Kathy

in Memos & Musings · 5 min read

TL;DR

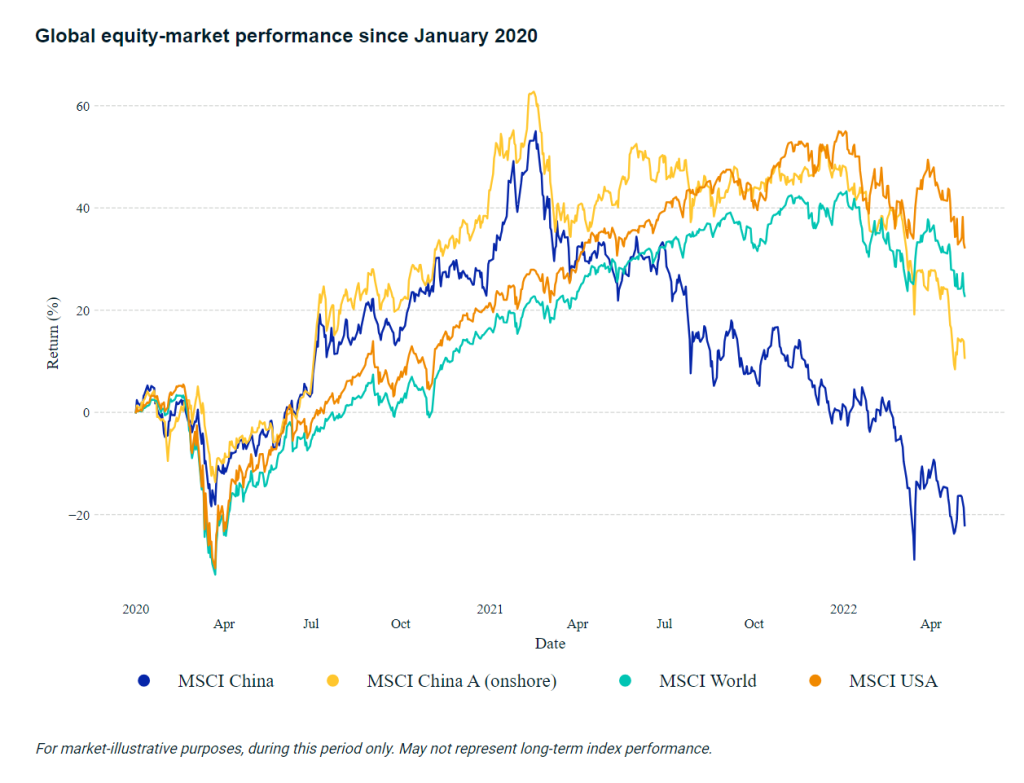

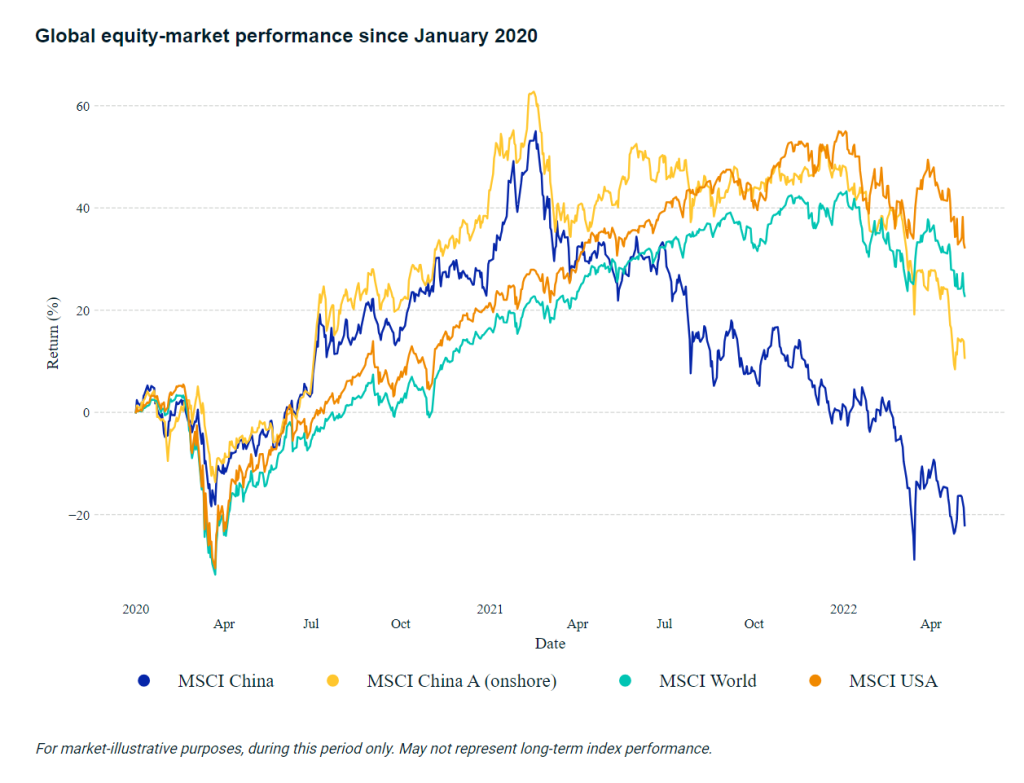

China’s equities outperformed those of other emerging markets in 2020 during the height of the COVID-19 pandemic. The earlier worries of delisting fears of China stocks, its regulatory tightening and the strict zero-COVID policy have all taken a back seat. However, a year later, China’s idiosyncratic factors, such as geopolitics and regulatory policies, led to a significant divergence in the performance of the Chinese market. This prompts us to question whether China is still a market worth looking at.

Background

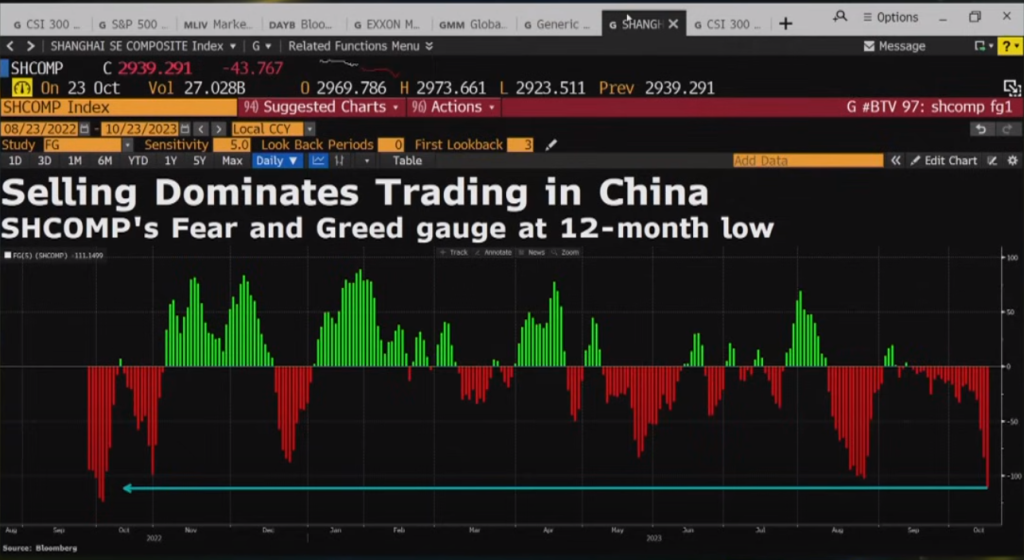

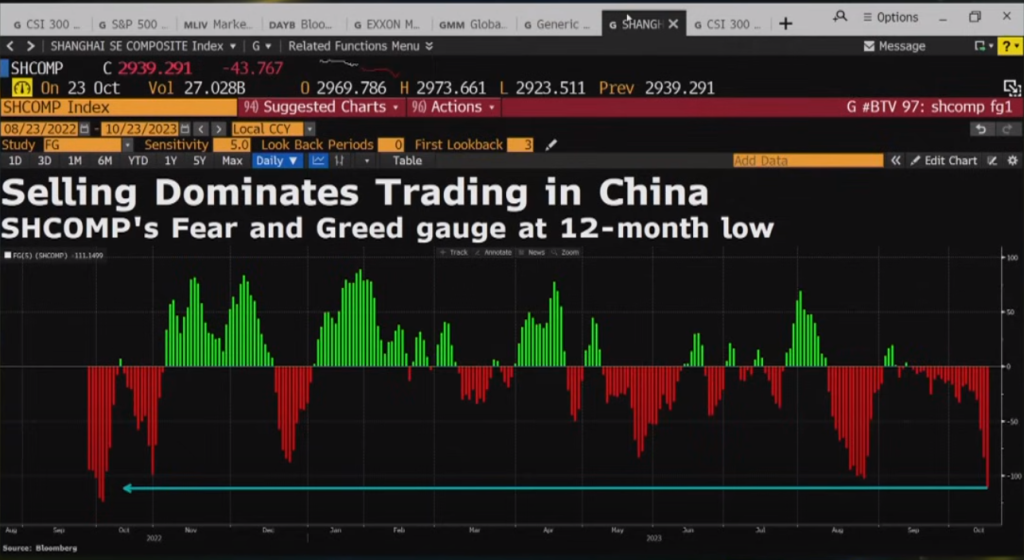

Investing in China involves distinct risks and greater unpredictability compared to Western markets. While China boasts expansive capital markets, they remain relatively ‘young,’ and are susceptible to notable fluctuations influenced by investor sentiment. This short-term volatility may be off-putting to investors more accustomed to the mature and institutionalized markets of the West. Additionally, as China continues to grow, it must address social concerns about inequality and confront antitrust and intellectual property issues, all of which have contributed to recent volatility.

China, contributing approximately 19% to global GDP, has firmly established itself as a major global player. It is poised to surpass the US economy, emphasizing its undeniable significance. The nation’s economic strength and improving market accessibility have the potential to reshape the emerging-market asset class and its role in global portfolios.

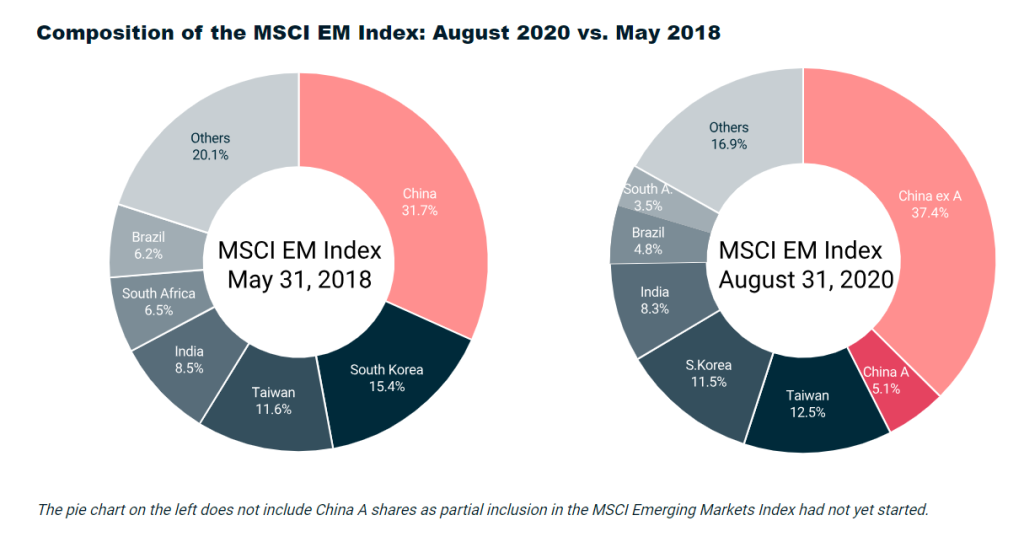

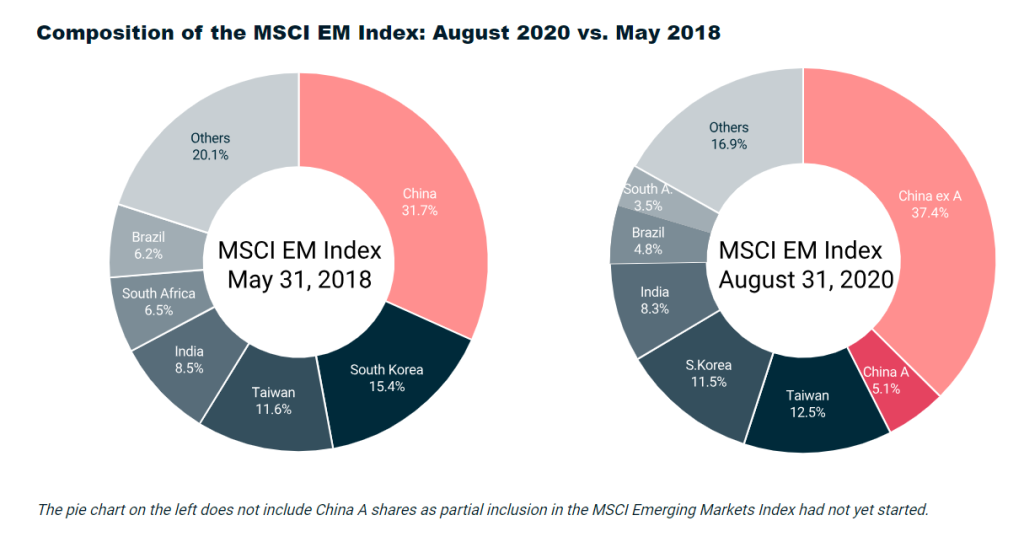

Notably, China’s representation in the MSCI Emerging Markets (EM) Index has surged from 7% in 2000 to about one third today, with the ongoing inclusion of A-Shares reaching 20%. At full A-Share inclusion, China could constitute 45% of the MSCI EM Index. As the second-largest global equity market, China boasts a substantial market capitalization nearing $18 trillion, with almost 5,900 listed stocks.

Source: MSCI.com

After the transitional phase of adapting to life with COVID-19, China’s domestic economic activity could undergo a boost, propelled by substantial pent-up demand and trillions of RMB in surplus savings. Unlocking these resources could potentially bolster domestic consumption, corporate earnings, and profitability.

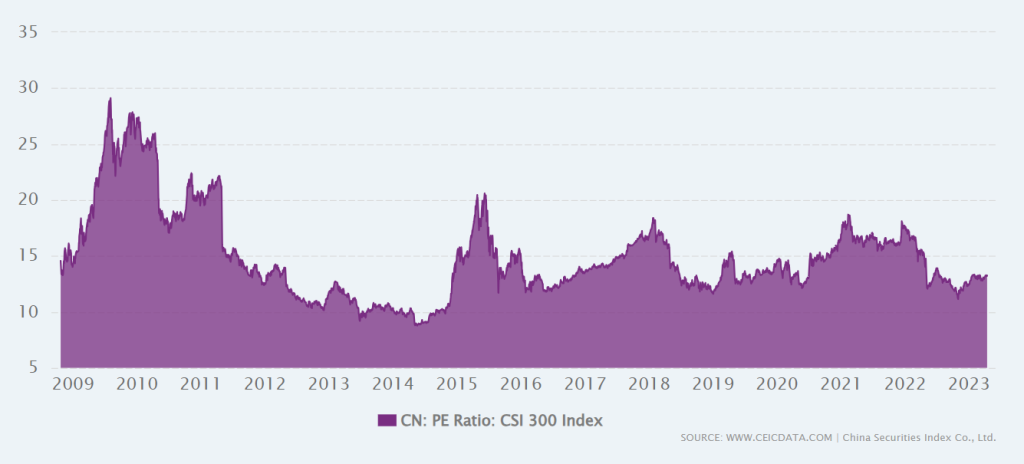

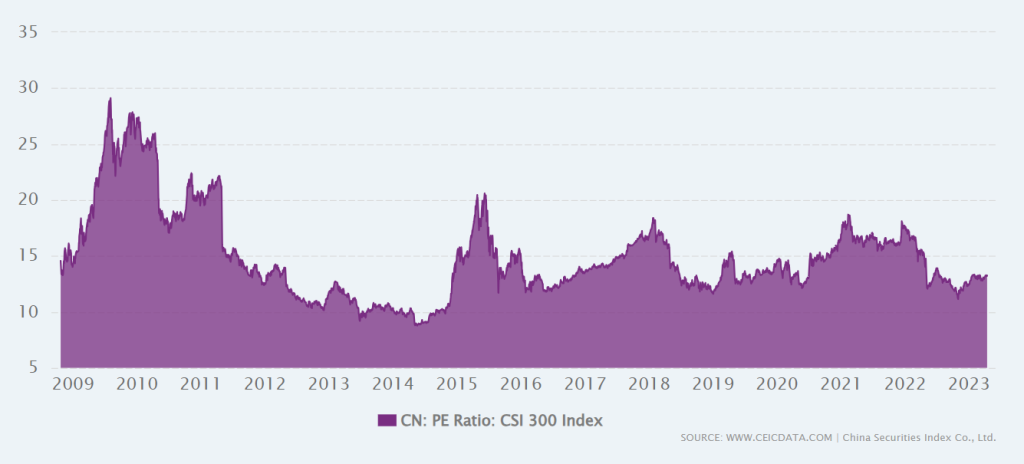

Currently, valuations of China equities have now become relatively undemanding historically with global asset managers fleeing China at record pace. With the ongoing shift to a growth-friendly policy stance and subsequent economic recovery, this may have meaningful implications for the outlook of China’s equity markets.

The case for investing in China

In light of China’s significant structural changes, we find compelling reasons to examine them at this moment:

Enhanced Portfolio Diversification

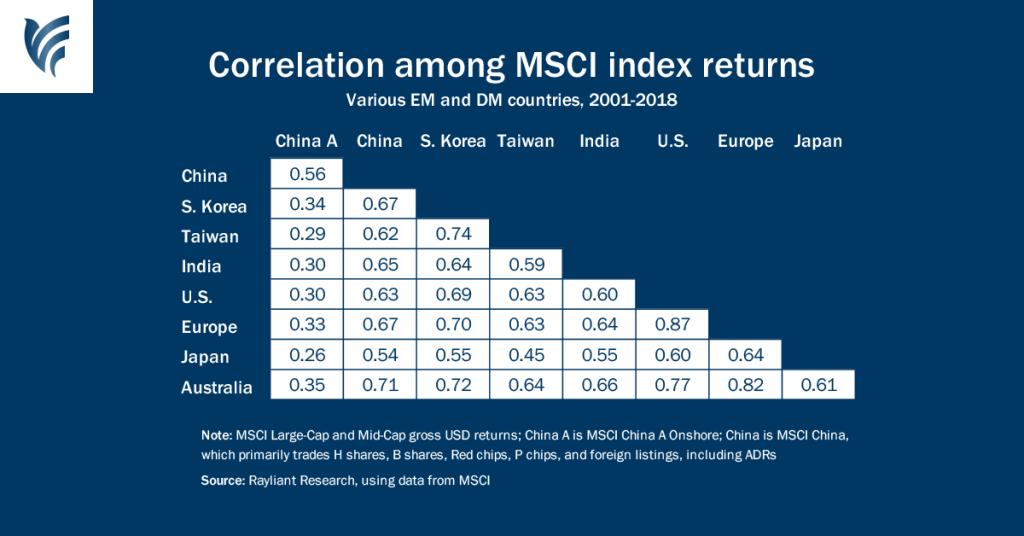

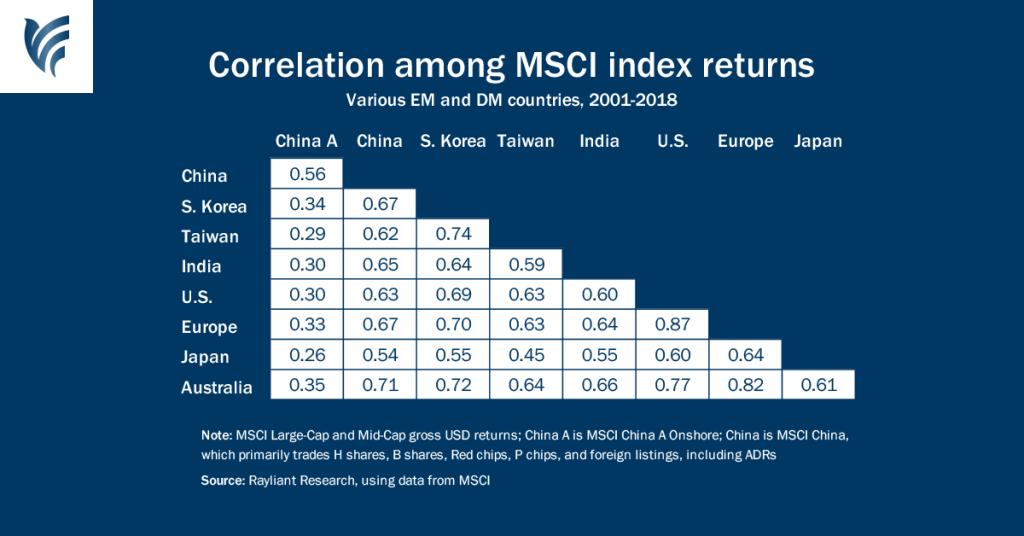

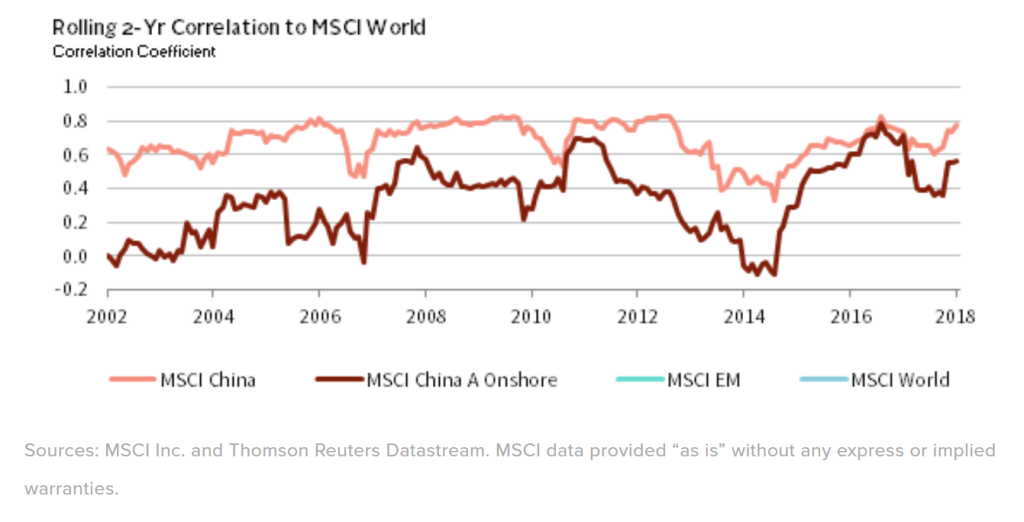

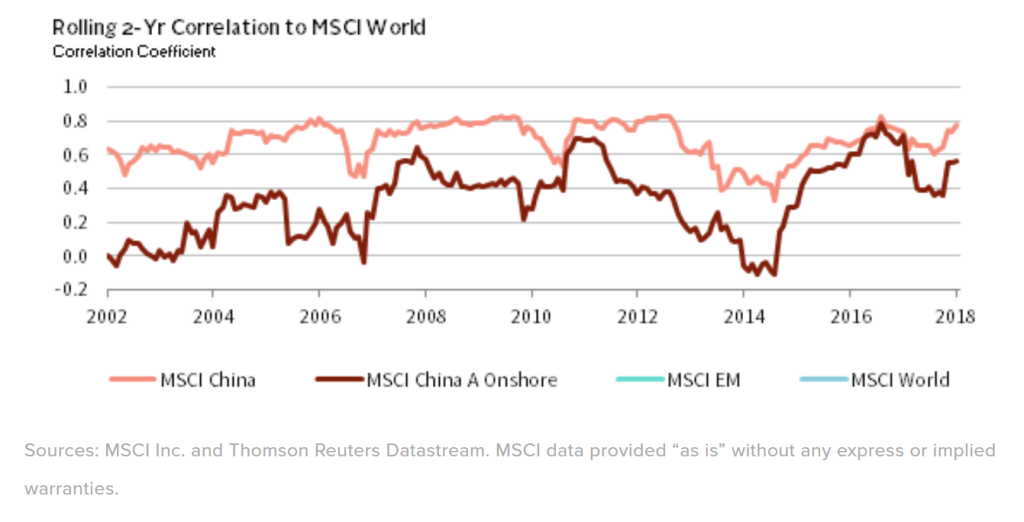

Chinese equities have the potential to offer diversification advantages to investment portfolios. Firstly, global investors have not fully tapped into the onshore Chinese equity markets, considering the size and significance of the Chinese economy. Historically, China’s domestic equity markets have shown a low correlation with developed markets due to its distinct economic and policy cycles.

Generally speaking, over the last two decades, China A-shares have exhibited a correlation of approximately 0.30 with other global equities, suggesting that they often move in different directions most of the time. It is also noteworthy that such a low correlation continues to be evident in the years following the Covid-19 pandemic. Including Chinese equities in a global portfolio may enhance the risk/return profile and provide a strong rationale for recognizing China as a distinct asset class.

Respectable returns, albeit with greater volatility

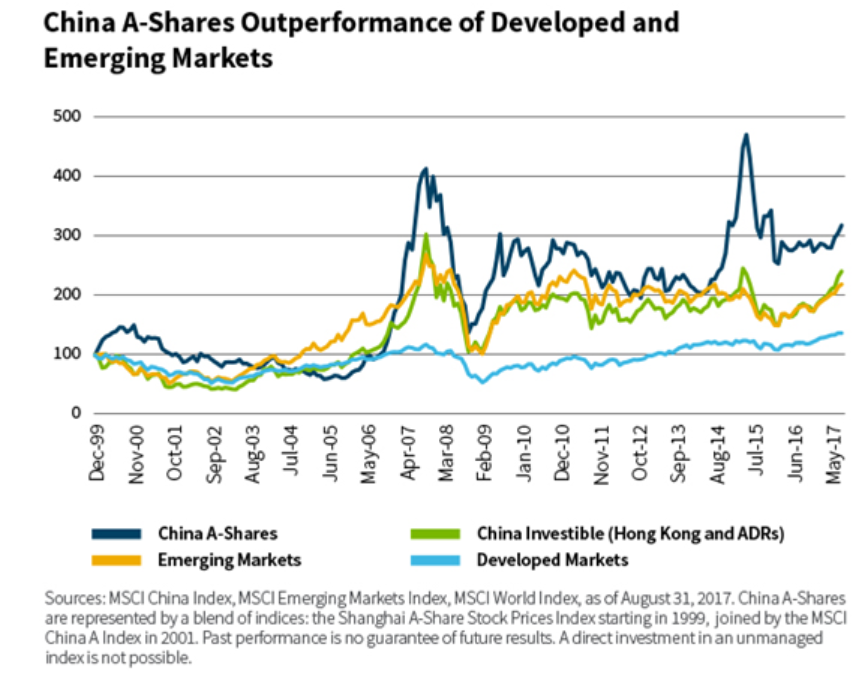

The graph below illustrates the development of the Chinese stock market in comparison to other pertinent markets from 1999 to 2017. Notably, the Chinese A-share market exhibited superior performance, experiencing a growth of over 200%. This was followed by Chinese markets accessible to foreign investors (Hong Kong and ADR) with a 140% increase, significantly surpassing the 40% growth observed in developed markets.

Short‑term news flow may be overwhelming at times and may distract investors from the longer‑term view. China’s equity markets can be highly volatile, witnessing substantial movements in both upward and downward directions, as observed during the regulatory challenges and COVID-19 lockdowns in 2022. Paradoxically, this volatility presents opportunities for investors seeking a more favorable risk-to-reward ratio. Regardless of one’s level of experience in investing in China, even a small allocation has the potential to enhance the risk/return profile, a key consideration for The Joyful Investors. An investor should not only be problem-oriented but also remain vigilant for opportunities and possess solutions.

For adept investors engaged in active investing, it can be a key way to help to navigate a market characterized by both complexity and volatility. Historical evidence indicates that extreme periods of volatility in China’s equity markets have presented lucrative long-term buying opportunities, with many stocks returning to valuation levels deemed to offer favorable long-term risk/reward potential.

Introduction of the CSOP Huatai-Pinebridge SSE Dividend Index ETF

Interestingly, CSOP Asset Management has just launched the CSOP Huatai-Pinebridge SSE Dividend Index ETF, one of the most representative A-share dividend ETFs on 1st December 2023. The fund, acting as a feeder fund, aims to invest at least 90% of its Net Asset Value in the Huatai-PineBridge SSE Dividend Index ETF (the ‘Underlying Fund’), comprising of 50 stocks with the highest dividend yield in Shanghai Stock Exchange over the past two years. Constituents possess characteristics of high dividend yield and low valuation. Listed in 2006, the underlying fund is currently the largest dividend ETF in mainland China, with its AUM standing at RMB 16.2 billion as of 30th September 2023. It is also the first and the largest smart-beta ETF in mainland China. Whether you’re new to investing in China or an experienced investor, this dividend ETF might be worth considering.

What’s in it for me as an investor?

For the longest time, income investors have had only a handful of options. However, in the current environment, with high-yielding bonds and REITs, the need for equity income extends beyond delivering income growth to also provide diversification and the potential for long-term capital gains.

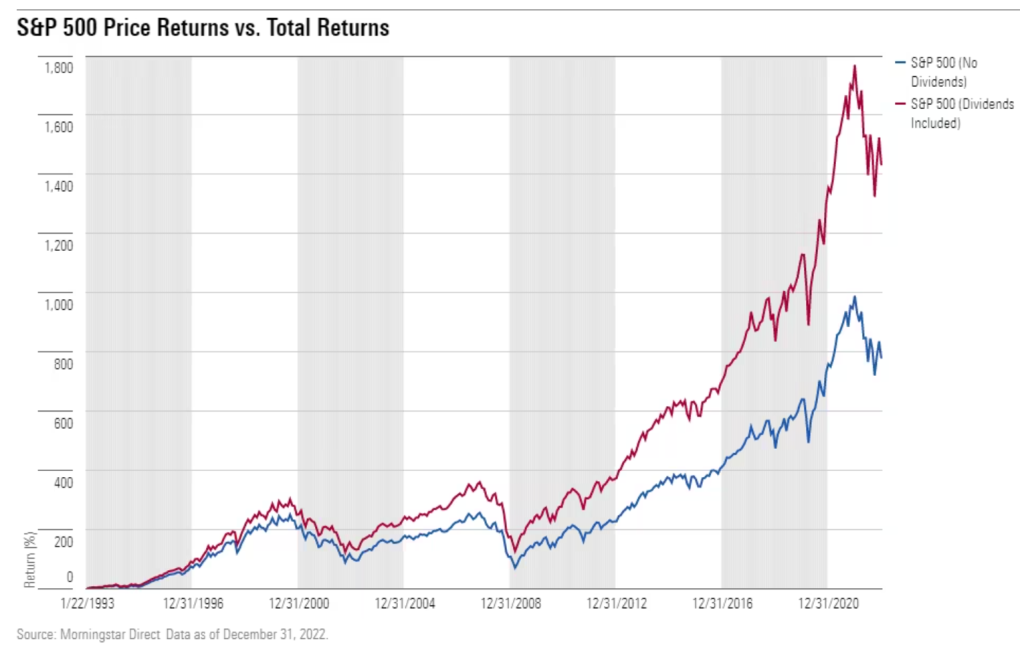

As seen in the U.S., dividends lay the foundation of a bull market. From 1993 to the end of 2022, the total return of the S&P 500 Index increased by more than 777%. With dividends included, the S&P 500 increased by more than 1400% during the same period.

As things stand, the dividend yield of the Shanghai Stock Exchange Dividend Index (SSE Dividend Index) is 6.10%, significantly higher than representative dividend indexes in the U.S. which typically ranged from 3% to 5%. High dividend strategies often serve as a cushion during bear markets or periods of volatility, historically showing relatively good excess returns.

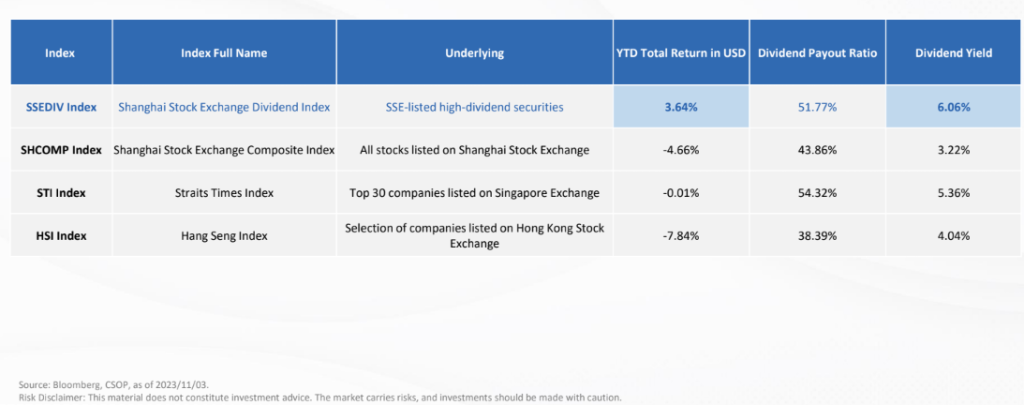

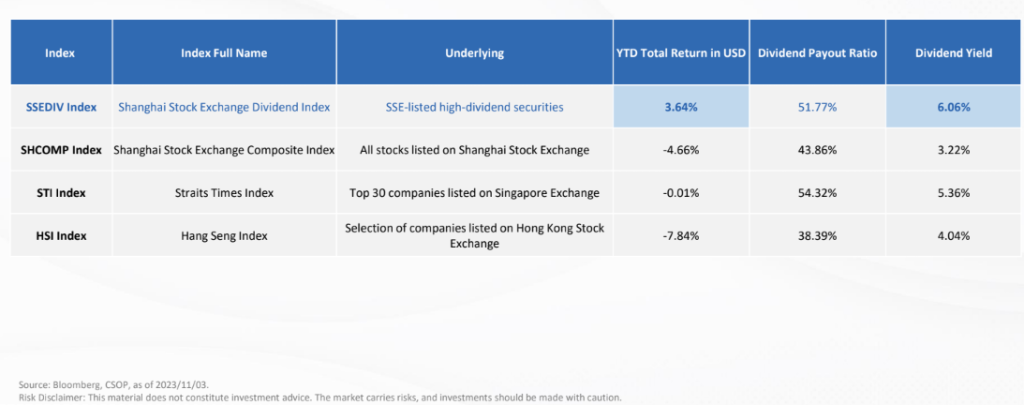

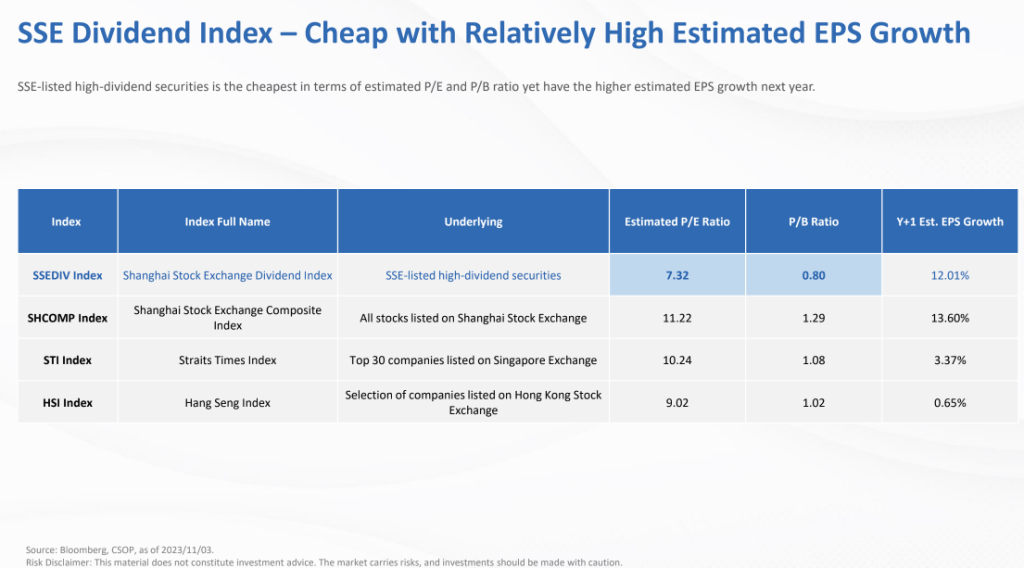

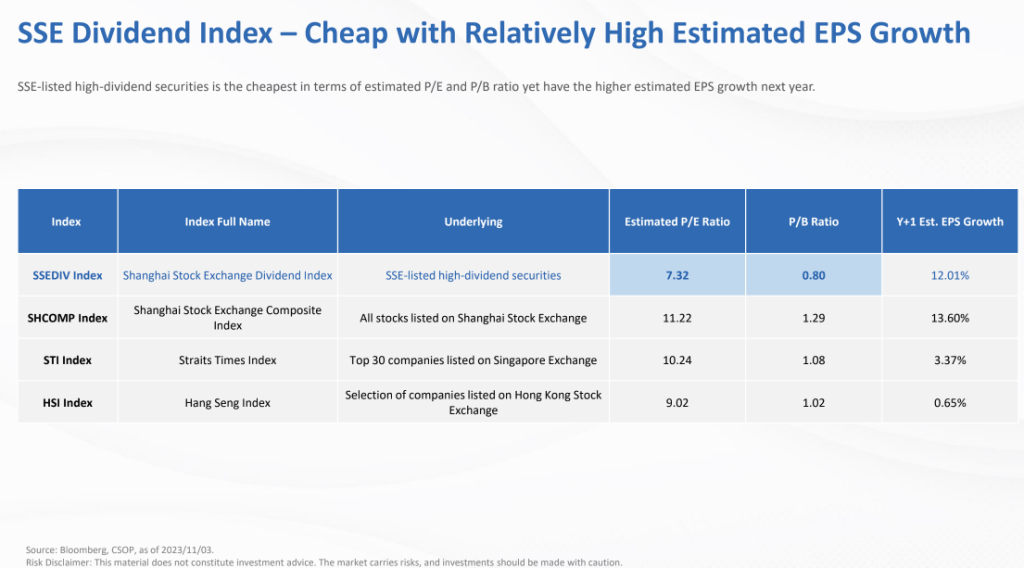

The SSE Dividend Index stands out with the highest YTD total return in USD and the highest estimated dividend yield when compared to other stocks listed on SSE, as well as top stocks listed in Singapore and Hong Kong.

(Source: CSOP, Wind, Huatai-Pinebridge Investments as of 31st August 2023)

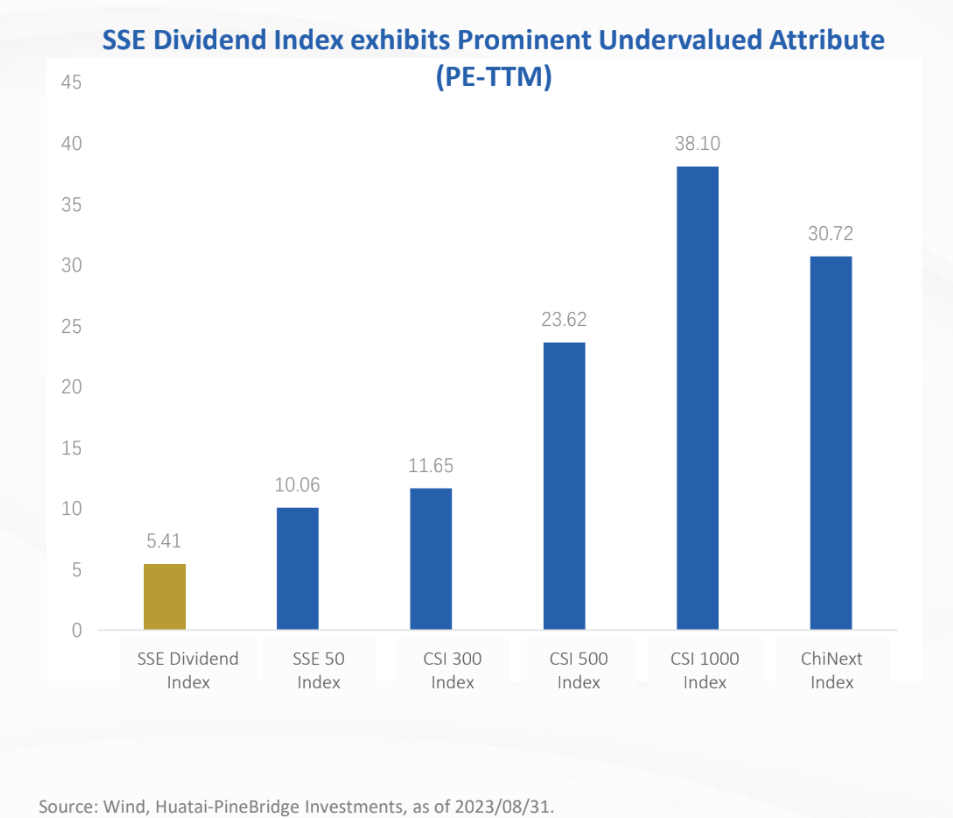

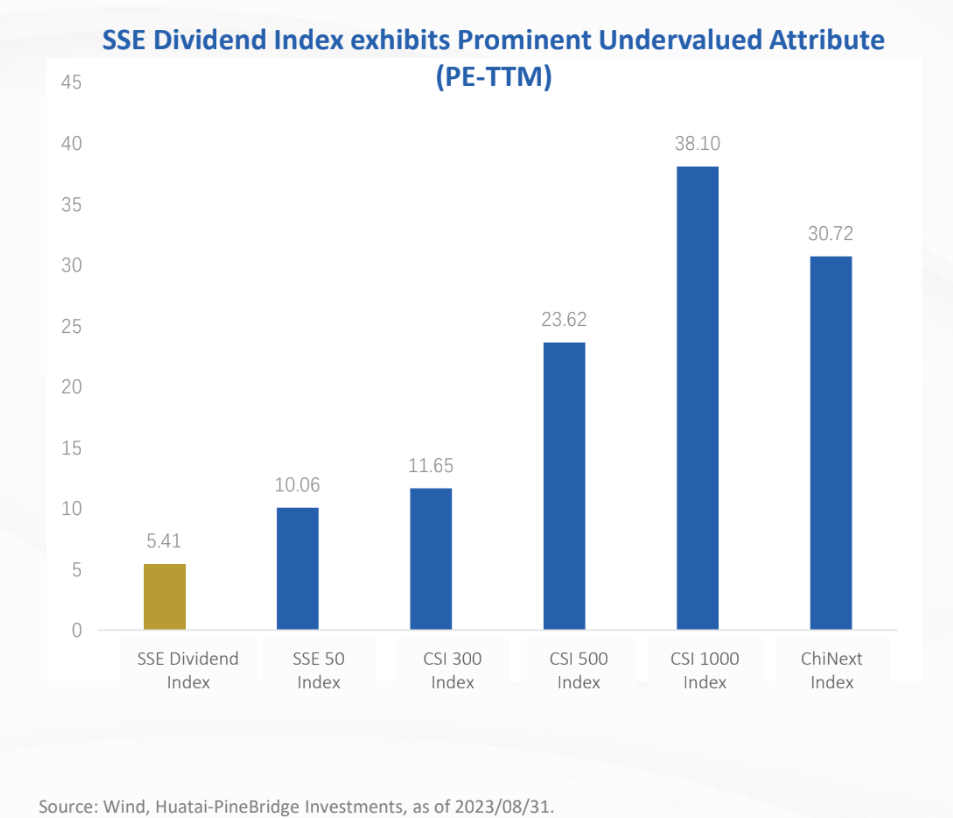

However, high yielding alone is not enough. Buying stocks on the cheap is desirable. In terms of valuation of this index, it is notably lower when compared to other similar core broad-based A-share indexes or other similar dividend indexes. Additionally, the current valuation of the index is situated at historically low percentiles.

(Source: CSOP, Wind, Huatai-Pinebridge Investments as of 31st August 2023)

China is often thought of as a growth market, but it can play an important role for income investors with this new ETF. The dividend-paying companies help diversify a broader equity income portfolio and bring in new sources of growth cost-effectively. This is particularly important today when income investors have a broader choice.

What you need to know about the CSOP Huatai-Pinebridge SSE Dividend Index ETF

The CSOP Huatai-Pinebridge SSE Dividend Index ETF (Stock Code: SHD) is a recently listed exchange-traded fund (ETF) on the Singapore Exchange (SGX). Here are some key details:

- Official Listing Date on SGX: December 1, 2023

- ETF Name & Ticker Code: CSOP Huatai-Pinebridge SSE Dividend Index ETF (Stock Code: SHD)

- Issuer: CSOP Asset Management

This ETF provides investors with the opportunity to participate in the performance of the Huatai-PineBridge SSE Dividend Index, which includes 50 high and steady-cash dividend-paying companies listed on the Shanghai Stock Exchange (SSE). As an investment product managed by CSOP Asset Management, it aims to offer a strategic investment avenue for those seeking exposure to dividend-yielding stocks in the Chinese market.

Putting it all together

It is true that China investors face inherent risks arising from government policies, property measures, interest rates, or GDP growth. While acknowledging China’s opacity in areas like policy-making and market oversight which we have seen in the past and will likely to continue, long-term investors can find reassurance in the preservation of its structural drivers and the continued translation of strategic priorities for transformation into potential long-term returns. Investors should exercise caution and focus on companies with the ability to secure market share, achieve higher margins and maintain strong management alignment with stakeholders. For investors seeking attractive long-term returns or a diversifier to lower overall portfolio risk, China may present a compelling investment case.

Learn together with The Joyful Investors

The market can be uncertain, but our approach to investing doesn’t have to be. Come January 2024, join us for our 2024 Stock Market Outlook event, where we will provide insights into the financial landscapes of the U.S., China, and Singapore markets. Notably, U.S. indices have approached their previous peaks, while we believe Singapore and China may present promising upside potential. At the event, we will delve into the market opportunities we are currently exploring.

For those already familiar with our initiatives, we also extend a warm invitation to participate in our upcoming investment workshops, where they are thoughtfully designed to provide a unique and enriching experience, tailored to elevate your existing understanding of investment strategies and market dynamics.

Whether you’re a seasoned investor looking to refine your skills or someone newer to the world of investments seeking foundational knowledge, our workshops are crafted to cater to diverse levels of expertise. Expect interactive discussions, real-world case studies, and hands-on exercises that will empower you to make more informed and strategic investment decisions.

For the latest updates, you can follow The Joyful Investors on InvestingNote, which is Singapore’s first and largest community platform where like-minded investors connect to become better together.

By accessing the pages on this website, you acknowledge and agree to the following terms:

Any information provided in this article is meant purely for informational and investor education purposes, and should not be relied upon as financial or investment advice. It does not take into account your individual circumstances, including but not limited to specific objectives, financial situation, and particular needs. It is advisable to consult your own financial, accounting, tax, legal, or other professional advisers. The availability of this website does not create any duty or representation to act as a financial or investment adviser.

The information provided herein may also contain projections or other forward looking statements regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures are not necessarily indicative of future or likely performance. You should not rely on the information presented on this website when making decisions regarding your finances or investments.

This website endeavors to present accurate factual information and data sourced from publicly accessible third-party outlets, complemented by insights gained through our learning journey. However, we cannot assure the accuracy and completeness of the information or data, and we do not pledge to regularly update them. We assume no responsibility for any errors or omissions in the information or data derived from third-party sources cited on the website.

Nothing on this website constitutes or is part of: (a) an offer, recommendation, invitation, or solicitation for any person to acquire or subscribe to any securities or investment or financial products; or (b) an offer to any person to enter into, induce, or attempt to induce any person to enter into any agreement or transaction for or with the intention of acquiring, subscribing, disposing of, entering into, effecting, arranging, or underwriting any securities or investment or financial products.

Additionally, this website may offer analyses, opinions, and perspectives on historical, current, and future trends, performance, prospects, and investor sentiment. These represent our individual viewpoints and reflect our independent judgment in good faith. Please be aware that our analyses, opinions, and views are subject to change without notice, and we do not warrant their accuracy, completeness, or currency. Past performance does not necessarily predict future outcomes, and alterations in laws, regulations, and market conditions may significantly influence our analyses, opinions, and views. We do not commit to ensuring the completeness of our analyses, opinions, and views, nor do we undertake to update them over time.

This is a sponsored blog post by CSOP Asset Management Pte. Ltd. but all opinions are of our own. You may refer to CSOP Asset Management Pte Ltd (“CSOP”)’s website here: https://www.csopasset.com/sg/en/products/sg-div/etf.php for more information on the full T&Cs and disclaimers.

About Kathy

Co-Founder of The Joyful Investors and Co-CIO of InvestingNote Portfolio. I graduated with a degree in Economics in National University of Singapore (NUS). My previous experience with traders at the Merrill Lynch enable me to realize many counter-intuitive truths about how the financial markets work and to uncover the challenges faced by many new investors. Investing can be astoundingly simple, and my goal is to make financial education accessible and easy to understand for everyone.

Important Information

This document is for information only and does not constitute an offer or solicitation nor be construed as a recommendation to buy or sell any of the investments mentioned. Neither The Joyful Investors Pte. Ltd. (“The Joyful Investors”) nor any of its officers or employees accepts any liability whatsoever for any loss arising from any use of this publication or its contents. The views expressed are solely the opinions of the author as of the date of this document and are subject to change based on market and other conditions.

The information provided regarding any individual securities is not intended to be used to form any basis upon which an investment decision is to be made. The information contained in this document, including any data, projections and underlying assumptions are based upon certain assumptions and analysis of information available as at the date of this document and reflects prevailing conditions, all of which are accordingly subject to change at any time without notice and The Joyful Investors is under no obligation to notify you of any of these changes.

· · ·

Have you enjoyed this article? We’d be grateful if you would share this useful content to your friends who may benefit from it as well.