Investing is no mean feat. Attempting to invest for the first time can be really intimidating. But remember how it was like when learning to drive for the first time? The amount of things we need to concurrently focus on seems mind blowing when we first learn a new skill. As we get a hang of it, we will soon realise that we do not require as much attention and time to do it well. Checking the blindspot, side mirror and rear mirror become a natural instinct. We could add cycling for the first time, cooking our first meal and a whole list of other things that we have never done before. How well we can perform these new tasks often is a direct result of the amount of time, effort and guidance received. Flying a plane as a professional pilot is not as dangerous as an untrained person trying to drive a car. When we put in the hours to learn and learn correctly, the risk drastically reduces. The same goes for learning to invest. Here are the 3 key reasons why people often delay their investment journey.

Excuse 1: I do not have time to invest.

This is one of the most common reasons for staying out of investments. These days, we rarely hear people use the term ‘9-6’ to describe their working hours. Clearly, working from 9am to 6pm is no longer the norm. As we struggle to cope with the long working hours and managing our other commitments in life, learning and starting to invest becomes a chore.

Excuse 2: I am not rich enough to start investing.

Higher costs of living reduces the unspent portion of our salary. Desire for better quality of life also reduces the amount of money left for savings and investments. How much do we have left for investments?

Excuse 3: Investing is too risky.

“The market takes the stairs up but the elevator down” — a widely used analogy to describe the high volatility and uncertainty of the market. Volatility is a term closely associated with the market, from the Dotcom Bubble Burst to the 2008 financial crisis, the 2015 Chinese stock market crash and the current COVID pandemic. The last 20 years have included some of the biggest stock market crashes in history and have deterred many from attempting to invest in those periods.

If the above are true, what reasons are there for us to get started on our investment journey, if we have not already started?

Time invested to invest will be worthwhile.

While it is true that a typical day for an adult is usually fully packed with work, personal and family commitments, it is still possible to set aside time to start investing. It would be crucial to first understand and appreciate the importance of investing so as to re-align your priorities and time management. Start off by setting aside at least an hour a day to read up on the basics of investing and build up your knowledge of investing, gradually. Once this habit of ‘an hour a day’ is ingrained into our daily routine, finding time to invest is no longer a chore and becomes an easy task. If you do not start now, you will never start. Investing involves discipline and perseverance.

Most people assume that extensive research is required in order to do stock picks to invest. There are more than 5,000 stocks in the US market and even in a small country like Singapore, we have over 700 listed securities to choose from. Yet, out of these seemingly huge numbers, it may not be wise to hold too many stocks in your portfolio. Ideally, maintaining a portfolio with 10 stocks is more than sufficient to diversify your portfolio, with the precondition that these stocks are good stocks.

There is also the presumption of the need to have deep financial or accounting knowledge in order to select the good stocks. This is not entirely true as only some basic knowledge is required to be able to handpick the stocks.

For beginners, it may in fact be useful to start off by investing in Exchange Traded Funds (ETFs). ETF is a basket of securities that tracks an underlying index. For example, SPY is the ETF that tracks Standard & Poor’s 500 Index while QQQ is the ETF that tracks the NASDAQ 100 Index. By investing in an ETF, it is equivalent to investing in the basket of securities that the ETF contains. As a result, the risk of holding an ETF is reduced through diversification. As ETFs usually hold a basket of securities of the top stocks that the index tracks, ETFs usually produce good yields. This can potentially save beginners some time while yielding good returns.

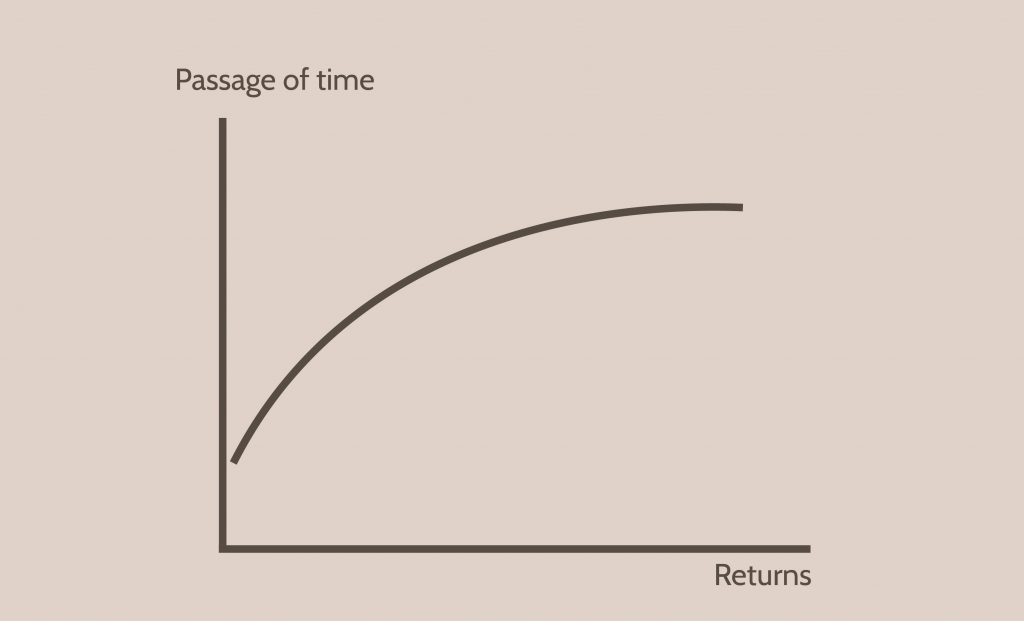

The learning curve for investing is an inverse exponential function. Specifically, the time spent on learning investing will reduce gradually and our investment in time will produce returns at a faster rate than the passage of time. This is due to the fact that once you have spent the time to select the fundamentally strong stocks and to settle the administrative matters such as opening a brokerage account, you can leave it to money to work for you.

Undoubtedly, the concept of compounding and time value of money makes it wise to start investing as early as possible. Contrary to the stereotype that investing is only for working adults, you may start investing early even in the schooling stage. In Singapore, the age requirement for opening the Central Depository (CDP) account is 18 years old. You could also possibly open some of the brokerage accounts at the young age of 18. Therefore, it is always good to be exposed to investing early. It might be too late if you do not start now.

People who have no time to learn how to let money work harder for them, can only spend more time working harder for money.

You do not have to be rich to invest.

Another common misconception many people have is that their starting capital is too insignificant to invest. They rationalise that peanuts are not going to grow into pistachios through investing. In fact, if we do not invest the money we have now, what are the other options available to grow our money?

The effect of compounding is a concept which many people are oblivious of. Compounding refers to the process of earning returns on returns. To illustrate, if we start with an investment of $1,000 that yields 10% after a year, we earn returns of $100. At the end of the second year, the returns of $100 from Year 1 will also yield returns of 10%, thus magnifying the total returns. This denotes that even if we start with a small initial capital for our investments, the money can snowball as a result of the compounding effect.

You’ve got to give it time. Warren Buffett, one of the most successful investors in the world, became a millionaire at the age of 30 with an initial capital of just a few thousand dollars at the young age of 14. However, Warren Buffett actually made 99% of his wealth after his 50s. This is due to the power of compounding, making larger increases in his portfolio. Therefore, perseverance is crucial in investing as it takes time for the compounding effect to work its magic. Start as early as you can, so that you can see the power of compounding working its way to your financial freedom.

Over the years, investing has also been made attractive for investors with small capital. In 2015, SGX released the change of lot size from 1,000 to 100 stocks, making it easier for investors with small initial capital to claim a stake. Take DBS stocks for instance. It is currently trading at the market price of S$22. More than 5 years ago, investors needed to have a minimum of S$22,000 (before factoring in commission fees) in order to purchase DBS stocks. Today, investors can own DBS stocks with just S$2,200 (excluding commission fees).

Various brokerage firms are also competing to offer the lowest possible commission and trading fees. TD Ameritrade for instance, has removed the commission fees for online traded U.S. exchange-listed stocks and ETFs. These changes put investors with lower starting capital at a better position to be able to partake in this investment journey.

Robert T. Kiyosaki wrote in his book “Rich Dad Poor Dad for Teens” that the Poor Dad embraces the concept of saving while the Rich Dad reinforces the concept of investing. In reality, there are many stocks which are priced at amounts which retail investors with limited capital can also afford to buy. This includes many of the REITS which are just priced at S$2 or less. Buying 100 stocks of the REITS will only require forking out a few hundred dollars. This makes investing a way to grow our money and this avenue of making profits is available to everyone, not just the rich.

The golden rule is — what you think is what you get. It really does not matter how small you start, rather, how early you get started.

Manage the risk, not avoid the risk.

Certainly the huge swings in the stock markets are not for the faint hearted. In times of financial crisis, the market can be slammed down by a whopping 30%. The most recent market crash in March 2020 saw at least 35% decline with the hospitality sector receiving the worst hit of an average of 70% decline.

If one has been unfortunate to invest $10,000 in the SPY ETF right before such drawdowns happen, they will be rudely surprised when the value of the investment drops to $8,000 shortly after. Historical performance of the stock market shows that this usually occurs every few years, with the bad years getting hit more than just once. It is not a matter of if, but when.

Nonetheless, wise investors do not get scared off by such market crashes. They turn the tables around by entering more positions for fundamentally strong stocks while the other retail investors close off their positions in fear, crystallising their losses.

Taking a step back to look at the longer time frame, investors will soon realise that strong stocks and ETFs rally up in the long term. If an investor had opened a position of SPY at US$140 right before the prices declined by 50% due to the 2008 recession, the investor would have profited by 140% by now, giving approximately 10% annualised return. While the past performance is not indicative of future performance, we can make educated inferences and learn useful lessons through the historical performance.

In fact, most of the greatest gains in any given period are made from the direst of circumstances. With such massive selloffs, comes great opportunities for investors to capitalize on. The COVID-19 pandemic has resulted in a market crash in March 2020. The market has since recovered over more than 50% for the Dow Jones Index and S&P 500 Index. Technology stocks have also fared brilliantly in this pandemic.

The key to successful investing lies in disciplined learning and application of the skills needed. The odds are always in your favour in the long term for fundamentally strong stocks. This rings true even if the stocks are bought at one of the worst possible moments as long as an investor stays on the course faithfully. Market always finds its way of transferring wealth from the impatient to the patient people. Successful investing is about managing risk, not avoiding it.

With the above substantiated points, if you find yourself still using any of the above reasons, it’s time to act on it. You may wish to gather more insights from the other articles or videos on our website to start your investing journey.

Pingback: How Much Money Do We Need To Start Investing – The Joyful Investors