Kathy

in Memos & Musings · 6 min read

Investors can celebrate the end of 2023 as the S&P 500 concludes the year with a remarkable 24% gain, and the Dow achieves near-record highs. The optimism is fueled by factors such as alleviating inflation, a resilient economy, and the anticipation of lower interest rates, especially during the final two months of the year.

On the final trading day of 2023, the benchmark S&P 500 experienced a slight decline, yet it wrapped up the year with an impressive 24.2% increase. The Dow Jones Industrial Average recorded a notable 13% rise, while the Nasdaq surged by 43%, driven by substantial gains in major technology firms like Nvidia, Amazon, and Microsoft.

The momentum, started in November, played a role in diversifying market gains beyond the prominent technology companies. Additionally, investor confidence was boosted by the Federal Reserve’s December announcement outlining its intention to implement three interest rate cuts in 2024.

The current sentiment in the stock market suggests confidence in the Federal Reserve’s ability to orchestrate a “soft landing.” This scenario involves the economy slowing down sufficiently to curb high inflation without plunging into a recession. Consequently, investors are anticipating the Fed to initiate rate cuts as early as March.

Portfolio Performance

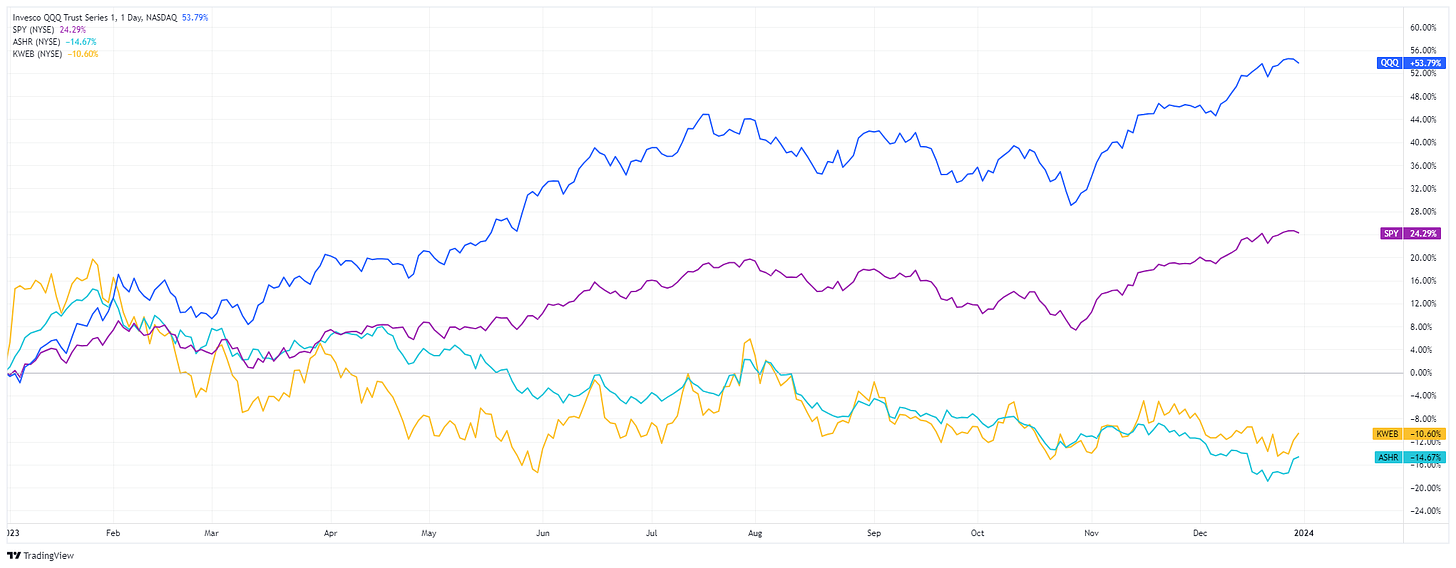

During the close of the market for this year, the SPDR S&P 500 ETF (SPY) was up by 24% for 2023. Whereas for Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR) it was down by about 15%. For our Moneyball growth investing portfolio consisting of both US and China stocks, was up by 70% during this same period.

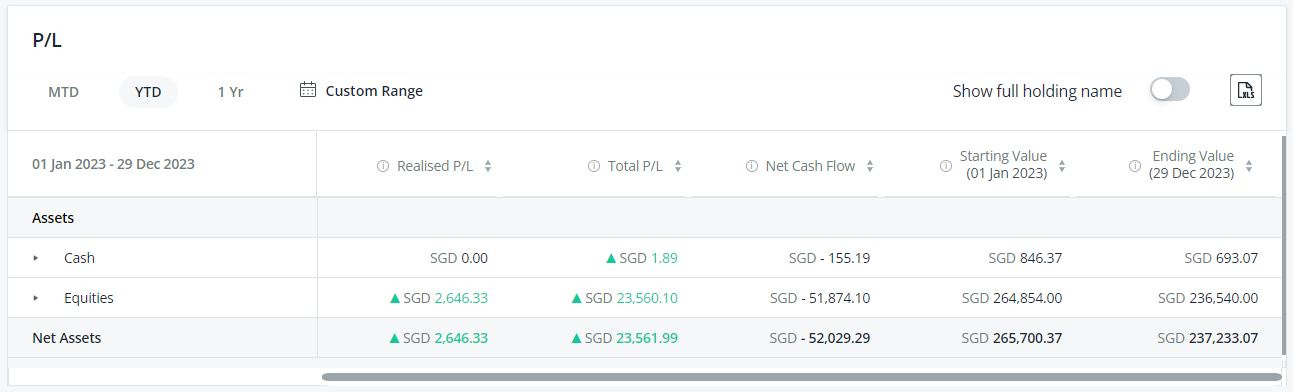

The screenshot below was captured from one of our growth portfolios for US/China stocks in TD Ameritrade on the last trading day of 2023.

Our growth portfolio for US/China is up by 69.9% or 155K USD from the original amount of 220K at the start of 2023

YTD Performance of the major US/China indices

Back home, we also took a quick look at our Singapore REITs portfolio and saw that it closed out with an 8.8% return for the year. On the other hand, many REITs ETFs concluded the year with nearly breaking even or experiencing slight losses.

As most of us remember, things took a turn for the better with the sharp rally on December 14th for the Singapore REITs. Back then, we took the opportunity to keep a screenshot of our performance to examine how our portfolio fared year to date, while SREITs, in general, have not meaningfully reversed back up. We felt that it was an important juncture to take stock of things before the bull markets become more obvious.

We want to illustrate the fact that the profits that can be made during the good times are actually less important than the small profits/losses that happen during the bad times. For example, at the point in time while our dividend portfolio was still in positive territory (albeit a mere 2%), the overall REITs ETFs such as NikkoAM-StraitsTrading Asia ex Japan REIT ETF (CFA) and CSOP iEdge S-REIT Leaders Index ETF (SRT) were still down by 8% and 4%, respectively.

Generating profits in bullish markets is relatively straightforward, but navigating adverse market conditions confidently demands a higher level of skill and caution, well before the markets show signs of recovery. The way to make outsized gains during good times is the ability to be able to take a relatively smaller loss, if at all, during significant pullbacks.

It is also noteworthy that we had only a very marginal top-up of ~7k to this account, indicating that our REITs portfolio did not outperform simply because of a sudden influx of money to pump in during the big crash to average down costs significantly.

Instead, the only reason for this portfolio to hold up well was through mindful purchases and divestments of individual REITs and with the rotation of the same capital we had. As always, we employ our Moneyball Investing methodology to rotate around our existing funds from fundamentally sound REITs to what we see as being overbought, to those that are oversold based on our technical analysis.

Generating good returns doesn’t necessarily hinge on a bullish market or involve employing options strategies, especially since they aren’t accessible for the Singapore markets. Nor does one need to have deep pockets to top up the account during crashes, which we didn’t do so. Instead, strategically selecting robust REITs and executing well-informed buy or sell decisions based on technical analysis can potentially outshine the market, no matter which way the market is swinging as we shared in a webinar with ShareInvestor recently too.

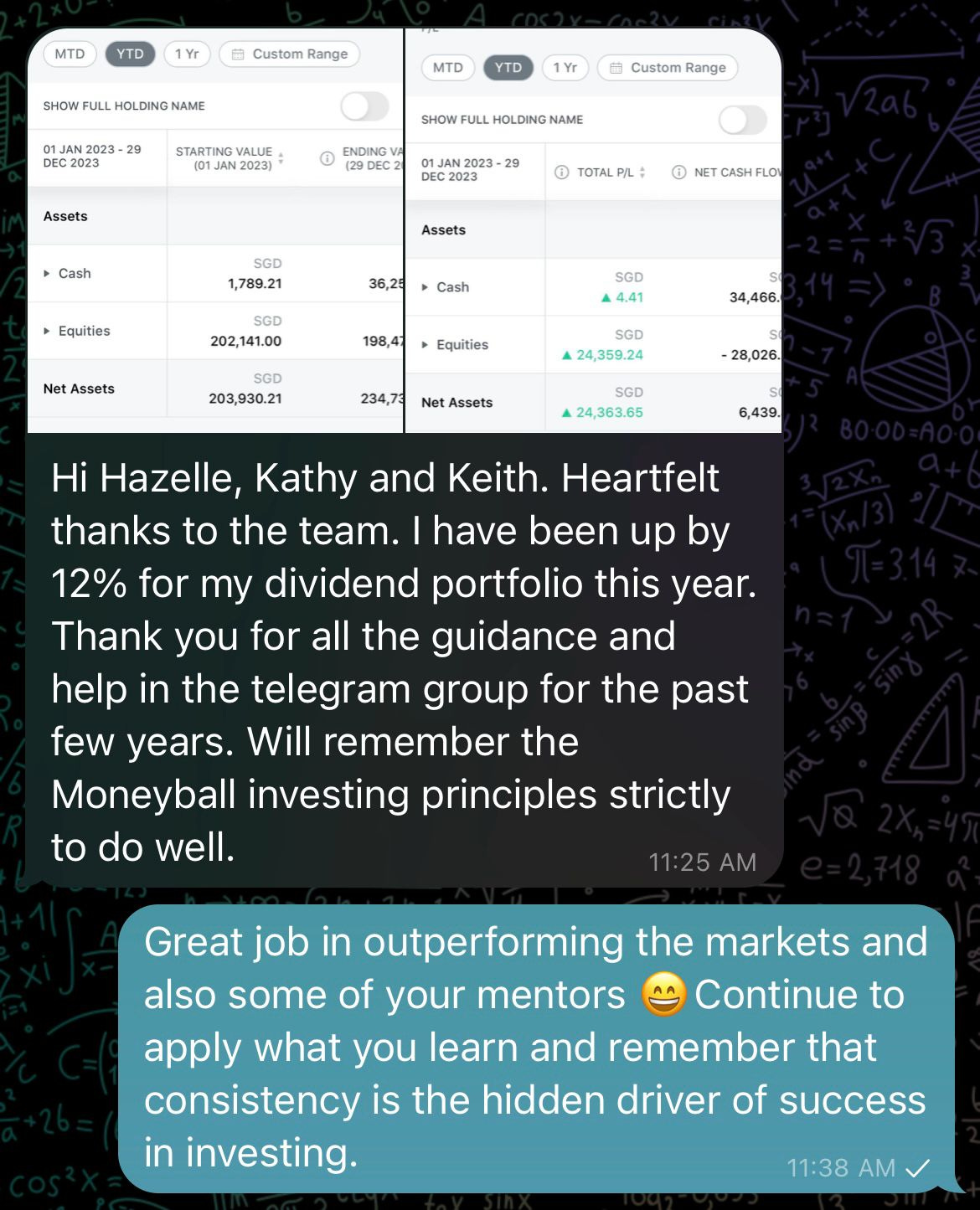

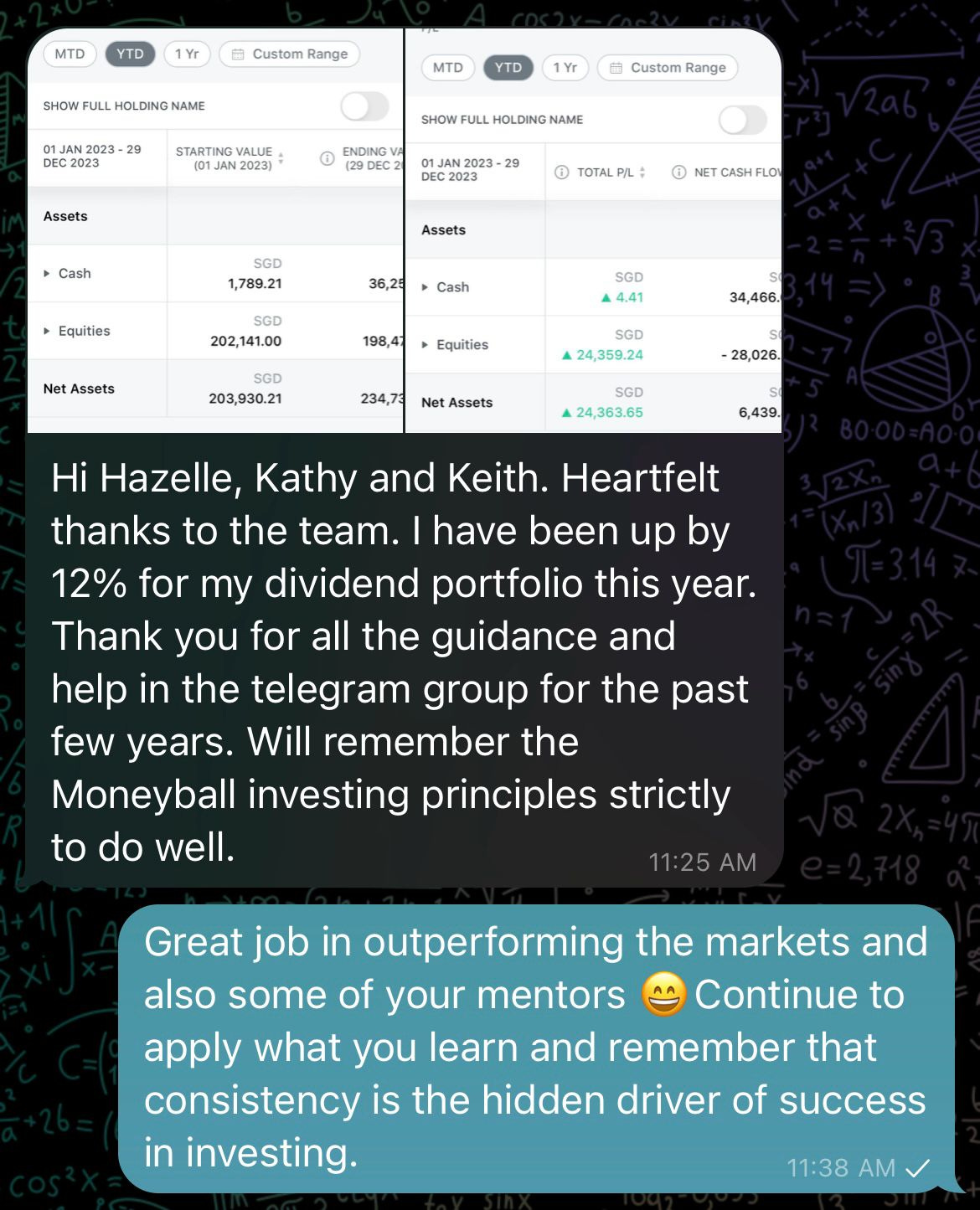

We were also very heartened to get messages from some of our students during the end of the year sharing the good progress they made. One of our mentees who joined our program in late 2022 saw an 11% market and TJI beating performance for his REITs portfolio for the year. It is entirely possible for our mentees to outperform us because of the different concentration of each stocks that one is holding. So long as one learns how to pick the winning stocks at great prices most of the time and develop their edge, it will only be a matter of time for anyone to do well in the financial markets.

We shared previously in our latest Q3 2023 portfolio update that during bad times, if we are able to mitigate our drawdowns, we would have position our portfolio to potentially achieve greater gains when the market eventually rebounds.

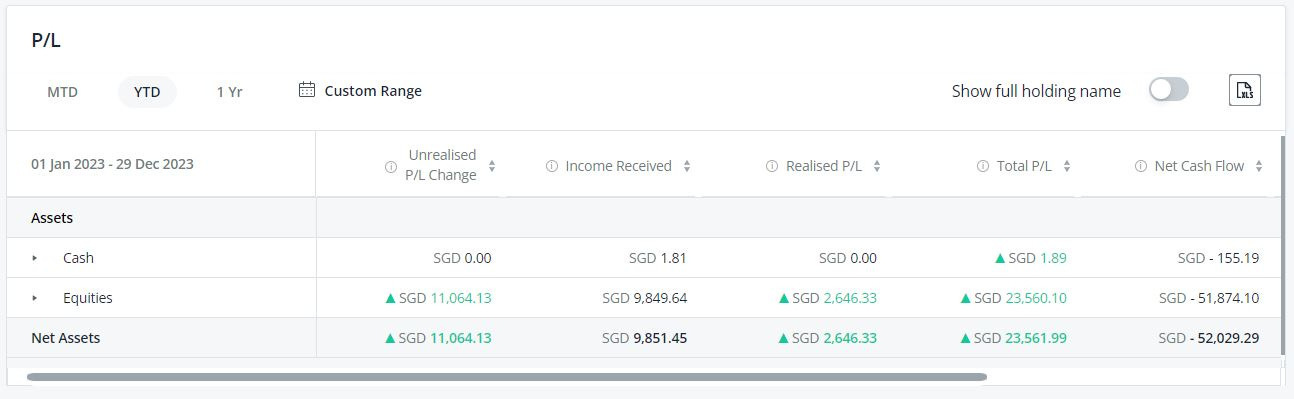

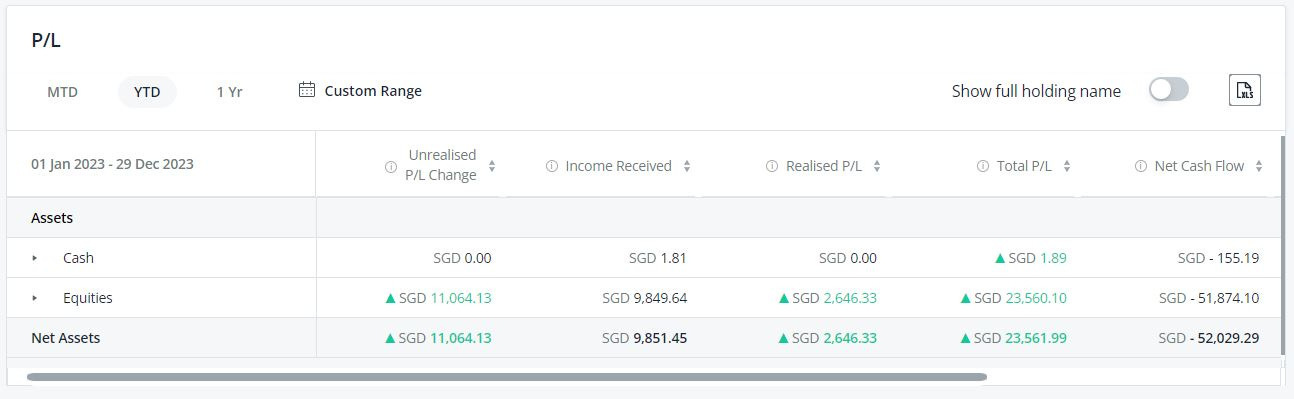

YTD Performance of our SREITs-dividend portfolio

Our SREITs portfolio is up by 8.8% for the year 2023.

YTD Performance of SREITs ETF

Also joyful to see that our community and mentees are doing just as well and huat together 😆

You can make your own play

Whether the markets are good or bad is not that important. What is important is that can you only make money in very good times or can you still fare reasonably well over the long term even if the market goes sideways or crashes in the mean time? The markets can be chaotic, but our results don’t necessarily have to be so sometimes.

This is an interesting year where our Moneyball investing methodology is once again put to the test. We have the US markets doing reasonably well, but the SREITs going pretty sideways generally and the China markets still underperforming. Regardless of the respective benchmarks with the diverse market conditions, we managed to outperform in both our dividend and growth portfolio by a good margin. It is a testament to illustrate that with a suitable investing methodology that takes care asset allocation, position sizing, one can still fared reasonably fine.

An excerpt from our July 2023 Portfolio Updates

In an earlier post in our public Telegram channel, we highlighted the usual mainstream recommendation for handling volatility, which typically involves diversification, dollar cost averaging or adopting a stance of indifference towards market fluctuations. This same type of advice was given for the Singapore REITs during the period of uncertainty.

The problem with such traditional guidance tends to err on the side of caution, offering a reliable but not particularly transformative approach to achieving substantial gains. The notion of averaging down in the face of adversity may seem appealing in theory, but it’s essential to acknowledge that, conversely, averaging up will also be the case during a recovery, leading to an ultimately higher average cost. This is not meant to downplay the pros of dollar-cost averaging but rather to recognize that it comes with its own set of drawbacks.

It is a reasonable advice and can be effective for investors with extended investment horizons. However, to get outsized returns or to even achieve Financial Independence, Retire Early (FIRE) requires an investment approach that seeks outsized returns and consistently relies on possessing a competitive edge in the market.

One such approach for investors to consider is to employ technical analysis. It might be more purposeful to decide when to stagger your purchases more progressively, when to take a slightly bigger leap and when to stop even buying or divest partially or fully when the time calls for it. We have found it to be particular useful to think in terms of risk to reward especially in an asset class like REITs.

At the end of the day, your investment performance boils down to how much you make when you are right and how much you lose when you are wrong.

Don’t sell in panic after a bad news (or even with a slew of bad news)

Stick to your guns and your methodology. We cannot emphasize this enough.

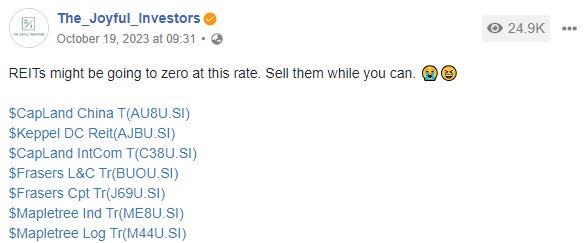

This video shares with you some of our thought process with how we approach the Singapore REITs while the mainstream media are still painting the “watch and wait” mindset. This was expected with what we have seen happened to the Singapore REITs in earlier this year. In good fun, we had a series of posts on InvestingNote to demonstrate how most investors are feeling about the Singapore REITs before its recovery. We first shared that REITs are going to be quite worthless, that REITs are not going to recover anytime soon and that the subsequent REITs rally was a bull trap. But with each post, we accompanied more screenshots of us simply buying more into the Singapore REITs aggressively. 😆

When most people see risk, we see adrenalin.

What should you do when a good REIT that you believe in becomes out of favor? You should have the gumption to add if you have the bullets and not break a sweat. Don’t let a good crash come to waste if you have conviction in the it and have a good investment time horizon.

Likewise we did the same for the US stocks. For example, Estée Lauder was down almost 20% after it’s profit outlook fell below it’s forecast. We added more positions following the big drop that same night. This was against the backdrop of all the doom and gloom coverage of the stock.

We recalled this with we what did with Facebook or META Platforms (META) in 2022 when the sentiments were really bearish as well. It can take a good stock a couple of years for them to return to its former high and is not unusual. As an investor, do you have that amount and length of conviction to make such outsized gains in these unloved stocks by accumulating them at depressed prices? The truth is that it may not already be easy to be holding them, let alone double down on them during those times.

Fast forward to today, now that META is at $350-ish, would you have loved to, for example buy META at $100-$200 with those huge pullbacks, as opposed to buying at $300 back then without META crashing that much? You probably have the answer. As long as you have a reasonably long enough time horizon, you would be in joy to be able to accumulate at those huge bargains. Money is actually made without you realizing when it happens.

Investors must have reasonable expectations to understand that good companies do not mean that they are any less volatile than the average company nor that they will beat earnings 100% of the time. Dips or corrections following earnings, company or industry-specific events are nothing to be surprised about. And it is also expected that market noises such as analyst reports or commentary will start coming why you should be selling a particular stock following that.

Earlier this year, McDonald’s stock had faced recent challenges, with a 17% decline from its peak. This was due to various factors, including challenges in the consumer market, an unexpected increase in royalty fees, and worries that weight-loss medications such as Wegovy might reduce demand for food companies. McDonald’s was one of the heaviest positions we went into in October this year when it was unloved by investors.

We saw the same with Autodesk (ADSK) in late November as well. Financial journalist were just as clueless as to why the stock will move in any given direction. They will base on the direction of the market and justify why the price rose or fell alongside their analysis. Everything sounds about right until you realize that one moment they can give you several reasons why it rose and the very next moment why it should fall instead.

Once we go into a stock after we have done our home work, our job is mostly done even if it continues to go sideways and retrace further. While not impossible, it is rare to have the fundamentals deteriorating quickly within a short span of time. The worst thing that an investor can do to his or her portfolio is to “paper hand” easily once things appear gloomy at the first instance. 🧻✋🏽

Always stay committed to your own strategies and tune out from those market noises. ⚔️

Concluding thoughts

At this juncture, we would be expecting most of the extended runs of these REITs or in the US tech sections to probably take a breather or so as we start the new year. Some of them have been pretty short-term overbought, and it would be entirely customary from a technical perspective to see some pullbacks. For those who are looking to accumulate further, exercise patience and wait for those opportunities when they eventually present themselves. 💪🏽

The recent market pullback and crashes will not be the last and it is important for investors who are seeking FIRE to adopt a more active approach towards investing to seek out better gains. To adopt a better risk to reward approach, one of our game plan in 2024 is to continue to use the suitable options strategies to build our Moneyball investing portfolio in particular for the US markets. 🔥

We will also be sharing in greater details of our house view of the financial markets for US, China and Singapore in our upcoming Market Outlook 2024 event at PhillipCapital, Raffles City Tower on January 13th 2024. We are also pleased to share that UOB Asset Management (UOBAM) will be joining us together to provide insights on the opportunities that Singapore has in a “higher-for-longer” regime and share the potential solutions which investors could capitalise on. For those of you who have registered for the event, we look forward to having you with us soon.

With that, we wish everyone good health and good wealth in this new year. 🎉

About Kathy

Co-Founder of The Joyful Investors and Co-CIO of InvestingNote Portfolio. I graduated with a degree in Economics in National University of Singapore (NUS). My previous experience with traders at the Merrill Lynch enable me to realize many counter-intuitive truths about how the financial markets work and to uncover the challenges faced by many new investors. Investing can be astoundingly simple, and my goal is to make financial education accessible and easy to understand for everyone.

Important Information

This document is for information only and does not constitute an offer or solicitation nor be construed as a recommendation to buy or sell any of the investments mentioned. Neither The Joyful Investors Pte. Ltd. (“The Joyful Investors”) nor any of its officers or employees accepts any liability whatsoever for any loss arising from any use of this publication or its contents. The views expressed are solely the opinions of the author as of the date of this document and are subject to change based on market and other conditions.

The information provided regarding any individual securities is not intended to be used to form any basis upon which an investment decision is to be made. The information contained in this document, including any data, projections and underlying assumptions are based upon certain assumptions and analysis of information available as at the date of this document and reflects prevailing conditions, all of which are accordingly subject to change at any time without notice and The Joyful Investors is under no obligation to notify you of any of these changes.

· · ·

Have you enjoyed this article? We’d be grateful if you would share this useful content to your friends who may benefit from it as well.