Hazelle

in Memos & Musings · 5 min read

This article was created in partnership with Societe Generale (Singapore branch), but the opinions are our own.

The Magnificent 7: Driving the S&P 500's Dominance

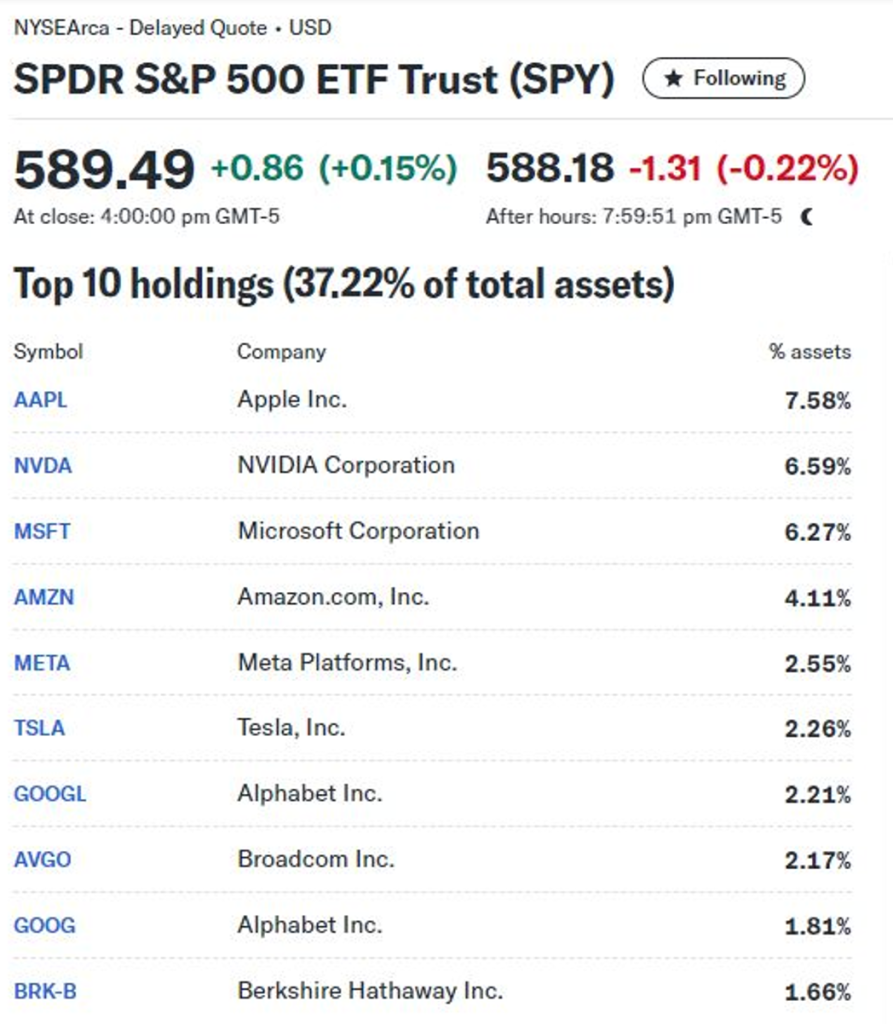

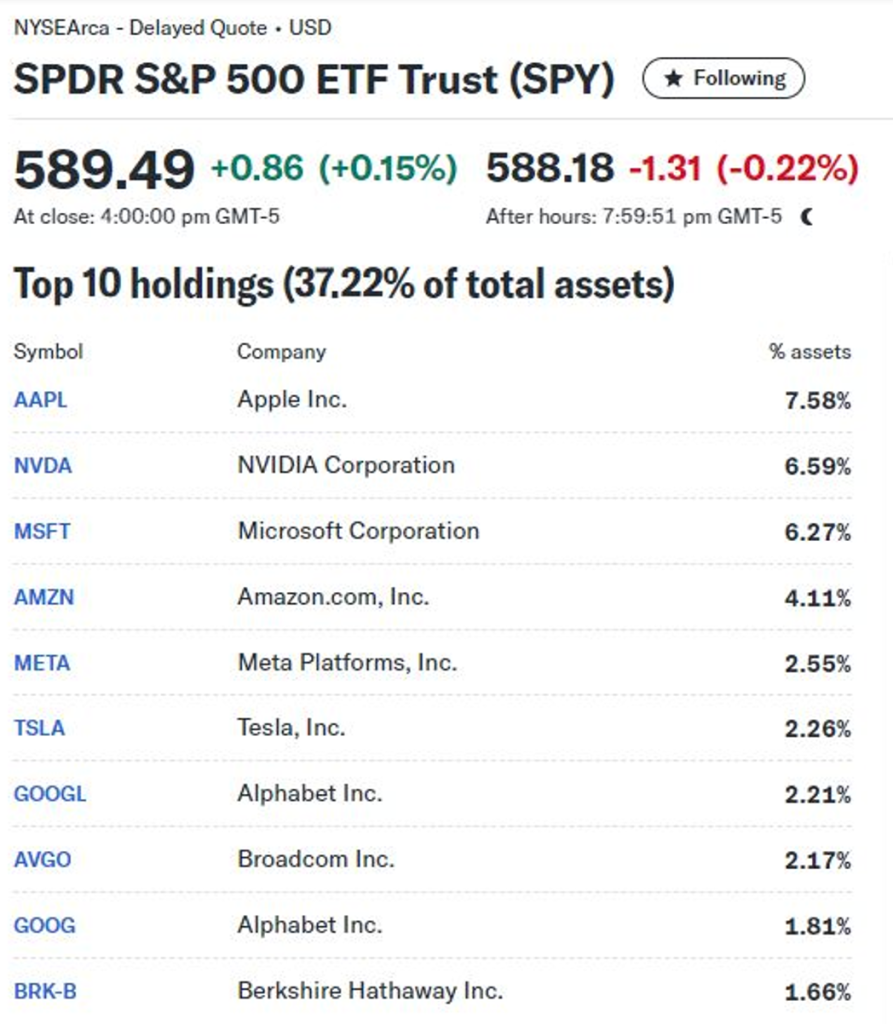

2024 has been a remarkable year for the financial markets. In our workshops leading up to 2025, a common question has been whether a bubble exists within the Standard & Poor’s 500, particularly given that a small group of stocks has been driving its performance. The seven dominant stocks in the S&P 500, often called the “Magnificent 7”, include Apple, Alphabet, Amazon.com, Meta, Microsoft, Nvidia, and Tesla. It’s evident that this small group of stocks has had a significant impact on the S&P 500 in recent years, contributing a disproportionate share of its overall gains.

As of early January 2025, the market capitalization of these seven top stocks accounted for approximately 32% of the S&P 500’s total capitalization— almost double the proportion they held just five years ago.

Source: Yahoo Finance App

The information relating to past performances above are for illustrative purposes only, and not a reliable indicator of future performance.

Source: Yahoo Finance App

Interestingly, of today’s Magnificent 7, only Microsoft was among the top ten 24 years ago.

Source: Voronoi (The information relating to past performances is for illustrative purposes only, and is not a reliable indicator of future performance.)

Historically, investors tend to treat the current leading companies as if their dominance will last for decades, often paying a premium for their stocks. Some firms do maintain their leadership, while others don’t, and change tends to be more common than lasting consistency.

However, a counterpoint to this view is that the Magnificent 7 are outstanding companies, most of which have strong fundamentals, making them deserving of their valuations.

Still, questions remain about the long-term growth trajectory of these companies. Can they maintain their rapid expansion in the face of potential economic slowdowns, changes in monetary policies, and evolving regulatory challenges?

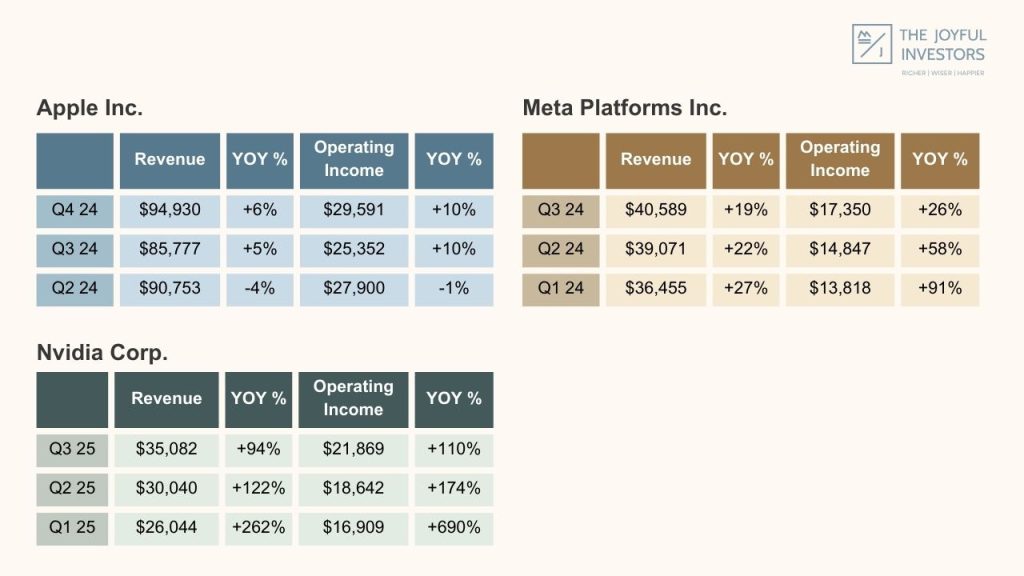

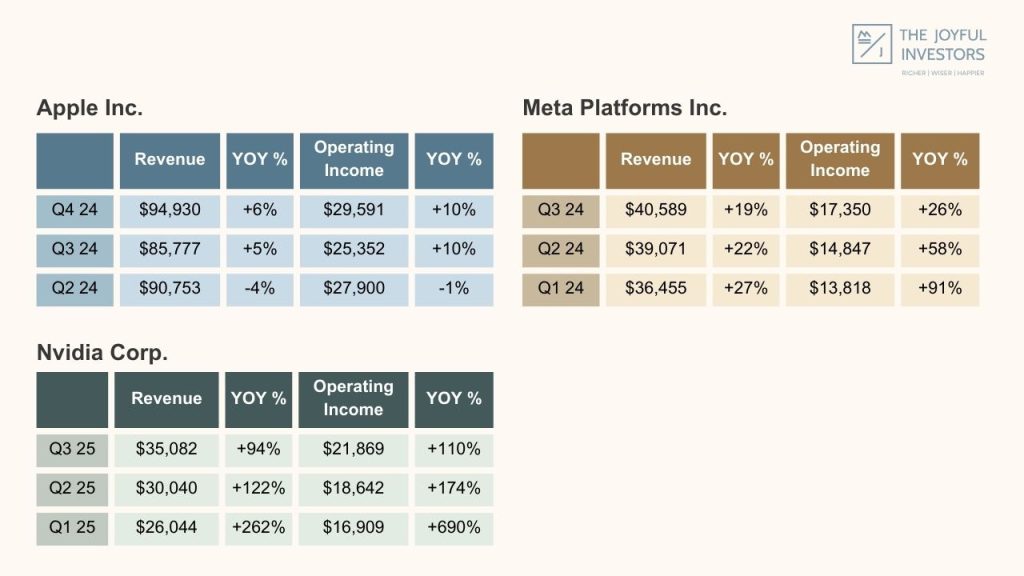

Earnings Season: A Reality Check

Investors will gain crucial insights during the upcoming earnings season. Here’s a quick look at how some of the Magnificent 7 performed in past quarters:

- Apple (AAPL): In its most recent quarter, Apple achieved a record-high September quarter revenue of $94.9 billion, marking a 6% year-over-year increase, while its active installed base of devices reached an all-time high across all product categories and geographic regions.

- Nvidia (NVDA): The standout performer last year in 2024, Nvidia grew its data center revenue by 112% in Q3 2025 from a year ago, driven by unprecedented demand for its GPUs in AI applications.

- Meta (META): Meta posted strong double-digit growth in advertising revenue, boosted by the rollout of AI-powered ad tools and increased user engagement across its platforms.

Source: The Joyful Investors (The information relating to past performances is for illustrative purposes only, and is not a reliable indicator of future performance.)

Earnings reports will offer clarity on whether the Magnificent 7’s performance is supported by tangible fundamentals or inflated by speculative exuberance.

Riding the Magnificent Wave with DLCs

For investors who believe in the Magnificent 7’s continued ascent—or those who foresee a potential pullback—Daily Leveraged Certificates (DLCs) can offer an innovative way to magnify potential returns or hedge against risks. DLCs, structured products listed on SGX, enable both bullish and bearish strategies by offering leveraged exposure to underlying stocks like those in the Magnificent 7. This allows investors to explore the tool for their trading portfolio, above and beyond their longer-term investment portfolio.

With DLCs, investors can:

- Magnify Returns: Gain 3x leveraged exposure to the Magnificent 7’s daily movements, capitalizing on short-term trends.

- Hedge Downside Risks: Hedge portfolio risks with Short DLCs, which increase in value when the underlying stock price declines.

- Enhance Flexibility: DLCs traded on SGX offer the opportunity for intraday trading, allowing active investors greater control over their positions. This provides the advantage of entering early during Asian hours, ahead of the US market open, such as in response to high-impact news or post-earnings results.

What are DLCs?

Daily Leverage Certificates (DLC) are exchange-traded financial products that enable investors to take a leveraged exposure to an underlying asset, such as an index or a single stock. DLCs replicate the performance of an underlying asset versus its previous day closing level, with a fixed leverage factor of up to 7 times (3 times leverage factor for Magnificent 7 stocks).

There are 2 types of DLCs — long DLCs and short DLCs.

For example, a 3x Long DLC, which will rise in value by 3% for each 1% rise in the underlying asset (before costs & fees). Similarly, a 3x Short DLC, which will rise in value by 3% for every 1% fall in the underlying asset (before costs & fees).

Sample List of US Stock DLCs (Comes in SGD and USD denominated)

Source: DLC.socgen.com

Let’s explore some scenarios that investors can possibly tap on the use of DLCs for Magnificent 7 stocks for the upcoming earnings season. The examples are purely hypothetical and do not take fees and charges payable by investors into consideration.

Scenario 1: Bullish in the upcoming earnings period

For those who are bullish about the potential upside of Magnificent 7 stocks in the near term, and would like to capitalize on it, here’s how DLCs can amplify gains through a focused trading strategy.

Stock X closed at $100 in the U.S market with a 3x Long DLC priced at $2. In the post-market hours, the share price rose to $105 (+5%) on favourable earnings. The unit price of the 3x Long DLC rises to $2.30 (+15%).

If you purchase a 1,000 units of 3x Long DLC on Stock X at a unit price of $2.30 when the SGX market opens, the total cost you paid on the DLCs will be $2,300.

Let’s say if the share price of Stock X rises to $110 (+10%) before the SGX market closes for the trading day, the value of each unit of the 3x Long DLC will now rise to $2.60 (+30%). Therefore, the gains made are magnified through the use of DLC.

However, should the price decline after you bought the 3x Long DLCs, the losses would also be magnified. For example, if the price of Stock X declines to $95 (-5%) instead of rising to $110 when the SGX market closes, the unit price of the 3x Long DLC will decline to $1.70 (-15%).

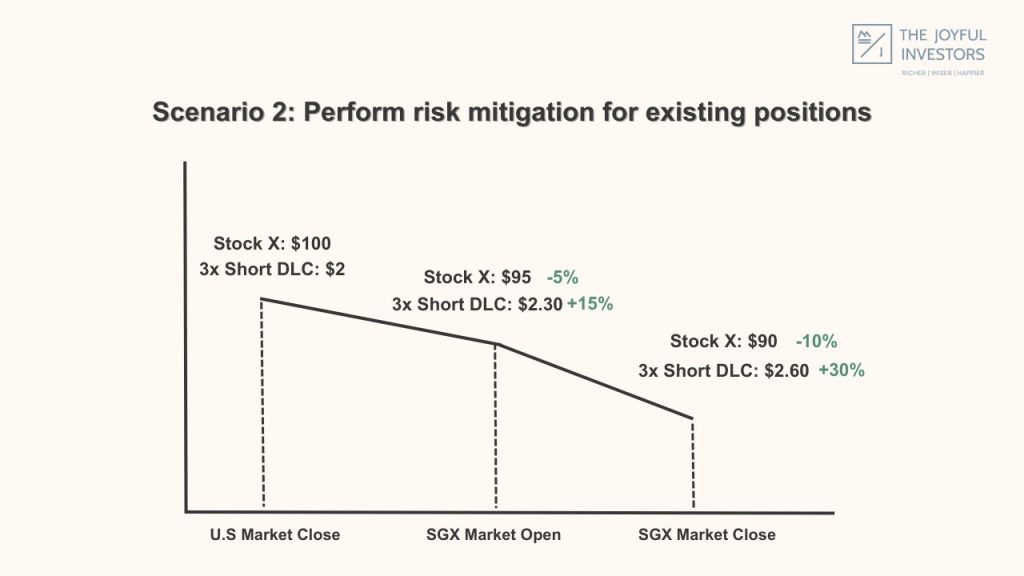

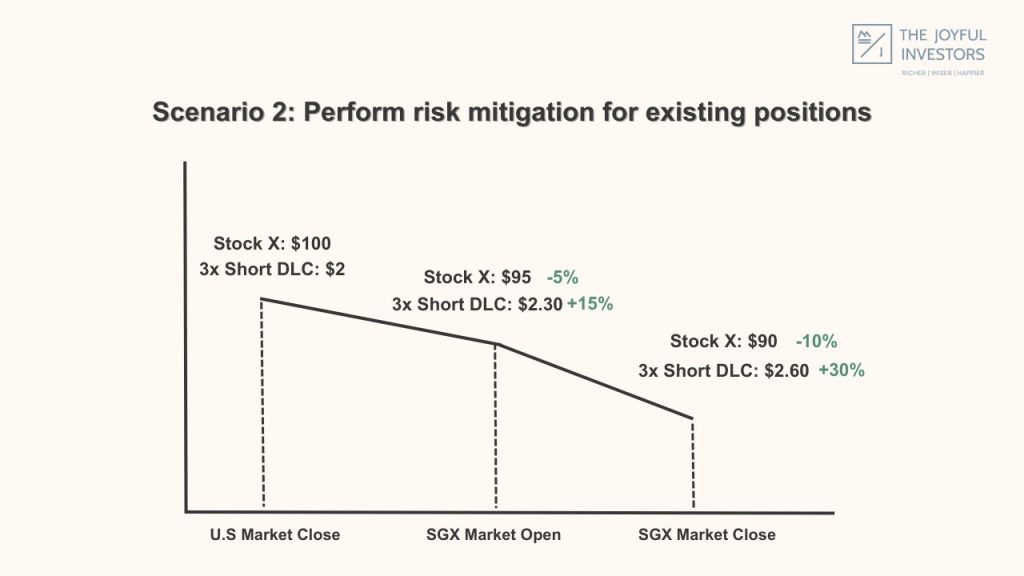

Scenario 2: Perform risk mitigation for existing positions in investment portfolio

Whether we are investing into the U.S Index like the S&P 500 or the tech heavy Nasdaq, the current constituents consist of a basket of high beta stocks considerably.

During market declines, they could face significant setbacks along the way. This presents an opportunity for profit-taking or risk-mitigation strategies that could position active investors well. Markets always move in cycles and every parabolic move eventually comes to an end.

For those of you who have been following us for a while, you’ll know that while generating good returns in the market is important for The Joyful Investors, a big part of what we focus on is managing risks and reducing portfolio volatility on the downside. DLCs can then provide a hedging use case for short term downside risks.

Here’s how short DLCs work.

Stock X closed at $100 in the U.S market with a 3x Short DLC priced at $2. In the post-market hours, the share price declined to $95 (-5%) on disappointing earnings. The unit price of the 3x Short DLC rises to $2.30 (+15%).

If you purchase a 1,000 units of 3x Short DLC on Stock X at a unit price of $2.30 when the SGX market opens, the total cost you paid on the DLCs will be $2,300.

Let’s say if the share price of Stock X declines further to $90 (-10%) before the SGX market closes for the trading day, the value of each unit of the 3x Short DLC will now rise to $2.60 (+30%). Therefore, the gains made through the use of DLC can act as hedging to offset some of the paper losses for the existing positions that you own in Stock X for your longer-term investment purposes.

In the same vein, traders who are taking a bearish stand on Stock X can also apply the strategy through purchasing a short DLC of Stock X.

However, should the share price of Stock X increase after you bought the 3x Short DLCs, the losses would also be magnified. For example, if the price of Stock X increases to $105 (+5%) instead of declining to $90 when the SGX market closes, the unit price of the 3x Short DLC will decline to $1.70 (-15%).

Some Key Features of the US Stock DLCs To Note

1. React to Key Events Beyond U.S. Market Hours

As the DLCs are traded during SGX market hours from 9am to 5pm, they allow traders to react swiftly to key events, such as earnings releases or the Federal Reserve’s announcements, which often occur after U.S. market hours. This provides an opportunity for traders to position themselves ahead of the U.S. market’s reopening, enabling them to capitalize on anticipated price movements driven by these developments. That said, you should be comfortable with the fact that you cannot manage your positions overnight until SGX market opens the next day.

2. Compounding Effect

A key feature of DLCs lies in their compounding effect. When held for a single trading day, the returns are calculated based on the daily percentage change of the underlying asset, magnified by the leverage factor. However, if the DLCs are held for longer than a trading day, there is a compounding effect due to the daily reset mechanism.

Illustration:

Stock Y price rises from $100 to $105 (+5%) at market close on Day 1. 3x Long DLC increases in value from $2 to $2.30 (+15%).

If the DLC is held till Day 2 and the share price continues to increase to $113.40 (+8% from Day 1 price), the price of the DLC increases from $2.30 to $2.85 (+24%).

There is a compounding effect on the price increase for the DLC (+42.5%). Without the compounding effect, the DLC would have only increased in price by +40.2% (Stock Y increased by +13.4%, with a 3x leverage +40.2%).

However, do note that while the compounding effect may work well for you in a trending market, it does not work well for you in the case of a volatile or sideways market.

3. Airbag Mechanism

DLCs have a intraday reset feature in case the underlying price changes breaches the predetermined airbag trigger level. This is not present in other derivative products and is unique to DLCs and other fixed leverage instruments out there.

The airbag on a 3x Short DLC would be triggered if the underlying stock gained 20% intraday. Whereas the 3x Long DLC airbag will not be triggered and would instead have gained around 60% So the airbag is only triggered when the direction of the underlying goes against the direction of your DLC. The benefit of the airbag is that it would slow down the rate of loss but the converse is also true, it would also recover less of its value if the underlying rebounds.

Risks and what DLCs are designed for:

Daily Leverage Certificates (DLCs) are leveraged products that you could lose your entire capital if the market moves against you.

DLCs are usually meant for short-term trades to take advantage of quick market trends. For long-term holding, the returns can deviate from the leverage factor built into the product, and you’ll also rack up more overnight fees.

Lastly, you’ll need to meet the qualifications to invest in Specified Investment Products (SIPs) before you can buy structured certificates. Your broker will evaluate whether you have the necessary knowledge and experience to trade SIPs. This assessment is based on three key criteria: your educational background, work experience, or prior investment experience. To qualify, you’ll need to meet at least one of these criteria.

In summary, while DLCs can be effective tools for amplifying returns, they carry risks due to their leveraged nature and the impact of daily compounding. If you’re aiming to ride the tech wave responsibly, it’s crucial to understand how DLCs work and ensure they align with your investment strategy.

If you’d like to explore more about US stock DLCs, visit the Societe Generale’s DLC website here for additional information.

Disclaimer

This advertisement has not been reviewed by the Monetary Authority of Singapore. The views expressed under this article represent the personal and independent views of the author and do not constitute investment advice. The content of this article does not form part of any offer or invitation to buy or sell any daily leverage certificates (the “DLCs”), and nothing herein should be considered as financial advice or recommendation. The price may rise and fall in value rapidly and holders may lose all of their investment. Any past performance is not indicative of future performance. Investments in DLCs carry significant risks, please see dlc.socgen.com for further information and relevant risks. The DLCs are for specified investment products (SIP) qualified investors only.

About Hazelle

Chief trainer of The Moneyball Investors Playbook program and founder of The Joyful Investors, a financial education firm that seeks to help avid investors learn to invest better and make the journey a joyful one. I graduated with a first class honors in Bachelor of Accountancy from Nanyang Technological University (NTU) and started my auditing career in one of the Big Four. I believe that once we know how to build our wealth sustainably, we can then live our best lives ever.

Important Information

This document is for information only and does not constitute an offer or solicitation nor be construed as a recommendation to buy or sell any of the investments mentioned. Neither The Joyful Investors Pte. Ltd. (“The Joyful Investors”) nor any of its officers or employees accepts any liability whatsoever for any loss arising from any use of this publication or its contents. The views expressed are solely the opinions of the author as of the date of this document and are subject to change based on market and other conditions.

The information provided regarding any individual securities is not intended to be used to form any basis upon which an investment decision is to be made. The information contained in this document, including any data, projections and underlying assumptions are based upon certain assumptions and analysis of information available as at the date of this document and reflects prevailing conditions, all of which are accordingly subject to change at any time without notice and The Joyful Investors is under no obligation to notify you of any of these changes.

· · ·

Have you enjoyed this article? We’d be grateful if you would share this useful content to your friends who may benefit from it as well.