Kathy

in Memos & Musings · 3 min read

This article was created in partnership with Societe Generale (Singapore branch), but the opinions are our own.

Finding Opportunity in Uncertainty: The Untapped Upside in China's Markets

After years of disappointment, Chinese stocks have raced ahead over the past year, outperforming U.S and global indices. This surge has been driven by strong liquidity, a resurgence in IPO activity, increasing flows from mainland investors, and a rally in benchmark-heavy internet platforms seen as beneficiaries of trends like AI.

Following a sharp selloff in April triggered by tariff threats from the Trump administration, a policy-driven rally emerged as state-affiliated investors stepped in aggressively. On August 7 and 8 alone, equity ETFs saw net inflows of 175.5 billion yuan—marking the largest two-day inflow since October 2024.

The sharp rise of Chinese equities has caught many investors by surprise. Over the past 12 months, the HSCEI benchmark of Chinese firms listed in Hong Kong has risen 45% in US dollar terms. The CSI 300 is up 33%. The S&P 500 and MSCI AC World indices look pedestrian by comparison, gaining around 14% each.

Credit: LSEG (The information relating to past performances is for illustrative purposes only, and is not a reliable indicator of future performance.)

This isn’t a call for a reckless gamble, but rather a strategic reassessment based on signals that the cycle may be turning. The case for a measured allocation to Chinese markets rests on some of the observations as listed below:

1. Policy Support: From Crackdown to Catalyst

The regulatory crackdown of 2021 — which dealt a heavy blow to China’s tech and education sectors — marked a pivotal moment, severely denting investor sentiment. However, recent policy signals and rhetoric point to a notable shift: from punitive regulation toward constructive engagement and market stabilization.

The government has since rolled out targeted initiatives aimed at steadying the critical property sector, including relaxed financing conditions for developers and lower mortgage rates. More importantly for equity markets, there has been a discernible change in tone toward the private sector, particularly the technology industry — long seen as a key driver of growth and innovation. Regulators have gone so far as to commend the contributions of tech firms, while indicating a wind-down of intensive regulatory scrutiny. When combined with interest rate cuts and commitments to boost domestic demand, this evolving policy posture is clearly designed to restore confidence.

In late September 2025, policymakers introduced a series of consumption support measures that are already showing signs of traction. Auto sales rebounded into positive territory, while household appliance sales surged about 20%. Perhaps most notably, the rollout of one-off cash transfers to low-income households also reflects a meaningful shift toward more direct forms of consumption support. This could be instrumental in sustaining domestic demand momentum.

2. Potential for Reallocation to China Equities

Beijing has sought to support a so-called “slow bull market,” aiming to enable better wealth creation and, in turn, aid consumption. Individual investors, scarred by the brutal 2024 cycle, are cautious and need a stronger, more sustained signal to confirm a bull market.

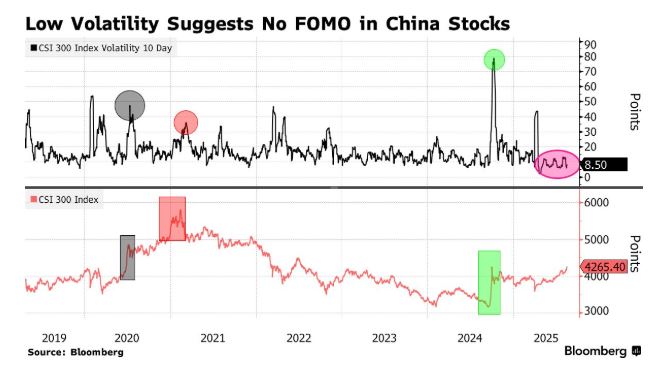

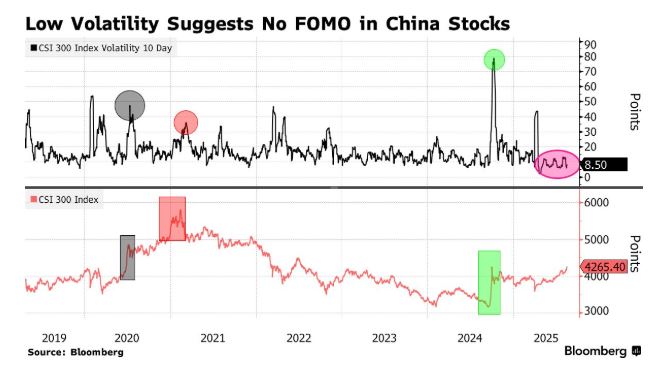

The 10-day historical volatility for the benchmark CSI 300 Index remains only a few points above this year’s low. The absence of retail euphoria is likely to limit the risk of crowd-driven booms and busts, potentially giving the recent rally more staying power.

Credit: Bloomberg (The information relating to past performances is for illustrative purposes only, and is not a reliable indicator of future performance.)

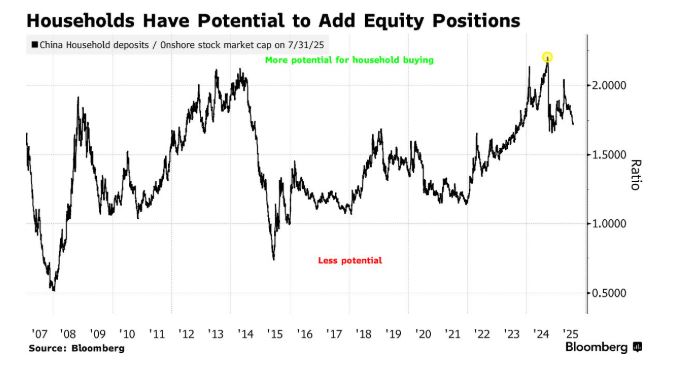

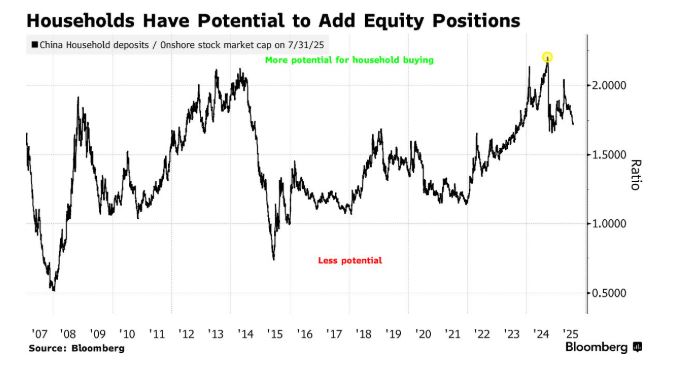

Mainland households sitting on record-high savings of over 160 trillion yuan ($22 trillion) as of July 2025, are turning to equities for better returns as interest rates drift lower. But recent net purchases in July, still trailed first-quarter highs and can remain a potent source of latent demand. Retail investors are not yet seen scrambling to buy shares.

Credit: Bloomberg (The information relating to past performances is for illustrative purposes only, and is not a reliable indicator of future performance.)

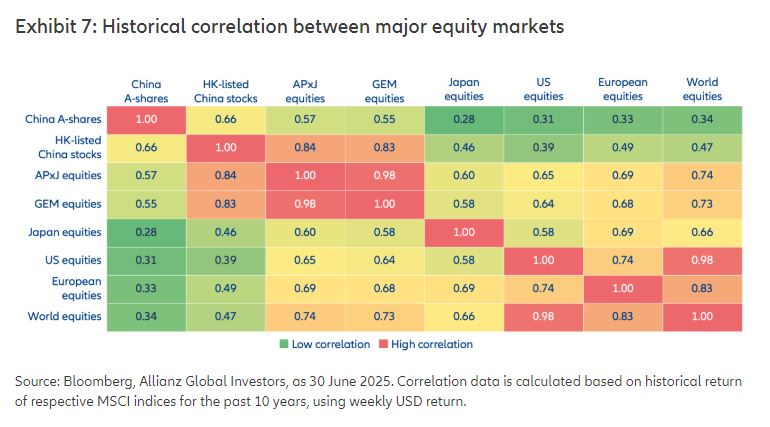

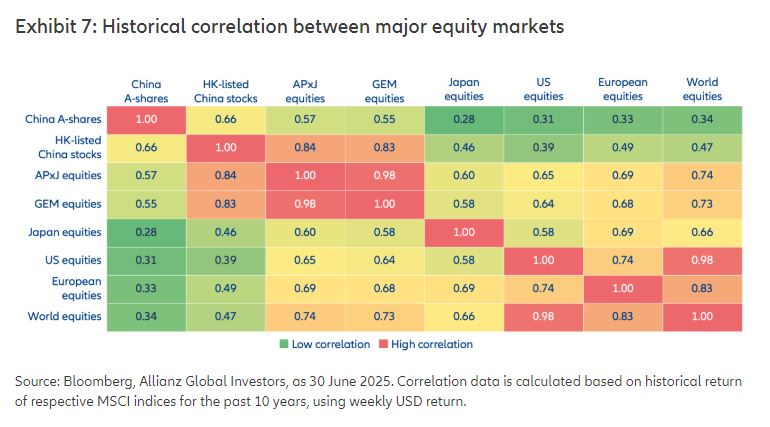

Foreign investors have also appeared to largely sit out this rally; while holdings have recovered by nearly 600 billion yuan from their 2024 lows, they remain far below historical peaks. For foreign investors, Chinese equities can be a powerful diversifier for portfolios heavily focused on US markets, helping to smooth long-term returns—especially compelling at a time when valuations still appear reasonable.

Credit: Bloomberg, Allianz Global Investors (The information relating to past performances is for illustrative purposes only, and is not a reliable indicator of future performance.)

Primarily, low interest rates, near-record low bond yields, a lack of attractive alternatives and a compelling risk-to-reward opportunity should continue to drive Chinese retail and institutional investors forward.

3. Resilience from the "New Economy"

Chinese tech companies are no longer in a holding pattern—they’re repositioning. The strategic focus among large-cap names has shifted decisively from unbridled user acquisition to sustainable profitability, cost discipline, and tangible shareholder returns via buybacks and dividends. This evolution reflects a sector that is maturing, and that maturity is a constructive signal for long-term investors.

A key pillar underpinning this resilience lies in a structural shift within China’s domestic tech landscape: leading players such as Alibaba and Baidu are now leveraging in-house AI chipsets to train large language models (LLMs).

This marks a strategic decoupling from near-exclusive reliance on NVIDIA hardware, reinforcing ambitions toward technological sovereignty while mitigating geopolitical and export-control risk. More importantly, it opens the door to highly targeted investment themes across the Chinese AI value chain.

The investment case for Chinese technology is thus evolving—from broad-based exposure to a more nuanced, theme-driven approach centred on domestic AI infrastructure development.

4. Record Southbound Inflows: A Vote of Confidence

With China broadly out of favor and trading at depressed valuations, the hurdle for positive surprise is unusually low. A full return to high-growth dynamics isn’t necessary—mere signs of macro stabilization, incremental earnings recovery, or even a modest de-escalation in geopolitical tensions could be enough to trigger a sharp mean-reversion rally.

In a global landscape where valuations are stretched, China remains one of the few large, liquid markets still offering a meaningful margin of safety for contrarian, value-oriented investors.

Credit: Bloomberg (The information relating to past performances is for illustrative purposes only, and is not a reliable indicator of future performance.)

China’s pivot toward technological self-reliance is gaining market traction, reflected in record southbound capital inflows into Hong Kong-listed Chinese equities via the Stock Connect.

This trend signals that sophisticated mainland investors are rotating into undervalued names, with a clear bias toward structural winners in high-conviction themes such as AI.

5. Potential Inflection point: Relative Performance Between US/China Stocks

Let’s take a closer look under the hood to observe what’s unfolding in real time. The chart below compares the relative performance of Chinese equities (using MCHI as a proxy) versus US equities (SPY) from 2020 to 2025. The yellow line represents the MCHI/SPY ratio, which has been in a persistent downtrend — highlighted by the blue trendline — underscoring the pronounced underperformance of China relative to the US in recent years.

However, the recent price action tells a different story. The ratio appears to be carving out a potential double bottom between late 2023 and early 2024 — a classic technical formation often associated with major trend reversals. More importantly, the ratio has broken above its long-term downtrend and is now consolidating near the 0.096 level, signaling that downside momentum may be exhausted.

Credit: Bloomberg (The information relating to past performances is for illustrative purposes only, and is not a reliable indicator of future performance.)

While we’ve yet to see a confirmed breakout above the horizontal resistance (marked in red), the prolonged basing action suggests that the underperformance of Chinese equities may have reached an inflection point. A decisive move above this resistance would affirm a shift in relative trend — setting the stage for a mean-reversion trade, where China begins to close the performance gap with the US.

From a macro lens, this potential reversal may be catalyzed by a combination of supportive factors: pro-growth policies from Beijing, compelling valuations, and a possible rotation out of richly priced US tech into more attractively valued markets like China.

Wrapping Up: A Compelling, if Cautious, Case

To be clear, the risks have not disappeared. Geopolitical tensions remain a significant overhang, and China’s structural growth slowdown is a real and ongoing concern. The offshore market — while buoyed by healthy IPO activity and sustained southbound capital flows — remains prone to volatility, particularly given its heightened sensitivity to global investor sentiment and geopolitical developments.

That said, for long-term investors, the current risk-reward setup might be attractive enough. Chinese equities have quietly outperformed over the past year, even amid persistent macro headwinds — a testament to the growing influence of policy support. Both monetary and fiscal levers are being pulled more actively to cushion the economy against external shocks.

This is not a market to chase, but one to approach with discipline — building exposure gradually and selectively. With investor sentiment still largely bearish for the most part, Chinese equities remain under-owned. History has consistently shown that some of the most rewarding investments are made when the crowd looks elsewhere.

What are your options as a China investor?

✅ Ride It Out: Long-term investors may choose to simply ride through the storm—accepting short-term swings while staying invested for the long run in the China growth story.

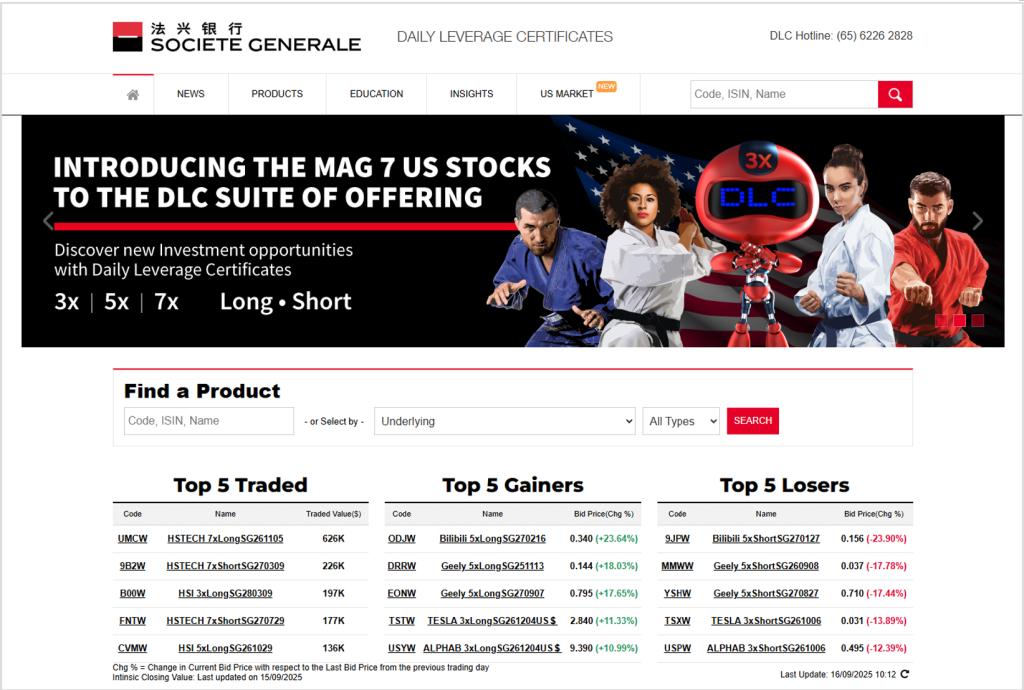

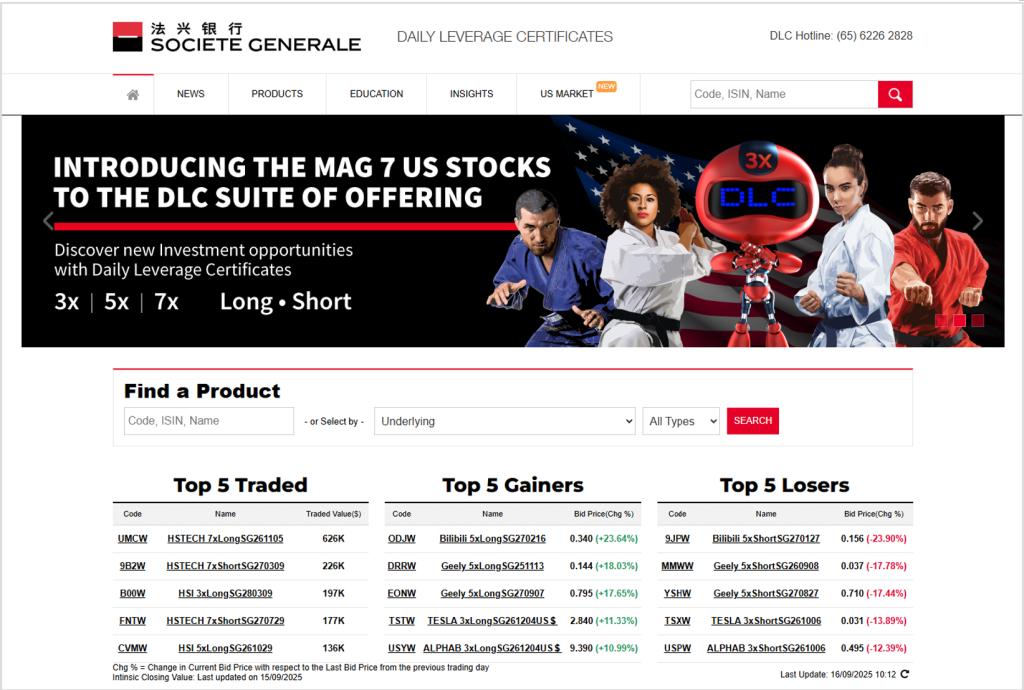

✅ Trade or hedge the Swings Proactively: And for those who prefer a more active approach with China stocks—positioning tactically for both upside opportunities with the renewed momentum or perhaps with some downside protection—there’s another option with Daily Leveraged Certificates (DLCs) listed on SGX.

3x/5x/7x DLCs: A flexible tool to navigate market swings

Daily Leveraged Certificates (DLCs) offer a dynamic and flexible way to trade volatility for some of these China H shares. Whether it’s to tactically hedge part of your portfolio during earnings season, express short-term views around tariff headlines, or capitalize on rate-driven swings, DLCs can help investors stay agile without abandoning long-term positions.

In short, DLCs allows traders and investors to:

Magnify Returns: Capture short-term trends with 3x/5x/7x daily leveraged exposure to the underlying asset’s performance, for both Long and Short directions

Hedge Downside Risks: Mitigate portfolio risk with Short DLCs, which gain value as the underlying stock price falls.

What are DLCs?

Daily Leverage Certificates (DLCs) are exchange-traded instruments that offer investors leveraged exposure to an underlying asset, such as a stock index or an individual stock. DLCs track the daily performance of the underlying asset relative to its previous closing price.

A bullish investor who thinks that the underlying asset is set to rise over the trading day can select, for example, a 5x Long DLC, which will rise in value by 5% for each 1% rise in the underlying asset (before cost & fees).

A bearish investor who expects the underlying asset to fall can instead select, for example, the 5x Short DLC, which will rise in value by 5% for every 1% fall in the underlying asset (before cost & fees).

At the same time, if the market moves against the investor, the DLC will amplify losses in the same way. For example, if the underlying asset falls by 1%, the value of the 5x Long DLC will decrease by 5% (before cost & fees). The investor’s entire invested capital is at risk but the maximum total loss will not be more than the total invested capital.

To explore some scenarios that traders or investors can possibly tap on the use of DLCs is available in this previous article as well.

Visit the issuer Societe Generale’s DLC website for the full list of DLCs – Click here.

Source: DLC.socgen.com

Risks and what DLCs should not be used for:

Daily Leverage Certificates (DLCs) are leveraged financial instruments that carry a high level of risk—including the potential loss of your entire capital if the market moves against your position.

These products are primarily designed for short-term trading, allowing investors to capitalize on rapid market movements. However, they are not intended for long-term holding, as the compounding effect of daily leverage can cause returns to deviate significantly from the expected multiple over time. Additionally, holding DLCs over extended periods may lead to higher costs due to accumulated fees.

In summary, while DLCs can be powerful tools for enhancing returns, their leveraged nature and the mechanics of daily rebalancing introduce complexities and risks. If you’re looking to participate in the tech rally or other fast-moving sectors, it’s essential to fully understand how DLCs work and ensure they fit within your overall investment strategy.

Disclaimer

This advertisement has not been reviewed by the Monetary Authority of Singapore. The views expressed under this article represent the personal and independent views of the author and do not constitute investment advice. The content of this article does not form part of any offer or invitation to buy or sell any daily leverage certificates (the “DLCs”), and nothing herein should be considered as financial advice or recommendation. The price may rise and fall in value rapidly and holders may lose all of their investment. Any past performance is not indicative of future performance. Investments in DLCs carry significant risks, please see dlc.socgen.com for further information and relevant risks. The DLCs are for specified investment products (SIP) qualified investors only.

About Kathy

Co-Founder of The Joyful Investors and Co-CIO of InvestingNote Portfolio. I graduated with a degree in Economics in National University of Singapore (NUS). My previous experience with traders at the Merrill Lynch enable me to realize many counter-intuitive truths about how the financial markets work and to uncover the challenges faced by many new investors. Investing can be astoundingly simple, and my goal is to make financial education accessible and easy to understand for everyone.

Important Information

This document is for information only and does not constitute an offer or solicitation nor be construed as a recommendation to buy or sell any of the investments mentioned. Neither The Joyful Investors Pte. Ltd. (“The Joyful Investors”) nor any of its officers or employees accepts any liability whatsoever for any loss arising from any use of this publication or its contents. The views expressed are solely the opinions of the author as of the date of this document and are subject to change based on market and other conditions.

The information provided regarding any individual securities is not intended to be used to form any basis upon which an investment decision is to be made. The information contained in this document, including any data, projections and underlying assumptions are based upon certain assumptions and analysis of information available as at the date of this document and reflects prevailing conditions, all of which are accordingly subject to change at any time without notice and The Joyful Investors is under no obligation to notify you of any of these changes.

· · ·

Have you enjoyed this article? We’d be grateful if you would share this useful content to your friends who may benefit from it as well.