Firstly, we must always understand that before we invest, we must have first already set aside 6-9 months of savings for emergency needs. If there are also any short term obligations such as debt installments to pay off, they should be set aside as well and should not be invested.

So with these out of the way, we assume that the $10K you mention is in addition to the above needs.

Firstly we must understand your investment objectives. Would it be something like for funding for your children’s university education or for your own retirement? Of which we should ideally be looking at something that is more than 5 to 10 years out. I get worried when I hear retail investors ploughing in their money for the purpose of growing their renovation funds, wedding funds which they need in just a couple of months or less than 2-3 years.

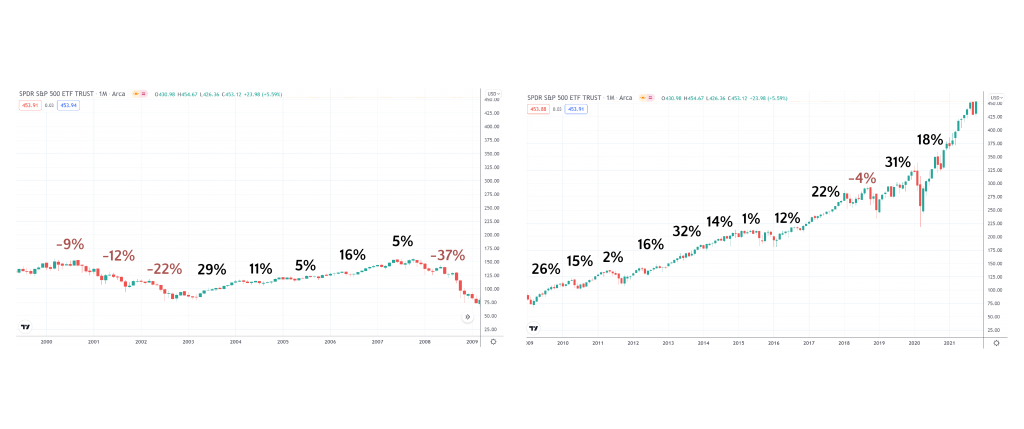

The higher your financial literacy, the lower the investment time horizon you can afford to have and still stand a good chance of doing well. But for most of us who may just be getting started, especially since you are reading this article, it is better to err on the side of caution and have a much longer investment time horizon which would enable you to ride out any unforeseen market events in between. That would mean a minimum of 5 years and beyond. If we take a look at the annualised returns for the S&P 500 index, despite being in a nice uptrend over the long term, there would still be some years where the S&P 500 is in a drawdown position or produces a negative year to date return. Therefore, having a longer investment time horizon of at least 5 years will increase your probabilities of win rates in this case.

Then, if you are invested in another country ETF where the underlying stocks are more cyclical, like banking or property stocks such as the ES3 ETF, which mirrors the STI, after 10 years out you could still well be flat.

And yes if today all you have is $10K and just getting started, an ETF like SPY does you good because you do not have to do that much of a research by picking your own stocks. The portfolio would definitely be much less volatile as compared to you picking 3-4 stocks with a $10K budget. If you are a more experienced investor and believe that you are good with stock picking then maybe you do not have to just invest in an ETF. But then the question here is “if I have $10K.” If you have been investing for some time and you still just have only $10K, maybe it is time to relook your process of stock picking or how you can be making higher probability entry points.

When you eventually manage to save more or grow your existing portfolio say close to $20K, maybe then it will be more purposeful to start stock picking where you perhaps can have say 5 positions of about $4k each. One way you can do so is to buy fractional shares with Interactive Brokers. But till you do that, take the time from when you start investing in the ETF, to learn how to do stock picking correctly which you eventually would thank yourself for.

–

Are you new to investing or have you been grappling with some unanswered questions in your investing journey? Send your burning questions to us at Ask Me Anything with TJI here.

Very useful advice. I was glad to have made the switch from investing in STI to the SPY ETF years ago.

Glad that you made the switch early. Yeah investing in the ES3 ETF still remains a rather common starting choice for many beginner investors in Singapore. Hopefully more new investors can better understand the choices that are available for them before starting out.