Kathy

in Memos & Musings · 2 min read

The global financial landscape in 2025 is grappling with heightened volatility as escalating tariffs, fluctuating interest rates, and intensifying geopolitical tensions reshape economic dynamics. Recent developments, such as the United States imposing a sweeping 25% tariff on imports from Canada, Mexico, and China, have triggered significant market reactions, with major indices like the S&P 500 experiencing its steepest quarterly decline since 2022. Meanwhile, geopolitical uncertainties have driven safe-haven assets like gold to record highs, reflecting widespread investor apprehension. These disruptions are particularly pronounced in major financial hubs like the United States, Hong Kong and Singapore, where export-dependent economies face mounting risks from trade barriers and slowing global growth.

Global Market Conditions

The U.S. economy is experiencing a period of uncertainty, largely due to the implementation of substantial tariffs on imports. Notably, a 25% tariff on steel and aluminium, alongside additional levies on goods from Canada and China, has contributed to rising inflation and economic unpredictability. These measures have led to increased consumer prices, prompting concerns about prolonged high interest rates as the Federal Reserve seeks to manage inflationary pressures.

Focusing on Hong Kong, a pivotal international financial center, its economy faces significant risks amid escalating U.S.-China trade tensions. The city’s economy is vulnerable to the repercussions of higher tariffs and geopolitical strains, which could dampen growth prospects. Additionally, discussions about the potential abandonment of the U.S. dollar peg highlight the financial challenges posed by ongoing geopolitical dynamics. Closer to home, Singapore’s economy is also susceptible to the adverse effects of the U.S.-China tariff conflict. The nation’s growth outlook is clouded by uncertainties stemming from increased geopolitical tensions and elevated trade barriers, which could hinder its export-dependent economy.

Impact of Tariffs, Interest Rates, and Global Tensions

The escalation of tariffs has introduced inflationary pressures across various economies, leading central banks to adopt cautious monetary policies. In the U.S., the prospect of sustained high interest rates looms as policymakers grapple with balancing inflation control and economic growth. This environment of uncertainty is further exacerbated by geopolitical tensions, which contribute to market volatility and investor apprehension.

Trade policy uncertainty. (Source)

Strategies and Opportunities for 2025 and Beyond

Despite these challenges, the equities market continues to offer potential opportunities for astute investors:

- Diversification: Investors can mitigate risks by diversifying their portfolios across various sectors and regions, reducing exposure to any single market’s volatility.

- Value Stocks: In times of economic uncertainty, value stocks—companies with strong fundamentals trading below their intrinsic value—may present attractive investment prospects.

- Defensive Sectors: Sectors such as utilities, healthcare, and consumer staples often exhibit resilience during economic downturns, providing stability to investment portfolios.

- Emerging Markets: Select emerging markets may offer growth opportunities, particularly in regions less affected by current trade tensions.

How You Can Invest Smarter

For investors seeking to capitalise on these opportunities, CMC Invest offers a comprehensive platform designed to facilitate efficient and cost-effective trading. Notably, CMC Invest provides 45 free monthly trades across major markets, including Singapore, U.S., U.K., Hong Kong, and Canada. Additionally, the platform offers a competitive foreign exchange (FX) settlement rate of 0.20%.

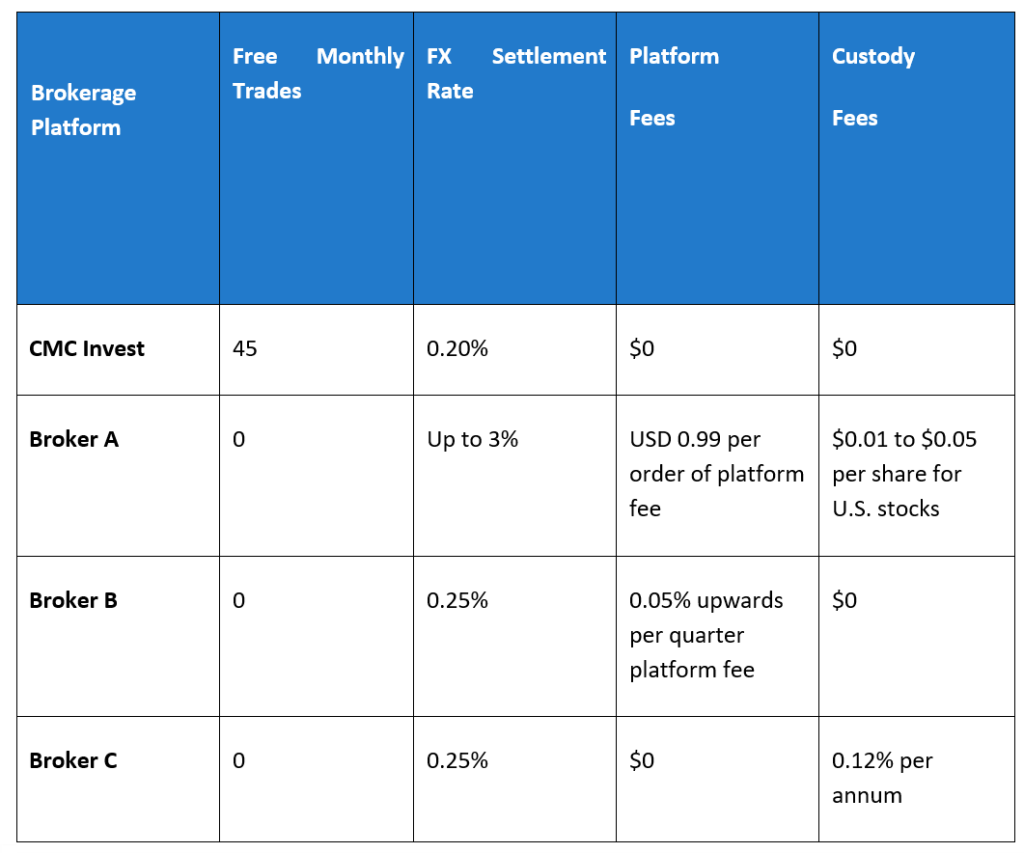

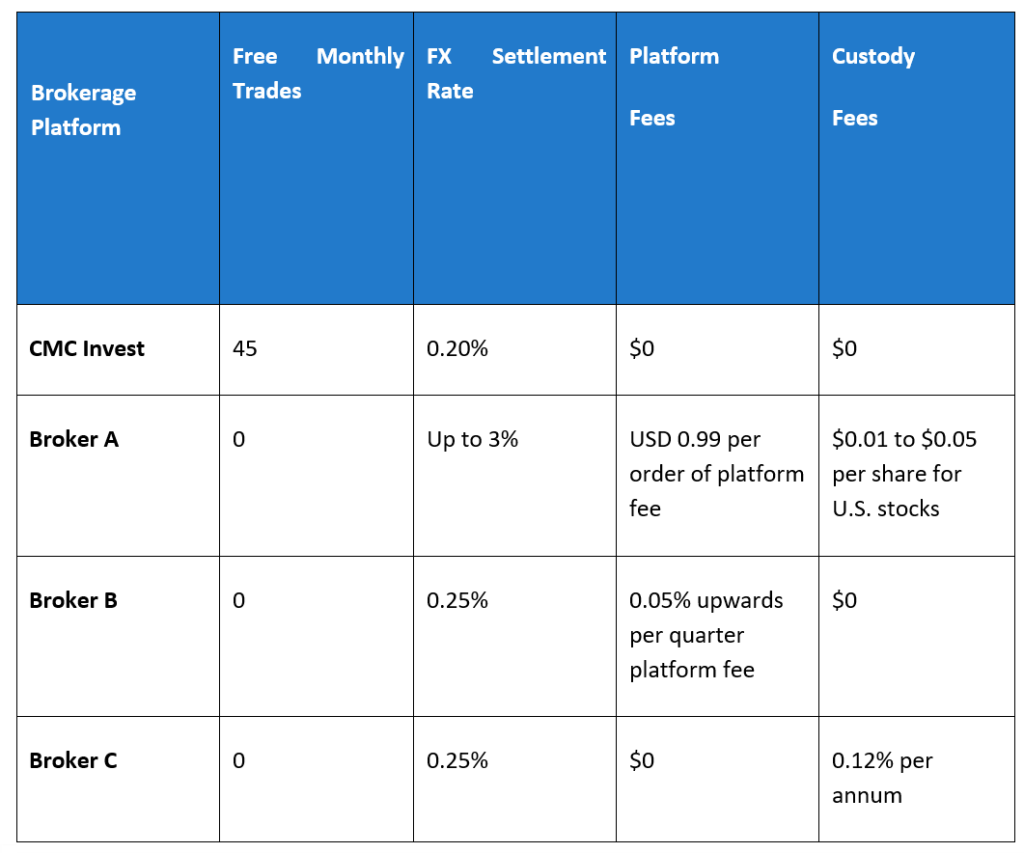

Competitive Fee Structure

CMC Invest’s fee structure is designed to maximise investor returns by minimising costs. Below is a comparison highlighting CMC Invest’s competitiveness relative to other brokerage platforms:

Note: The above comparison is illustrative and at the time of writing; actual fees may vary.

By offering a higher number of free trades and lower FX settlement rates without imposing platform or custody fees, CMC Invest provides a cost-effective solution for investors aiming to optimise their equity investments.

Enjoy an Investing Note exclusive promotion:

Open your account today with our link here or enter the promo code ‘investingnote’ to receive 4 free Grab shares and kickstart your investing journey. Plus, fund S$1,000 and make 2 buy trades by 31 May 2025 to get 1 additional Super Micro Computer (SMCI) share.

This offer is in addition to the existing welcome offer, which gives you up to 1 free Microsoft share.

Conclusion

Navigating the current global financial landscape requires a strategic approach to investing, particularly in equities. Platforms such as CMC Invest, with their competitive fee structures and comprehensive offerings, empower investors to effectively capitalise on market opportunities while minimising costs so you get to keep more of your profits. As always, it is advisable for investors to conduct thorough research and consider their individual financial goals and risk tolerance when making investment decisions.

Kickstart your investing journey with CMC Invest today.

T&Cs apply. Investing involves risks. This content does not constitute financial advice. It should not be interpreted as an offer, recommendation, or solicitation to buy or sell any financial products. Any related discussions, comments, or posts by the author or other users should not be seen as such. The information provided is for general informational purposes only and does not take into account your individual investment goals, financial circumstances, or needs. CMC Invest makes no guarantees regarding the accuracy or completeness of the information. Investors are encouraged to conduct their own research and consult a professional advisor before making any investment decisions. This advertisement has not been reviewed by the Monetary Authority of Singapore.

About Kathy

Co-Founder of The Joyful Investors and Co-CIO of InvestingNote Portfolio. I graduated with a degree in Economics in National University of Singapore (NUS). My previous experience with traders at the Merrill Lynch enable me to realize many counter-intuitive truths about how the financial markets work and to uncover the challenges faced by many new investors. Investing can be astoundingly simple, and my goal is to make financial education accessible and easy to understand for everyone.

Important Information

This document is for information only and does not constitute an offer or solicitation nor be construed as a recommendation to buy or sell any of the investments mentioned. Neither The Joyful Investors Pte. Ltd. (“The Joyful Investors”) nor any of its officers or employees accepts any liability whatsoever for any loss arising from any use of this publication or its contents. The views expressed are solely the opinions of the author as of the date of this document and are subject to change based on market and other conditions.

The information provided regarding any individual securities is not intended to be used to form any basis upon which an investment decision is to be made. The information contained in this document, including any data, projections and underlying assumptions are based upon certain assumptions and analysis of information available as at the date of this document and reflects prevailing conditions, all of which are accordingly subject to change at any time without notice and The Joyful Investors is under no obligation to notify you of any of these changes.

· · ·

Have you enjoyed this article? We’d be grateful if you would share this useful content to your friends who may benefit from it as well.