Keith

in Memos & Musings · 5 min read

This article was created in partnership with Nikko Asset Management, but the opinions are our own. This article should not be construed as financial advice, and do consider your own specific financial circumstances when making investment decisions.

Here’s Why This Fund May Be Worth Your Attention

When building an investment portfolio, many people naturally look to equities as the primary driver of returns. While equities tend to offer higher returns over the long term, bonds can play a key role in adding stability and reducing risk, especially during periods of market volatility. Bonds can potentially provide a predictable income stream, preserve capital, and cushion against market downturns, making them an important part of a well-rounded portfolio.

One challenge some investors face is that gaining exposure to bonds often requires a significant capital outlay—typically at least $250k—and comes with limited liquidity if they need to sell.

The ABF Singapore Bond Index Fund could be a solution for those looking to add bonds to their portfolio without such high capital requirements or liquidity constraints. Listed on the SGX, this fund allows investors to buy or sell during market hours, with real-time pricing that offers transparency, unlike bond unit trusts that use forward pricing (typically valued at end of each trading day).

For those seeking to potentially strengthen their portfolio without committing large amounts of capital, the ABF Singapore Bond Index Fund may offer a diversified, stable, income-generating option. By tracking SGD debt obligations backed by the government of Singapore and Singapore quasi-government entities, as well as from time to time, SGD debt obligations issued by other Asian Governments, Asian Quasi-sovereign entities, and/or supranational financial institutions, it could be a way to enhance portfolio stability while staying invested in high-quality bonds.

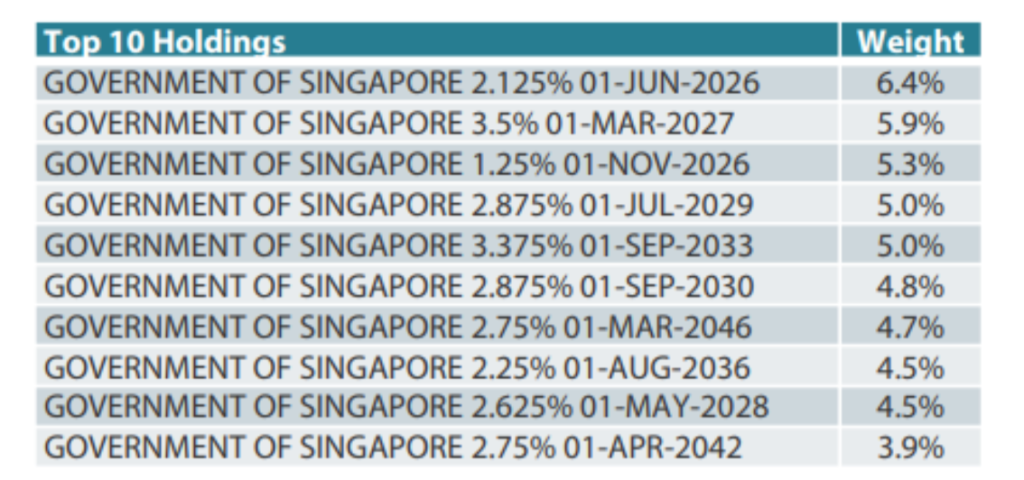

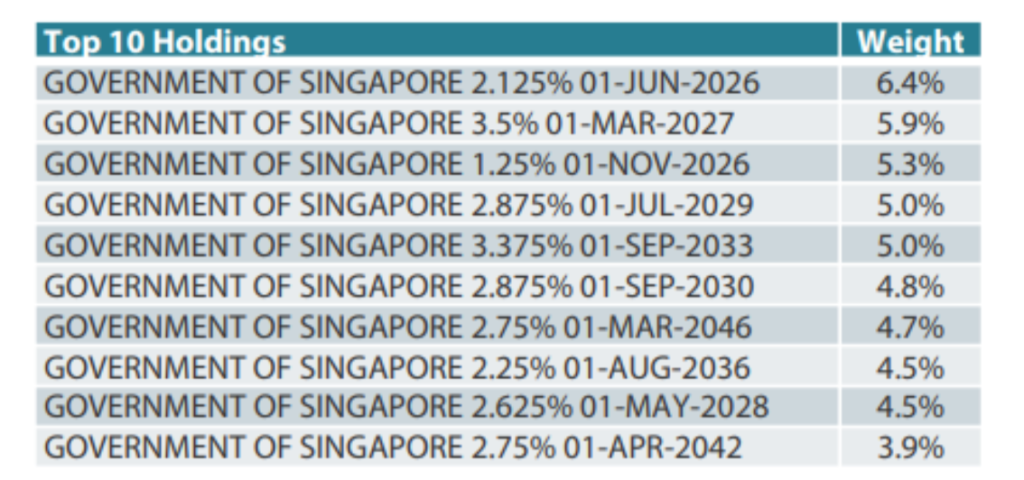

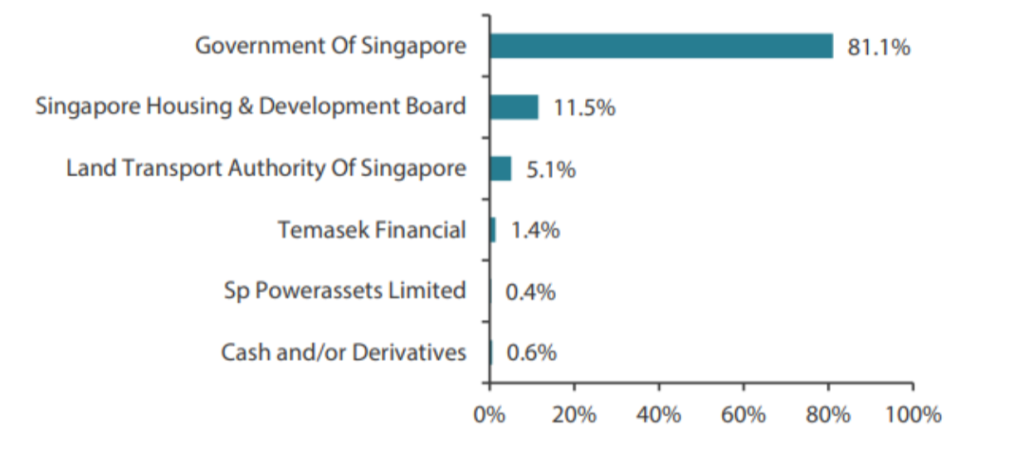

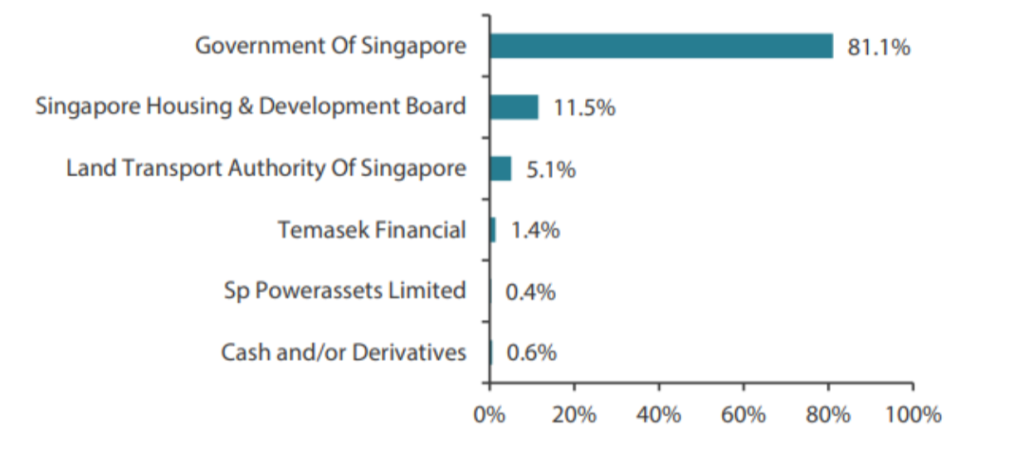

Strong Portfolio of High-Quality Holdings

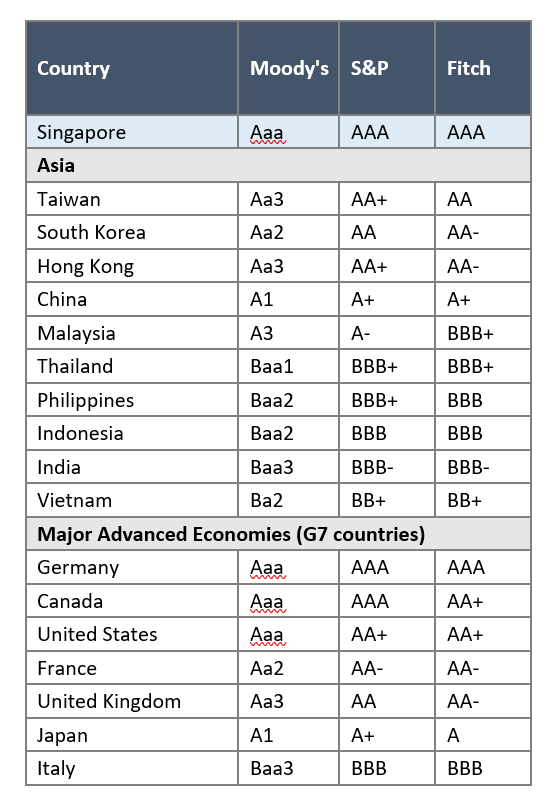

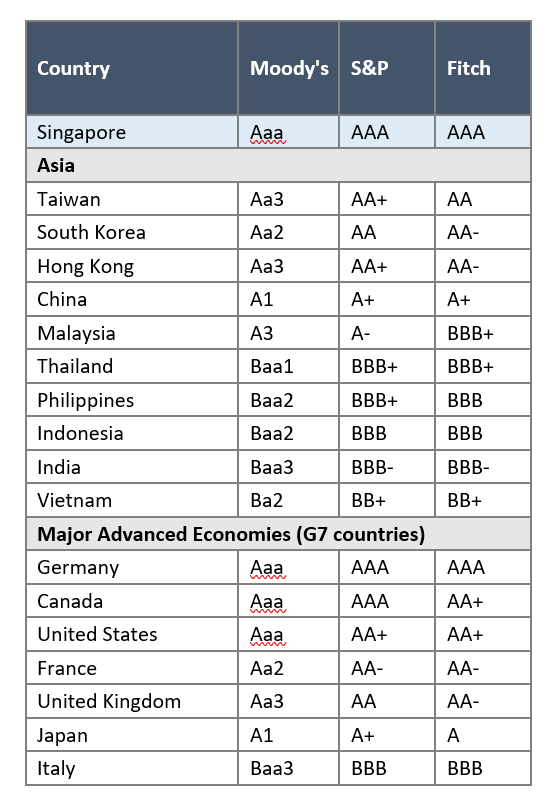

The fund’s backbone is its high-quality, Singapore Government and Singapore government-linked bond portfolio, of which Singapore Government bonds made up almost 81% of the portfolio as of September 30, 2024. With Singapore’s AAA rating (a status which has been retained throughout the last 20 years —unwavering through crises like the Asian Financial Crisis, the 2008 Global Financial Crisis, and the Covid-19 Pandemic)—this is a potential opportunity to invest in a bond portfolio with high credit rating*.

* Average credit rating of the portfolio is AAA as of 31 Oct 2024. (Source: Nikko AM brochure, Jun 2023)

Source: NikkoAM factsheet, October 2024

Source: Bloomberg, 14 November 2024

Grow with the world’s highest yielding AAA sovereign bonds

From Sep 2014 to Sep 2024, the iBoxx ABF Singapore Index which the Fund tracks posted an annualized return of 2.2%1—a steady performer compared to the -0.1% return on an annualized basis of the broader FTSE World Government Bond Index (WGBI), which tracks sovereign debt across more than 20 countries. (Source: Nikko AM, Nov 2024)

It is often generally assumed that we have to compromise on returns if we want a lower-risk investment. But SGD Government and Quasi Government bonds seem to have proven otherwise. They can potentially deliver higher returns than some sovereign debts with higher default risk. (Disclaimer: historical performance is not indicative of future returns)

And here’s the good news: performance of both the fund and the index1 have improved recently, as the market’s positive trend has given returns an extra boost.

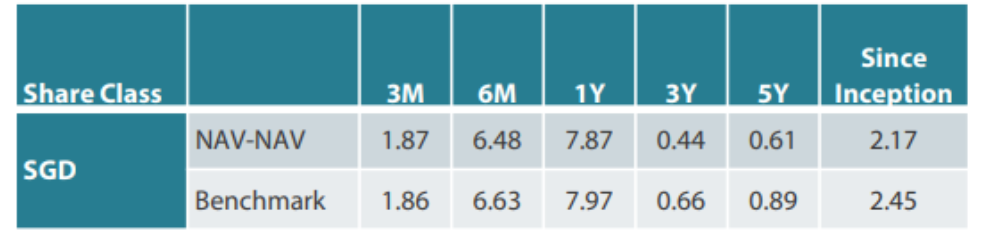

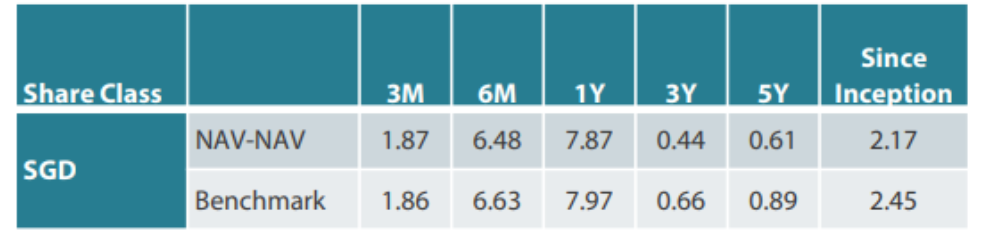

Performance (%) of ABF Singapore Bond Index Fund

Note: NAV-NAV performance = Fund performance

Benchmark performance = iBoxx ABF Singapore Index performance

Source: Nikko Asset Management Asia Limited as of 31 October 2024. Returns are calculated on a NAV-NAV basis and assuming all dividends and distributions are reinvested, if any. Returns for period in excess of 1 year are annualised. Past performance is not indicative of future performance.

1Index performance is not exactly the same as that of the Fund, it does not factor in any management fees and expenses of the Fund. Returns and performance figures are stated in SGD terms. Past performance is not indicative of future performance.

Key Features and Risks to Keep in Mind

The ABF Singapore Bond Fund is a Singapore-based Exchange Traded Fund (ETF), aiming to track the total return of the iBoxx ABF Singapore Index before fees and expenses. Managed by Nikko Asset Management Asia Limited, this fund is designed for investors who seek an “index-based” approach to investing in a portfolio of Singapore sovereign (or any other Asian sovereign) and quasi-sovereign bonds in a cost effective and easy to access manner. A quick heads-up: this isn’t a capital-guaranteed product. As an ETF, its price will fluctuate with the market, meaning shares may trade above or below your initial purchase price. This fund is generally better suited for those who seek medium to long-term capital appreciation.

Why Bond Funds Make Sense Right Now

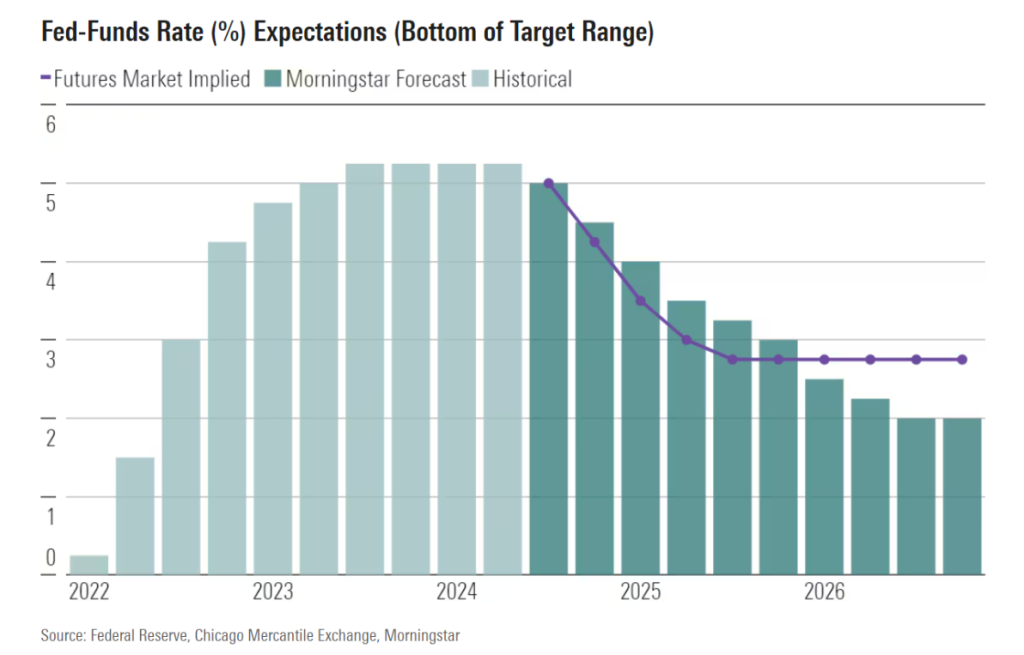

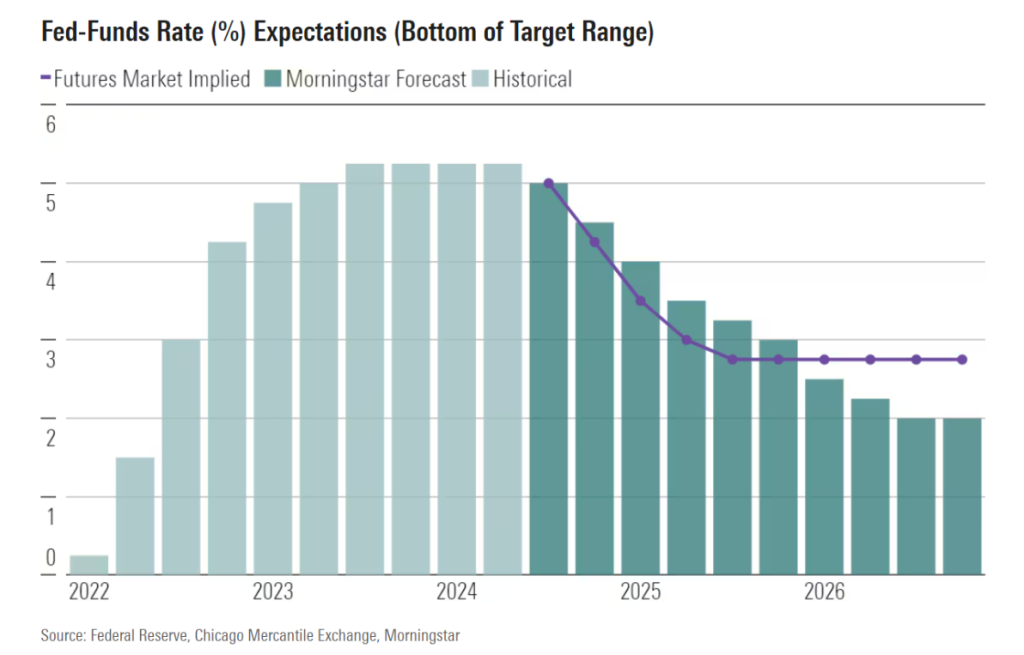

After 11 rate hikes since 2022 pushed U.S. interest rates to a 25-year high of 5.25%-5.50%, the Federal Reserve finally changed direction in September 2024. A 50-basis-point rate cut marked the beginning of what’s expected to be a prolonged easing cycle, potentially creating an opportunity for bond investors to make a strategic move.

What’s the Fed thinking? This rate cut suggests the Fed sees inflation nearing a level that won’t hinder economic expansion. While inflation hasn’t quite hit the 2% target, it’s likely close enough for the Fed to refocus on growth and employment rather than strict inflation control.

Our house view? This cut looks like a mid-cycle adjustment—not an emergency measure. While there are signs of some economic cooling, current data doesn’t hint at a 2025 recession. Instead, market expectations point to a federal funds rate of around 2.75%-3.00%* by the end of 2025.

Hence, if the Fed keeps easing, bond funds could be positioned to benefit, making this a possible good time to reconsider bonds in your portfolio.

*Forecast is not necessarily indicative of future performance

Source: Morningstar, 20 September 2024

How Investors Stand to Benefit

With rates peaking and set to trend downward, bonds may potentially be primed for gradual price gains, making now an ideal time to consider adding them to your portfolio. As rates are likely to continue to fall, bonds could offer a solid blend of stability and growth. In this regard, the ABF Singapore Bond Index Fund may possibly fit this scenario well.

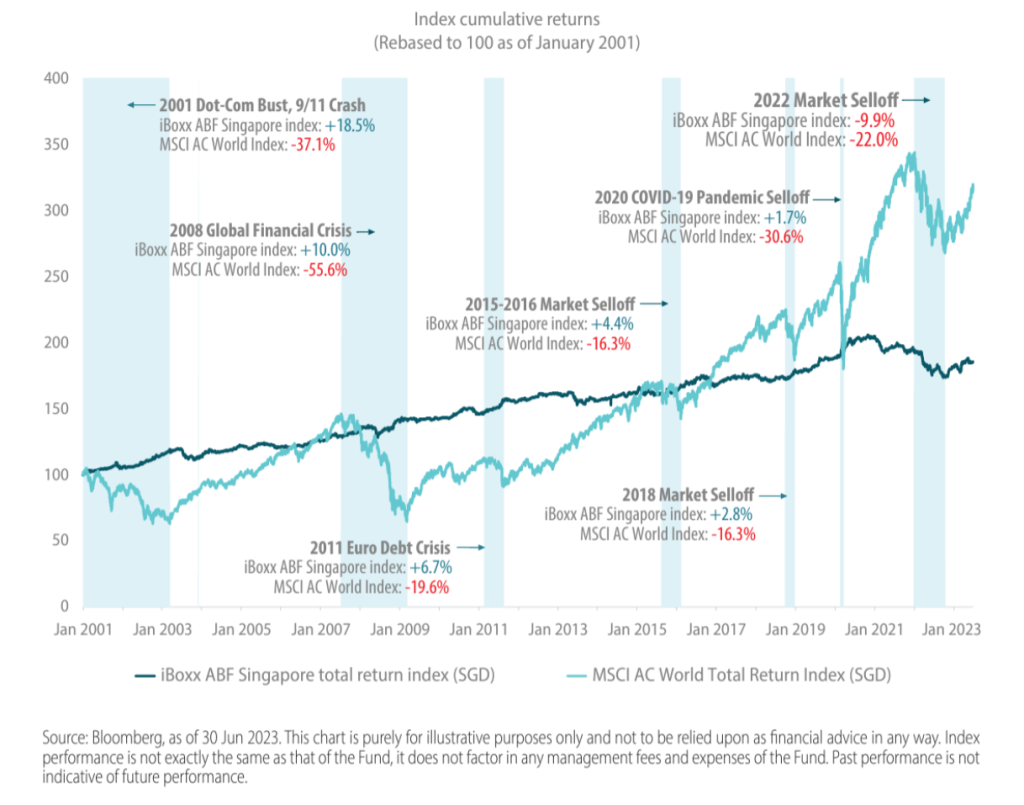

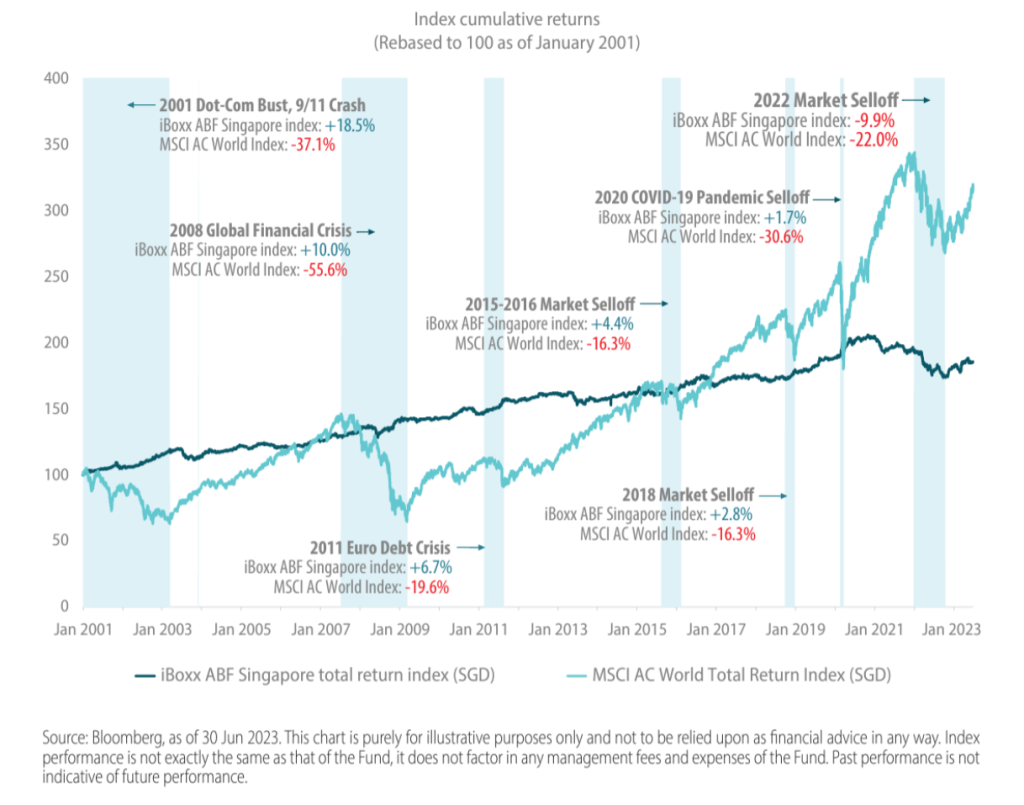

Chart: Returns comparison during periods of market distress

In comparison with the MSCI AC World Total Return Index,, a global equity index. The iBoxx ABF Singapore total return index provided more stability in times of market distress. The point is not to necessarily outperform the broader based MSCI AC World Index but more to cushion against huge drawdowns during periods of instability. Hence it is suitable for investors seeking a lower risk asset class that has mostly performed well relative to global equities during periods of adverse market conditions.

This approach is particularly helpful for equity investors with funds that are set aside for a mid to long investment time horizon while aiming for stability during possible challenging periods. It could be the case that an investor may not want to have all the assets to be fully committed to equities at a moment in time, even though equities may generally outperform over time. For some investors, it’s just as essential to manage the downside risk for the funds.

In short, diversification is the cornerstone of portfolio construction, especially in uncertain markets. For high-risk investors, adding SGD government or quasi-government bonds can help balance a portfolio heavy on high-risk equities. On the other hand, low-risk investors might find the ABF Singapore Bond Index Fund a good mid- to long-term investment option.

A couple of additional perks? The fund pays distributions2 twice a year—great for income-seeking investors. Plus, since it’s fully invested in Singapore Dollars, local investors enjoy the benefits of a strong SGD and the stability of Singapore’s capital markets, all without worrying about currency risk.

2Note: Distributions are not guaranteed and are at the absolute discretion of the Manager. Any distribution is expected to result in an immediate reduction of Fund’s NAV. Distributions will only be paid to the extent that they are available for distribution pursuant to the Trust Deed and covered by income received from the underlying investments of the Fund.

Fund information and its distribution channels

Investors may get exposure to ABF Singapore Bond Index Fund through participating dealers such as Phillip Securities, DBS Vickers and CGS-CIMB Securities.

The Fund is available for purchase via Cash and is also included under the CPF Investment Scheme (“CPFIS”) – Ordinary Account and Supplementary Retirement Scheme (“SRS”)

The total expense ratio of the Fund is respectable at about 0.25% p.a. (as of June 2024)

To find out more about the fund, visit nikkoam.com.sg/abf

To find out more about investing in ETFs using SRS, visit this webpage.

Important Information by Nikko Asset Management Asia Limited:

This document is purely for informational purposes only with no consideration given to the specific investment objective, financial situation and particular needs of any specific person. It should not be relied upon as financial advice. Any securities mentioned herein are for illustration purposes only and should not be construed as a recommendation for investment. You should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you. Investments in funds are not deposits in, obligations of, or guaranteed or insured by Nikko Asset Management Asia Limited (“Nikko AM Asia”).

Past performance or any prediction, projection or forecast is not indicative of future performance. The Fund or any underlying fund may use or invest in financial derivative instruments. The value of units and income from them may fall or rise. Investments in the Fund are subject to investment risks, including the possible loss of principal amount invested. You should read the relevant prospectus (including the risk warnings) and product highlights sheet of the Fund, which are available and may be obtained from appointed distributors of Nikko AM Asia or our website (www.nikkoam.com.sg) before deciding whether to invest in the Fund.

The information contained herein may not be copied, reproduced or redistributed without the express consent of Nikko AM Asia. While reasonable care has been taken to ensure the accuracy of the information as at the date of publication, Nikko AM Asia does not give any warranty or representation, either express or implied, and expressly disclaims liability for any errors or omissions. Information may be subject to change without notice. Nikko AM Asia accepts no liability for any loss, indirect or consequential damages, arising from any use of or reliance on this document. This advertisement has not been reviewed by the Monetary Authority of Singapore.

The performance of the ETF’s price on the Singapore Exchange Securities Trading Limited (“SGX-ST”) may be different from the net asset value per unit of the ETF. The ETF may also be suspended or delisted from the SGX-ST. Listing of the units does not guarantee a liquid market for the units. Investors should note that the ETF differs from a typical unit trust and units may only be created or redeemed directly by a participating dealer in large creation or redemption units.

The Central Provident Fund (“CPF”) Ordinary Account (“OA”) interest rate is the legislated minimum 2.5% per annum, or the 3-month average of major local banks’ interest rates, whichever is higher, reviewed quarterly. The interest rate for Special Account (“SA”) is currently 4% per annum or the 12-month average yield of 10-year Singapore Government Securities plus 1%, whichever is higher, reviewed quarterly. Only monies in excess of $20,000 in OA and $40,000 in SA can be invested under the CPF Investment Scheme (“CPFIS”). Please refer to the website of the CPF Board for further information. Investors should note that the applicable interest rates for the CPF accounts and the terms of CPFIS may be varied by the CPF Board from time to time.

Nikko Asset Management Asia Limited. Registration Number 198202562H.

About Keith

Keith is an investment mentor at The Joyful Investors and is the originator behind the Moneyball Investing methodology, a strategy that facilitated his attainment of financial independence by the age of 35. He is a licensed senior wealth adviser who has more than 18 years of experience in working with asset managers to deliver wealth advisory services to private clients, with a focus on retirement planning. His expertise in portfolio management has not only enabled many clients to retire early but has also earned him accolades, including the iFast Symposium Top Wealth Advisers award, among others.

Important Information

This document is for information only and does not constitute an offer or solicitation nor be construed as a recommendation to buy or sell any of the investments mentioned. Neither The Joyful Investors Pte. Ltd. (“The Joyful Investors”) nor any of its officers or employees accepts any liability whatsoever for any loss arising from any use of this publication or its contents. The views expressed are solely the opinions of the author as of the date of this document and are subject to change based on market and other conditions.

The information provided regarding any individual securities is not intended to be used to form any basis upon which an investment decision is to be made. The information contained in this document, including any data, projections and underlying assumptions are based upon certain assumptions and analysis of information available as at the date of this document and reflects prevailing conditions, all of which are accordingly subject to change at any time without notice and The Joyful Investors is under no obligation to notify you of any of these changes.

· · ·

Have you enjoyed this article? We’d be grateful if you would share this useful content to your friends who may benefit from it as well.