Dollar cost averaging is the strategy to invest your money by a fixed amount over fixed regular intervals. You may have heard about this term called ‘regular savings plan’. Though termed as a savings plan, it is actually an investment plan put up by various brokerage firms and banks offering people a disciplined means of putting a fixed amount of money at regular intervals into investments. These regular savings plans are based on the concept of dollar cost averaging to hedge against market volatility to reduce the risk of investment. Let’s take a look at how it works through an example.

DCA works out to be beneficial for you

In this scenario, you have set aside a sum of $400 for your investment budget. The current market price of Stock A is $100. If you have adopted the lump sum investing strategy, you would then invest a single sum of $400 to purchase 4 units of Stock A in the first month.

However, if you have adopted the DCA strategy to put in fixed amount of money every month to buy Stock A, you could have purchased 1 unit of Stock A at $100 in the 1st month, 1.25 units at $80 in the 2nd month, 1.11 units at $90 in the 3rd month and 0.91 unit at $110 in the 4th month.

Comparing both strategies, we will realise that the lump sum investing approach allows you to purchase 4 units of Stock A at an average cost of $100 per unit. On the other hand, the DCA strategy allows you to purchase 4.27 units of Stock A at an average cost of $94 per unit. You see, DCA in this example seems to allow you to reduce the average cost of investing in a particular security thereby improving your returns.

DCA turns out to be disadvantageous to you

There is in fact a flaw in the above example. Very often, people only show the perfect scenario of how DCA will play out to be beneficial for you. That is, how DCA helps when the price of the shares fall.

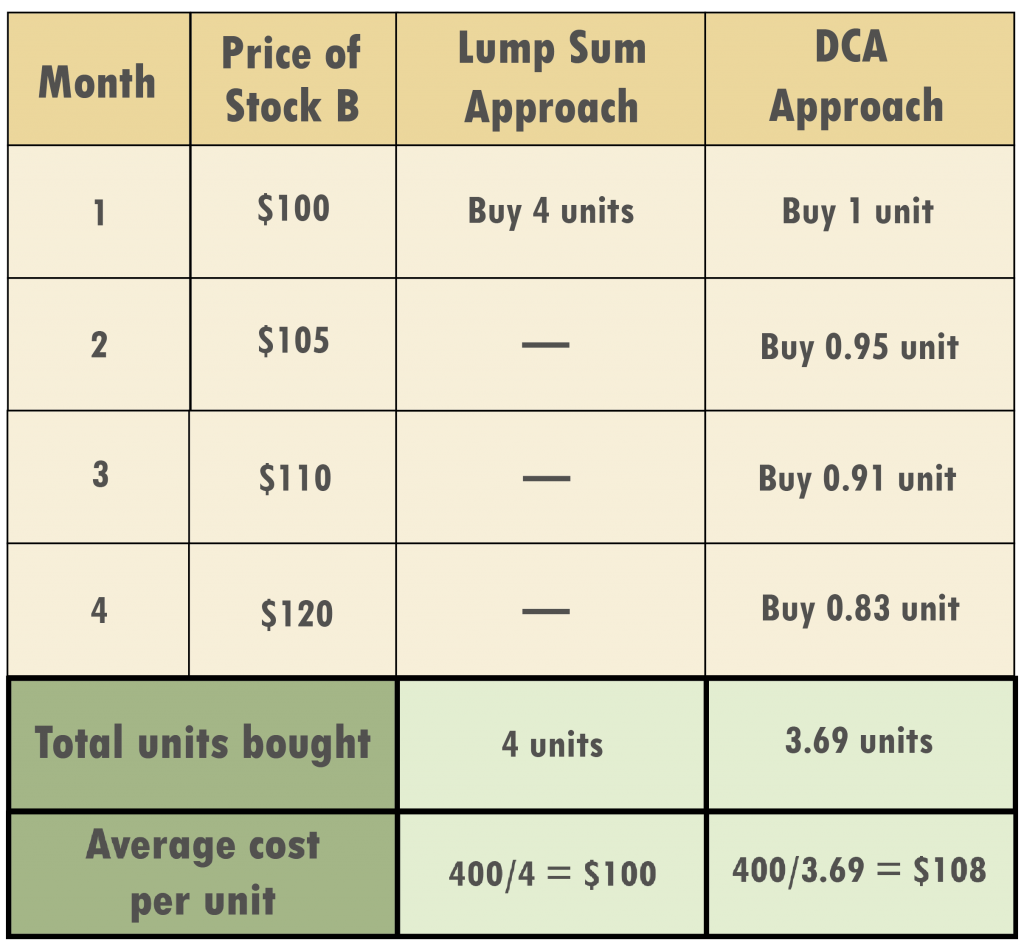

What happens if the share prices are rallying up on an uptrend? Let us look at this example here.

If prices of Stock B increase every month to $120 by the 4th month, you can only purchase 3.69 units of Stock B at an average cost of $108 using DCA. Hence, you are worse off than doing the investment through the lump sum strategy.

This is why even though the DCA strategy encourages easy and disciplined investment plans, it may not be the best strategy that results in the best returns. I personally prefer to maintain more autonomy in my investing plan instead of blindly throwing in my money at regular intervals by disregarding if the security is currently priced fairly. Understanding the valuation of a stock is essential as we do not want to risk buying stocks that are overpriced and be faced with the likelihood that prices may fall any time. I strongly believe in the importance of performing the fundamental and technical analysis by analysing stock chart patterns and candlesticks to enter the market at the right price.

Dollar value averaging

Instead of adopting the DCA strategy, I prefer to use the dollar value averaging strategy. Dollar value averaging focuses on buying more positions of a security when the price falls and taking up fewer positions of a security when the price increases.

How many times have you bought a stock thinking that you have gotten it at a good price, only to see the price continuing to drop further over the next few weeks? Did you think to yourself, “I should have waited a little bit more!”?

With dollar value averaging, you would be able to capitalise on the temporary price corrections by adding in positions at different price levels in different periods. You have full autonomy to decide on how you want to apportion your capital to enter at different price points instead of sticking to a rigid plan of putting in a fixed amount of money at regular intervals of time.

Some new investors may also be scared off by the temporary decrease in share prices and their paper losses and end up selling their positions, only to convert these paper losses into real losses.

Putting things into perspective

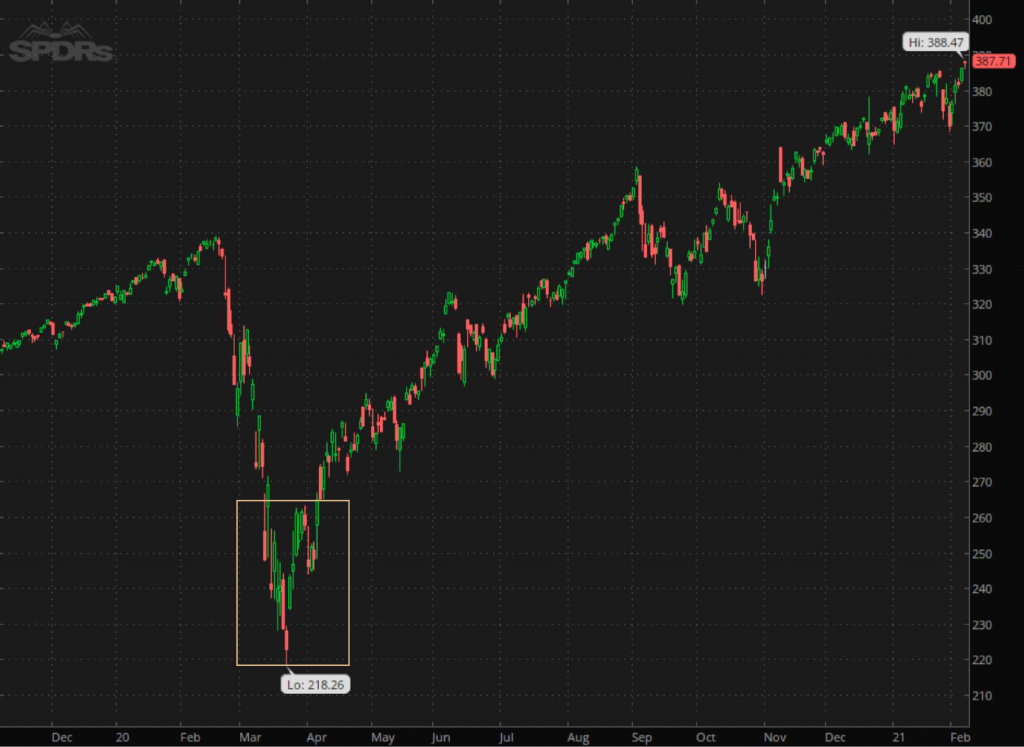

Let’s look at the SPY ETF to understand this further. If you look at the prices at the start of July 2019, I would not have entered a position as the prices were at all time high at that time. If I had been disciplined and patient, I would be able to add some positions at lower prices when there was a price correction in August 2019 using the dollar value averaging approach.

Advocates for DCA would usually oppose the idea of lump sum investing. But I personally do not condemn lump sum investing and I find that it is a matter of time and situation to decide on the most appropriate strategy to use.

Looking back at the SPY ETF price chart, I will have either used the lump sum investing strategy or dollar value averaging approach to enter positions when the price crashed to its lowest in end March 2020 to early April 2020 because prices have already declined by a considerable amount from its usual level.

Having said that, always remember that you must have first done your due diligence to pick up good stocks that are worth investing in. Do not fall into value traps. In Singapore, the SPH stock is one good example. It has been on a downtrend since 2015. Do not fall into the value trap by adding more positions just because you see the share prices decreasing. Always remember to check if the businesses are fundamentally strong before adding the stocks into your watchlist. Imagine what would have happened to your portfolio if you have been doing DCA since then.

I would not say DCA strategy is a totally bad strategy. It is a strategy that works well for investors who require a more disciplined approach to start investing. After all, taking action is nonetheless better than not taking action or stopping half way. But personally, I prefer to use the dollar value averaging approach or sometimes I do adopt lump sum strategy as well. It really depends on the situation to pick the strategy that is the most appropriate. Ultimately, if you are picking the good businesses to buy, dollar value averaging is just an icing to the cake. Even if you adopted a lump sum approach on a good stock at a good price, you will eventually see your returns in the long term.