Kathy

in Memos & Musings · 2 min read

What happened?

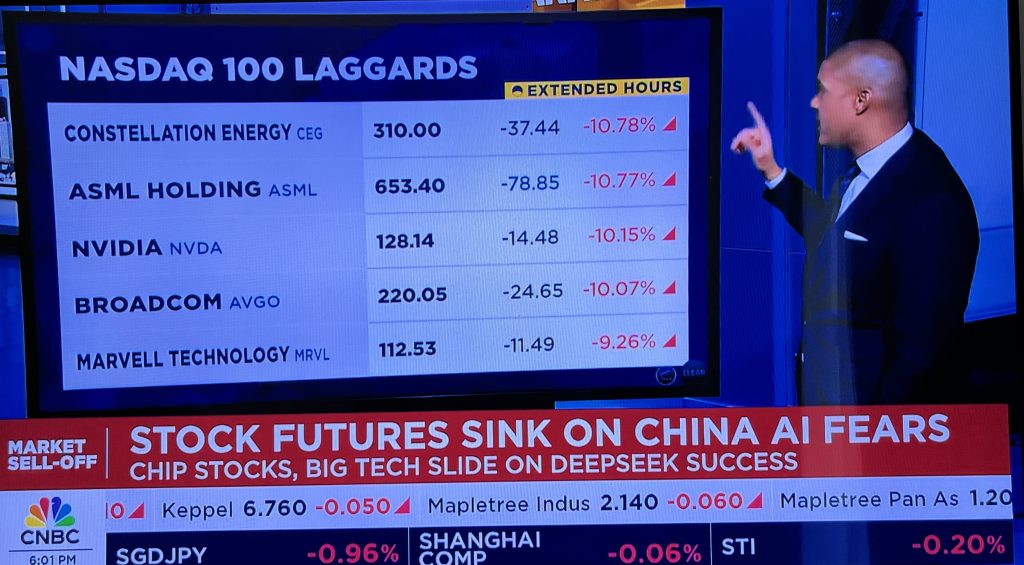

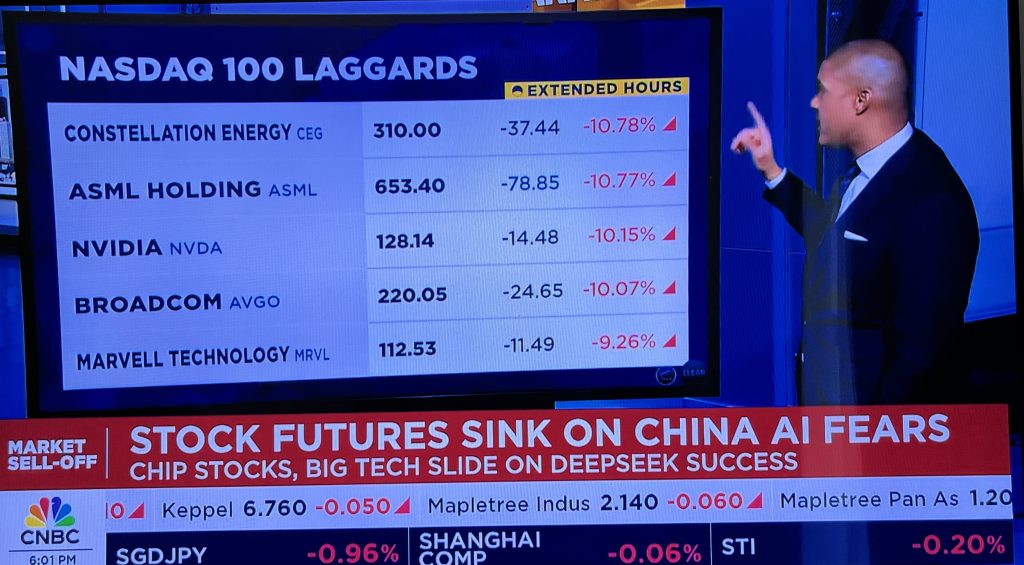

China’s artificial intelligence lab DeepSeek vaporized $586 billion and counting from Nvidia‘s (NASDAQ:NVDA) market capitalization on 27 January 2025. The unveiling of its DeepSeek R1 large language model (LLM) using inferior Nvidia chips has seemed to achieve superior results to comparable models on the market, and doing so at dramatically lower costs, which upended the AI market.

What made DeepSeek even more impressive was its efficiency. Trained on just 2,048 H800 GPUs, it used only a tenth of the computing power required for Meta Platforms’ (NASDAQ:META) comparable Llama 3.1 model, which needed 16,384 of the pricier H100 GPUs. The training cost was estimated to be 27 times lower as well.

As the industry digests these developments, it may take some time for the market to fully grasp the implications for AI—but Nvidia might find it harder to justify the sky-high valuations it once commanded.

Nassim Taleb predicts larger pullbacks after Nvidia’s plunge

Speaking at Miami Hedge Fund Week, Nassim Taleb told Bloomberg that investors should prepare for potential drawdowns “two or three times larger” than Monday’s selloff, which he views as “completely in line with expectations” given the market’s structure.

Black Swan author Nassim Taleb warns that this may just be the beginning, with a much larger correction potentially on the horizon and points to the fragility of the market, where gains have been heavily concentrated in a handful of stocks. In fact, Nvidia, Apple, Amazon, Alphabet, and Broadcom accounted for nearly half of the S&P 500’s returns in 2024. This was also one of the concerns that Coach Hazelle from The Joyful Investors, cited in her recent YouTube video on “How to manage risks and uncertainty to build a thriving portfolio” which we thought could be one of the key themes for 2025.

Taleb also highlighted the inherent volatility of tech stocks, calling them “gray swans.” As he put it, “People are beginning to realize it’s not flawless. There’s a small crack in the glass. Now they’re thinking—maybe it’s not infallible.”

Taleb cited Sir Clive Sinclair, who pioneered the laptop computer but went bankrupt, and AltaVista, which quickly vanished from the search engine space after Alphabet Inc.’s Google took over the market. He also warned that the electric vehicle sector could face a similar fate, writing, “Next: electric cars.” His cautionary note is backed by historical examples, such as General Motors’ early push into EVs with the EV1—only to later file for bankruptcy in 2009. Perhaps the same could be said for Nvidia.

Bottom line: Balancing Opportunity and Risk

While concerns about market fragility are valid, the rise of low-cost AI models like DeepSeek may actually fuel semiconductor demand rather than diminish it. As AI becomes more accessible, adoption is likely to accelerate across industries, driving an even greater need for advanced chips. In the bigger picture, this could present a strong long-term growth opportunity for the semiconductor sector.

That said, it’s important to stay rational and consider both sides of the argument. Taleb raises a valid point—no company is invincible, and even industry leaders can become obsolete or lose their competitive edge over time. Risk management remains the cornerstone of sound portfolio strategy. While gaining exposure to high-potential sectors is important, maintaining a balanced and measured approach is just as crucial.

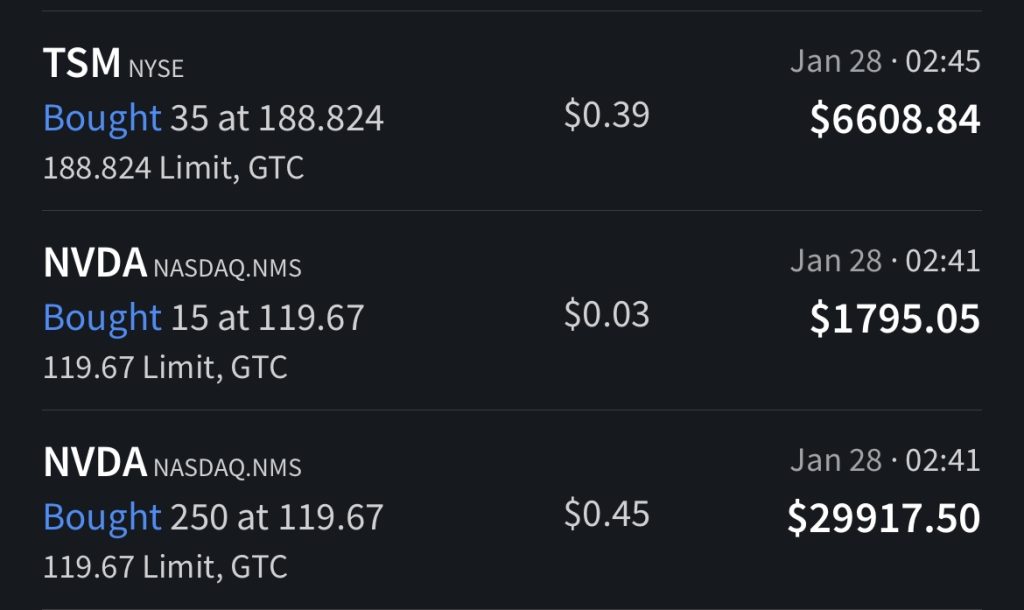

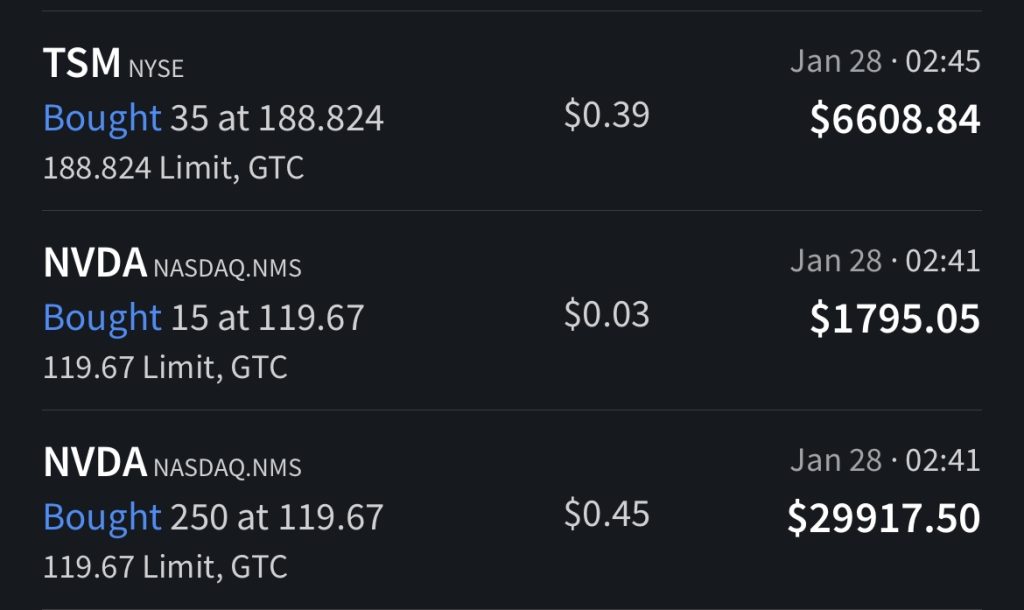

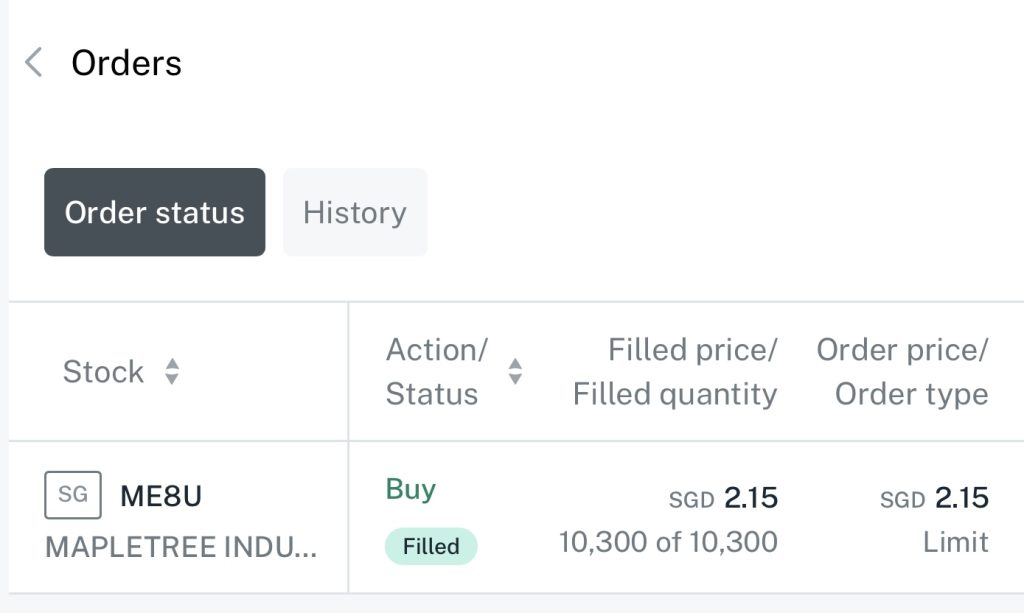

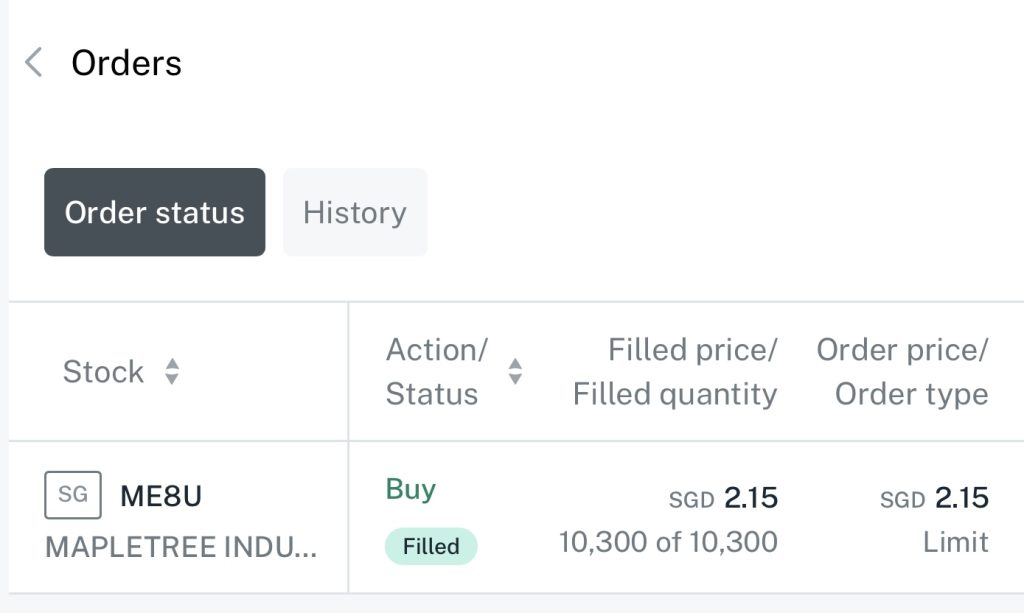

Following our Moneyball Investing methodology, we viewed the recent pullback as a potential buying opportunity and added further to our semiconductor positions such as Nvidia and Taiwan Semiconductor Manufacturing Company, which were also featured stocks in our InvestingNote Portfolio subscription service. Closer to home, we also seized the opportunity to add to one of our core positions in our dividend portfolio which was Mapletree Industrial Trust too which was also somewhat affected by the DeepSeek’s threat due to its exposure in data centres.

Screenshot from our brokerage accounts

Our approach is to maintain enough exposure to benefit from potential upside—but not so much that an eventual pullback could cause significant damage to the portfolio. At the end of the day, mindful purchases and thoughtful diversification are what separate long-term winners from the rest.

If you want an in-depth analysis of the companies on our investing watchlist and real-time updates on our trade alerts, join us at InvestingNote Portfolio. You’ll gain exclusive access to our research insights, market strategies, and portfolio moves—helping you make informed investment decisions with confidence.

Stay ahead of market trends, navigate volatility with a data-driven approach, and invest alongside a community of like-minded individuals. Join us today and take your investing journey to the next level!

About Kathy

Co-Founder of The Joyful Investors and Co-CIO of InvestingNote Portfolio. I graduated with a degree in Economics in National University of Singapore (NUS). My previous experience with traders at the Merrill Lynch enable me to realize many counter-intuitive truths about how the financial markets work and to uncover the challenges faced by many new investors. Investing can be astoundingly simple, and my goal is to make financial education accessible and easy to understand for everyone.

Important Information

This document is for information only and does not constitute an offer or solicitation nor be construed as a recommendation to buy or sell any of the investments mentioned. Neither The Joyful Investors Pte. Ltd. (“The Joyful Investors”) nor any of its officers or employees accepts any liability whatsoever for any loss arising from any use of this publication or its contents. The views expressed are solely the opinions of the author as of the date of this document and are subject to change based on market and other conditions.

The information provided regarding any individual securities is not intended to be used to form any basis upon which an investment decision is to be made. The information contained in this document, including any data, projections and underlying assumptions are based upon certain assumptions and analysis of information available as at the date of this document and reflects prevailing conditions, all of which are accordingly subject to change at any time without notice and The Joyful Investors is under no obligation to notify you of any of these changes.

· · ·

Have you enjoyed this article? We’d be grateful if you would share this useful content to your friends who may benefit from it as well.