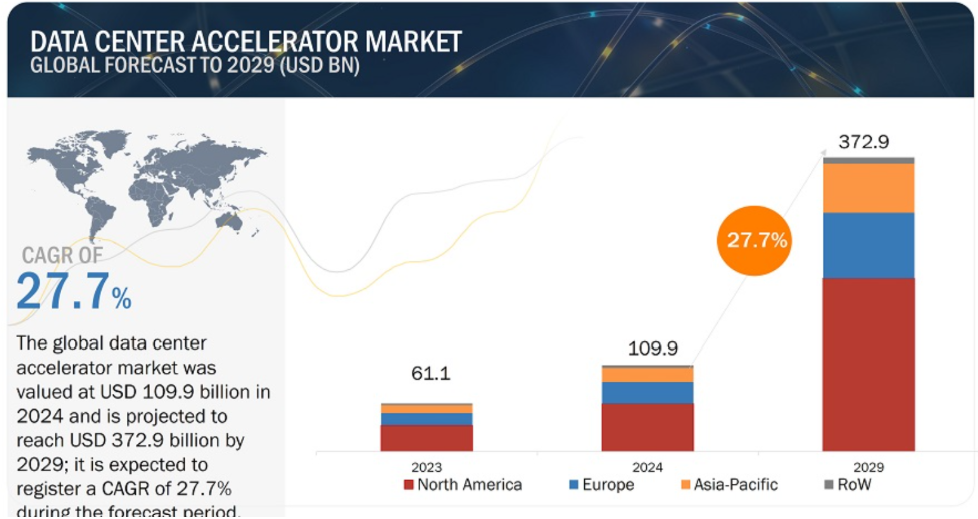

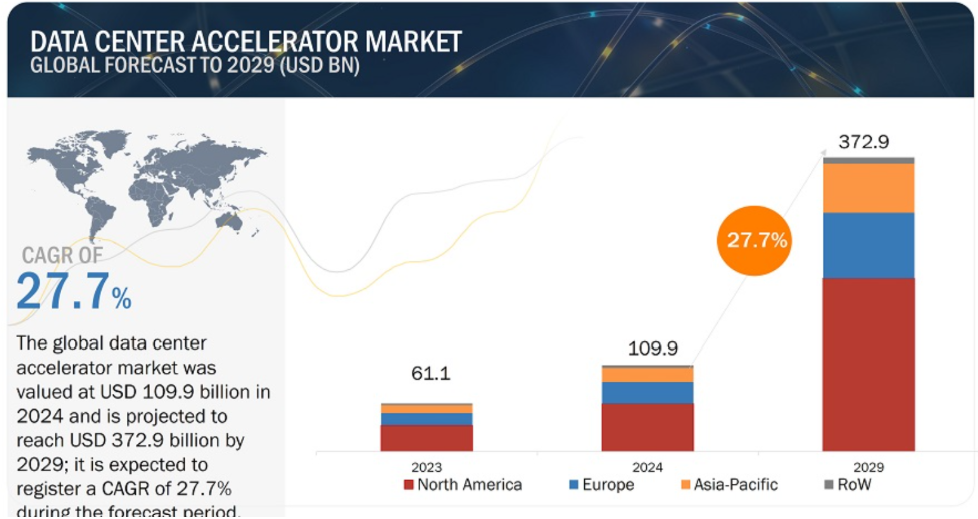

The global AI data center accelerator market, valued at USD 109.9 billion in 2024, is projected to surge to USD 372.9 billion by 2029, growing at an impressive CAGR of 27.7%. The rapid expansion of data centers and the rise of cloud-based services, fueled by advancements in technologies like AI, IoT, and big data analytics, present a huge growth opportunity for NVIDIA. With its dominance in AI-enabled data center GPUs and its ability to meet the increasing complexity of high-performance computing workloads—from genomics to machine learning and cybersecurity—NVIDIA is poised to capture a significant share of this burgeoning market.

AI development unfolds in two essential phases. The first is AI training, where developers feed a large dataset of images into a model to help it learn. The second is AI inference, where the trained model analyzes new data and makes decisions based on its learned patterns. As AI continues to evolve, GPUs are set to play a pivotal role, not only driving AI training but also dominating the vast majority of AI inference tasks, powering the next generation of intelligent applications.

Expansion of the Automotive Market

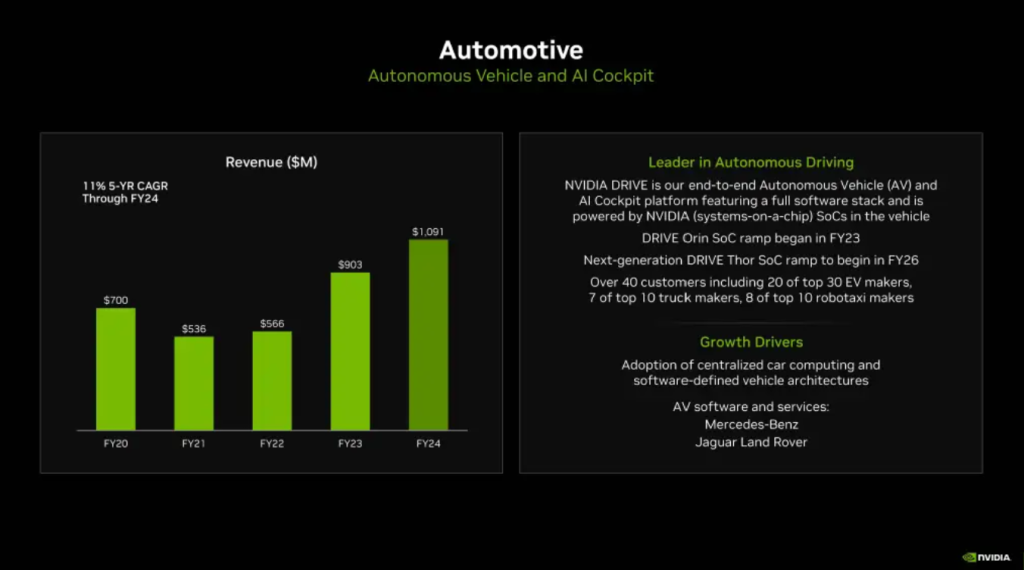

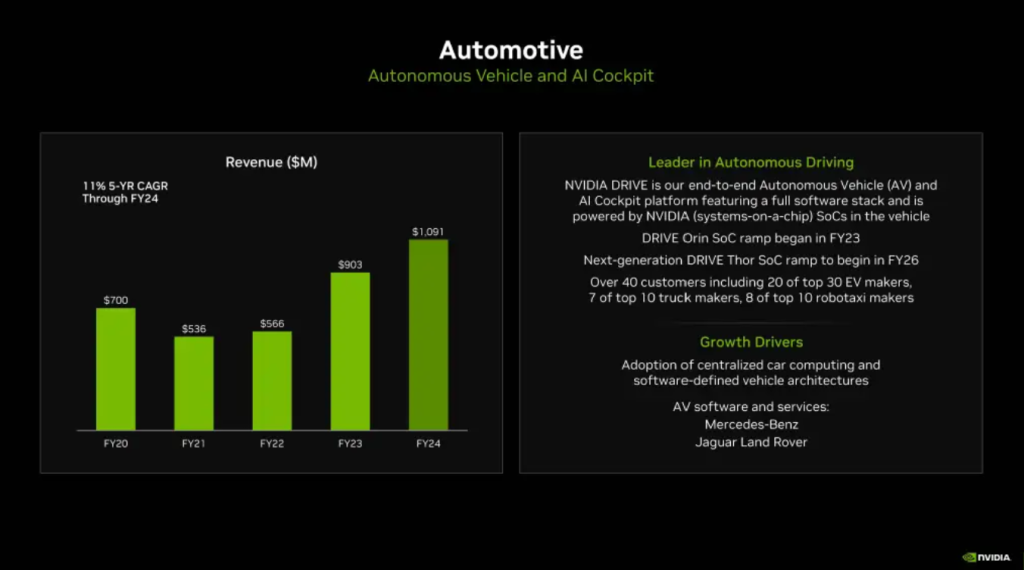

NVIDIA is advancing rapidly in the automotive sector, leveraging its AI-powered platforms to drive innovation in autonomous vehicles. Over the past five years, its Automotive revenue has grown at an 11% compound annual growth rate (CAGR). As the industry shifts toward electrification and automation, NVIDIA’s DRIVE platform is central to enabling autonomous driving, digital cockpits, and advanced driver assistance systems (ADAS). This positions NVIDIA to capitalize on a rapidly expanding market, as automakers increasingly adopt AI-driven solutions for enhanced safety, efficiency, and performance. With autonomous vehicle technologies gaining traction, NVIDIA is solidifying its role as a key player in the future of smart transportation.

Continuous investment into new technologies such as Blackwell

NVIDIA’s Blackwell architecture is set to make a major impact, marking a significant leap forward in AI and high-performance computing (HPC). With its unmatched parallel computing capabilities, Blackwell delivers up to 20 petaflops of FP4 performance through 208 billion transistors. Not only does it outperform its predecessor, the H100, it also redefines efficiency, offering up to 30 times the performance for large language model (LLM) inference workloads while slashing energy consumption by 25 times. As AI continues to evolve, Blackwell places NVIDIA firmly at the forefront of next-generation AI innovations, making it a critical growth driver for the company.

By tapping into these key growth drivers — cutting-edge technologies like Blackwell, expanding into markets like automotive, and capitalizing on the explosive growth of the AI data center accelerator market, NVIDIA is well-positioned to maintain its leadership and drive sustained long-term growth.

Potential Investment Risks

Customer concentration risk with the Magnificent 7

NVIDIA’s current success is closely linked to the Magnificent 7 (Mag7) tech companies, which include major players like Meta, Amazon, and Google. Together, these companies are estimated to contribute over 40% of NVIDIA’s latest revenue.

Although the Mag7 companies are generally stable and resilient, they tend to move in tandem. If one of them decides to scale back AI-related capital spending due to macroeconomic challenges, others could follow suit — directly affecting NVIDIA’s revenue and profits. On top of that, there’s a longer-term risk that some of these tech giants might eventually develop their own in-house chips, reducing their reliance on NVIDIA and cutting off a substantial portion of its income.

Export restrictions to other countries such as China

NVIDIA also faces significant geopolitical risks, especially from U.S. export restrictions targeting China and other countries. In 2023, the U.S. government imposed new licensing rules that restrict the export of NVIDIA’s high-performance chips — including the A100, H100, and L40S — to China, Russia, and several other nations. As a result, NVIDIA’s data center revenue from China dropped from 19% in fiscal year 2023 to 14% in fiscal year 2024, with similar levels expected for fiscal year 2025.

Since China was previously a key growth driver for NVIDIA’s AI and data center business, these restrictions could further constrain its ability to access the world’s second-largest economy. If U.S. sanctions tighten further or geopolitical tensions escalate, NVIDIA could see even deeper revenue declines from China and other restricted markets.

NVIDIA’s Q4 Fiscal 2025: A Masterclass in Growth — But Not Without Risks

NVIDIA’s latest quarterly results were nothing short of extraordinary. The company reported $39.33 billion in revenue, achieved a remarkable 73% gross margin, and delivered 80% profit growth — all while maintaining a formidable cash position. Today, NVIDIA reigns as the undisputed leader of the AI revolution, dominating surging demand for data center GPUs and leaving competitors racing to catch up.

That said, the road ahead isn’t without challenges.

Valuation concerns loom large — after such a steep rally, even a slight miss in earnings or a moderation in growth could spark significant volatility. Competition is also heating up fast, with AMD, Intel, and custom silicon developed by cloud giants (such as Google’s TPUs and AWS’s Trainium) all vying for a piece of the pie.

Adding to the risks are ongoing supply chain constraints, geopolitical uncertainties — particularly U.S. restrictions on exports to China — and the cyclical nature of tech spending. As AI adoption matures, today’s explosive demand for cutting-edge GPUs may eventually normalize.

The takeaway? NVIDIA’s dominance is undeniable, but the path forward is unlikely to be smooth.

Looking to trade NVIDIA’s wild price swings? Daily Leveraged Certificates (DLCs) could be your go-to tool.

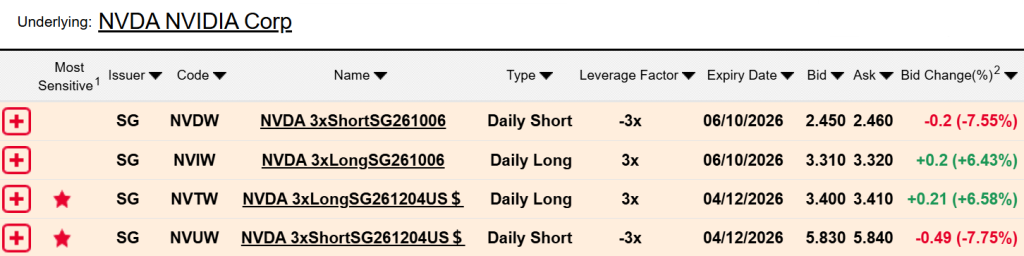

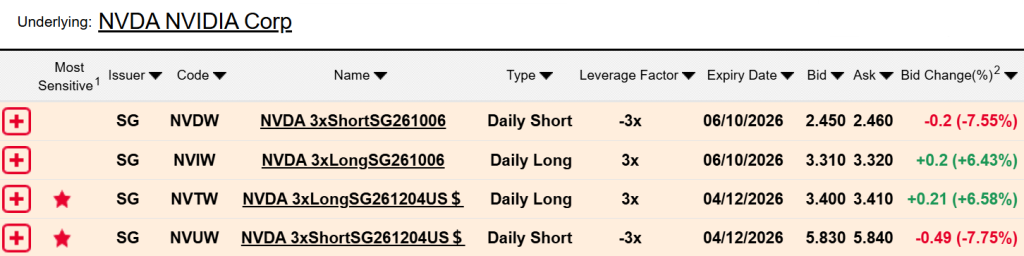

For traders looking to capitalize on NVIDIA’s rapid price swings, Daily Leveraged Certificates (DLCs) listed on the SGX offer a flexible and efficient way to do so. With 3x leverage, DLCs amplify NVIDIA’s daily price moves — meaning both gains and losses are magnified compared to the stock itself. This makes them particularly effective for short-term trades, especially when volatility surges around key events like earnings, product announcements, or major tech news.

Source: DLC.socgen.com

What sets DLCs apart for NVIDIA traders is their cost efficiency and ease of use. Designed for intraday trading, these products are simple to understand and available in both long and short versions — so you can quickly switch between bullish and bearish positions as the market evolves.

With NVIDIA at the heart of the AI boom and its share price highly sensitive to shifting sentiment, DLCs offer traders a tactical way to seize short-term opportunities without locking into longer-term commitments.

Disclaimer

This advertisement has not been reviewed by the Monetary Authority of Singapore. The views expressed under this article represent the personal and independent views of the author and do not constitute investment advice. The content of this article does not form part of any offer or invitation to buy or sell any daily leverage certificates (the “DLCs”), and nothing herein should be considered as financial advice or recommendation. The price may rise and fall in value rapidly and holders may lose all of their investment. Any past performance is not indicative of future performance. Investments in DLCs carry significant risks, please see dlc.socgen.com for further information and relevant risks. The DLCs are for specified investment products (SIP) qualified investors only.

About Hazelle

Chief trainer of The Moneyball Investors Playbook program and founder of The Joyful Investors, a financial education firm that seeks to help avid investors learn to invest better and make the journey a joyful one. I graduated with a first class honors in Bachelor of Accountancy from Nanyang Technological University (NTU) and started my auditing career in one of the Big Four. I believe that once we know how to build our wealth sustainably, we can then live our best lives ever.

Important Information

This document is for information only and does not constitute an offer or solicitation nor be construed as a recommendation to buy or sell any of the investments mentioned. Neither The Joyful Investors Pte. Ltd. (“The Joyful Investors”) nor any of its officers or employees accepts any liability whatsoever for any loss arising from any use of this publication or its contents. The views expressed are solely the opinions of the author as of the date of this document and are subject to change based on market and other conditions.

The information provided regarding any individual securities is not intended to be used to form any basis upon which an investment decision is to be made. The information contained in this document, including any data, projections and underlying assumptions are based upon certain assumptions and analysis of information available as at the date of this document and reflects prevailing conditions, all of which are accordingly subject to change at any time without notice and The Joyful Investors is under no obligation to notify you of any of these changes.

· · ·

Have you enjoyed this article? We’d be grateful if you would share this useful content to your friends who may benefit from it as well.