Keith

in Memos & Musings · 3 min read

Over the weekend, we chanced upon an interesting study on China’s retail investors that shed light on some notable trends. We shared this study in one of our posts on our InvestingNote account. While the study is dated, other more recent studies have continued to more or less show the same trends as this one.

One key observation is that most retail investors in China have relatively small account sizes (<500K CNY). Unlike in more developed markets like the US—where institutional investors play a dominant role—China’s trading volume is largely driven by these retail investors. Among them, those with the smallest accounts make up the majority and tend to exhibit behavioral biases such as overconfidence and gambling tendencies. This often results in weaker information processing and less accurate predictions of future returns.

These characteristics contribute to the high levels of market volatility in China, as retail investors typically have shorter holding periods and trade more frequently. Given this unique market structure, China presents a different investment landscape compared to markets with a stronger institutional presence and longer investment horizons.

Because of this, investing in China often requires a more tactical approach. Opportunities tend to be short-lived, making active investing a more viable strategy.

Interestingly, these findings pretty much align with insights shared in an earlier YouTube video by our Chief Trainer, Hazelle, where she outlined key investing considerations for those looking to gain exposure to the China market.

Here are some of the useful pointers in the video:

- Adopt a measured approach towards China

Investors must be able to expect surprises from China’s Politburo. The Chinese Politburo has a history of influencing the stock market through abrupt policy shifts and carefully chosen rhetoric. Decisions can be made swiftly and unpredictably, causing dramatic market reactions overnight. Whether it’s regulatory crackdowns, economic stimulus measures, or shifts in monetary policy, these moves can significantly impact investor sentiment and stock valuations.

The level of unpredictability makes the Chinese market a challenging environment, particularly for those unaccustomed to navigating rapid government intervention. The key is to focus on industries benefiting from policy tailwinds and long-term consumption trends. Sectors aligned with government priorities—such as renewable energy, advanced manufacturing, or domestic consumption—tend to offer more stability and growth potential. For example, Chinese consumer stocks remain a compelling area, given the country’s push toward self-sufficiency and a growing middle class.

- Using an ETF instead of Stock Picking

When investing in China, an exchange-traded fund (ETF) can provide sufficient exposure to the Chinese market for most retail investors who may be less skilled at individual stock picking. Given that many Chinese stocks—particularly in the tech, financial, and consumer discretionary sectors—are trading at historically low valuations at the time of writing, investing in a broad-based China ETF can be a practical choice. This is especially relevant if China isn’t your primary investment focus but rather a tactical play within your portfolio.

ETFs offer a simple, low-cost way to gain diversified exposure to certain sectors of the Chinese market without the complexity of picking individual stocks. They also provide a layer of risk management by spreading investments across multiple companies, reducing the impact of volatility in any single stock.

There are specific ETFs that offer distinct coverage based on sector focus. Whether you’re looking to capitalize on China’s tech rebound or gain broad exposure to financials and blue-chip stocks, there are ETF options tailored to each strategy, some of which are listed in SGX as well which we covered in the video.

For those seeking a straightforward way to invest in China’s recovery while mitigating the risks of individual stock selection, ETFs can be a smart and efficient option.

- Even in a bull market, expect significant pullbacks in between 📉

A bull market doesn’t mean prices will rise in a straight line. While the general trend may be upward, there will always be periods of consolidation, pullbacks, and short-term corrections. However, some investors mistakenly believe that a bull market guarantees daily or weekly gains. They jump in expecting instant profits, but when the market inevitably experiences pullbacks after a strong rally, they panic. Feeling disheartened, they sell their positions prematurely—what’s commonly referred to as having “paper hands.” Instead of viewing market fluctuations as part of the natural cycle, they see them as signs of failure. Frustrated that the market isn’t behaving the way they expected, they blame external factors, unaware that the real issue lies in their lack of understanding and emotional discipline.

On the other hand, experienced investors see these pullbacks as opportunities rather than setbacks. They understand that markets move in waves and that a temporary dip can provide a chance to enter or add to positions at better valuations. By strategically managing their risk and maintaining a long-term perspective, they avoid unnecessary drawdowns and position themselves for stronger gains when the next upward momentum kicks in. The key difference? Trained investors focus on the bigger picture, while emotional investors get shaken out by short-term noise.

Take a look at this screenshot below from one of our brokerage apps—this growth portfolio has exposure to both the US and China markets. Earlier this year, when China saw a bigger pullback, the portfolio had dipped by about 5% before bouncing back to around 11% as of February 10, 2025.

That said, with a market like China, you can never say never. There’s always a chance we can revisit those earlier lows. If it happens, we’ll stay level-headed as expectations have been set accordingly.

What matters is being prepared. Investors need to have strong hands whenever volatility hits. While we can’t control the market’s ups and downs, we can control our entry prices and position sizes to match our own comfort levels and mitigate the downside risks.

- Manage risks with proper position sizing

The China markets move very unpredictably, often defying expectations regardless of policy shifts, economic data, or expert forecasts. In highly volatile markets like China, going all in at the wrong price can make recovery incredibly difficult. The key to staying in the game is maintaining cash reserves—having the ability to deploy capital strategically rather than being fully exposed from the start.

In investing, money follows discipline. Those who focus on risk management consistently outperform those who chase returns without a strategy. The key to long-term success—and peace of mind—is to be process-driven, not money-driven. You control your entry, exit, risk level, and position sizing. When you shift your focus from executing a solid strategy to obsessing over short-term gains and losses, your decision-making suffers.

This is especially critical in volatile markets like China, where emotional swings can be extreme. If you let winning trades make you euphoric and losing trades devastate you, the market will control you instead of the other way around. Emotional discipline is just as important as financial discipline.

- Do not leverage on China (or even other markets for that matter)

Leverage may amplify gains, but it also magnifies losses. A leveraged portfolio experiences deeper drawdowns when the market declines, making recovery significantly harder. While the potential upside may seem attractive, prudent investing requires equal consideration of the downside risks. Markets don’t always move in a straight line, and positioning yourself too aggressively can leave you vulnerable to unexpected volatility.

Social media has become a powerful force in shaping market movements, often intensifying both rallies and crashes. With the ease of online influence, large groups of investors can move in unison, creating rapid surges in stock prices or triggering sharp sell-offs. Market sentiment can shift quickly, driven by speculation and hype rather than fundamentals. As a result, many investors may find themselves following momentum blindly, only to be caught on the wrong side of a trade when the trend reverses. This was what happened to China as well recently back in October 2024 which we highlighted in our posts on InvestingNote too here. (and here 😖)

It’s crucial to prepare for not just the average market conditions but also the worst-case scenarios. A portfolio must be built to withstand the deepest corrections, longest pullbacks, and most extreme crashes. Even when an investment thesis is sound, the market may take longer than expected to recognize its value. Prices may consolidate or decline further before the opportunity materializes. The key is ensuring your portfolio can endure these fluctuations so that when the time comes, your strategy proves its worth.

Avoid placing yourself in a position where a few bad days could force you out of the market entirely.

To sum it up:

We hope these key takeaways serve as a helpful starting point, especially for those who are just beginning to explore opportunities in the China market. While these insights provide a quick overview, gaining a deeper understanding is essential for making well-informed investment decisions.

Investing in China has always come with higher risks and volatility, and recent market conditions have only amplified these challenges. However, the sheer scale and diversity of opportunities remain compelling for investors seeking long-term returns across various asset classes.

Over the past decade, China’s economic trajectory has been marked by rapid growth, often accompanied by concerns over a potential hard landing. Yet, time and again, the country has defied expectations and navigated through challenges. Today, China’s macroeconomic landscape is largely shaped by the government’s strategic objectives, which continue to drive long-term structural shifts in the economy.

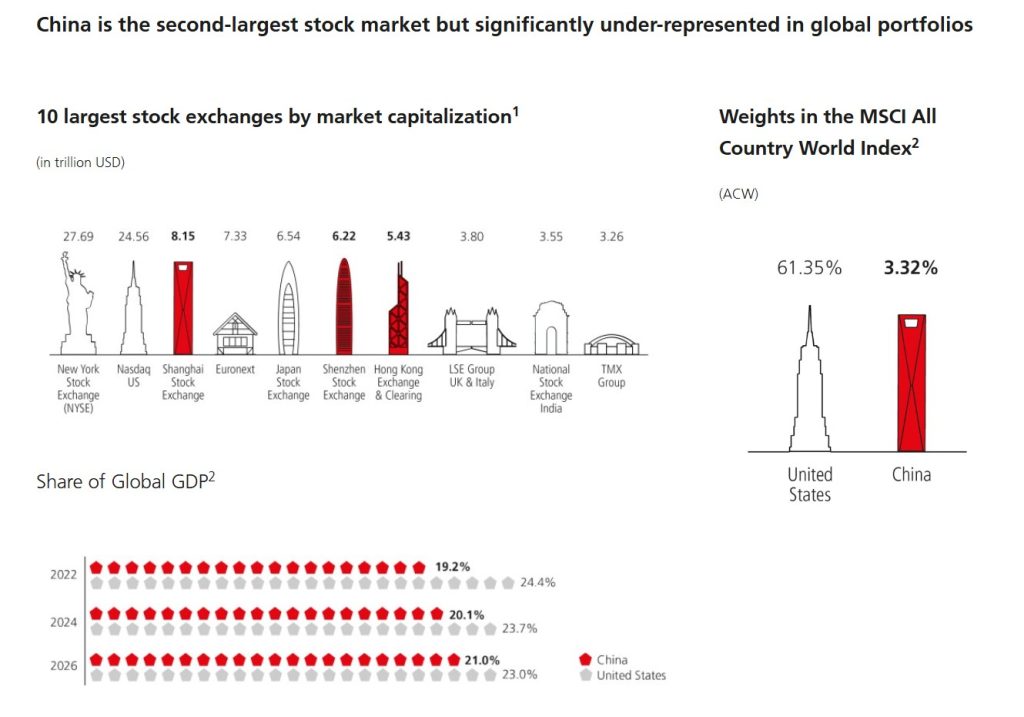

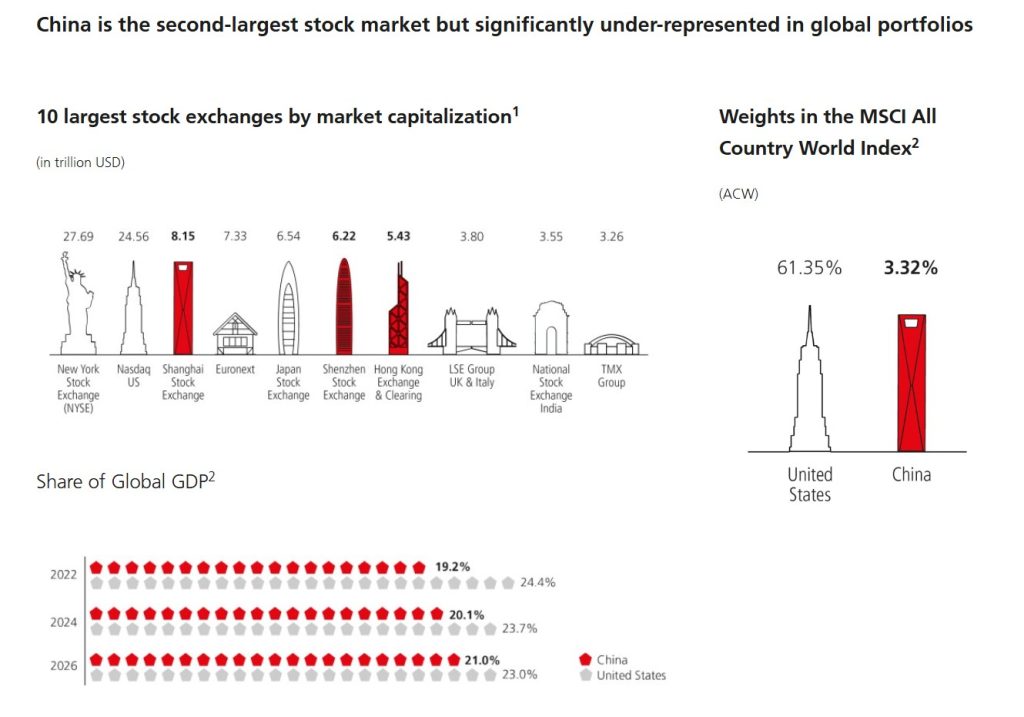

In our personal view, China may deserve a dedicated allocation in a global portfolio—just like the US. As the world’s second-largest economy and a key driver of global growth, China remains underrepresented in many investors’ portfolios despite its significance. In addition, Chinese equities and fixed-income assets tend to have low correlation with other widely held portfolio allocations, providing valuable diversification benefits.

Image credit: UBS

Lastly, for a more in-depth discussion on investing in China—along with actionable insights—be sure to check out the full video by Hazelle below:

About Keith

Keith is an investment mentor at The Joyful Investors and is the originator behind the Moneyball Investing methodology, a strategy that facilitated his attainment of financial independence by the age of 35. He is a licensed senior wealth adviser who has more than 18 years of experience in working with asset managers to deliver wealth advisory services to private clients, with a focus on retirement planning. His expertise in portfolio management has not only enabled many clients to retire early but has also earned him accolades, including the iFast Symposium Top Wealth Advisers award, among others.

Important Information

This document is for information only and does not constitute an offer or solicitation nor be construed as a recommendation to buy or sell any of the investments mentioned. Neither The Joyful Investors Pte. Ltd. (“The Joyful Investors”) nor any of its officers or employees accepts any liability whatsoever for any loss arising from any use of this publication or its contents. The views expressed are solely the opinions of the author as of the date of this document and are subject to change based on market and other conditions.

The information provided regarding any individual securities is not intended to be used to form any basis upon which an investment decision is to be made. The information contained in this document, including any data, projections and underlying assumptions are based upon certain assumptions and analysis of information available as at the date of this document and reflects prevailing conditions, all of which are accordingly subject to change at any time without notice and The Joyful Investors is under no obligation to notify you of any of these changes.

· · ·

Have you enjoyed this article? We’d be grateful if you would share this useful content to your friends who may benefit from it as well.