Ready to start on dividend investing but not sure what are some considerations for setting up your account and dividend portfolio?

Administrative aspects

For a start, there are many brokerages in Singapore that offer access to the S-REITs and other companies listed on the SGX. We have the traditional brokerage platforms like DBS Vickers, Fundsupermart, POEMS, Interactive Brokers and more. In recent years, there are also new players in the market such as Tiger Brokers and Moomoo providing competitive commission rates for investors. You can easily find the latest commission rates on their respective websites as they do change from time to time. The various brokerages may also offer promotional rates for certain periods as well.

Another area to look out for before setting up your brokerage account is to decide if you would want to open an account that is CDP-linked or a custodian account.

A CDP-linked account is one whereby the stocks you purchased are held under your name and will be stored in your CDP account managed by SGX. On the other hand, for a custodian account, the stocks you purchased are held under the name of your custodian which could be for example, DBS Bank or iFAST, so they are acting like the legal owner of the shares and holding the shares on your behalf.

Both a CDP-linked account and a custodian account has its pros and cons. But our focus today would be on dividend investing. When it comes to dividend investing, one of the advantages of having a CDP-linked account is that the dividends are automatically credited to your bank account.

This is because CDP has the Direct Crediting Service (DCS) which allows you to credit the dividend payments directly into your designated bank account. With the automated crediting of dividends, it makes things even more convenient and you can just withdraw the money from your bank account directly if you are living on dividends for your expenses! Whereas if you are investing for dividends using a custodian account, you will have the additional step of manually transferring the dividends payment every quarter or every half-yearly from your brokerage account to your bank account.

Considerations to construct a balanced dividend portfolio

Then when it comes to constructing the dividend portfolio, what are some considerations to take note of to construct a balanced portfolio?

First, ensure that there is some element of diversification in your portfolio. When you invest in a REIT, find out where the properties are concentrated at. The properties managed by a REIT could be in different parts of the world, such as in the U.S. or in China or they could be in Singapore as well.

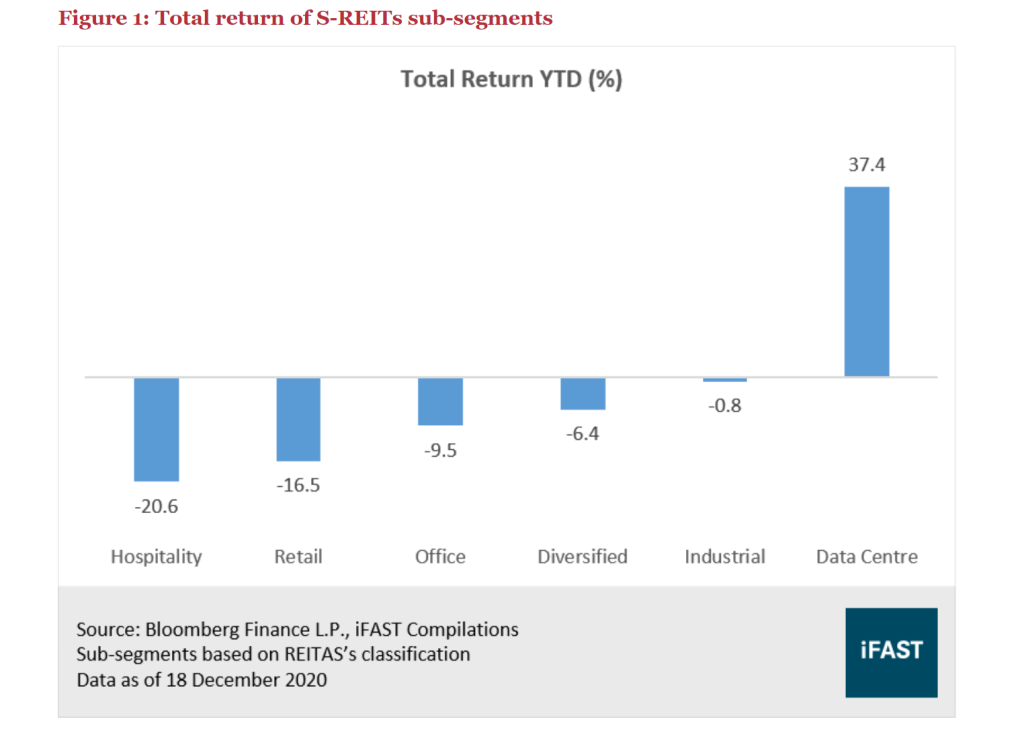

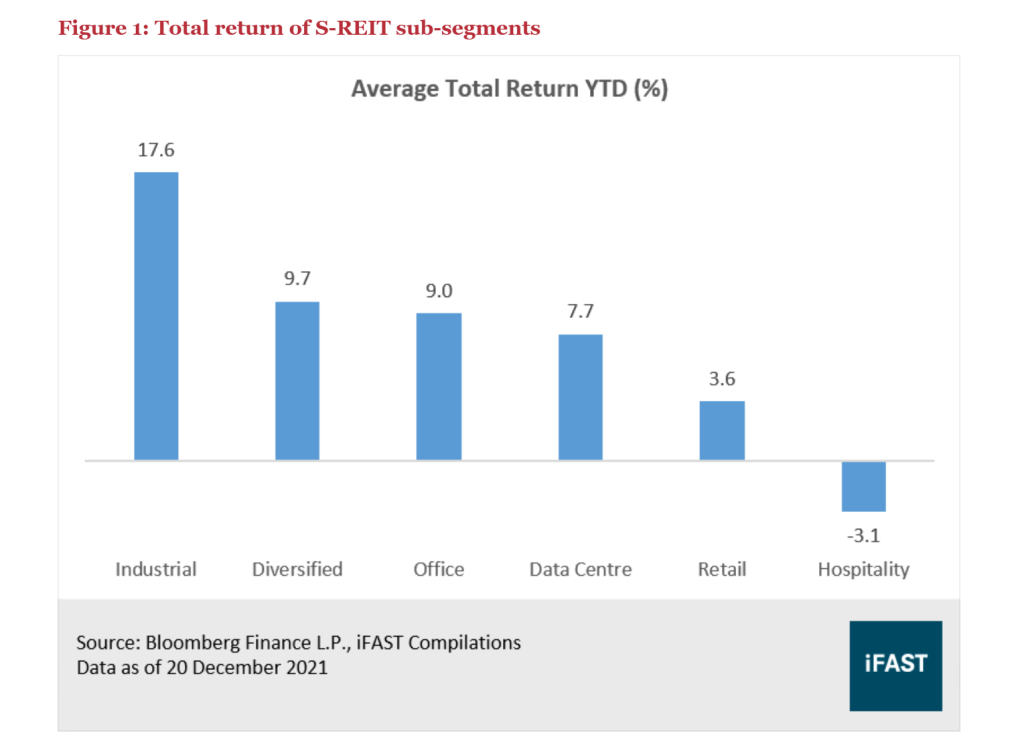

Another aspect to look out for would be the sector of the REITs that you invest in. If you had your entire portfolio in the hospitality REITs sector, you should have seen how your portfolio was hit during the pandemic period. Therefore, it would be good to invest in REITs from more than 1 sector to prevent extreme underperformance of your portfolio.

Next, stability of the distributions is just as important as finding a REIT that gives a high distribution. Never go for a REIT just because it has a high dividend yield in a year or two. Look at the stability of the distributions over the years. This is especially important for retirees or for those who are living on the dividends who need not just a stream of income, but a consistent stream of income to cover your living expenses.

Lastly, the entry point for investing in REITs or the price level that you buy the REITs at is something that has often been neglected. Most investors investing for dividends put their focus only on the yields but overlook the fact that capital gains and capital losses are just as important when investing for dividends. Dividend stocks are not very much different from growth stocks in the sense that you would still be exposed to capital gains and losses. There are many times when dividend investors realise the dividends they collected are not even sufficient to cover their capital losses, or that the dividends collected may only just allow them to breakeven. Therefore, other than checking for stable yields, enter a position only when the REITs are appropriately priced.

If you are now ready to start on dividend investing, stay tuned for our next blog post as we will be sharing about the key metrics to know as a dividend investor!

Do also follow us on our Telegram channel as we post about Singapore REITs from time to time.

Pingback: How Big A Portfolio Do You Need To Live On Dividends? - The Joyful Investors