Kathy

in Memos & Musings · 2 min read

Most investors associate options with fast trades, leverage, and speculation.

But that’s only one side of the story.

When used thoughtfully, options can play a very different role in a portfolio — one that focuses less on excitement and more on consistency, risk management, and smoother returns.

Instead of asking, “How much can I make?”

Options encourage a better question: “How can I change the shape of my returns?”

Options as a Risk Premium, Not a Bet

At a fundamental level, options exist because market participants are willing to pay for protection, flexibility, or certainty.

For investors, this creates an opportunity to earn a risk premium by taking the opposite side of that demand. Rather than relying entirely on price appreciation, part of the return comes from income generated over time.

This shift matters.

It means returns are no longer always dependent on being right about direction — only that markets behave within reasonable expectations.

How Options Can Reduce Portfolio Volatility

Traditional equity investing depends heavily on price movement. If prices stall or move sideways, returns stagnate.

Options introduce an additional return stream. That income:

- Helps offset small drawdowns

- Reduces reliance on precise entry timing

- Dampens the emotional impact of short-term market swings

Over time, this can result in a smoother equity curve, even if headline returns look less dramatic in strong bull markets.

Letting Time and Probability Do the Work

Options can be wasting assets. As time passes, their value naturally decays.

For investors positioned correctly, this creates a structural edge:

- Returns are earned as time passes, not just when prices rise

- Outcomes are driven by probability, not bold forecasts

- Small, repeatable gains replace the need for occasional big wins

This is especially useful in markets that move slowly or unpredictably — where patience is rewarded more than conviction.

Income Beyond Dividends

Options also broaden the definition of income.

Instead of relying solely on dividends, investors can:

- Generate returns from idle cash

- Earn income from existing holdings without selling them

- Gradually improve their cost base over time

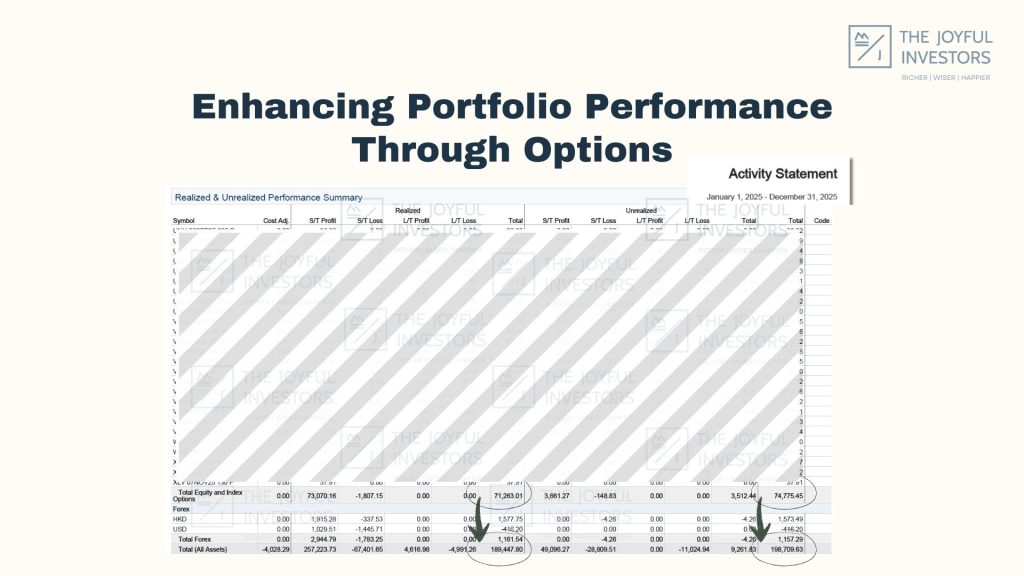

Image source: Brokerage statement screenshot illustrating that options-generated income contributed more than one-third of the total portfolio gains (S$74K of S$198K), alongside capital appreciation in the year 2025.

The result is a form of synthetic income — returns generated even when markets appear to go nowhere.

Understanding the Trade-Offs

Of course, these benefits don’t come without compromises.

By earning premiums, investors accept:

- More modest upside during sharp rallies

- Continued exposure during major market sell-offs

- The need for disciplined asset selection and position sizing

Options don’t eliminate risk. They reshape it.

And when applied without discipline, they can magnify the very volatility they are meant to reduce.

What Investors Must Be Mindful Of

Options are powerful tools but only when they are deployed with a portfolio-first mindset.

The biggest mistake investors make is building option positions that only work during good times. When markets are calm and trends are friendly, almost any approach can look smart. The real test comes during tail-risk events — sudden shocks, sharp drawdowns, and periods when correlations spike.

Building for the future in portfolio construction means preparing not just for what is likely to happen, but for what can happen.

That means:

- Position sizing must assume markets can move faster than expected

- Risk exposure must be survivable during sharp, short-term dislocations

- Strategies must be stress-tested against extreme scenarios, not just backtested during stable periods

When these considerations are ignored, options can do more harm than good. This is why so many investors get wiped out when volatility spikes not because options are dangerous, but because they were used without respect for tail risk.

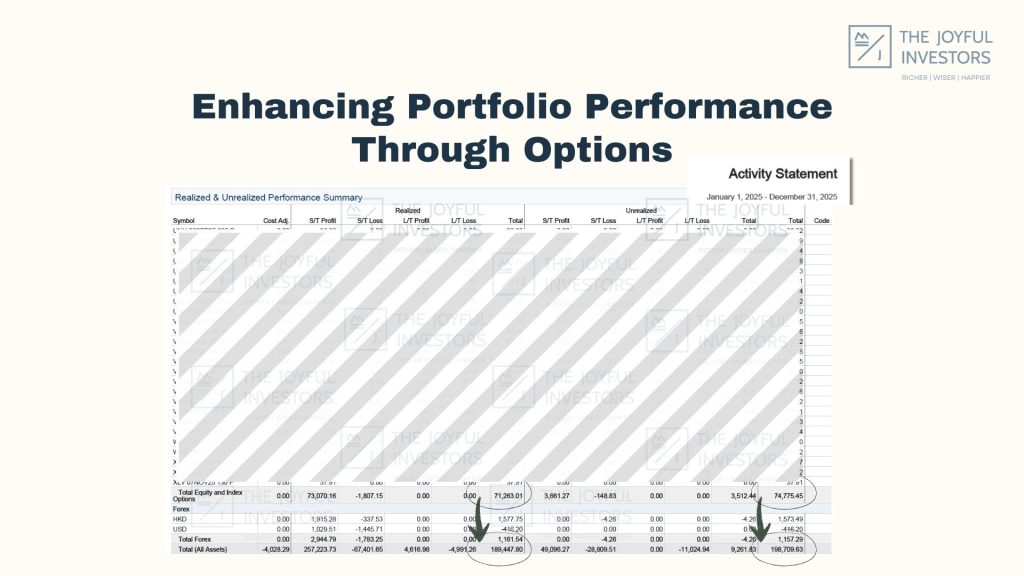

Case in point: during the market pullback around Liberation Day, when markets fell nearly 10% over two days in April 2025 following Trump’s tariff announcement, many options-based portfolios suffered severe and, in some cases, irrecoverable damage.

Image source: Screenshot of a Moneyball Investing portfolio that incorporates options strategies. For illustration purposes, historical performance is not indicative of future results.

Yet, as shown in the screenshot above, our antifragile portfolio went on to perform better thereafter — not by luck, but because it was designed with adverse scenarios in mind from the outset.

Short-term drawdowns are inevitable and we are not able to avoid them entirely, but it is our job as an investor to ensure our portfolio remains positioned to recover and compound over time.

Final Thoughts: Changing the Shape of Returns

Options are not about outperforming every year or chasing big wins.

They are about changing how returns are earned — smoothing volatility, improving consistency, and giving investors more ways to get paid while waiting.

Used properly, options don’t replace investing fundamentals.

They enhance them.

And for long-term investors, that difference matters more than most realise.

If you’re curious how investors actually use options as part of a long-term portfolio — not for trading hype, but for better risk-adjusted returns — we break it down clearly in this video here.

Watch as we explain how options can be integrated thoughtfully to smooth returns, manage volatility, and support portfolio growth over time. 💪🏽

About Kathy

Co-Founder of The Joyful Investors and Co-CIO of InvestingNote Portfolio. I graduated with a degree in Economics in National University of Singapore (NUS). My previous experience with traders at the Merrill Lynch enable me to realize many counter-intuitive truths about how the financial markets work and to uncover the challenges faced by many new investors. Investing can be astoundingly simple, and my goal is to make financial education accessible and easy to understand for everyone.

Important Information

This document is for information only and does not constitute an offer or solicitation nor be construed as a recommendation to buy or sell any of the investments mentioned. Neither The Joyful Investors Pte. Ltd. (“The Joyful Investors”) nor any of its officers or employees accepts any liability whatsoever for any loss arising from any use of this publication or its contents. The views expressed are solely the opinions of the author as of the date of this document and are subject to change based on market and other conditions.

The information provided regarding any individual securities is not intended to be used to form any basis upon which an investment decision is to be made. The information contained in this document, including any data, projections and underlying assumptions are based upon certain assumptions and analysis of information available as at the date of this document and reflects prevailing conditions, all of which are accordingly subject to change at any time without notice and The Joyful Investors is under no obligation to notify you of any of these changes.

· · ·

Have you enjoyed this article? We’d be grateful if you would share this useful content to your friends who may benefit from it as well.