Kathy

in Memos & Musings · 3 min read

Which option should I go for?

For new REITs investors we have often been asked how they may opt in for partial scrips. While different brokers may vary in terms of how you apply for it, investors are often guided clearly how they may do so by the respective brokers.

What is more important is you ask yourself if you would like to elect for full scrips or simply receive the dividends in cash.

If you are accumulating for the long run, probably opting for 100% scrips is fine too as selling odd lots is not as tedious as it used to be in the past.

On the other hand, if you do not wish to get odd lots or would prefer to have the ability to reinvest dividends at your own discretion, then you may simply do nothing as the default choice is to get 100% of the dividends in cash. This is of course also the only logical option if the reinvestment price is higher than the current share price which you can buy cheaper at the open market assuming you have the funds to do so currently.

Lastly, partial elections (meaning receiving part scrips and part cash) would be suitable for investors who deem that the reinvestment price is reasonably attractive but do not wish to have odd lots.

Using Mapletree REITs as example

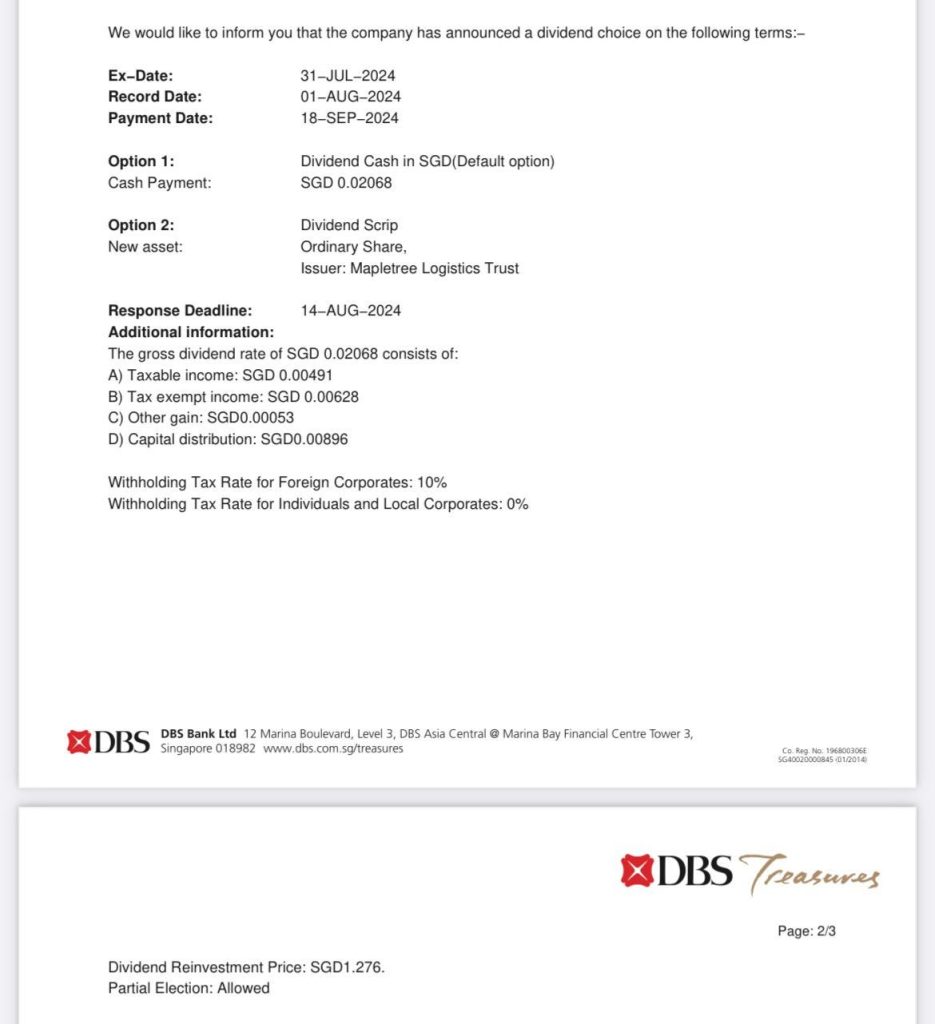

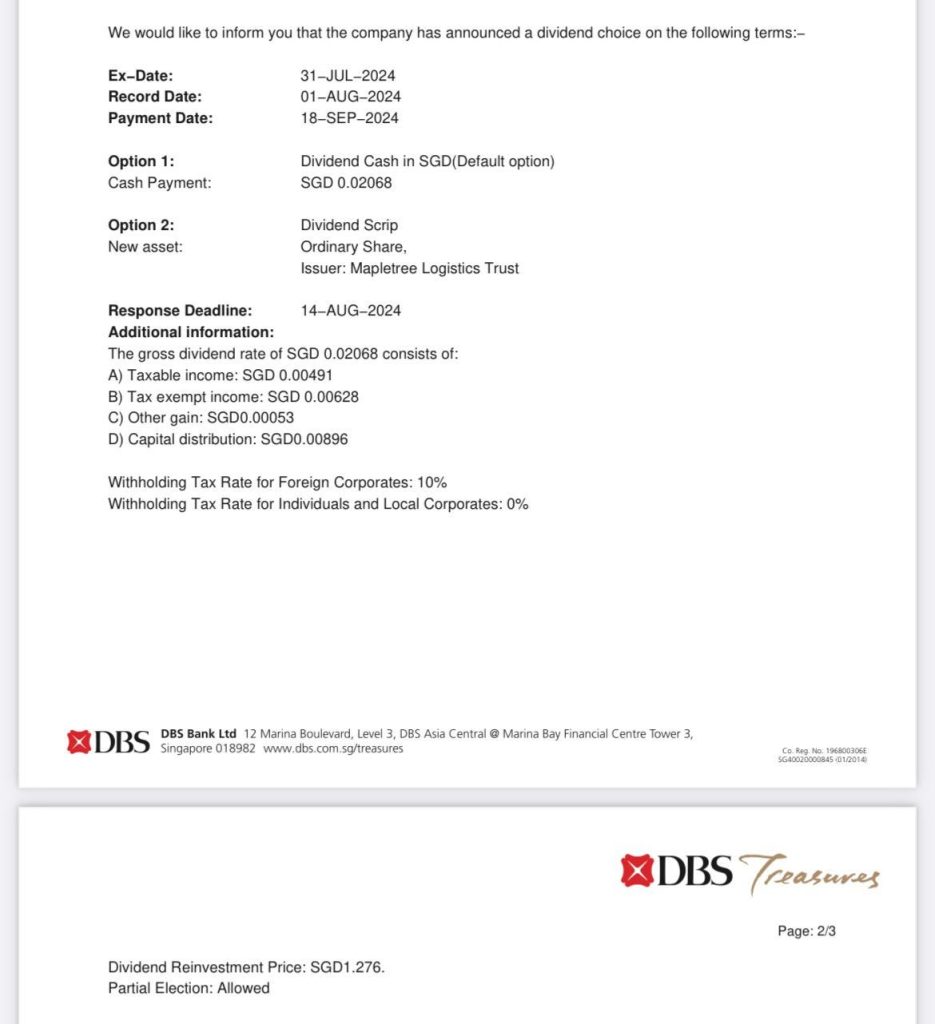

Using recent examples, let’s look at Mapletree Industrial Trust (ME8U) and Mapletree Logistics Trust (M44U). As of the time of writing on 15th August 2024, the price of Mapletree Industrial Trust (ME8U), the price is at $2.28 while the reinvestment price is at $2.2209. For Mapletree Logistics Trust (M44U), the price is at $1.30 while the reinvestment price is at $1.276. So in both cases the reinvestment price still makes sense.

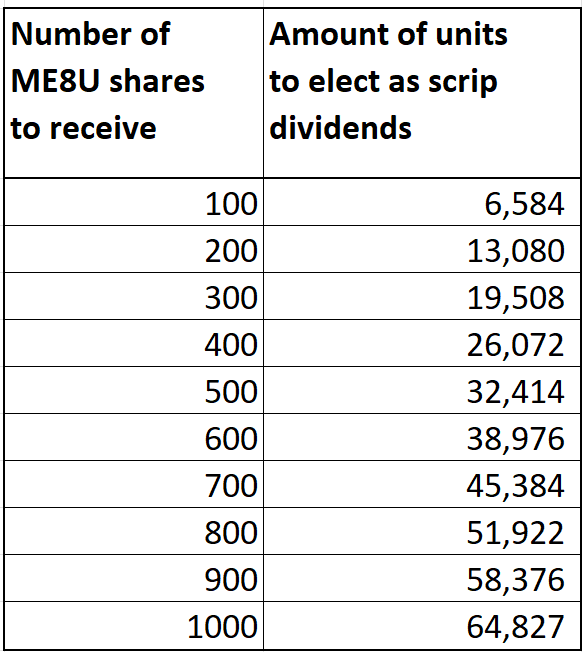

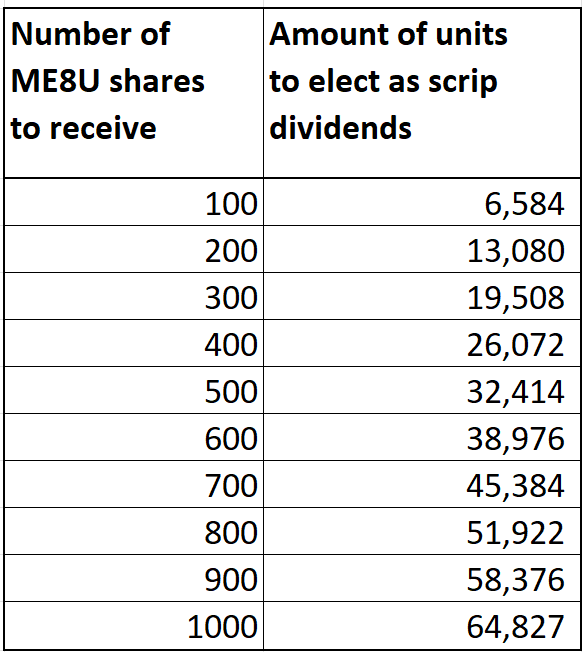

Based on the gross dividend rate in the letters, these are the amount of units we can opt as scrips to avoid getting odd lots for Mapletree Industrial Trust and Mapletree Logistics Trust in these latest exercises.

For Mapletree Industrial Trust unitholders:

For Mapletree Logistics Trust unitholders:

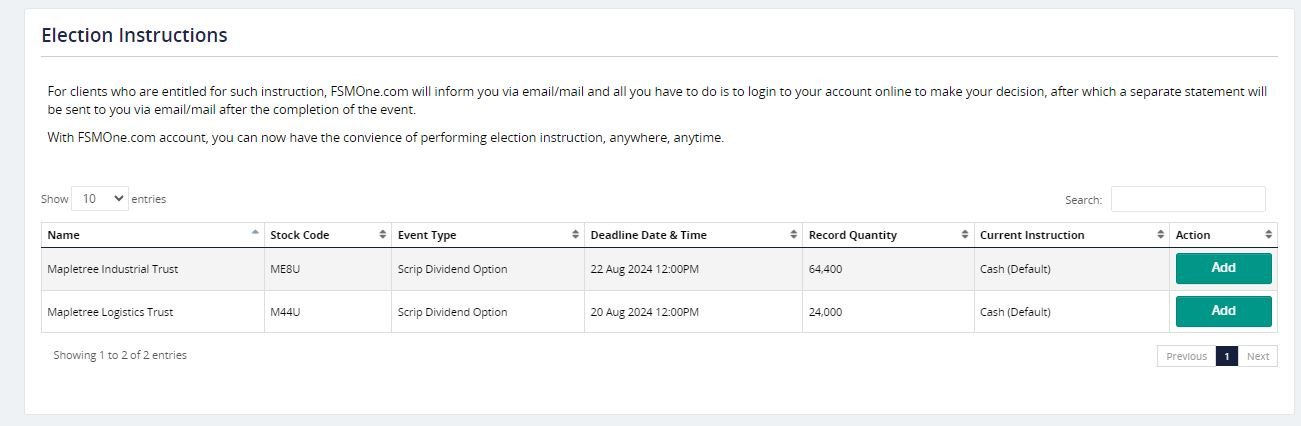

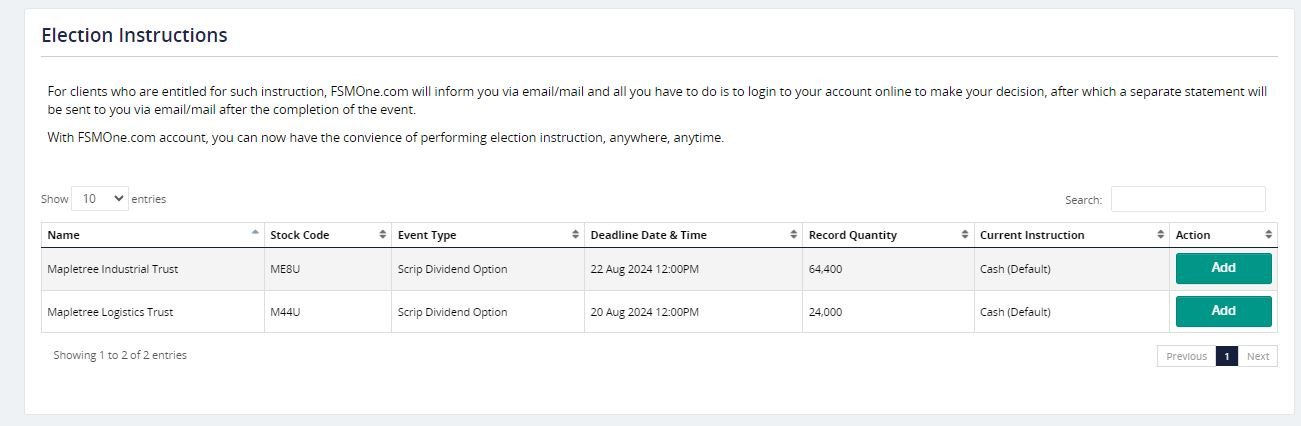

For execution, we can use FSMOne as an example which many of us are using else well. You may click on the notification email which will lead you to the election instructions.

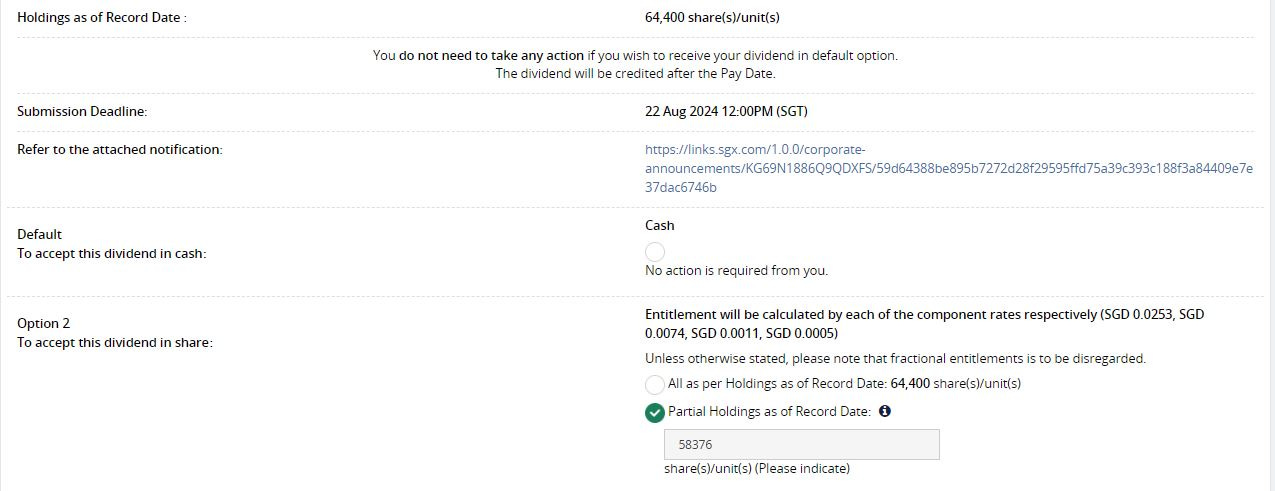

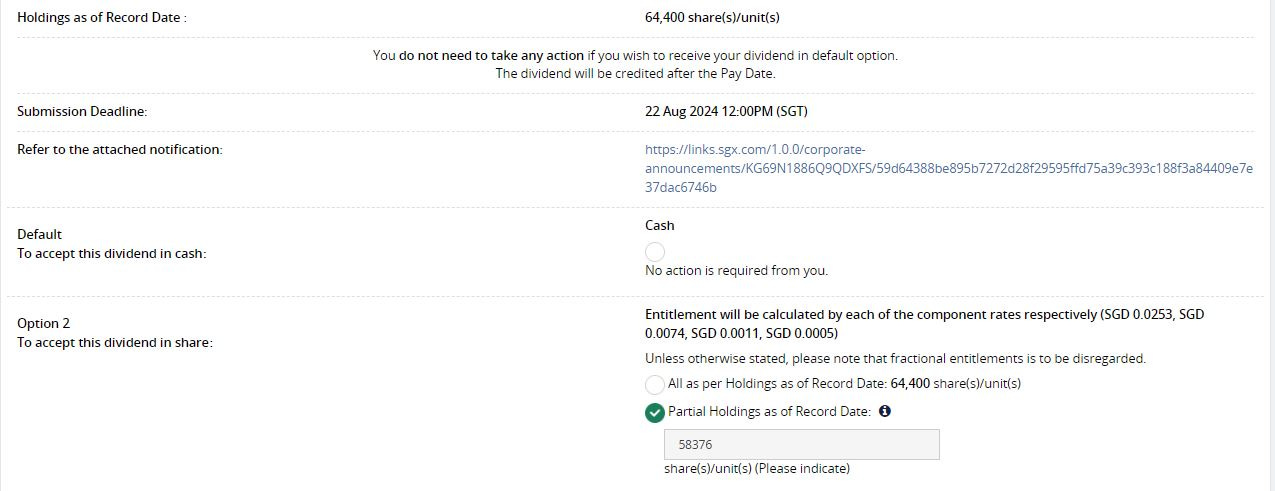

If you wish to receive 100% of the dividends in cash, there is nothing that you need to do. (In fact you do not even have to bother to click on the email.)

To receive 100% of the dividends in scrips, click on Option 2 and choose “All as per holdings as of record date”.

And lastly to opt for partial election without odd lots, click on Option 2 and choose “Partial holdings as of record date” and key in the number of units that you want to be paid as scrips.

However, some brokers require you to enter percentages rather than the exact number of units. Due to rounding, the final number of units may vary based on the decimal places used. Investors are advised to verify these details with their brokers in such cases. Additionally, be sure to complete this verification before the response deadline set by the brokers.

Happy investing!

About Kathy

Co-Founder of The Joyful Investors and Co-CIO of InvestingNote Portfolio. I graduated with a degree in Economics in National University of Singapore (NUS). My previous experience with traders at the Merrill Lynch enable me to realize many counter-intuitive truths about how the financial markets work and to uncover the challenges faced by many new investors. Investing can be astoundingly simple, and my goal is to make financial education accessible and easy to understand for everyone.

Important Information

This document is for information only and does not constitute an offer or solicitation nor be construed as a recommendation to buy or sell any of the investments mentioned. Neither The Joyful Investors Pte. Ltd. (“The Joyful Investors”) nor any of its officers or employees accepts any liability whatsoever for any loss arising from any use of this publication or its contents. The views expressed are solely the opinions of the author as of the date of this document and are subject to change based on market and other conditions.

The information provided regarding any individual securities is not intended to be used to form any basis upon which an investment decision is to be made. The information contained in this document, including any data, projections and underlying assumptions are based upon certain assumptions and analysis of information available as at the date of this document and reflects prevailing conditions, all of which are accordingly subject to change at any time without notice and The Joyful Investors is under no obligation to notify you of any of these changes.

· · ·

Have you enjoyed this article? We’d be grateful if you would share this useful content to your friends who may benefit from it as well.