Kathy

in Memos & Musings · 2 min read

The market meltdown of Q1 2024

The current market environment is especially painful for investors with heavy tech exposure, particularly those focused on the “MAG 7” stocks — Tesla, Nvidia, Alphabet, Amazon, Meta, Microsoft, and Apple — all of which have seen significant declines from their recent highs:

- Tesla: -50%

- Nvidia: -25%

- Alphabet: -22%

- Amazon: -20%

- Meta: -20%

- Microsoft: -19%

- Apple: -19%

Nearly all MAG 7 stocks are now in bear market territory (a decline of 20% or more from a recent peak), which highlights a broader shift in sentiment. A portfolio that is concentrated in the above stocks would have seen paper losses of about 20% from the highs. While it’s true that markets and strong stocks often recover over time, risk mitigation is a factor that’s too often overlooked. Many investors focus solely on potential returns, neglecting how risk exposure can greatly affect overall portfolio performance.

The perfect storm that drove recent volatility was a crowded trade unwinding all at once. Hedge funds, retail investors, and momentum traders were all positioned similarly, leading to a sharp repricing when sentiment shifted. Hedge funds sold global stocks at their fastest pace since the pandemic crash in 2020.

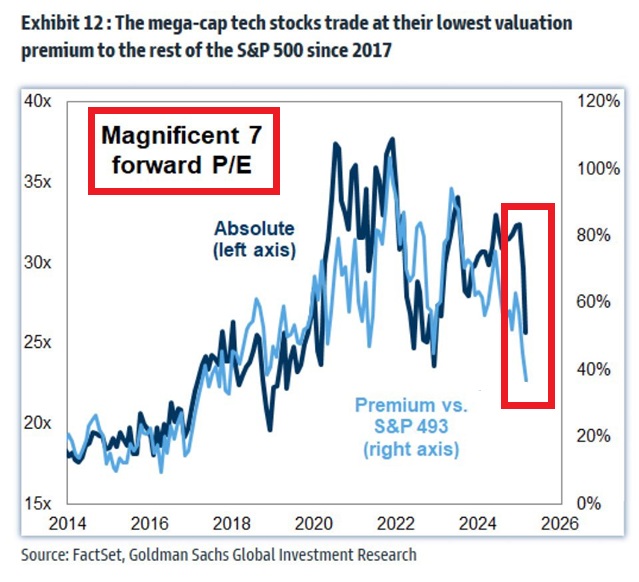

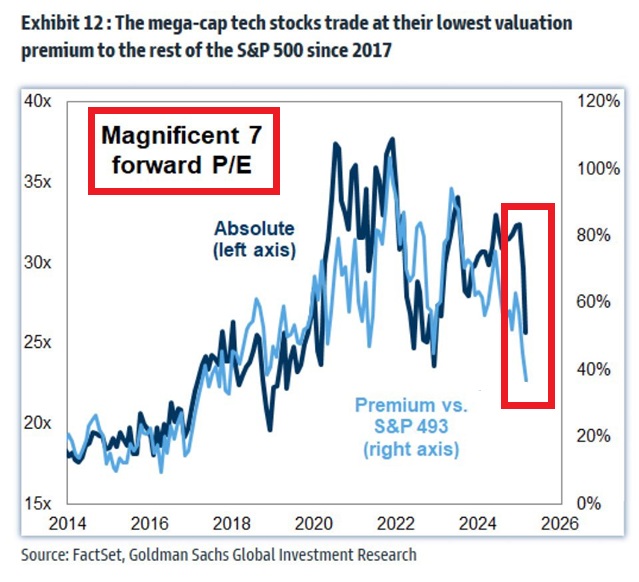

This has resulted in a massive reset of momentum trades, leaving certain pockets of the market oversold. For investors concentrated in mega-cap tech, this reset has brought valuations down significantly.

Finding the Silver Lining: Opportunity Amid Market Turbulence

While we may not be fully out of the woods yet, this moment offers an opportunity to step back and reassess risk-to-reward dynamics. Mega-cap tech, in particular, has undergone a valuation reset and is now trading at its lowest premium to the broader S&P 500 in years. Some of the recent selling pressure may have been overdone, creating potential for a turnaround in these stocks.

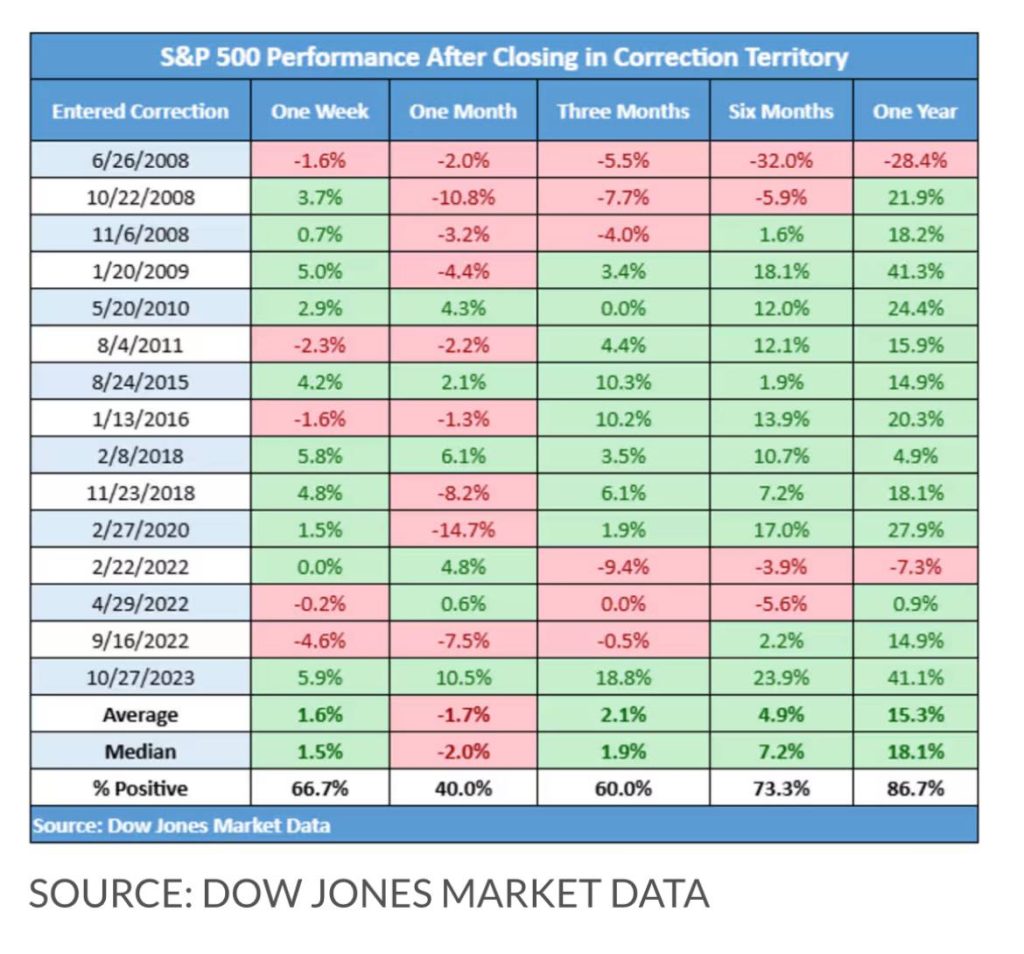

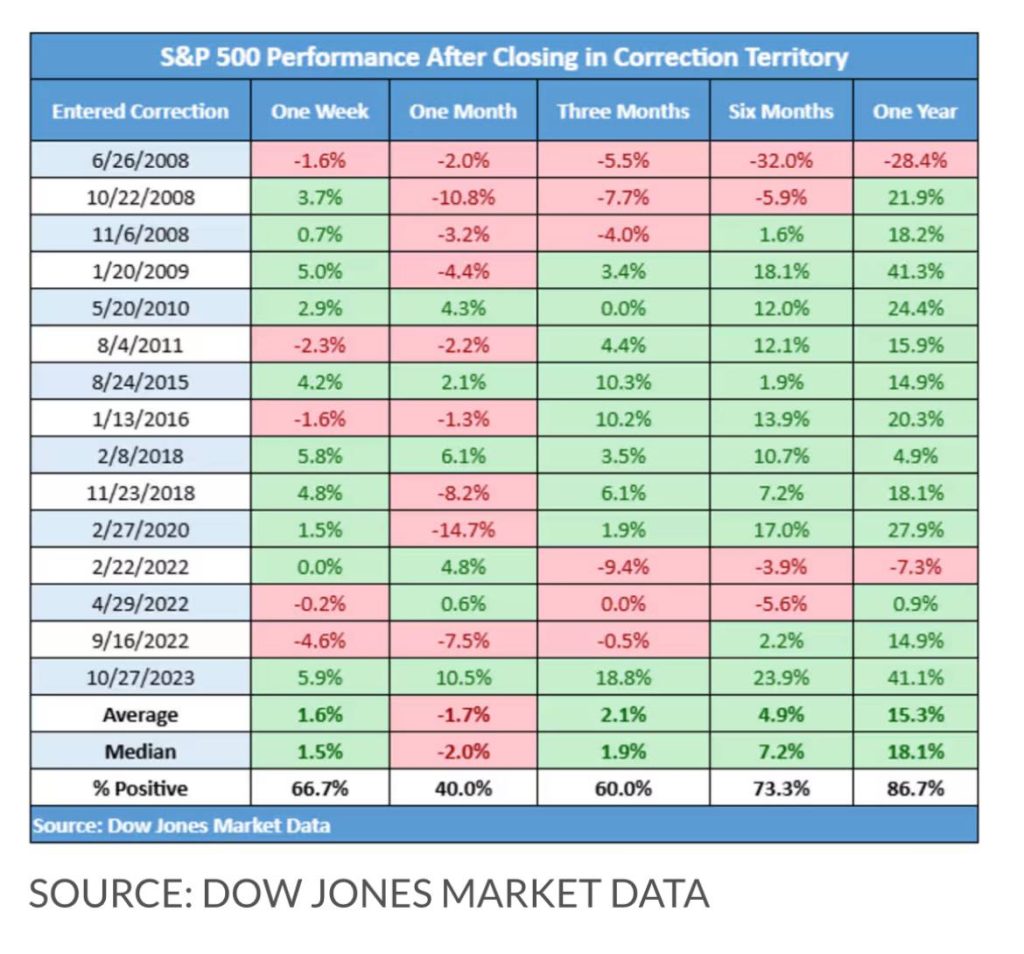

While past performance is no guarantee of future results, historical trends can provide useful context. Since 2008, the S&P 500 has, on average, gained 15.3% in the year following its first close below the correction threshold, with the market finishing higher 86.7% of the time. This pattern suggests that market downturns have frequently been followed by strong recoveries, though the timing and magnitude of any rebound remain uncertain.

Staying tactical is crucial in this environment. Markets remain volatile, and uncertainty persists, but the risk-reward equation is becoming increasingly attractive. Investors should carefully assess their portfolio exposure, ensuring a balance between potential upside and the inherent risks of concentrated positions—particularly in high-volatility sectors. Staying nimble and diversified can help navigate the ongoing market fluctuations while positioning for potential recovery.

More insights from The Joyful Investors

🤜🏽 Like what you read? Get more investing ideas and market updates by joining our community at bit.ly/FireWithTJI

About Kathy

Co-Founder of The Joyful Investors and Co-CIO of InvestingNote Portfolio. I graduated with a degree in Economics in National University of Singapore (NUS). My previous experience with traders at the Merrill Lynch enable me to realize many counter-intuitive truths about how the financial markets work and to uncover the challenges faced by many new investors. Investing can be astoundingly simple, and my goal is to make financial education accessible and easy to understand for everyone.

Important Information

This document is for information only and does not constitute an offer or solicitation nor be construed as a recommendation to buy or sell any of the investments mentioned. Neither The Joyful Investors Pte. Ltd. (“The Joyful Investors”) nor any of its officers or employees accepts any liability whatsoever for any loss arising from any use of this publication or its contents. The views expressed are solely the opinions of the author as of the date of this document and are subject to change based on market and other conditions.

The information provided regarding any individual securities is not intended to be used to form any basis upon which an investment decision is to be made. The information contained in this document, including any data, projections and underlying assumptions are based upon certain assumptions and analysis of information available as at the date of this document and reflects prevailing conditions, all of which are accordingly subject to change at any time without notice and The Joyful Investors is under no obligation to notify you of any of these changes.

· · ·

Have you enjoyed this article? We’d be grateful if you would share this useful content to your friends who may benefit from it as well.