For hundreds of years, the leading universities of Europe have taught that the Earth was the center of the universe. It wasn’t until 1992, 350 years after Galileo’s death, that Pope John Paul II lifted his excommunication that the sun is at the center of our system and that the planets revolve around it.

The investing world, too, has its very fair share of deeply entrenched beliefs that are long held and hard to change. To suggest anything else is heresy.

Market participants are irrational.

Market participants are assumed to be rational when averaged-out but such theory conveniently steps over the fact that individual market participants on their own can often be extremely irrational. Market participants’ views of the world will never correspond to the actual state of affairs. Everyone can gain knowledge of the same facts, but when it comes to formulating an overall view, their perspective is bound to be either biased or inconsistent or both.

In capital markets, the price is set by the most panicked seller at the end of a trading day. The price is not determined by the value of the company’s cash flow or assets.

Market participants also have behavioral biases when it comes to investing such as anchoring bias, confirmation bias, optimism bias and disposition bias just to name a few. Confirmation bias happens when perhaps the initial good performance of a stock last year leads an investor to allocate even more money to it by selectively learning about the good news of the company while ignoring any other red flags.

Successful investing is anticipating the anticipation of others and doing otherwise.

Just like in newspapers when they organize beauty contests, or in Singapore I think we used to have the New Paper New Face contest where readers may be selected to win a prize if they make a correct guess of the winner. Sometimes it is not about choosing who you think is really attractive. But rather who you think that most people will find attractive, so that you earn a chance to win the prize by identifying the most popular face. The task here is not to identify the most attractive face or faces to you but to identify the ones which you believe others would find the most attractive.

Hence there are times where we initiate a position on a stock, we buy it not only because it is a fundamentally good stock, but also at the same time it is deemed to be unpopular or unloved at that point in time but is expected to gain popularity in the future, which of course then means we can get in at a good price.

Avoid stocks that have wolf packs.

When I was learning to drive, my instructor told me to avoid dense groups of cars going at high speeds together on the expressway. These are what I call wolf packs. In a wolf pack, you feel the love and comfort of being in a special group. These drivers on the car will then tend to overlook the speed limits and live in their own bubble. This is how hyper-growth concept stocks get to their large valuation multiples. There will always be such wolf packs existing at every point in time. It is where investors pay high prices for very uncertain prospects but take comfort in knowing that there are people who are doing so as well. Prices become irrationally high.

However we all know what can potentially happen to these cars. Not all of them may get into an accident, but for those that do, they will end up in a multi-car pile up. As long as the drivers in between start to falter, people start to no longer have diamond hands as they call in, it leads to an ugly chain reaction.

The Efficient Market Theory

Then we also have the efficient market theory known as EMH in finance textbooks. The falsifying assumptions behind efficient market theory began with the Frenchman Leon Walras.

Louis Bachelier developed the theory of the random walk, which assumes that from any starting point, prices go up or down with equal probability in the same way that a coin toss is equally likely to produce heads or tails. His founding assumption allowed him to apply the traditional laws of probability to price movements, crucially the law of normal distribution. The belief is that prices cannot be reliably exploited to make an abnormal profit.

Bachelier’s work was further developed by Eugene Fama in the 1960s into the Efficient Market Hypothesis (EMH) which holds that in an ‘ideal’ market all relevant information is priced into a security – and that yesterday’s price does not influence today’s or tomorrow’s.

Fama and his successors tended to argue from the established fact that most mutual funds underperform the S&P 500 to the conclusion that no other investor could outperform any market.

But in our opinion, the efficient market theory is so far removed from working reality.

There are indeed active managers that can beat the market, or most of the time. The market is not completely efficient. Such is an example.

Two economists are walking down the street. One of them spots a $100 bill on the ground and tells the other economist. The other economist says, “don’t be silly, if there were a hundred dollas on the ground, someone would have picked it up already.” Such an “ideal” world does not exist to Fama.

Prices can move a very long way from fair value, simply due to mismatches of supply and demand. This is best illustrated by what is called the scarcity paradox as set out by Adam Smith.

The short term market especially is often a popularity contest to be exploited by traders. The short term fluctuations allow us to use the weighing machine to take advantage of the true value in companies.

Market inefficiencies are visible every day to practitioners. But the anomalies do not automatically close. The challenge is having the conviction and the staying power and the process to exploit them. There can be occasions when valuation anomalies persist for months or years.

In fact EMH is also where Buffett parted ways with his mentor Graham. Warren Buffett personally also dismissed the EMH stating that he would have been just a bum on the street, should the markets have been efficient. For Buffett’s style of value investing to be successful, the efficient market theory must not be valid. If it were, there would be no value stocks to be found. Buffett himself also added that, “the disservice done to students and gullible investment professionals who have swallowed EMH has been an extraordinary service to us”.

Perhaps the best evidence of market inefficiency is the persistence of skill, the market wizards who exist can consistently outperform the market.

Risk X Return

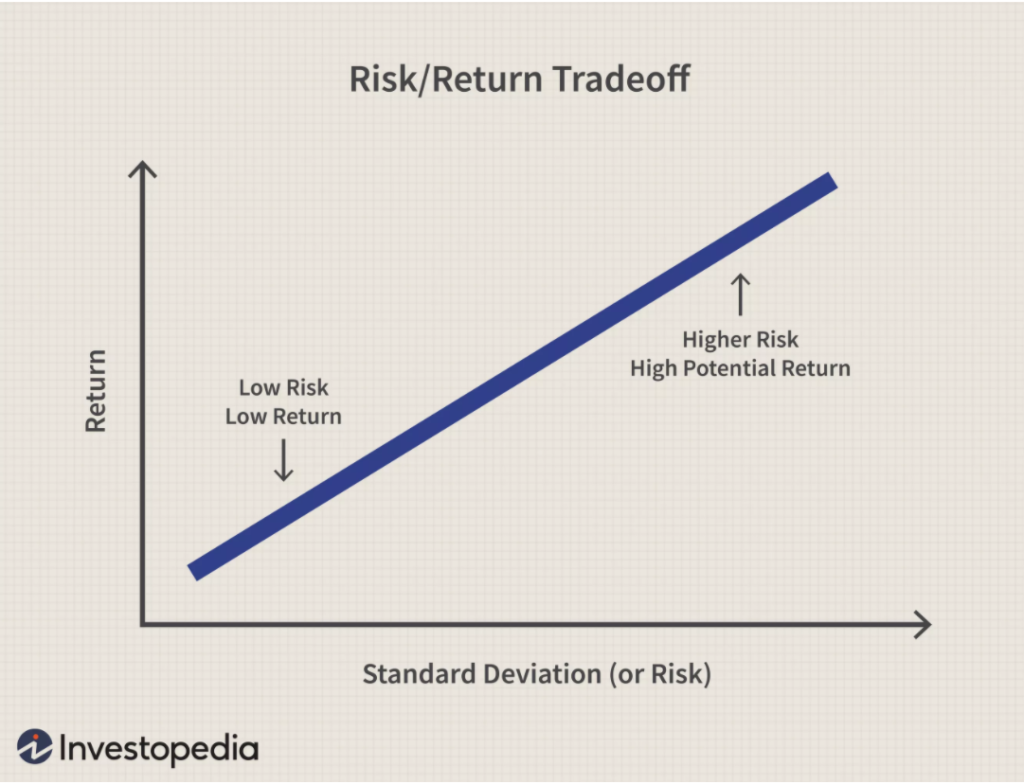

One last example of market inefficiency is also the idea between risk and return. Every finance textbook or every broker’s slide deck has a chart that looks like this.

Source: Investopedia

The majority of the people or academics believe that as returns increase, the risk undertaken will be correspondingly increased as well. They believe that to achieve more return, you have to take on more risk. This is only true in an efficient market, but an efficient market does not exist in the real world.

The reality is that in an inefficient market, value investing offers not only less risk but more return. This truth doesn’t fit neatly onto the diagonal risk-return line, but it is the truth nonetheless.

Barrow Hanley, a global leader in value investing, has also proven over the past thirty years that you do not need to take high risks to achieve high returns. The firm continues to operate under the belief that fundamental research and a bottom-up approach to investing yields the best results for them.

Hence it is not the higher the return, the higher the risk. What is true is the higher the financial intelligence, the lower the risk.

Again, the possibility of being able to achieve a good risk to return tradeoff is evident from investors that are able to achieve good and respectable sortino ratios over time in their portfolios. An investor that has a better sortino ratio than another is more competent in maximizing returns per unit of downside risk undertaken.

It is important to be a critical thinker in the financial markets. I realize that to do well, one must learn to avoid the conventional wisdom of the crowd. There are many concepts that I learned in finance 101 and continue to be taught in programs such as CFP that were hard to swallow when I finally understood that in practice it works differently.

There are many concepts that we learn in school and continue to be portrayed in mainstream media that are hard to swallow or feel unpleasant if you learn that in practice it works differently. Because until one is able to do so, it is always more comforting to assume or believe that it is impossible to do so. It is nice to think that the market can’t be beaten, if I don’t know how to. It is in us, humans, to want to avoid such conflicting and uneasy feelings of cognitive dissonance by taking the easy way out. And if almost everyone says so, it can’t be wrong.

Pingback: Interview With Money FM 89.3 On China Market Outlook And Our Investment Methodology - The Joyful Investors