The stock markets of 2021 had quite its fair share of roller coaster rides especially for investors who have been stock picking. New stresses and concerns led to broad sell-offs that impacted the markets – from the Delta or Omicron variants, the inflation worries, the acceleration of tapering by the US Fed and the regulatory clamp downs of the Chinese government. The wide volatility has indeed left many investors feeling nauseous this year.

One of the tenets of successful investing is the ability to manage one’s emotions. After investing for many years and talking to fellow financial practitioners or trainers, there is no denying that as normal human beings, we can be affected emotionally whenever the portfolio takes a hit. It is natural for any investor to have emotions. The difference between an experienced and inexperienced investor is sometimes not just what they feel, but what they eventually do during a booming or crashing market. I don’t think we can control our total emotions but we just have to acknowledge them and learn how to manage them.

During the bear times

When a crisis hits, a novice investor’s typical reaction would be to sell into losses, for fear of bigger losses ahead. The anxiety of not knowing how low the market can go is just too unsettling. On the other hand, a learned investor will understand that crashes are inevitable even for solid stocks. They will either wait it out or may seize the opportunity to add more positions at dirt cheap prices. It has almost always been the case when the masses are most anxious, is the point where the greatest upside awaits. As legendary trader Jesse Livermore once said, “Buy when there is blood on the streets, even when the blood is yours.”

During the bull times

Conversely when the market is on a tear, with stocks hitting all time highs coupled with positive news coverage, it is easy to put past any concerns and to be all in into the market. Everyone wants to have a piece of the action and ride all the way up to the moon and beyond. It is very easy to be in the comfort of the masses. The problem however is that, if everyone in the market who can buy has already bought, eventually there will be fewer and fewer new buyers to sustain the stock price upwards. What ensues would then be profit taking by the market makers and other traders. Investors will start to see the unrealized profits getting eroded in the correction.

The stock market cycle

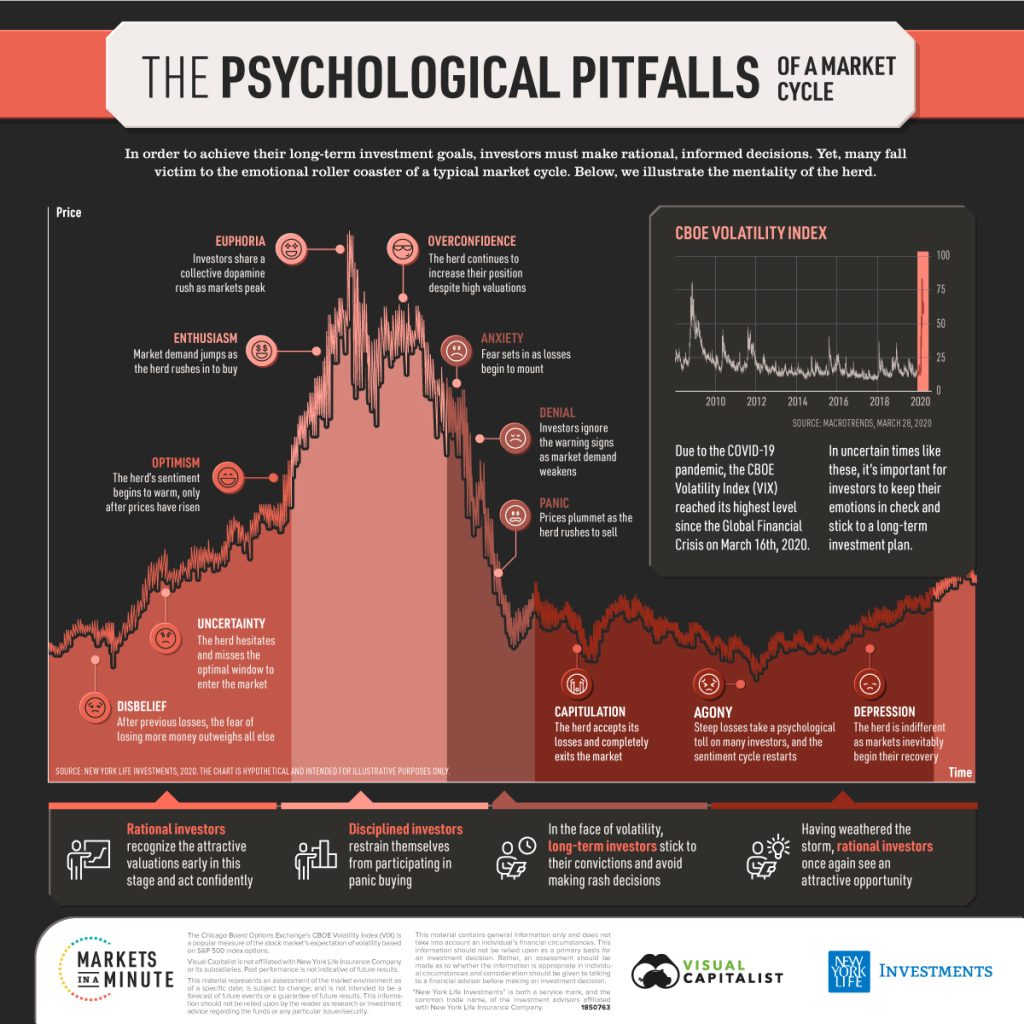

The diagram below shows the sentiments an investor typically undergoes in response to the transition of the market cycle. It is the overall attitude or psychology of the investors based on the ongoing price movements of the market.

All markets move in cycles and seasons. The value of your investments will eventually rise, peak, dip or bottom out. It is part and parcel of the financial markets just like the different seasons we experience every year. Investors may feel excited seeing their portfolio grow easily day by day during a market bull run and feel that they are spot on and good at investing. Conversely, during a bear market, they will feel anguish about being in the market and wish they had never dabbled in the stock market.

The biggest problem that most investors are not aware of is that they fail to recognize that the markets are cyclical and think that bull or bear markets are going to last forever. If they understand that the bull market will eventually end, they will certainly take some or all of the profits off the table. Likewise, if they know that the bear market will eventually become a new bull run, they would not capitulate towards the end of the crash. While it is not possible to predict the exact top or bottom of a cycle, one can actually make educated guesses using technical analysis which is a topic for another article.

Learning how to manage your emotions to do the right thing can be just as important as managing your investments. Successful investing is about being able to grow your portfolio in a systematic way over the long term. One of the ways to not let emotions get the better of you is to never make conclusions about your portfolio performance based on a short limited time frame.

Looking at the S&P 500 as an example

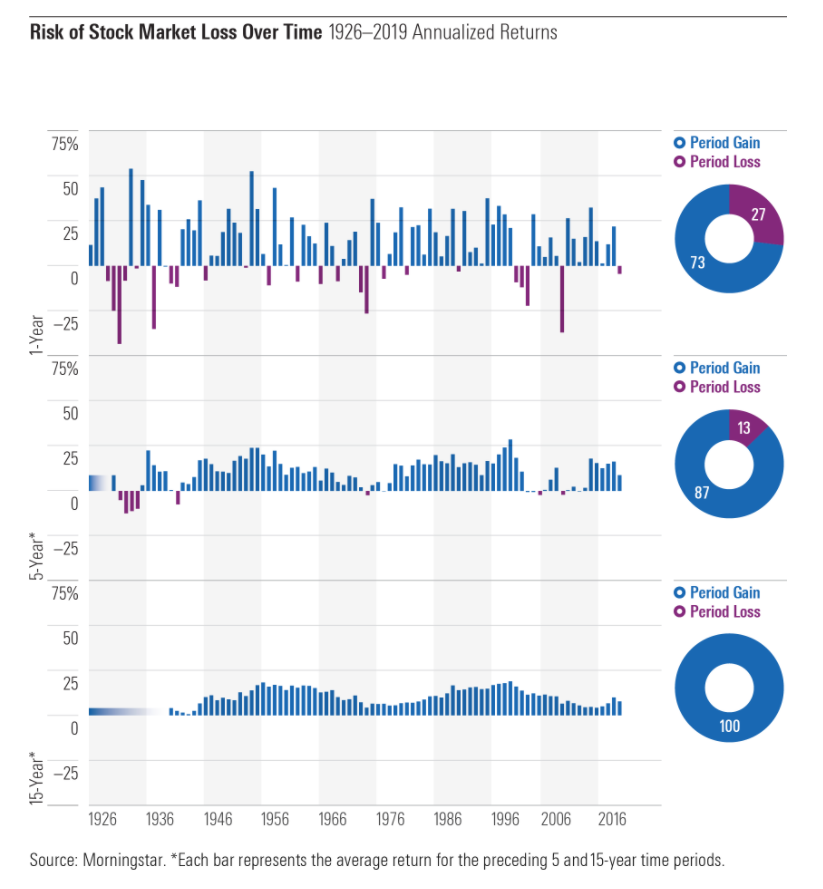

Let me give you an example — the SPY ETF, which investors buy to get exposure to the US stock markets. While it has been making annualized returns of approximately 10%, in the short term, there are some negative periods as well. Just because an ETF or a stock position that you hold is going sideways or in a downtrend for a few quarters doesn’t necessarily mean that you are holding the wrong ones. Mr. Market moves in cycles and time is needed for things to play out.

Learn to stomach the drawdowns

The price to pay for enjoying gains in the stock market is the willingness to stomach the occasional unpleasant drawdowns. Some investors who have invested for sometime may encounter drawdowns that still allow them to be above water, while the newer ones might be underwater. It’s like taking 3 steps forward and 5 steps backward. You probably wished you didn’t even get started to begin with.

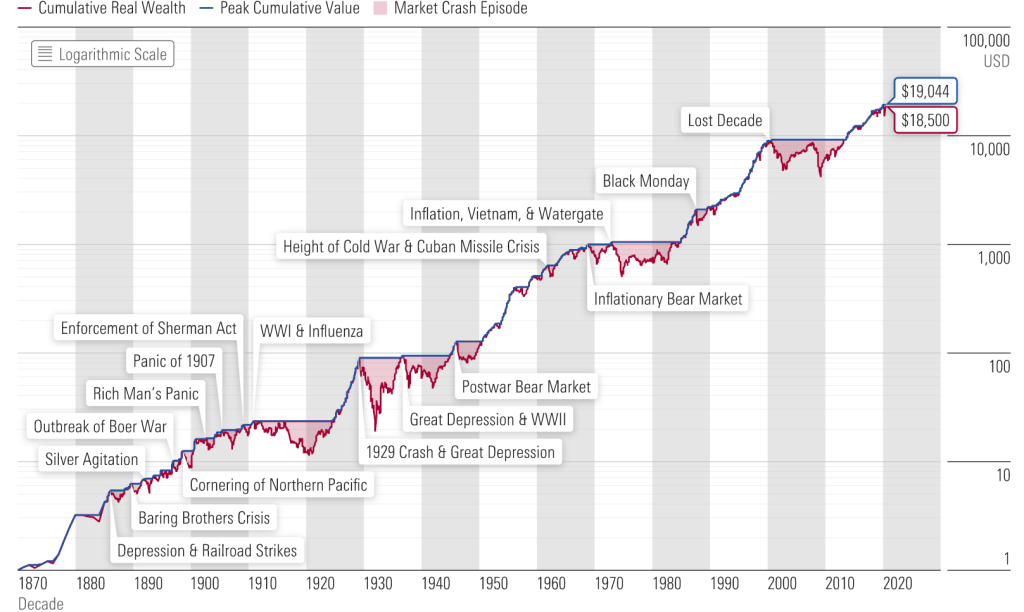

If you are new, my advice is that you may want to take a look at this chart below of the S&P 500. There were numerous crises over the years and each time, the market recovered and grew stronger. The drawdowns that you are encountering now is nothing new and could well be just a tiny blip in the whole chart.

Another example: Our Moneyball Portfolio

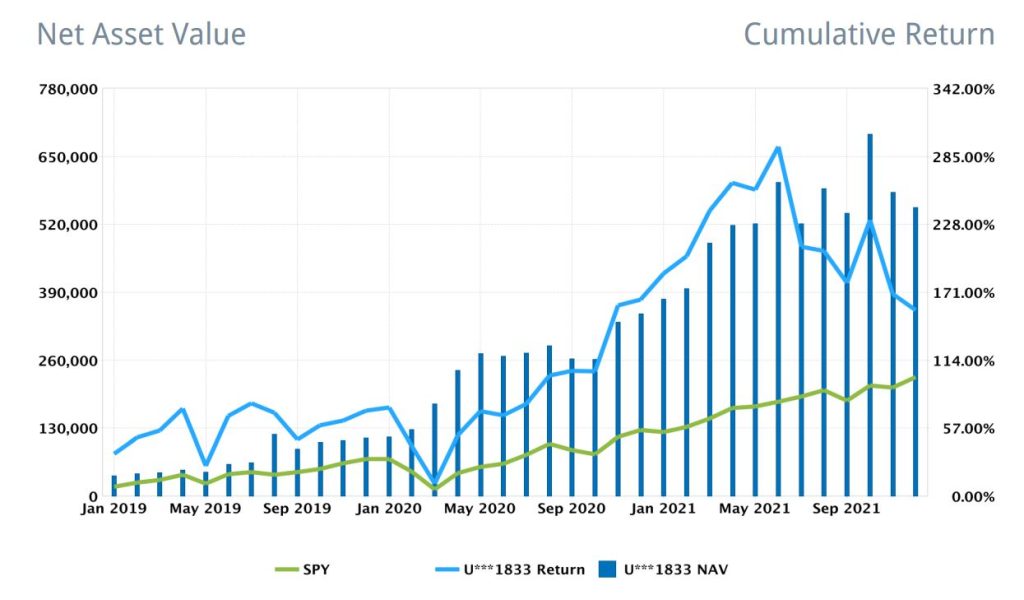

Let us now also share with you a real-life example of what happened to our Moneyball Portfolio in 2021.

During the first half of 2021, our portfolio was up by about 48%. Nearing the end of 2021, we find ourselves just about breakeven at -3% for the year 2021. This brings to mind the Greek mythology of Sisyphus for the disturbing familiarity. Long story short, Sisyphus was punished by the Gods for cheating death and being forced to roll an immense boulder up a hill, only for it to roll down every time it neared its top. He had to repeat this action for eternity. Each time he got so far, only to end up where he started. This cannot be further from the truth. It felt like that because we made it sound so.

Our portfolio was largely made up of US stocks since inception in 2015 and throughout 2021, we made the decision to start shifting around to China tech stocks more which were a lot more attractive in terms of risk to reward setup. As our portfolio was primed for growth for the long run, sometimes it needed time for the trades to play out and that could mean a few quarters.

With contrarian investing as part of our methodology, it means going against the masses and the trends. In the short term drawdowns are to be expected. And even more so, with a market like China where there are much more retail investors as compared to institutional investors. This also does not help with the role the government plays in affecting their stock prices.

However, we are of the opinion that the regulatory changes imposed by the Chinese government are going to be healthy for their tech industry in the long run. We also took the opportunity to add more to our positions throughout 2021. Always remember that if you like a good stock at $1, you must love it at $0.80.

Clearly, with the recency effect, we probably only tend to remember our portfolio value how much it was say during the last quarter, or at the start of the year. But if we zoom out in time, we see that it is not uncommon for us to have such Sisyphus moments every few months. We were approximately back to where we were in Nov 2020 in Dec 2021. Similarly we were briefly back to Jan 2019 or slightly worse off during Mar 2020 covid crash.

But if we look at the bigger picture even with this 3 year time frame, we can see that there is a meaningful progression overtime despite the occasional drawdowns – The end of 2021 as compared to the beginning of 2019. (We started our Moneyball Portfolio way back in 2015 with Saxo Capital but data is no longer retrievable with the account closed in 2019 as we transited to Interactive Brokers in late 2018.)

Investors must understand that the portfolio can never grow linearly and in one direction all the time. Just like an airplane has to course correct during the flight or sometimes take a slightly longer path due to weather conditions as it heads towards its destination. Once investors understand and accept this, can only the investing journey be a much joyful one.

Real challenge lies in execution on your own portfolio

That being said, it is very easy for a reader to look at our past performance and acknowledge that such drawdowns seem reasonable to endure in order to attain such respectable gains over time. However, the same cannot be said if it is your own money that is put to the test. As you see your gains evaporating or paper losses amounting, it is just so easy to throw in the towel and simply call it a day.

Many retail investors are willing to have a more aggressive portfolio until the day the inevitable drawdowns happen. Psychologically, they have never been ready for it. All they really asked themselves was are they able to accept big gains which obviously no one has problems with. This is something akin to mountaineering where you can learn all the theories there are. But it is only when you are there in the mountains, that is where you find out who you really are.

The sooner you can understand how the markets work and learn to deal with your emotions with the right course of actions, the earlier you can play the game of investing well and become a successful investor. This is because Wall Street never changes, as human nature never changes.

P.S. One of the topics we cover in our Moneyball Investors Playbook is on understanding the market cycles and psychological management. Our methodology is focused on not allowing our natural emotions to cloud our investing decisions and have a systematic way of deciding when to buy or sell with our proprietary technical analysis methods.

You may learn more on our upcoming webinar on how we can help you to become a better investor.