Keith

in Memos & Musings · 3 min read

U.S.–China Trade Tensions Resurface

Markets across the U.S. and China remain on edge as escalating tariff measures reignite fears of a prolonged trade war between the world’s two largest economies. Investor sentiment has been highly reactive, with sharp intraday swings reflecting growing uncertainty around policy direction, global growth implications, and the broader impact on corporate earnings.

The renewed tit-for-tat tariff actions—led by the U.S. imposing steep duties and China swiftly responding with countermeasures—have triggered volatility across equity markets and have forced investors to confront the possibility that the worst is still to come. As both sides dig in, market participants are closely watching for signs of de-escalation or further escalation, which could set the tone for risk assets in the near term.

In this market update, we explore how the latest developments are influencing investor behavior, sector performance, and what it may signal for short- and long-term positioning across both U.S. and Asian markets.

U.S. Markets

U.S. stocks closed lower on Tuesday, wrapping up a volatile session that initially saw optimism surrounding the president’s tariff policies. Early in the day, the Dow Jones Industrial Average surged by 1,400+ points, driven by investor hopes that the administration might follow through on potential trade agreements. However, that early momentum faded, and the index ended the day down 0.8%, hitting a 52-week low.

The S&P 500 experienced a historic swing. For the first time since at least 1978, the index climbed over 4% intraday before reversing course and finishing the day down more than 1%. Meanwhile, the tech-heavy Nasdaq recorded its largest intraday gain since at least 1982—only to surrender those gains by the close. The dramatic moves underscore just how sensitive markets remain to developments related to trade and tariffs.

President Donald Trump’s new tariffs are set to take effect on 9th April 2025, including a widely discussed 104% tariff on Chinese imports. U.S. Customs and Border Protection announced it is ready to begin collecting country-specific tariffs from 86 trade partners.

Prior to this, the first week of April has been especially punishing for the markets. Last Friday marked the second straight day of 4% or greater losses for the S&P 500. A two-day plunge of 10% or more has only happened four times since the 1950s. On Monday morning, the S&P 500 teetered on the edge of entering bear market territory but managed to stabilize by the close.

China Markets

On the other hand, China has signaled its readiness to support its economy in the face of new tariffs imposed by U.S. President Donald Trump, with officials indicating flexibility to lower borrowing costs and ease reserve requirements for banks if needed.The reserve requirement ratio for financial institutions and key central bank policy rates could be adjusted at any time. The article also highlighted the potential to further expand the fiscal deficit, including the issuance of special treasury bonds and targeted government debt.

On April 4, President Xi Jinping’s administration announced a 34% tariff on all U.S. imports, effective April 10, in direct response to the tariffs previously levied by the U.S. on Chinese goods. In addition to the tariffs, China unveiled several countermeasures, including immediate restrictions on the export of seven categories of rare earth elements—a key component in high-tech manufacturing.

Chinese authorities have also pledged targeted support for industries and businesses most affected by the escalating trade tensions. Measures include helping companies adjust their operations, pivot toward domestic and alternative international markets, and continue efforts to preserve trade ties with the U.S. where possible.

It appears that Beijing had long anticipated a renewed wave of trade restrictions from Washington. As such, the Chinese leadership has proactively assessed the risks and claims to have strategic plans in place to cushion the impact and maintain economic stability.

Where will the markets go from here?

Market sentiment in both the U.S. and China has been badly hit by the trade war as a result.

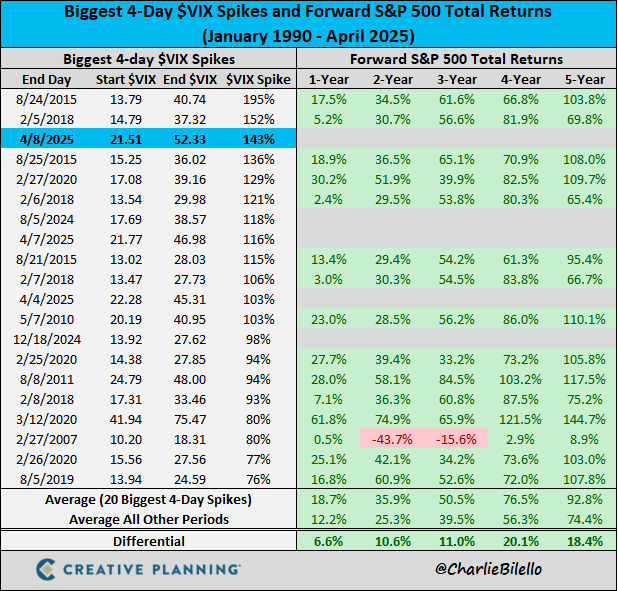

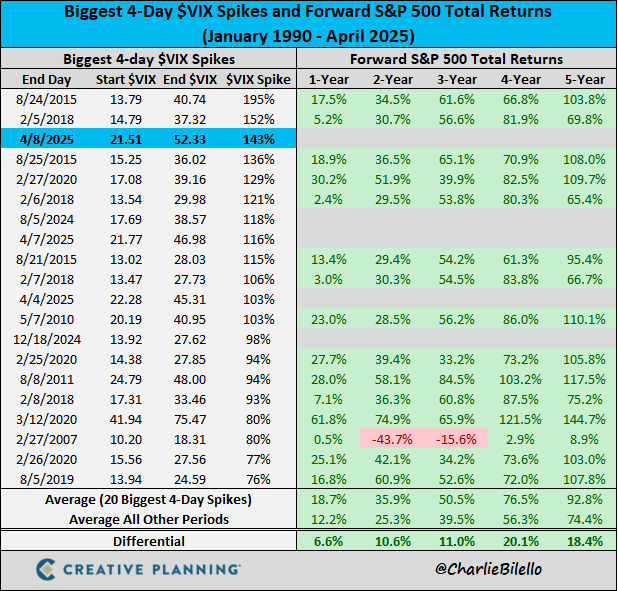

One of the most striking developments last week was the spike in market volatility. The VIX, Wall Street’s fear gauge, showed a spike of 143% over the last 4-day period—one of the most significant 4-day increases on record. Since 1990, the 20 biggest such spikes have encouragingly saw the S&P 500 delivered a positive 1-year forward return of roughly 18.7%. While historical performance is no guarantee of future results, this data may suggest a potential silver lining. In addition, history shows that the sharper and faster the market drops, the greater the likelihood of a relatively swift rebound—a pattern that investors hope will repeat once again.

Source: Charlie Bilello (The information relating to past performances is for illustrative purposes only, and is not a reliable indicator of future performance.)

As of 9 April, the VIX remains elevated in the 40–50 range, signaling heightened market volatility. While this level of uncertainty can be unsettling, it may also present a strategic opportunity over the long term. Historically, sharp spikes in the VIX have often preceded strong market rebounds, as mentioned earlier. If historical patterns hold, the current downturn could potentially pave the way for a meaningful recovery over time.

Source: TradingView as of 7 April 2025 (The information relating to past performances is for illustrative purposes only, and is not a reliable indicator of future performance.)

The current market downturn appears to be driven more by policy uncertainty than by a breakdown in the fundamentals of the high-quality companies we invest in. But when markets face rapid, sharp declines—like the one we’re currently witnessing—margin calls and forced liquidations from leveraged accounts often accelerate the sell-off. This dynamic can lead to panic selling, where even fundamentally strong companies are mispriced. The upside to such market dislocation is that it creates a rare opportunity to acquire high-quality businesses at significant discounts—opportunities that long-term investors should not overlook.

While continued volatility is likely in the near term, it’s important to stay focused on the bigger picture. Our investment horizon spans years, not weeks or months. Though short-term market movements can be unpredictable, the intrinsic value of well-positioned companies tends to endure—and it’s in that long-term resilience where the real opportunity lies.

Interestingly, shortly after markets opened on Monday, reports surfaced suggesting that President Trump was considering a 90-day pause on tariffs. The S&P 500 quickly surged over 400 points in response—only for the White House to later deny any knowledge of such a move. The index then promptly gave back about 300 points of that rally.

This dramatic reversal highlights how eager both institutional and retail investors are to rotate back into risk assets. There’s a clear sense that plenty of sidelined capital is waiting for the right moment to re-enter the market—likely at the first real sign of a bottom. No one wants to miss out if a trade deal materializes, which is why a sharp rebound could unfold just as quickly as the sell-off did.

As we’ve been pointing out in our recent social posts, the latest wave of selling has largely been self-inflicted—driven by the unpredictable actions of a single individual. And now, markets are reacting to every word Trump utters, despite his well-documented tendency to reverse course.

Later that same day, Trump escalated tensions by threatening a new 50% tariff on China unless it rolled back its existing 34% tariff by April 8. That would bring the total U.S. tariff burden on Chinese imports to a staggering 104%.

In theory, such a move should have sent markets reeling. Yet, the S&P 500 still closed more than 200 points above the session’s low. Even China’s markets opened Tuesday with strength, and by Wednesday morning, Chinese stocks had pared most of their losses despite opening sharply lower—the day the 104% tariff was set to take effect.

So what does all this tell us?

If the trade war is clearly intensifying, why have markets been so resilient—or even bounced—on days when sentiment should be at its worst?

Of course, we could be wrong. But in our experience, when bad news keeps coming yet the market stops reacting negatively—or even starts to rally—it’s often a strong sign that the bottom may already be in… or at the very least, that we’re getting close.

That said, we should be prepared for big moves in either direction. Volatility is likely to remain elevated, but within that chaos lies opportunity for those who stay focused on the long game.

Riding the Volatility with DLCs

For traders looking to capitalize on market volatility, Daily Leveraged Certificates (DLCs) present a dynamic and innovative instrument to either amplify returns or hedge against downside risks. Listed on the Singapore Exchange (SGX), DLCs such as those tracking the Nasdaq and Hang Seng Tech Index (HSTECH) provide leveraged exposure—both long and short—to a range of high-profile underlying stocks.

These instruments are particularly attractive for active traders aiming to express tactical views, as they enable both bullish and bearish strategies. For instance, the Nasdaq DLCs allow exposure to prominent U.S. tech giants—including names in the so-called Magnificent 7—while the HSTECH DLCs track some of China’s top technology companies. This offers traders the flexibility to act quickly on short-term momentum or reversals, depending on their market outlook.

Beyond short-term trading, DLCs can also play a role in a diversified portfolio strategy. For long-term investors who are temporarily cautious or bearish, DLCs can serve as a tactical hedge—allowing for downside protection on specific market segments without the need to unwind core holdings. By using DLCs to hedge a portion of their exposure, investors can manage near-term volatility while staying committed to their broader long-term investment objectives.

In short, DLCs allows traders and investors to:

- Magnify Returns: Capture short-term trends with 3x daily leveraged exposure to the underlying asset’s performance.

- Hedge Downside Risks: Mitigate portfolio risk with Short DLCs, which gain value as the underlying stock price falls.

- Enhance Flexibility: DLCs listed on the SGX provide intraday trading opportunities, giving active investors greater flexibility and control over their positions. One key advantage is the ability to react early during Asian market hours—well before the U.S. markets open. This allows traders to respond swiftly to major news events or earnings announcements, positioning themselves ahead of potential market moves.

What are DLCs?

Daily Leverage Certificates (DLCs) are exchange-traded instruments that offer investors leveraged exposure to an underlying asset, such as a stock index or an individual stock. DLCs track the daily performance of the underlying asset relative to its previous closing price, applying a fixed leverage factor of up to 7 times (with a 3-times leverage cap for Magnificent 7 stocks).

To explore some scenarios that traders or investors can possibly tap on the use of DLCs is available in this previous article as well.

Visit the issuer Societe Generale’s DLC website for the full list of DLCs – Click here

Risks and what DLCs should not be used for:

Daily Leverage Certificates (DLCs) are leveraged financial instruments that carry a high level of risk—including the potential loss of your entire capital if the market moves against your position.

These products are primarily designed for short-term trading, allowing investors to capitalize on rapid market movements. However, they are not intended for long-term holding, as the compounding effect of daily leverage can cause returns to deviate significantly from the expected multiple over time. Additionally, holding DLCs over extended periods may lead to higher costs due to accumulated fees.

In summary, while DLCs can be powerful tools for enhancing returns, their leveraged nature and the mechanics of daily rebalancing introduce complexities and risks. If you’re looking to participate in the tech rally or other fast-moving sectors, it’s essential to fully understand how DLCs work and ensure they fit within your overall investment strategy.

Disclaimer

This advertisement has not been reviewed by the Monetary Authority of Singapore. The views expressed under this article represent the personal and independent views of the author and do not constitute investment advice. The content of this article does not form part of any offer or invitation to buy or sell any daily leverage certificates (the “DLCs”), and nothing herein should be considered as financial advice or recommendation. The price may rise and fall in value rapidly and holders may lose all of their investment. Any past performance is not indicative of future performance. Investments in DLCs carry significant risks, please see dlc.socgen.com for further information and relevant risks. The DLCs are for specified investment products (SIP) qualified investors only.

About Keith

Keith is an investment mentor at The Joyful Investors and is the originator behind the Moneyball Investing methodology, a strategy that facilitated his attainment of financial independence by the age of 35. He is a licensed senior wealth adviser who has more than 18 years of experience in working with asset managers to deliver wealth advisory services to private clients, with a focus on retirement planning. His expertise in portfolio management has not only enabled many clients to retire early but has also earned him accolades, including the iFast Symposium Top Wealth Advisers award, among others.

Important Information

This document is for information only and does not constitute an offer or solicitation nor be construed as a recommendation to buy or sell any of the investments mentioned. Neither The Joyful Investors Pte. Ltd. (“The Joyful Investors”) nor any of its officers or employees accepts any liability whatsoever for any loss arising from any use of this publication or its contents. The views expressed are solely the opinions of the author as of the date of this document and are subject to change based on market and other conditions.

The information provided regarding any individual securities is not intended to be used to form any basis upon which an investment decision is to be made. The information contained in this document, including any data, projections and underlying assumptions are based upon certain assumptions and analysis of information available as at the date of this document and reflects prevailing conditions, all of which are accordingly subject to change at any time without notice and The Joyful Investors is under no obligation to notify you of any of these changes.

· · ·

Have you enjoyed this article? We’d be grateful if you would share this useful content to your friends who may benefit from it as well.