Hazelle

in Memos & Musings · 6 min read

One of the key principles in investing is to know when to invest by not conforming with the crowd and not following mainstream financial advice. In practice, this is something which many investors find difficult to be done.

At critical turning points of the market, the majority of the investors often rely on financial information from analysts and the mainstream financial media. However, analysis by these outlets are often wrong at critical turning points of the market.

What analysts were saying during the Covid-19 market crash

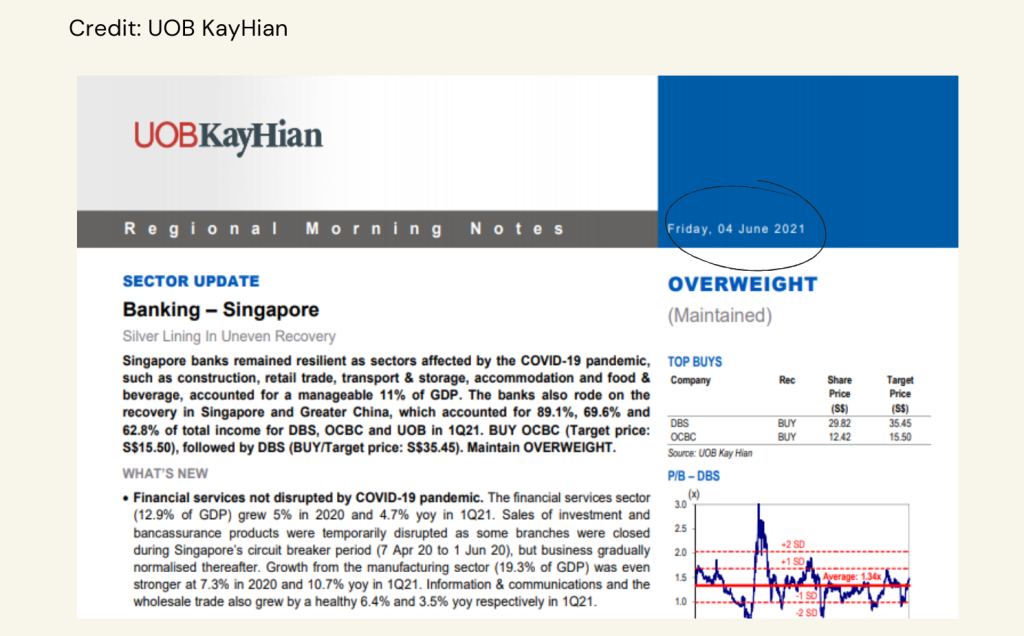

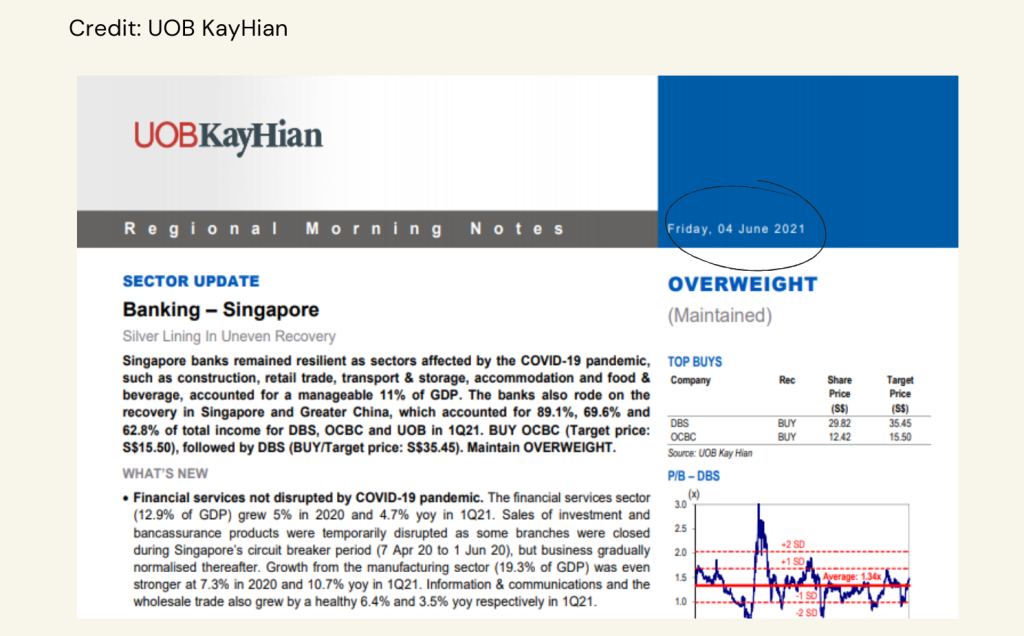

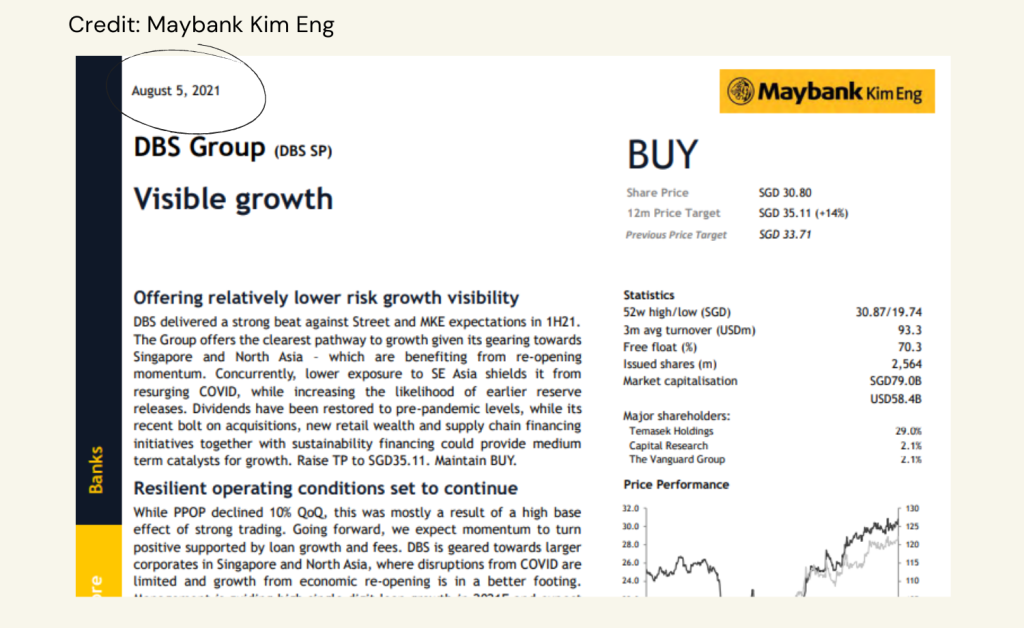

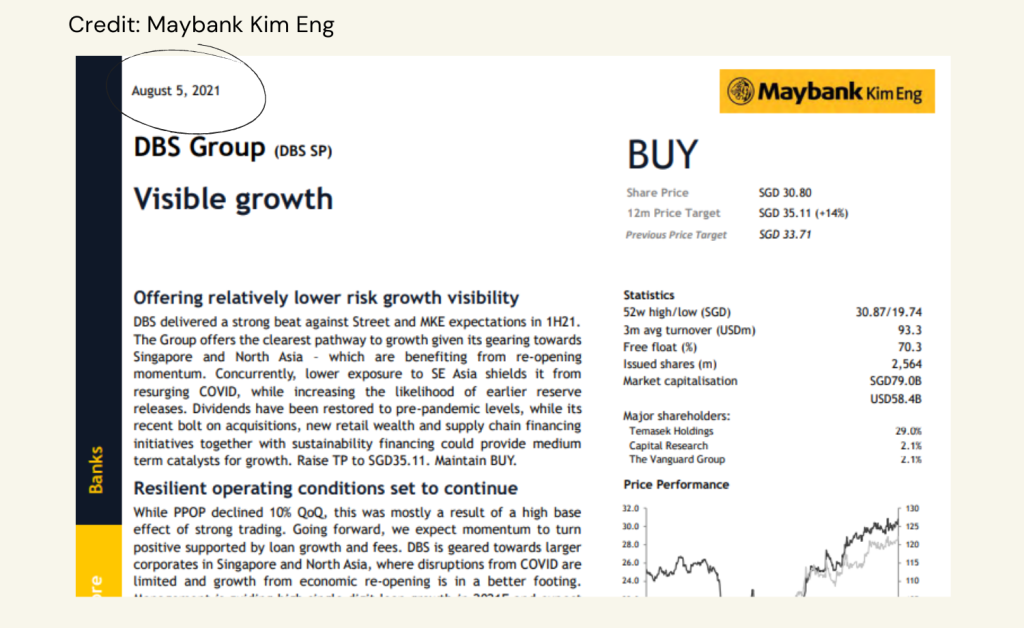

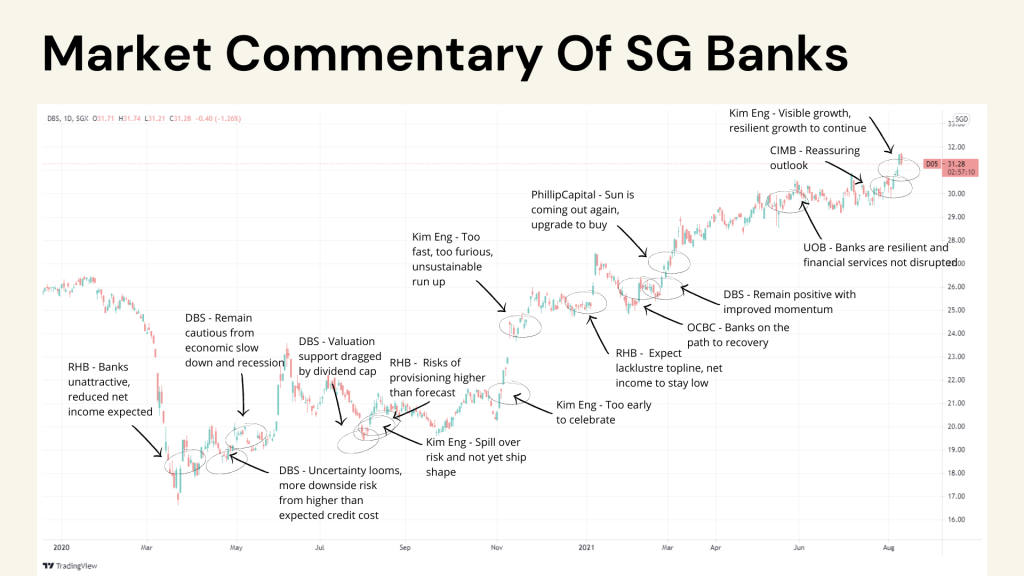

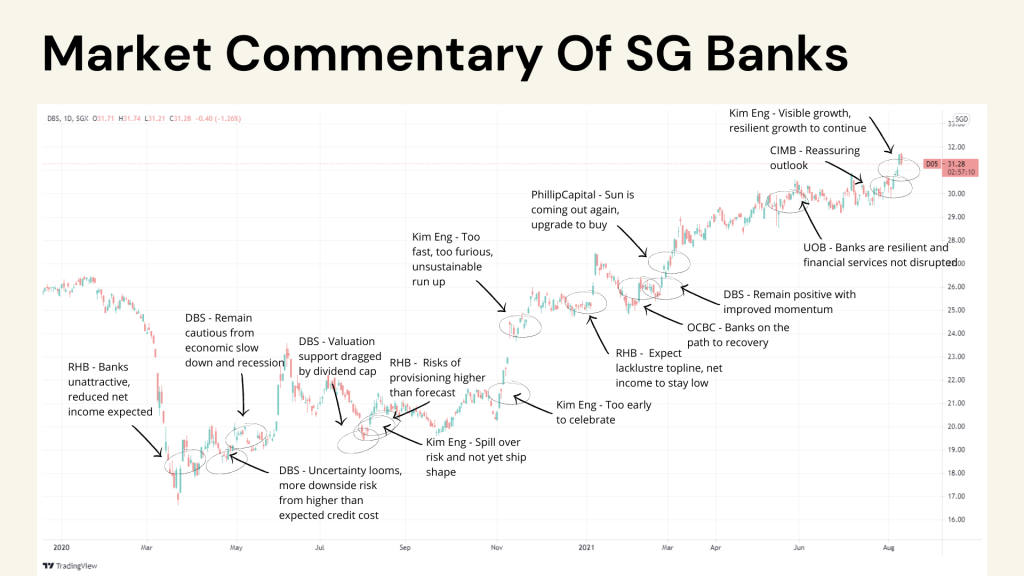

During the Covid-19 crash, if you have been following the financial analysts reports, these are what you would have read.

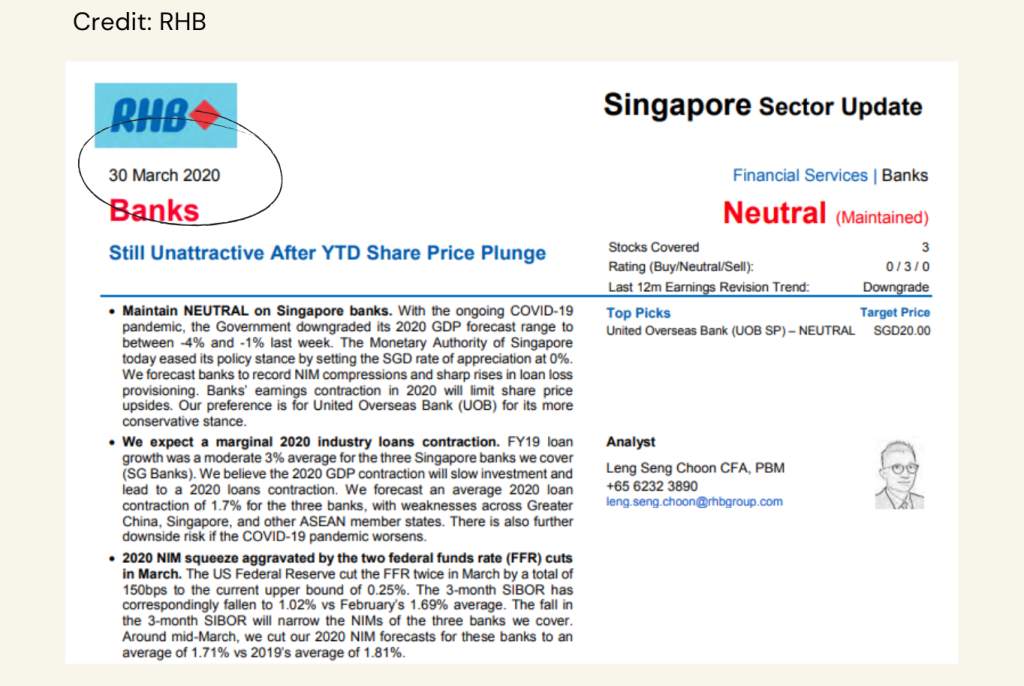

Back in March 2020, RHB bank published a “NEUTRAL” call saying that it is unattractive after the share prices plunged.

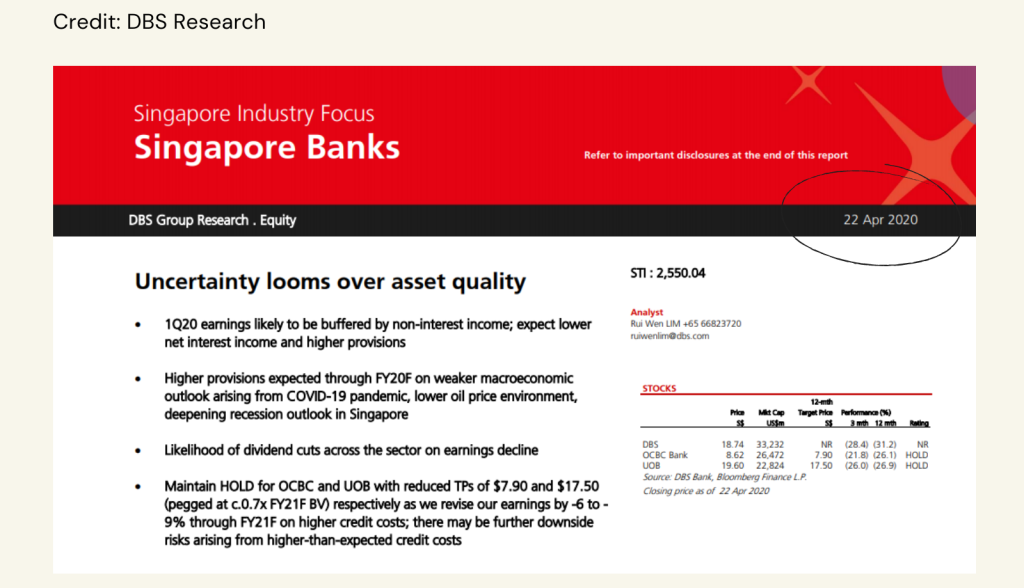

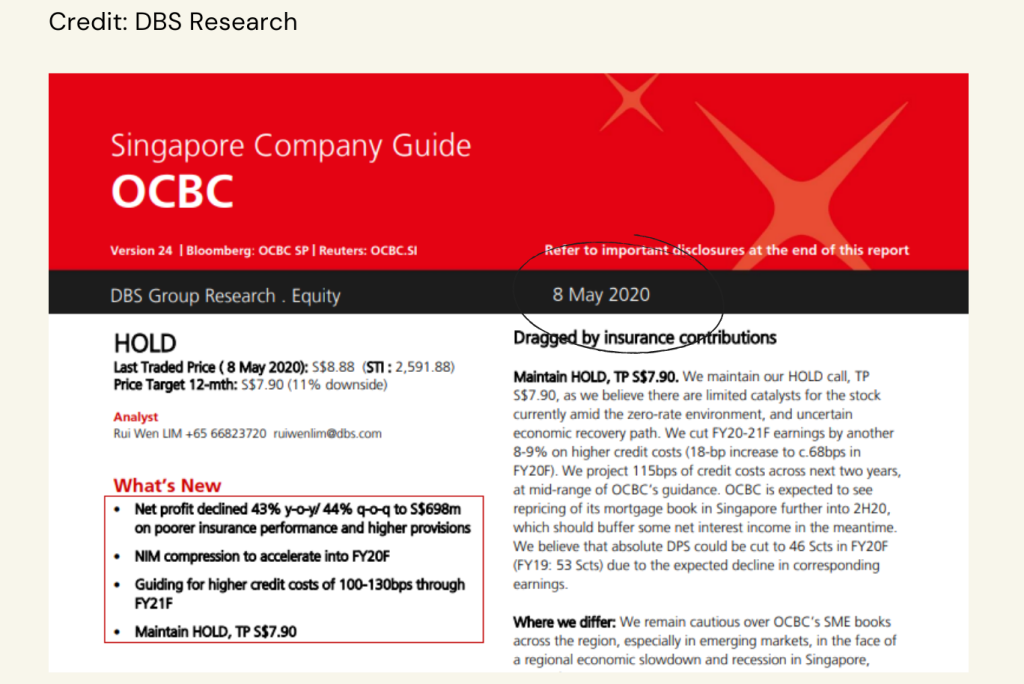

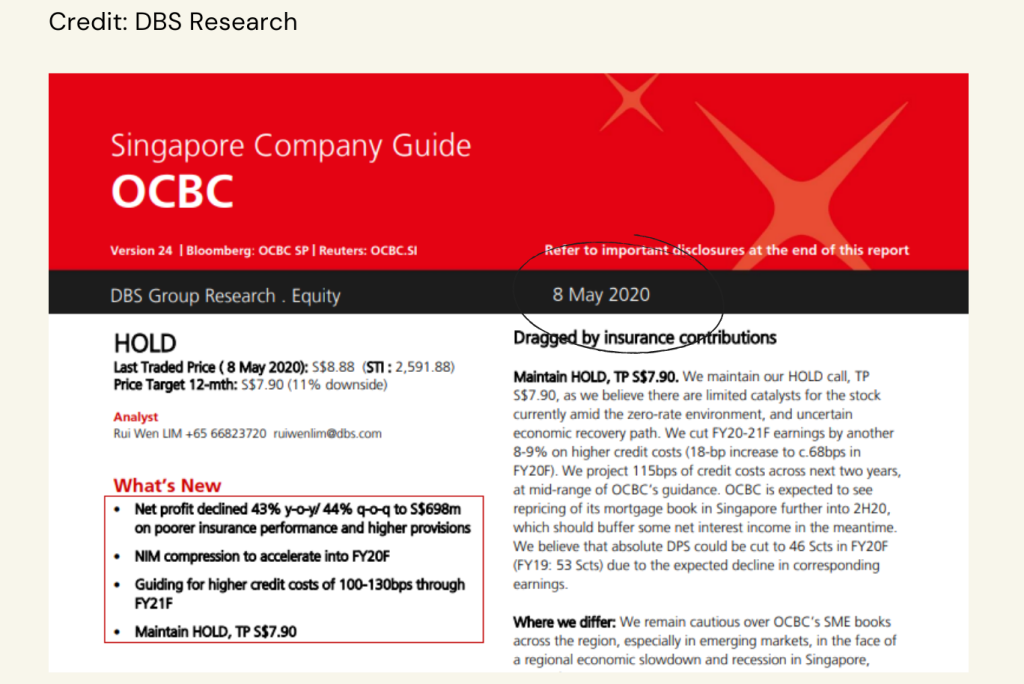

In April 2020, DBS released the analyst report saying that there is still a lot of uncertainty, so their call is “HOLD”.

May 2020 – Again, analyst call is “HOLD”.

July 2020 – “HOLD”.

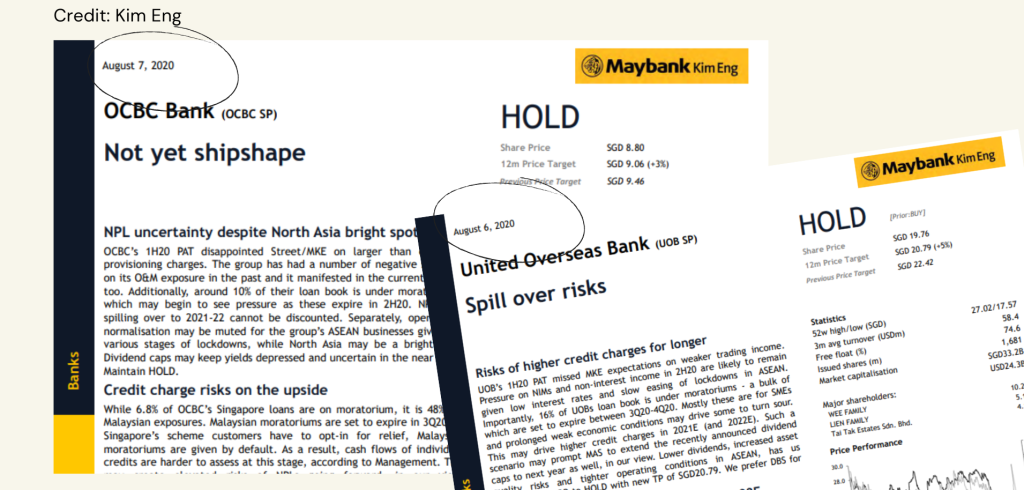

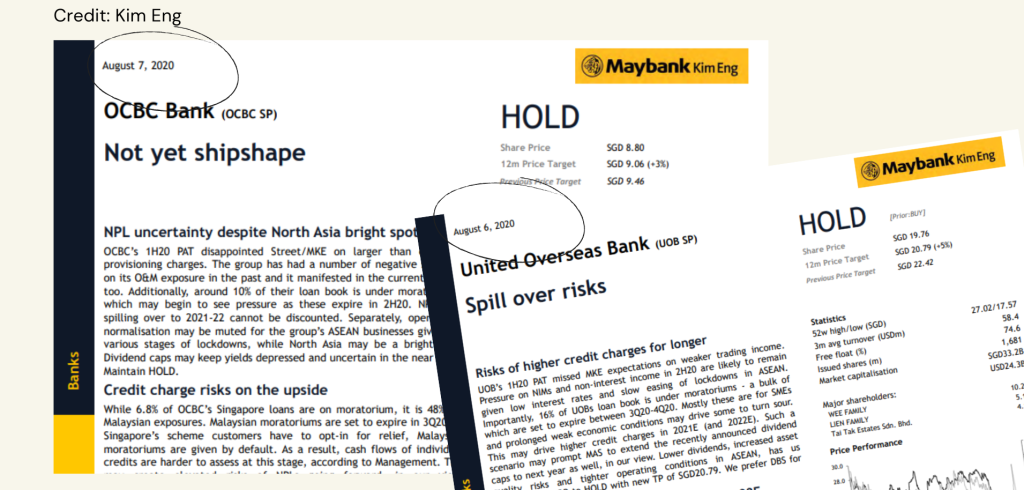

August 2020 – Analyst at Maybank says “HOLD”. RHB says they have a “NEUTRAL” outlook for the DBS stock.

November 2020 – Maybank analyst says it is too early to celebrate the recovery. In the same month, they published another report saying the recent run up is unsustainable. The call has turned to “NEGATIVE”.

December 2020 – Another “NEUTRAL” outlook.

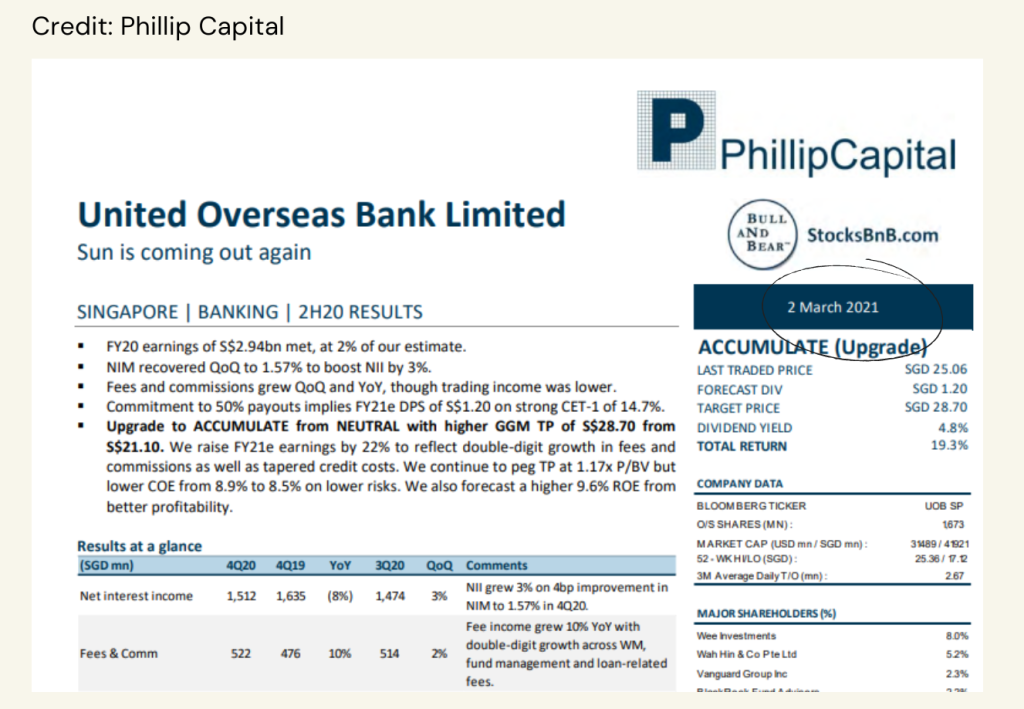

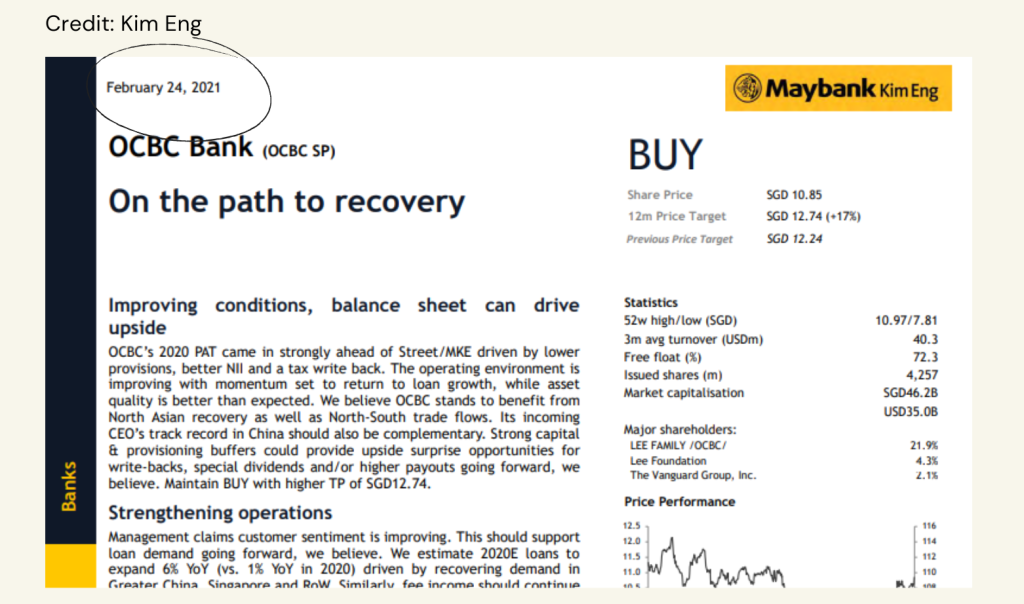

Finally in February 2021, analysts from various banks and brokers such as DBS, UOB and Phillip Capital are saying that it is time to “BUY” the bank stocks.

The “BUY” call continues in June 2021 and in August 2021 as well.

Financial analysts are often wrong at critical turning points of the market

Let’s put together all the screenshots in one illustration, together with the stock price movement of the Singapore bank stocks. For simplicity purposes, we use the DBS stock chart to represent since all the 3 Singapore banks (OCBC, UOB and DBS) have pretty similar price movement during the Covid crash up till recovery.

DBS stock chart during the period from 2020 to July 2021

As we can see, in general, the analysts were telling investors not to buy during the stock market crash and before the stock prices recovered to pre-covid levels, citing reasons such as lower dividends, higher uncertainty, slow economic growth and so on.

On the other hand, when prices have already gone up to above pre-covid levels, analysts then begin to turn towards a positive outlook, changing to “BUY” rating. However, if we look at the stock chart, that is also the time when the upside potential (the potential profits you can earn) is much lower. In fact, the risk-to-return setup was the best during the market crash. That is the period when the SG bank stocks were on sale and investors can get to buy them at a discounted price! This is why we don’t like to rely on the market calls of financial analysts to determine when we buy a stock. They are often wrong at critical turning points of the market.

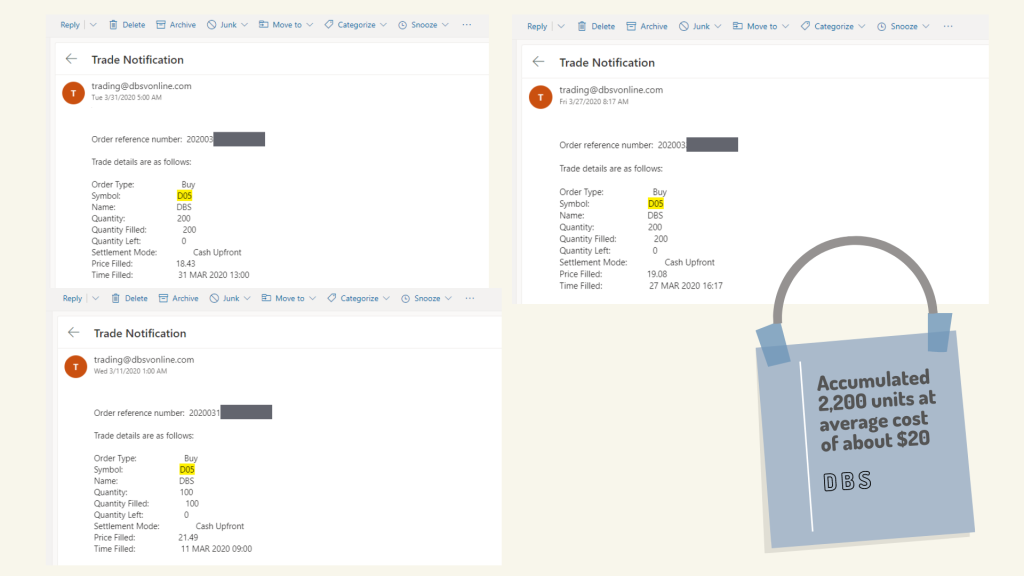

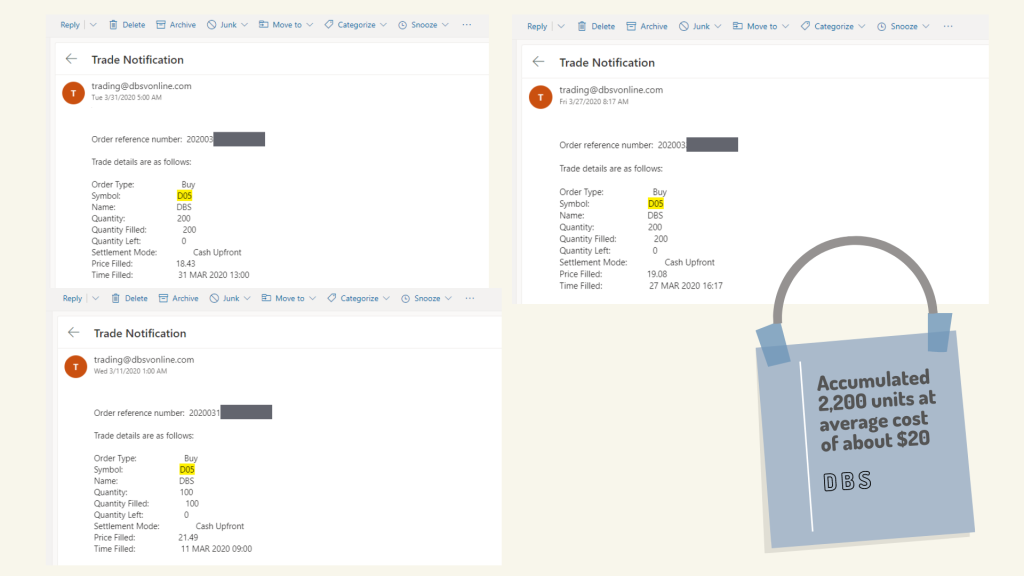

We took the opportunity to buy SG bank stocks during the Covid-19 market crash

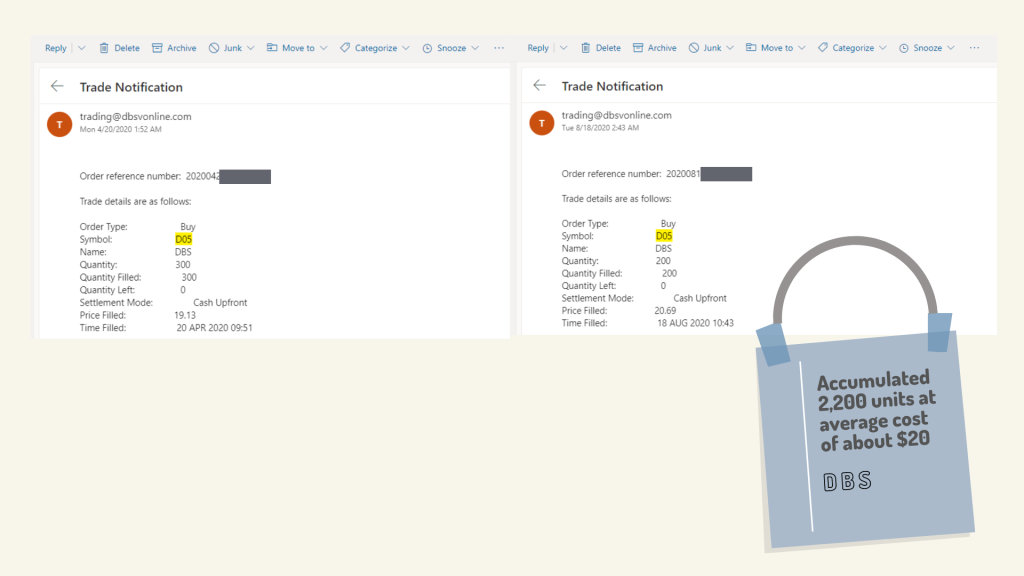

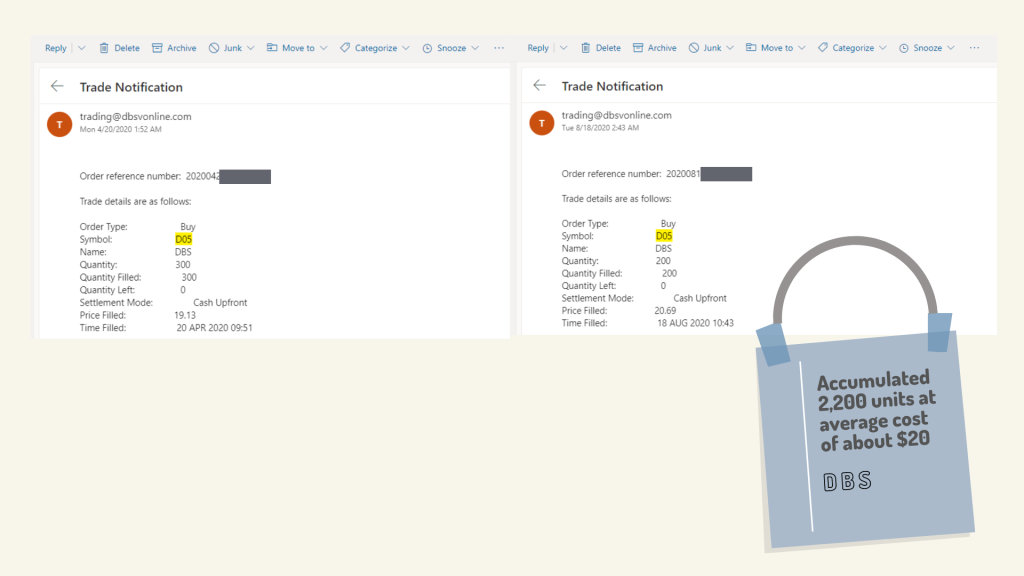

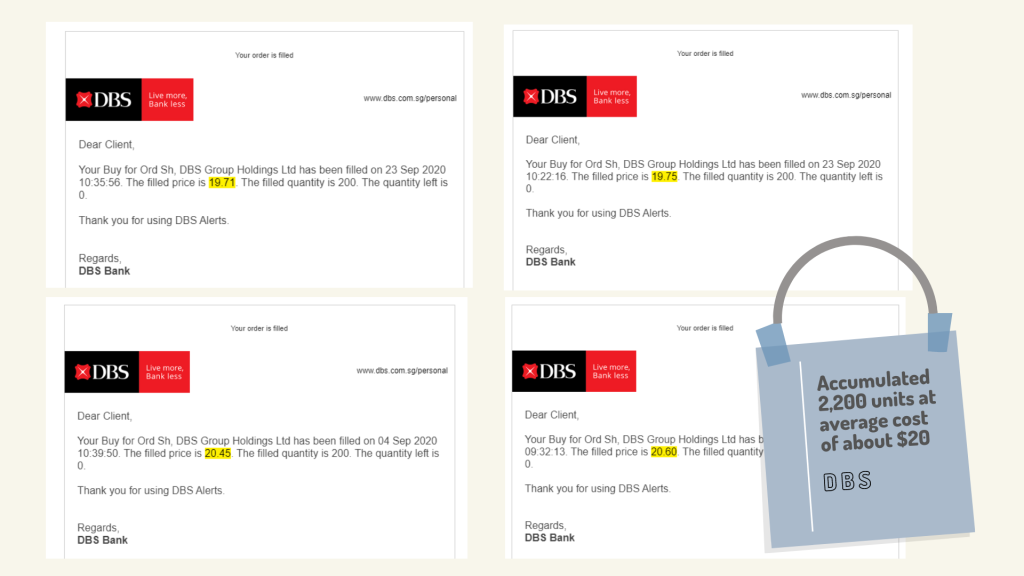

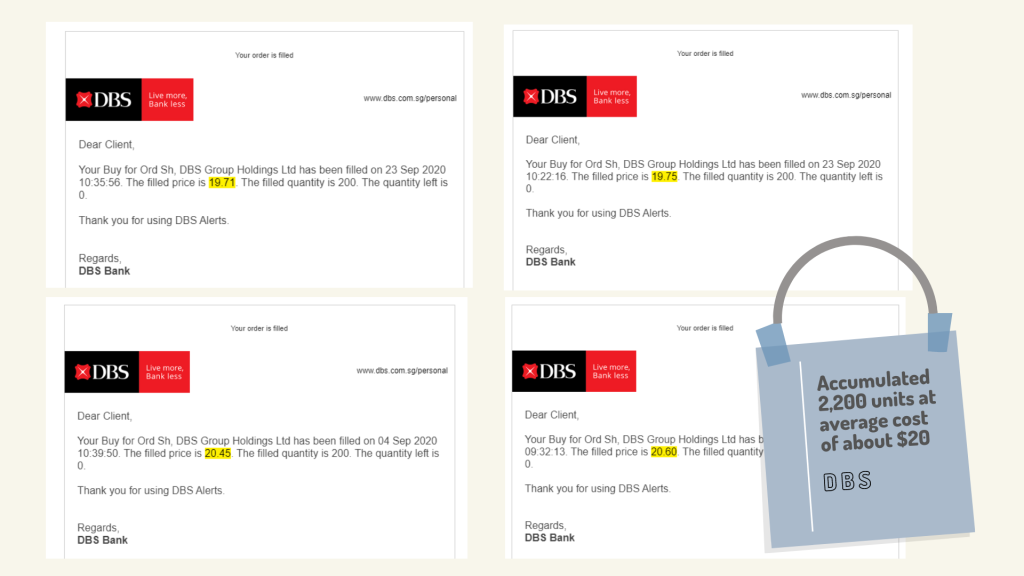

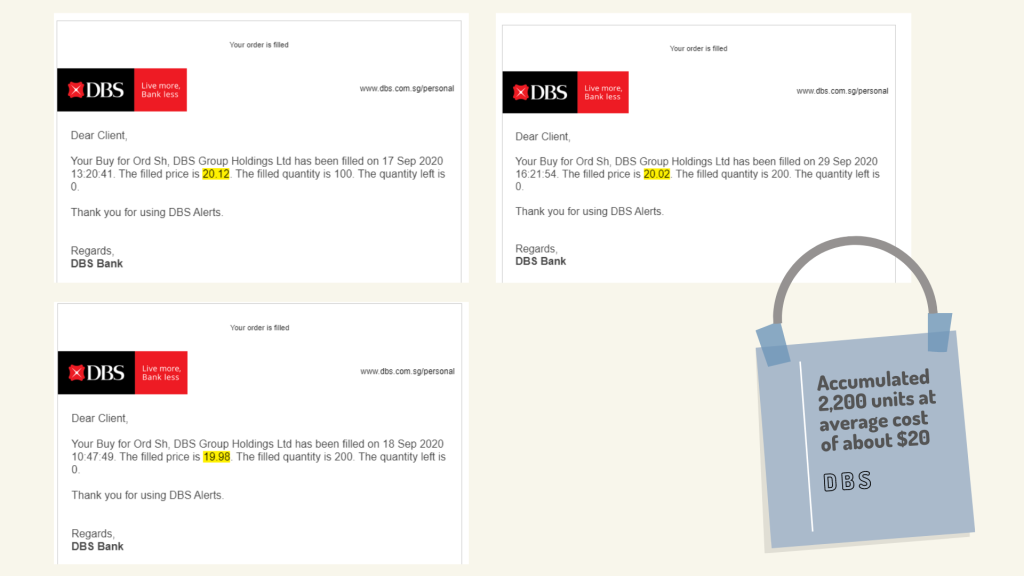

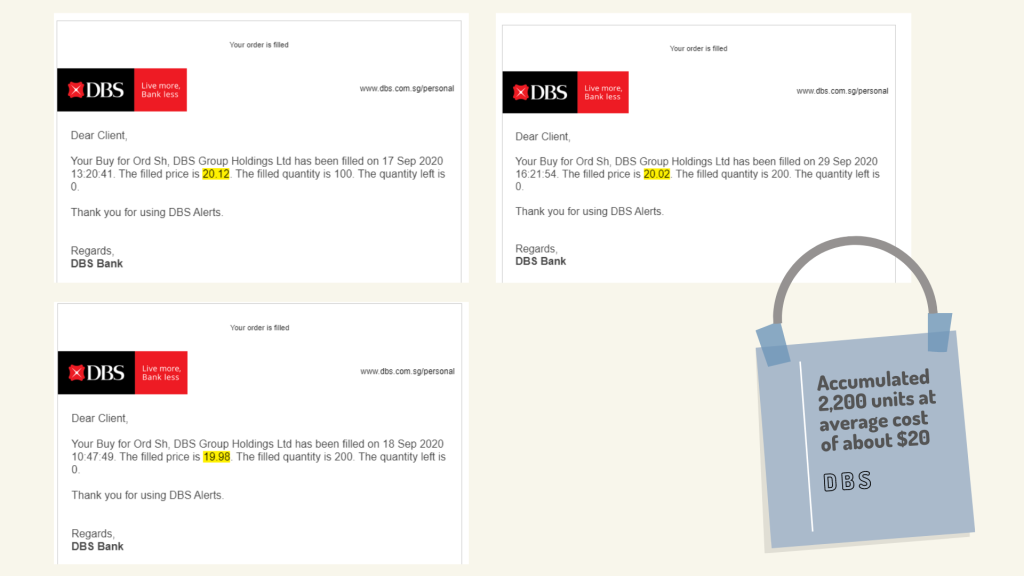

During the Covid-19 market crash, we initiated positions of the bank stocks as early as March 2020. Here are the screenshots for DBS stock (D05). We bought the shares in March, April, August and September 2020. This gives us an average cost per share of about $20.

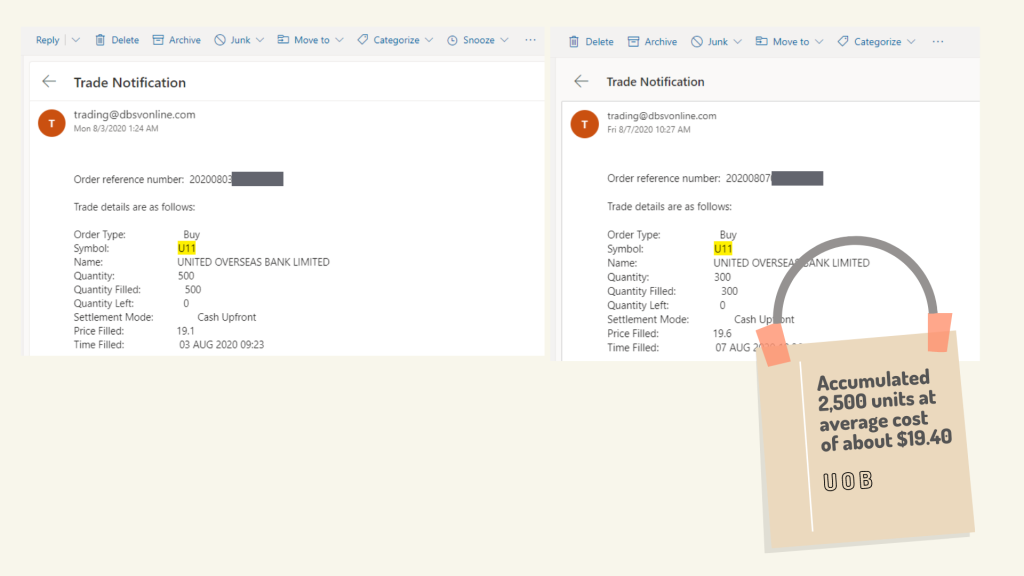

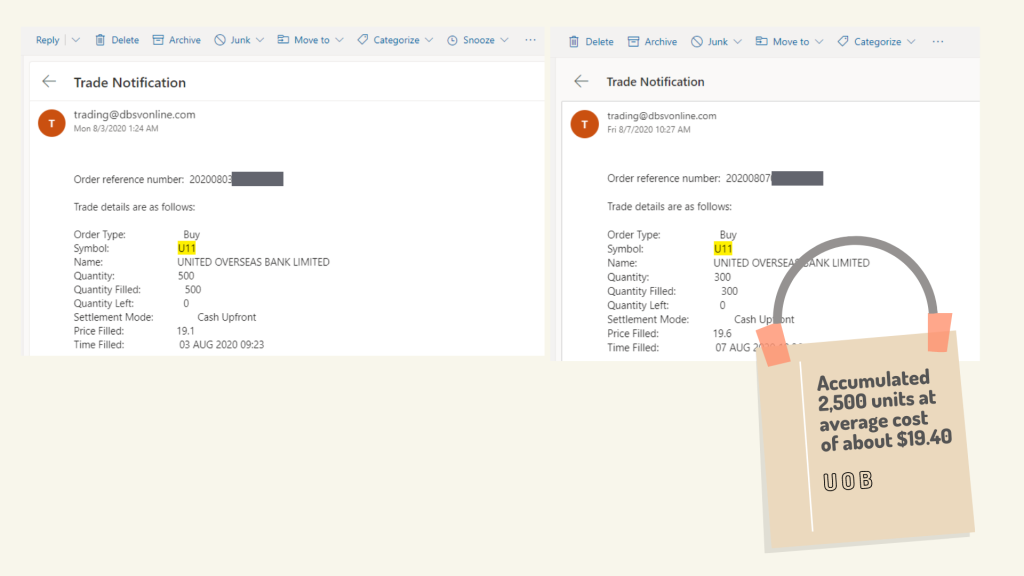

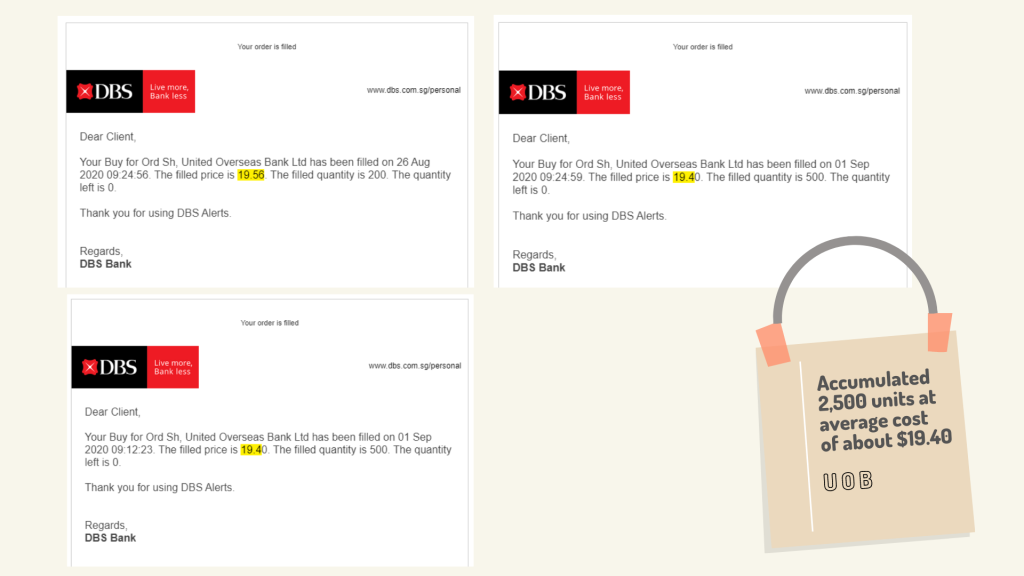

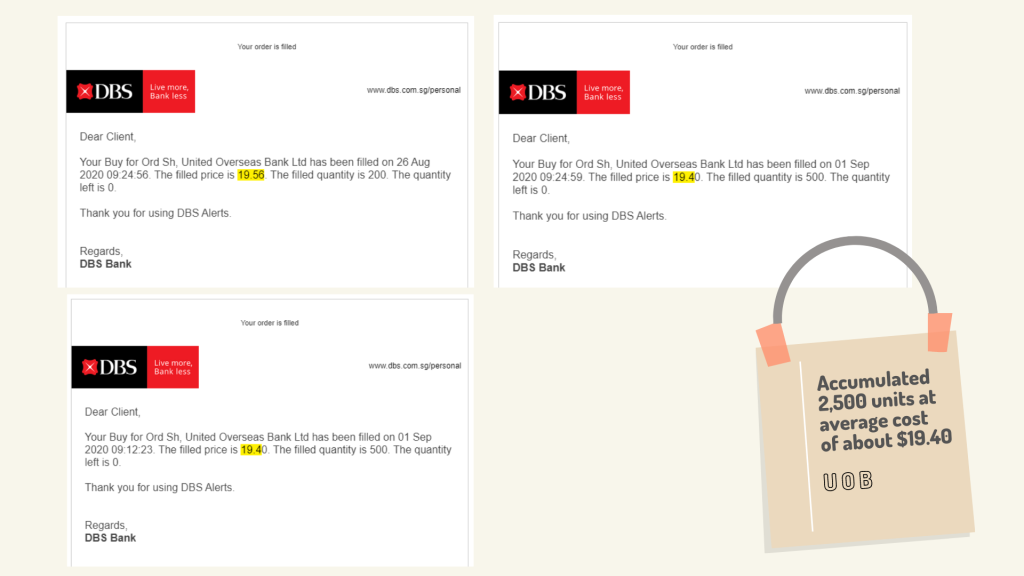

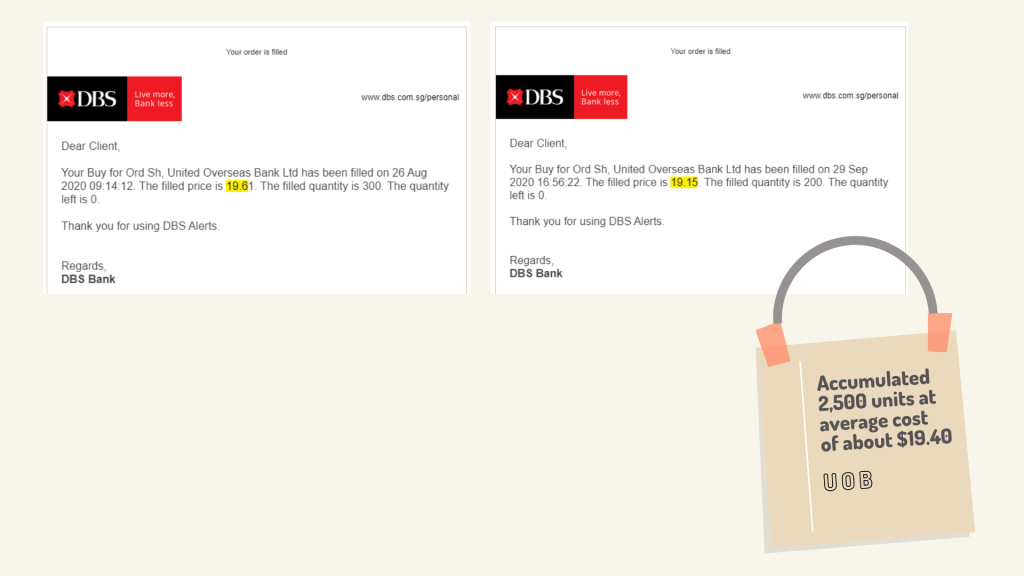

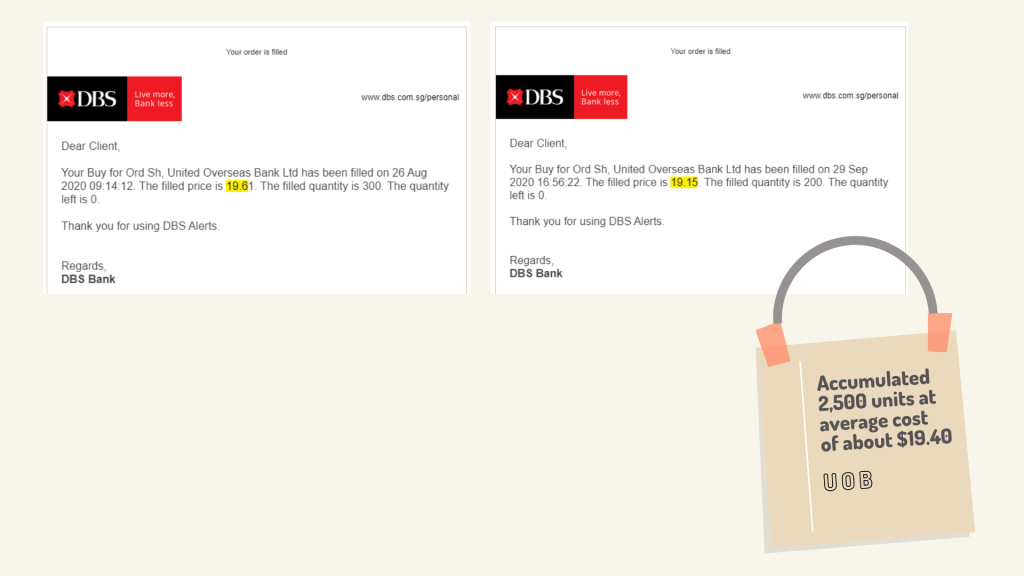

Likewise for UOB stock (U11), we bought the shares in August and September 2020 when the analyst reports were against buying more shares. The average cost per share was about $19.

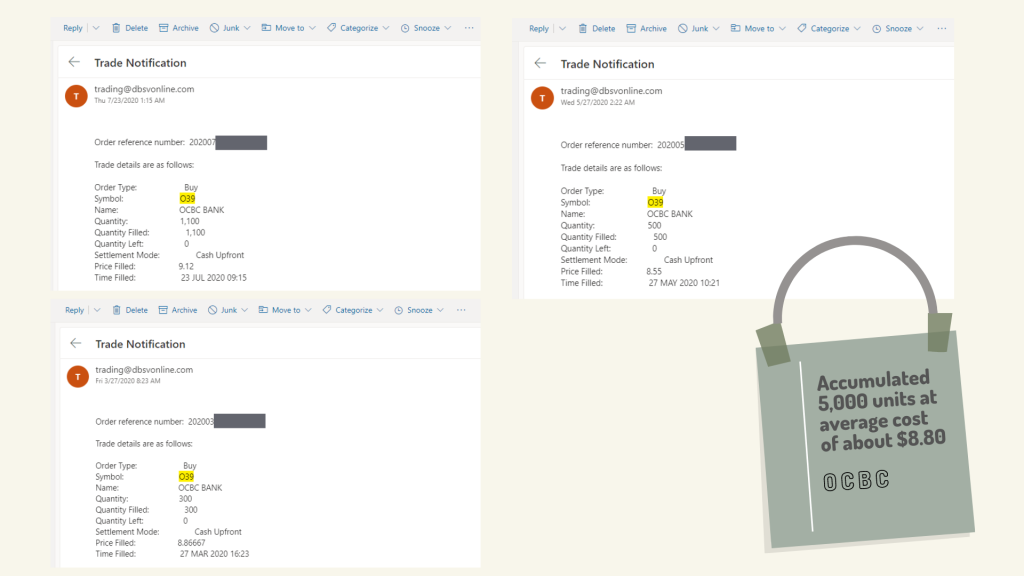

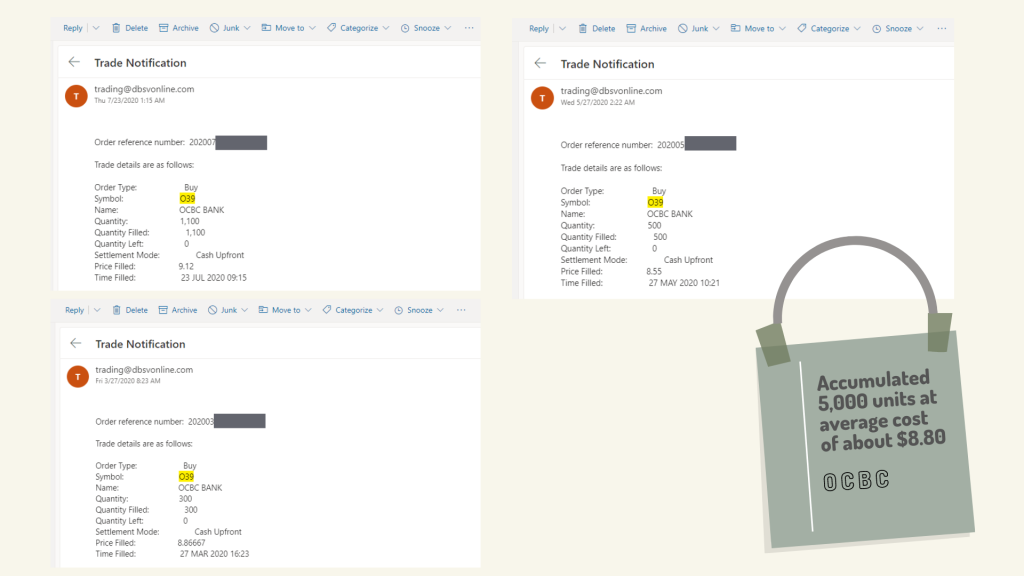

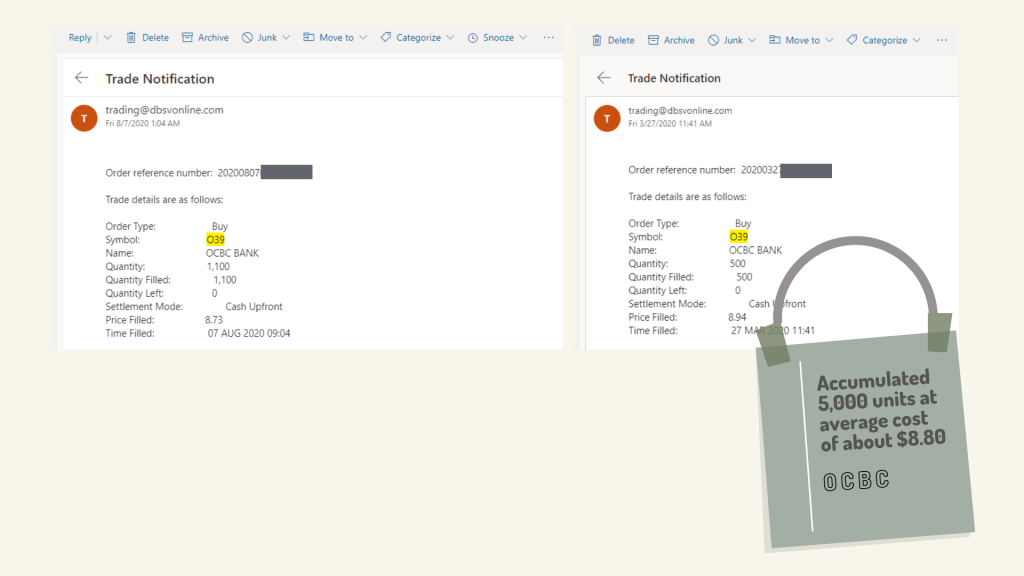

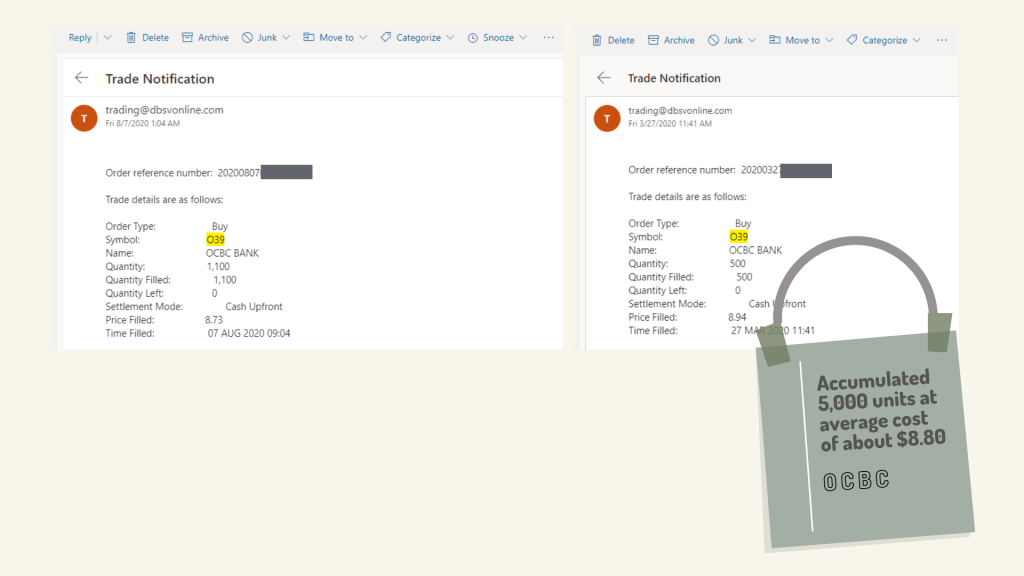

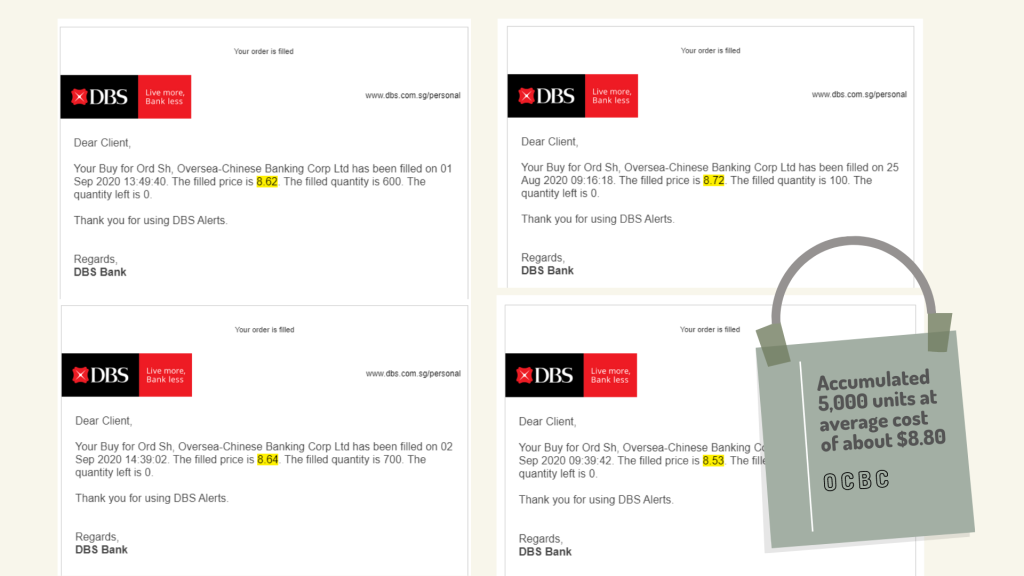

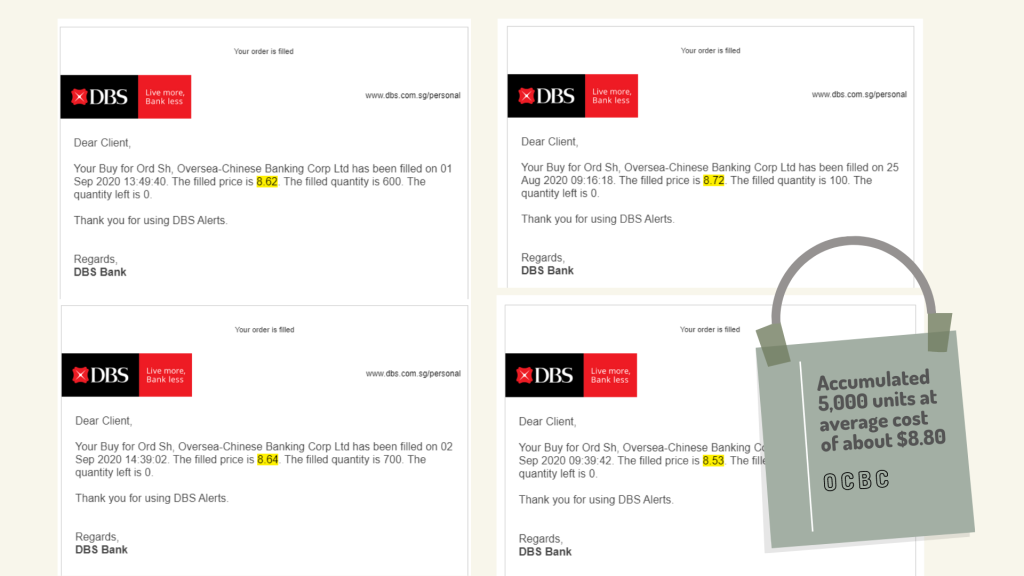

And for OCBC stock (O39), we bought shares between March to September 2020 with an average cost of $8.80 per share.

How we managed to buy SG bank stocks at great prices using technical analysis

Technical analysis (TA) is an analysis methodology that allows us to get a gauge of how most investors are feeling about the stock market. In particular, we use TA to study the trend of the stock prices, the strength or the momentum of the stock prices and to use certain chart patterns to decide if there could possibly be a reversal of trend.

Let’s take a look at the stock chart for DBS stock.

During the Covid-19 crash, stock prices for DBS retraced to about $20 level. This is also the historical resistance zone back in the year 2000 to 2015. But this resistance was broken in 2017 when DBS prices rallied above the $20 zone.

So when prices retraced to this level again during the March 2020 crash, there is a possibility that this prior resistance zone would turn into a support zone. If this indeed turned into a support zone, prices would rebound off from the support zone and rally up. Hence, we added positions of DBS at approximately $20.

In the event if prices retraced to the next lower support level, we can continue to add shares in tranches to lower down the average cost per share. We apply TA to help us identify appropriate price levels to buy the shares to increase the upside potential of our investments. While TA does not guarantee that one would get the shares at the exact bottom of the crash, the thing is we also do not need to buy at the exact bottom to be hugely profitable. As long as we apply TA to buy stocks at great prices when they are going on sale, that would increase the chances of getting sizable profits once the recovery sets in.

Time your entries using technical analysis and not based on the news or analysts’ opinions

The thing is that most retail investors would have tuned in to the analysts reports or the fear-inducing news reports during the market crash in 2020 and would not have been able to take hold of the opportunity to profit from the market crash.

At the outset, the question that we have to ask ourselves is, are the Singapore bank stocks fundamentally sound? Are they able to continue to generate earnings and cash flow? Would their stock price recover eventually once the panic-selling is done? This would give us the conviction to invest in the stocks even when the news and analysts are saying otherwise.

The next step is then to apply the rules in TA to analyse the stock price movements for appropriate price entries with good risk-to-return setup. It is by human nature to feel wary and fearful when the stock market is in turmoil. The flight-to-safety mindself kicks in where the majority of the investors tend to panic sell on market decline and stay out of the market. Stick to your guns and invest only based on the investing rules (fundamental analysis and technical analysis). This is how you can grab the next opportunity in the markets when it comes along.

About Hazelle

Chief trainer of The Moneyball Investors Playbook program and founder of The Joyful Investors, a financial education firm that seeks to help avid investors learn to invest better and make the journey a joyful one. I graduated with a first class honors in Bachelor of Accountancy from Nanyang Technological University (NTU) and started my auditing career in one of the Big Four. I believe that once we know how to build our wealth sustainably, we can then live our best lives ever.

Important Information

This document is for information only and does not constitute an offer or solicitation nor be construed as a recommendation to buy or sell any of the investments mentioned. Neither The Joyful Investors Pte. Ltd. (“The Joyful Investors”) nor any of its officers or employees accepts any liability whatsoever for any loss arising from any use of this publication or its contents. The views expressed are solely the opinions of the author as of the date of this document and are subject to change based on market and other conditions.

The information provided regarding any individual securities is not intended to be used to form any basis upon which an investment decision is to be made. The information contained in this document, including any data, projections and underlying assumptions are based upon certain assumptions and analysis of information available as at the date of this document and reflects prevailing conditions, all of which are accordingly subject to change at any time without notice and The Joyful Investors is under no obligation to notify you of any of these changes.

· · ·

Have you enjoyed this article? We’d be grateful if you would share this useful content to your friends who may benefit from it as well.