Kathy

in Memos & Musings · 3 min read

The year 2025 began on a tumultuous note for the global financial markets, as investors found themselves navigating a complex and rapidly evolving landscape. A resurgence of trade war fears, fueled by escalating tensions between major economies, cast a shadow over market sentiment, creating waves of uncertainty.

At the same time, the meteoric rise of Chinese artificial intelligence (AI) technologies emerged as a dominant theme, reshaping industries and challenging the global balance of technological power. These dual forces—geopolitical instability and technological disruption—left market participants with much to digest, as they grappled with the implications for growth, innovation, and competition.

And yet, this was only the beginning. As the year unfolded, it became increasingly clear that 2025 would be a pivotal period, marked by both unprecedented challenges and transformative opportunities, setting the stage for a new era in global finance and technology.

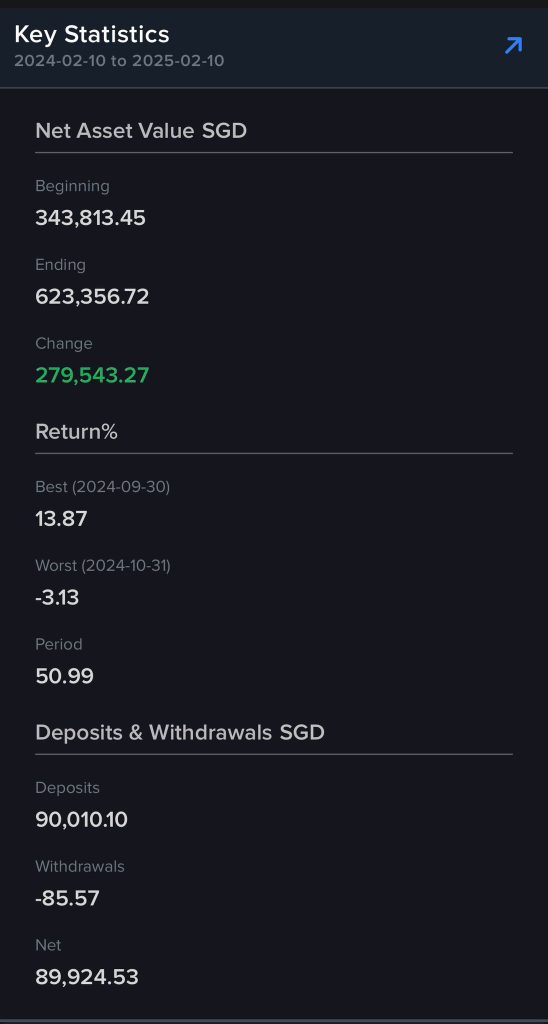

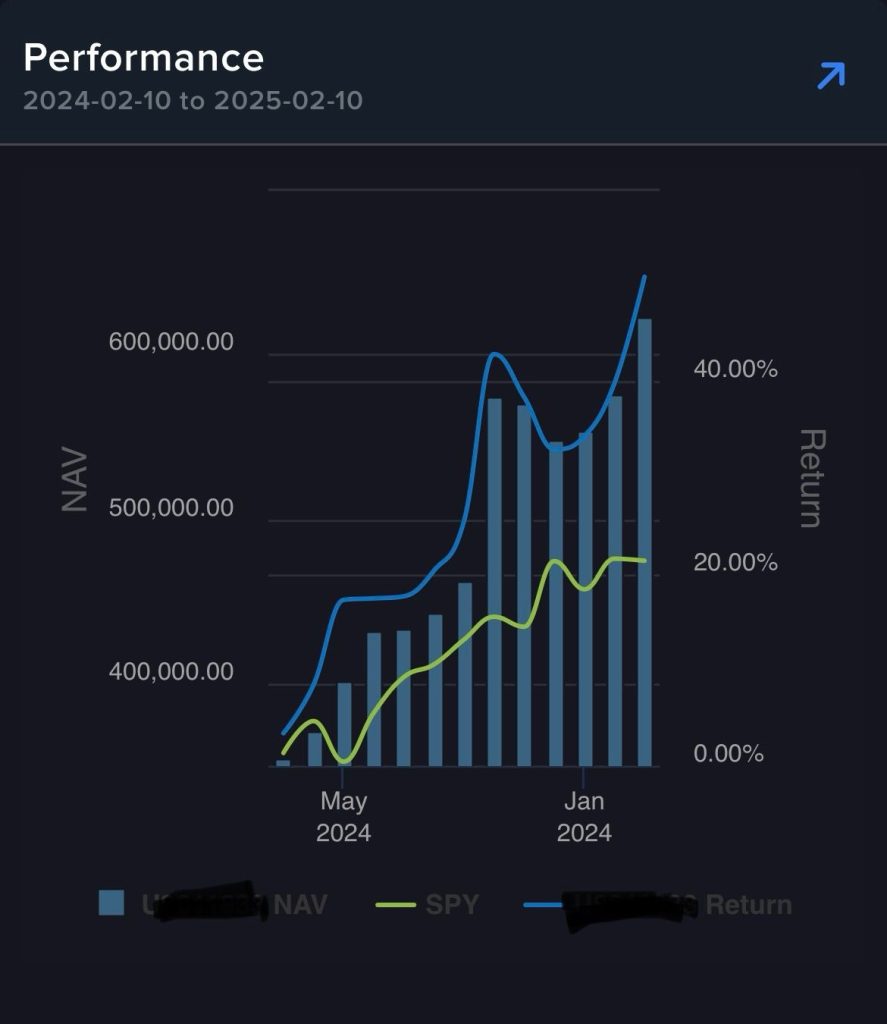

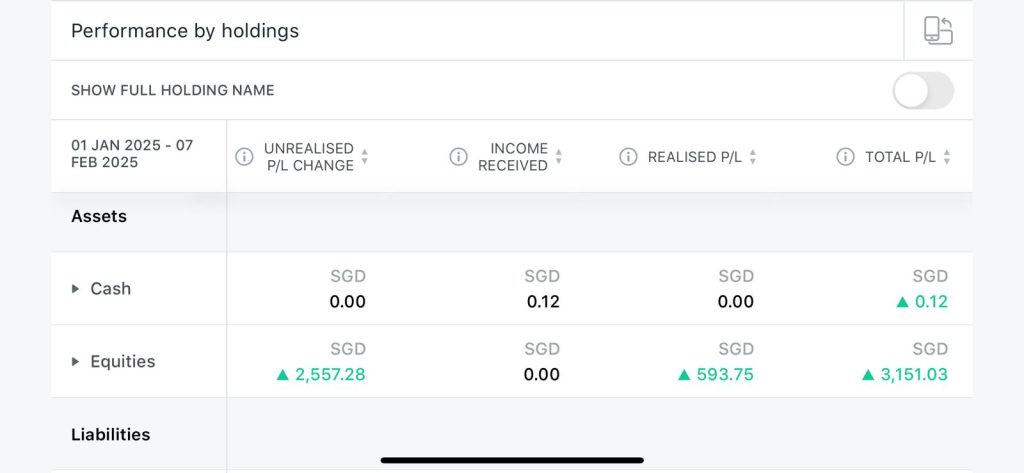

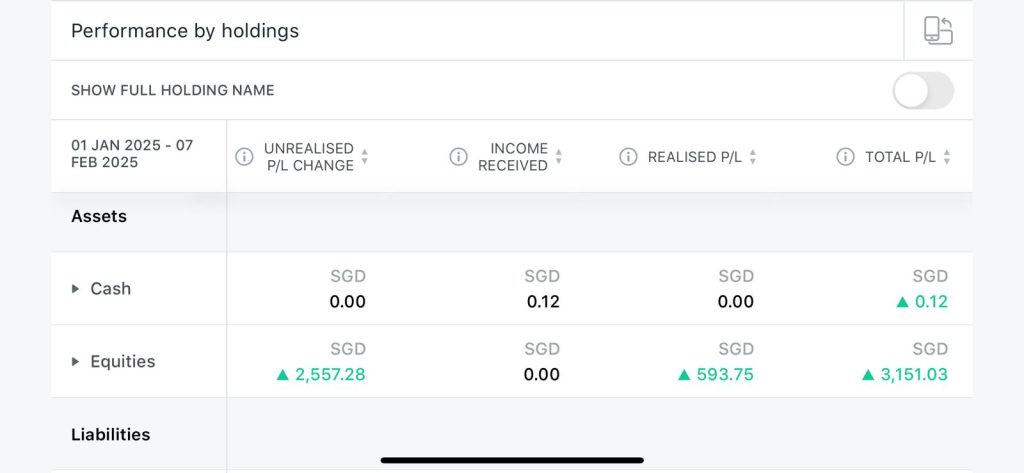

At the time of writing, we have yet to pocket any dividends from our dividend portfolio this year, but our growth portfolio is off to a good start so far—up 12.2% YTD, ahead of the S&P 500’s 3.2% YTD gain, or 50.9% over the past year compared to the S&P 500’s 20.6%.

The outperformance has been driven by selective stock picking in the U.S. and China markets, along with strategic position sizing based on the attractiveness of each opportunity—something we discussed in our recent YouTube video, How to Manage Risks and Uncertainty to Build a Thriving Portfolio.

It all ties back to our Moneyball Investing Strategy, which is built on one core principle: We only buy when the risk-to-reward setup is in our favor, beyond all other considerations.

This also means we’re not here to chase hype-driven rallies. That means missing some stocks that go parabolic in weeks or months. But it also means avoiding the painful pullbacks that often follow. This discipline allows us to capture upside while sidestepping unnecessary risk.

Conviction in our picks has also been key—staying invested until opportunities eventually play out, as seen with our China positions that have started to move up in recent months. That said, we recognize that not everything will work out at the same time. Our goal remains to achieve an overall strong portfolio performance. For instance, at this juncture, stocks like Adobe and Nike have been a drag on our portfolio, even as the broader strategy continues to outperform.

It’s all about how much you gain when you’re right and how deep the drawdowns are when you’re wrong (or just not right yet). When things don’t go as planned, we aim to stay close to the benchmark while waiting for our investment thesis to play out—just like we highlighted in our 2024 portfolio performance update. Our performance (in blue) has tracked closely with the S&P 500 (in green), but with greater upside potential when our thesis proves correct.

In a well-diversified portfolio, it’s unrealistic to expect all positions to be profitable at once. If everything is making money at the same time, it often means that during a market pullback, all positions could turn red—which isn’t necessarily ideal.

Translating to numbers, this also serves as a reminder that in our journey to grow our investment portfolio, drawdowns are inevitable from time to time. If you’re aiming for $100K, you should be prepared for multiple $10K pullbacks. To reach $1 million, expect to see $100K drawdowns along the way.

This is also reflected in our NAV in blue as well towards the end of last year. This isn’t the first $1 million portfolio we’ve built and we have seen this playing out repeatedly. Part of wealth building is also about having strong hands to embrace the inevitable pullbacks and capitalize on them.

Back home, our dividend portfolio—comprised of Singapore REITs—has held up well despite concerns over fewer rate cuts. While most REIT ETFs have faced year-to-date drawdowns of -1% to -3%, our portfolio has still managed to post slight capital gains. This will also likely set us up for a good rebound to potentially outperform as well even during the recovery when it happens.

Also broke a personal record of watching more than 10 lion dance performances locally and overseas this year. It has been something that we personally always enjoy but haven’t found the chance to do it. Glad we found the time and energy to do it this Chinese new year.

A heartfelt thank you to our wonderful business partners and students for the thoughtful treats and gifts this Chinese New Year! We feel incredibly blessed to have such a supportive community working alongside us.

Lastly, The Joyful Investors wishes everyone a good year ahead and buy 蛇么 HUAT 什么. May you be filled with prosperity, joy, and success in the year ahead! Always remember that building sustainable wealth is really about understanding the potential downside risks and making calculated bets that offer asymmetrical returns. And for those that will be attending our in-person workshops, courses or panelist discussions in February, we look forward to seeing you.

About Kathy

Co-Founder of The Joyful Investors and Co-CIO of InvestingNote Portfolio. I graduated with a degree in Economics in National University of Singapore (NUS). My previous experience with traders at the Merrill Lynch enable me to realize many counter-intuitive truths about how the financial markets work and to uncover the challenges faced by many new investors. Investing can be astoundingly simple, and my goal is to make financial education accessible and easy to understand for everyone.

Important Information

This document is for information only and does not constitute an offer or solicitation nor be construed as a recommendation to buy or sell any of the investments mentioned. Neither The Joyful Investors Pte. Ltd. (“The Joyful Investors”) nor any of its officers or employees accepts any liability whatsoever for any loss arising from any use of this publication or its contents. The views expressed are solely the opinions of the author as of the date of this document and are subject to change based on market and other conditions.

The information provided regarding any individual securities is not intended to be used to form any basis upon which an investment decision is to be made. The information contained in this document, including any data, projections and underlying assumptions are based upon certain assumptions and analysis of information available as at the date of this document and reflects prevailing conditions, all of which are accordingly subject to change at any time without notice and The Joyful Investors is under no obligation to notify you of any of these changes.

· · ·

Have you enjoyed this article? We’d be grateful if you would share this useful content to your friends who may benefit from it as well.