Keith

in Memos & Musings · 3 min read

As we step into the second half of the year, financial markets are showing signs of nervousness, with several high-stakes events converging to create what could be a perfect storm of volatility. Investors are not just dealing with the usual mid-year market jitters—they are staring down two major catalysts that could meaningfully shift market sentiment in the weeks ahead.

The first is the highly anticipated earnings season for the technology sector, which has been the primary driver of this year’s equity rally. With tech valuations running hot and expectations elevated, investors will be watching closely to see if Big Tech can continue to deliver on growth promises, especially amid the AI boom and a shifting macro backdrop. Even minor disappointments could trigger outsized reactions in tech-heavy indices like the Nasdaq.

The second catalyst is the looming August 1st tariff deadline, which threatens to reignite trade tensions on a global scale. President Trump’s aggressive tariff proposals—targeting key U.S. trade partners—are set to kick in unless last-minute deals are secured. This has added a layer of geopolitical uncertainty to an already sensitive market environment, raising fears of supply chain disruptions, inflationary pressures, and retaliatory trade measures.

Together, these two factors—corporate earnings risk and trade policy risk—are creating a potentially combustible setup, where market swings could become sharper and more unpredictable in the near term.

Tech has soared… But can it keep up?

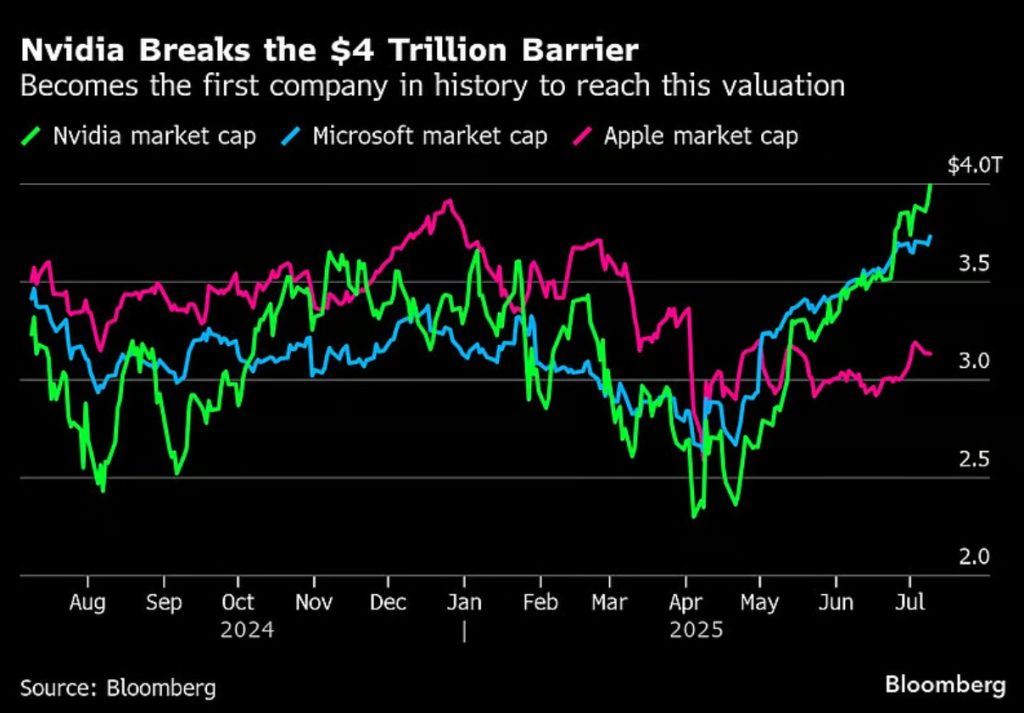

Over the past few months, tech stocks have been on a tear. From April to July, investors have increased their tech allocations at the fastest pace since 2009, according to a poll by the Bank of America. The Nasdaq has surged more than 35% from its April lows, hitting fresh record highs, while NVIDIA became the world’s first USD 4 trillion company in July 2025 and secured approval to sell previously restricted chips to China.

Credit: Bloomberg

There’s clear optimism around continued earnings growth, especially with the AI megatrend gaining momentum. But with valuations now looking stretched, expectations are high—and the margin for error is shrinking.

Faster, sharper reactions to earnings season

This sets the stage for what could be one of the most unpredictable and fast-moving earnings seasons in recent memory. We have all seen the noticeable shift in how markets react to corporate earnings over the past decade. Previously, it was common to see a slower, more gradual “post-earnings drift,” where share prices would continue to adjust in the weeks following an earnings announcement as investors processed the results.

But in today’s market, reactions have become much sharper and far more immediate. Stocks now tend to reprice within hours or even minutes of results being released, especially when earnings surprise significantly to the upside or downside. This acceleration is largely driven by the rise of algorithmic trading, faster dissemination of information, and the dominance of short-term sentiment-driven strategies.

As a result, we’re entering this earnings season with heightened sensitivity. Positive surprises — companies beating analyst expectations or raising guidance — could lead to explosive upside moves, especially in sectors like tech where optimism remains high. On the flip side, any earnings misses, disappointing guidance, or signs of margin pressure could trigger swift and steep sell-offs, particularly in stocks trading at elevated valuations.

For investors, this means being prepared for greater price volatility around earnings releases — where quick reactions from the market can create both risks and short-term opportunities.

Tariff deadlines loom

Adding to the market’s growing list of concerns is the fast-approaching August 1st tariff deadline. President Trump’s latest round of proposed tariffs is broad in scope and aggressive in scale—ranging from 25% to as high as 50% on dozens of key trading partners, including major economies like Canada, Mexico, Japan, South Korea, and the European Union. These tariffs, if implemented, have the potential to reignite global trade tensions and inject fresh uncertainty into markets that are already sensitive to geopolitical risks.

The impact of these tariffs is not just confined to financial markets—it could also hit the real economy in tangible ways. Everyday consumer goods, including essentials like coffee, clothing, footwear, and household items, could see noticeable price increases. This raises the risk of inflationary pressures resurfacing at a time when central banks are already juggling the delicate balance between supporting growth and containing inflation.

With the clock ticking down and few clear signals of diplomatic breakthroughs, investors are rightly cautious. The combination of aggressive tariffs, rising input costs, and potential retaliation from trade partners could introduce additional headwinds to corporate profitability and consumer demand in the months ahead.

The interest rate wildcard: Friend or foe?

A significant wildcard remains in interest rates. Treasury markets have been jittery, and any large-scale sell-off in U.S. government bonds could push yields sharply higher—raising borrowing costs, squeezing corporate profits, and applying downward pressure on equity valuations. Conversely, if rates drop again, it could fuel corporate buybacks and expansion.

The equity rally now stands at the crossroads of growth expectations and renewed rate volatility.

Volatility is the new normal

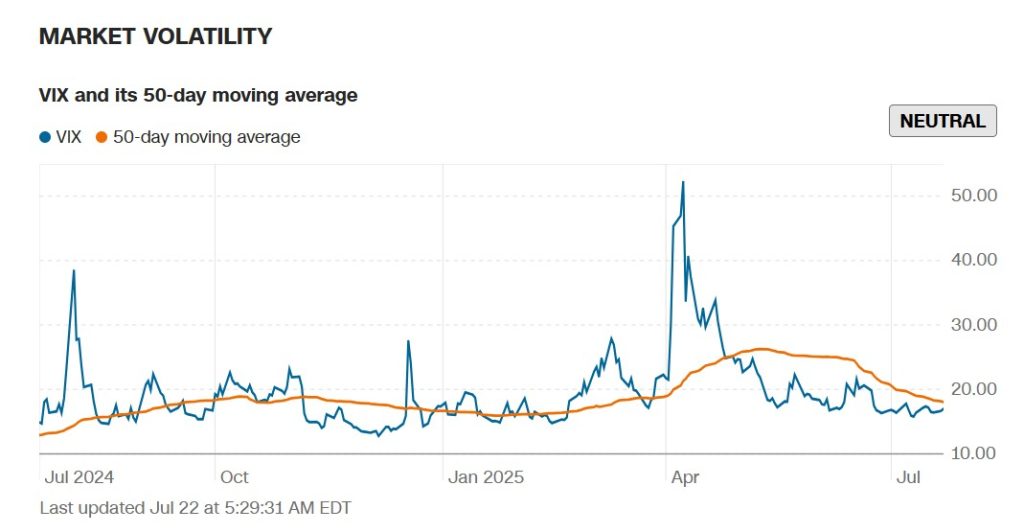

In short, we have already seen how quickly sentiment can shift. The VIX, Wall Street’s fear gauge, spiked close to 60 back in April 2025—one of the highest readings since the COVID crash—before cooling back down to below 20 in recent weeks.

Credit: CNN Business

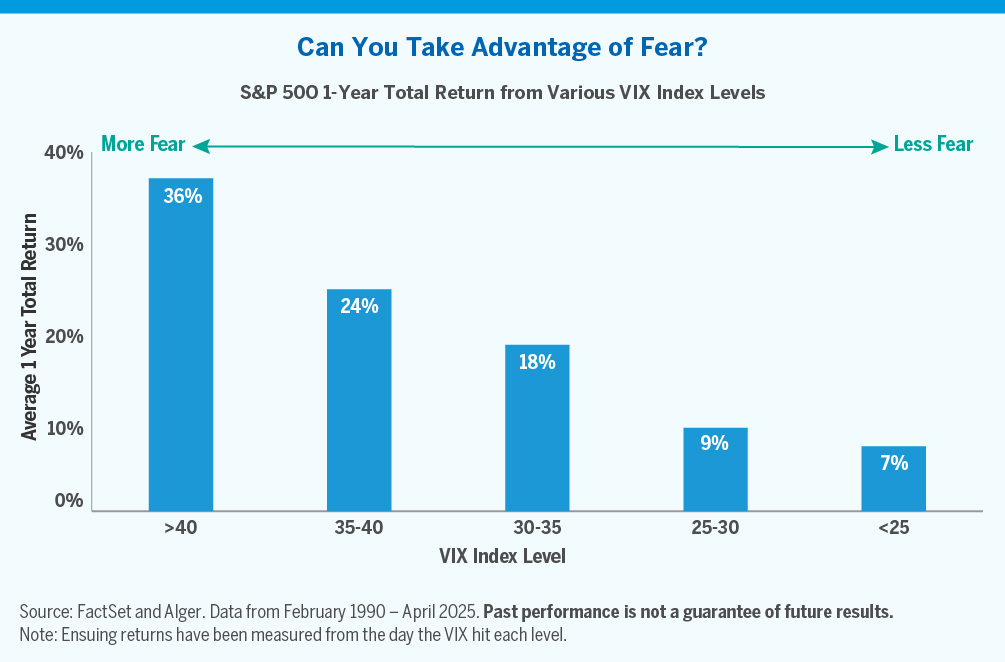

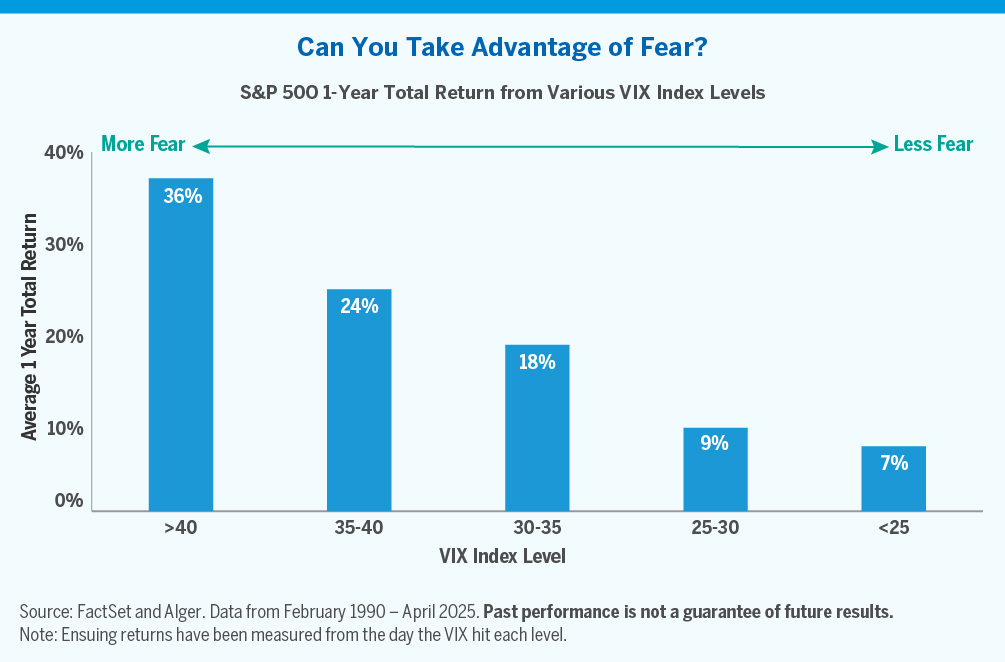

History has consistently shown that extreme fear in markets often precedes some of the best opportunities for investors. In fact, periods of heightened panic can set the stage for strong rebounds, while low levels of fear tend to coincide with more modest returns.

As illustrated by the chart below, when market fear—as measured by the VIX—spikes above 40, forward-looking equity returns have historically been highly attractive. On average, investing during these periods of elevated fear has delivered a robust 36% total return over the following 12 months. In contrast, when fear is subdued and the VIX falls below 25, the market tends to offer more muted returns, with average one-year gains falling to just around 7%.

Credit: FactSet and Alger

This pattern reflects a simple but powerful reality: opportunities are rarely obvious or comfortable. The most attractive entry points often emerge when investor sentiment is pessimistic and uncertainty dominates the headlines.

That said, the recent roller-coaster swings in sentiment—from panic to euphoria and back again—are a stark reminder that volatility is becoming a more permanent feature of today’s markets. Rather than expecting smooth sailing ahead, investors should be prepared for continued market turbulence and position themselves accordingly.

What are your options as an investor now?

✅ Ride It Out: Long-term investors may choose to simply ride through the storm—accepting short-term swings while staying invested for the long run.

✅ Trim and Lock in Gains: More conservative investors could consider taking some profits off the table after the recent rally, trimming exposure, and raising cash to be redeployed after potential pullbacks.

✅ Trade the Swings Proactively: And for those who prefer a more active approach—positioning for both upside opportunities and downside protection—there’s another option with Daily Leveraged Certificates (DLCs).

3x/5x/7x DLCs: A flexible tool to navigate market swings

Daily Leveraged Certificates (DLCs) offer a dynamic and flexible way to trade volatility. Whether it’s to tactically hedge part of your portfolio during earnings season, express short-term views around tariff headlines, or capitalize on rate-driven swings, DLCs can help investors stay agile without abandoning long-term positions.

In short, DLCs allows traders and investors to:

Magnify Returns: Capture short-term trends with 3x daily leveraged exposure to the underlying asset’s performance.

Hedge Downside Risks: Mitigate portfolio risk with Short DLCs, which gain value as the underlying stock price falls.

Enhance Flexibility: DLCs listed on the SGX provide intraday trading opportunities, giving active investors greater flexibility and control over their positions. One key advantage is the ability to react early during Asian market hours—well before the U.S. markets open. This allows traders to respond swiftly to major news events or earnings announcements, positioning themselves ahead of potential market moves.

What are DLCs?

Daily Leverage Certificates (DLCs) are exchange-traded instruments that offer investors leveraged exposure to an underlying asset, such as a stock index or an individual stock. DLCs track the daily performance of the underlying asset relative to its previous closing price, applying a fixed leverage factor of up to 7 times (with a 3-times leverage cap for Magnificent 7 stocks).

To explore some scenarios that traders or investors can possibly tap on the use of DLCs is available in this previous article as well.

Visit the issuer Societe Generale’s DLC website for the full list of DLCs – Click here.

Risks and what DLCs should not be used for:

Daily Leverage Certificates (DLCs) are leveraged financial instruments that carry a high level of risk—including the potential loss of your entire capital if the market moves against your position.

These products are primarily designed for short-term trading, allowing investors to capitalize on rapid market movements. However, they are not intended for long-term holding, as the compounding effect of daily leverage can cause returns to deviate significantly from the expected multiple over time. Additionally, holding DLCs over extended periods may lead to higher costs due to accumulated fees.

In summary, while DLCs can be powerful tools for enhancing returns, their leveraged nature and the mechanics of daily rebalancing introduce complexities and risks. If you’re looking to participate in the tech rally or other fast-moving sectors, it’s essential to fully understand how DLCs work and ensure they fit within your overall investment strategy.

Final thoughts: Prepare, don’t predict

At the end of the day, none of us can predict with certainty how the next few weeks or months will unfold. Markets are constantly shifting, driven by an evolving mix of earnings results, geopolitical tensions, interest rate moves, and investor sentiment. Trying to time every twist and turn is often a fool’s errand.

But what we can do is prepare. We can position ourselves with the awareness that volatility isn’t just a short-term blip—it’s becoming a more permanent feature of modern markets. And how we navigate this environment will make a crucial difference in our long-term investing outcomes.

That means having a game plan, being flexible in our approach, and using the right tools at the right moments. Sometimes it means staying patient and riding out short-term noise. Other times, it means being proactive—taking profit after strong rallies, holding cash for opportunities, or deploying tactical instruments like DLCs to hedge risk or amplify returns.

Ultimately, success doesn’t come from predicting every market move—it comes from staying prepared, disciplined, and adaptable no matter how turbulent the waters get.

Disclaimer

This advertisement has not been reviewed by the Monetary Authority of Singapore. The views expressed under this article represent the personal and independent views of the author and do not constitute investment advice. The content of this article does not form part of any offer or invitation to buy or sell any daily leverage certificates (the “DLCs”), and nothing herein should be considered as financial advice or recommendation. The price may rise and fall in value rapidly and holders may lose all of their investment. Any past performance is not indicative of future performance. Investments in DLCs carry significant risks, please see dlc.socgen.com for further information and relevant risks. The DLCs are for specified investment products (SIP) qualified investors only.

About Keith

Keith is an investment mentor at The Joyful Investors and is the originator behind the Moneyball Investing methodology, a strategy that facilitated his attainment of financial independence by the age of 35. He is a licensed senior wealth adviser who has more than 18 years of experience in working with asset managers to deliver wealth advisory services to private clients, with a focus on retirement planning. His expertise in portfolio management has not only enabled many clients to retire early but has also earned him accolades, including the iFast Symposium Top Wealth Advisers award, among others.

Important Information

This document is for information only and does not constitute an offer or solicitation nor be construed as a recommendation to buy or sell any of the investments mentioned. Neither The Joyful Investors Pte. Ltd. (“The Joyful Investors”) nor any of its officers or employees accepts any liability whatsoever for any loss arising from any use of this publication or its contents. The views expressed are solely the opinions of the author as of the date of this document and are subject to change based on market and other conditions.

The information provided regarding any individual securities is not intended to be used to form any basis upon which an investment decision is to be made. The information contained in this document, including any data, projections and underlying assumptions are based upon certain assumptions and analysis of information available as at the date of this document and reflects prevailing conditions, all of which are accordingly subject to change at any time without notice and The Joyful Investors is under no obligation to notify you of any of these changes.

· · ·

Have you enjoyed this article? We’d be grateful if you would share this useful content to your friends who may benefit from it as well.