In Part 1 of the blog post series, we shared about the various investment strategies that investors commonly employ to determine what to buy and when to buy. In addition, we also shared about the pros and cons of each strategy as well as which ones we personally adopt.

You might be asking, which exactly is the best strategy to adopt for yourself?

For instance, investors who faced setbacks with growth stocks during the tech bubble shifted towards relying on dividends to ensure steadiness.

Likewise, those who concentrated on dividends for a significant duration and encountered declines in their capital, have now embraced the potential of growth-oriented investments.

Alternatively, those who became disillusioned with both growth and dividend strategies might perceive crash investing as the most secure option because they are surely not buying at high prices.

Hence, we can have one group of investors telling you that dividend investing is the best while another group of investors supporting growth investing and yet another group of investors who believed in contrarian investing. Who is right and who is wrong?

The issue lies in people’s tendency to analyze problems based solely on their own past experiences, rather than considering the bigger picture. This can be compared to the blind men and the elephant parable where investors rely solely on their own experiences to make judgments and decisions. While experience often appears to be a dependable guide, it can occasionally mislead us instead of making us wiser.

Despite this, many of us persist in believing that we have accurately extracted the right insights from our personal experiences and the stories of others. That’s why investors are always searching for the next holy grail and the best investing strategy.

Ask the right questions to get the right answers

- What is your investment objective and which instrument/market is suitable?

First things first, we don’t talk about which is the best investing strategy first. Hold your horses, you will understand in a short while. Before we even talk about the investing strategy, you must first know why you are on the journey of investing.

Investing is a needs-based process. For example, are you investing to FIRE, or to retire early? Or are you investing for the purpose of seeking stability in consistent cashflow because you are now nearing retirement? Or are you doing this just for speculation? For punting?

Instead of asking what is the best investing strategy, the first question you should be asking yourself is, what is your financial objective for investing? Given that, you can then move on to identify which is a good market or a suitable instrument to invest in that has a comparative advantage to you.

Perhaps we can explain it in another way using an analogy. Let’s say you are going on a vacation to Phuket. If your goal is to reach Phuket in the fastest manner, then to achieve this goal, the best mode of transport will be to take a plane. However, if your goal is to enjoy a nice road trip, you can drive there.

Unfortunately, many individual investors fail to grasp this concept. Now what do we mean by this? For example, if you are seeking consistent dividends, being a Singaporean, there is little reason to focus on U.S stocks that have a 30% withholding tax. Instead, we can focus more on the Singapore REITs.

Another example. If you are seeking capital appreciation, you might have a better chance and a bigger pool of options to look at with the U.S markets, as opposed to the small handful that we have in Singapore.

Or if your goal is strictly for capital protection, then you can simply just look at fixed deposits or T-bills.

Once you are clear of your investing objective, you know which instruments or market to zoom into before you can even talk about any strategy. Get the suitable instrument right first. Diagnose first before you prescribe, like when you visit a doctor.

Which investing strategy can thrive in what you invest in?

Once you are clear of your investing objective and the suitable market and instrument to invest in, we can then identify which investing method is appropriate for the market or for the instrument.

Example: Investing in Singapore REITs for consistent cashflows

Let’s use the goal of investing for consistent cashflow and dividends as an illustration. In the Singapore context, we can focus more on investing in the Singapore REITs.

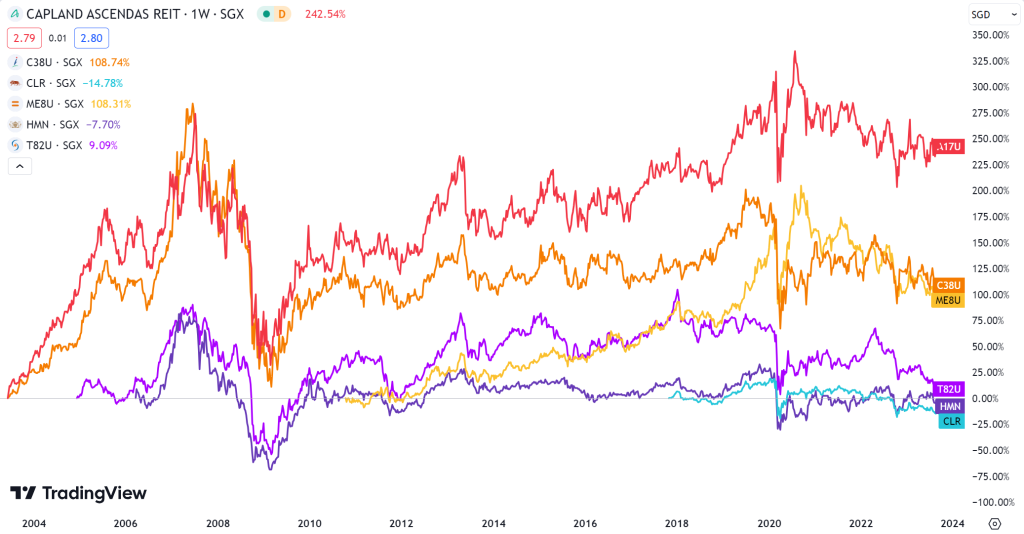

There are about 40 REITs listed on the SGX, but are all 40 of them doing well? The answer is, no! Only the best of the breed is doing well. This means that the investing strategy of Fundamental Analysis (FA) is crucial so that you are investing only in those REITs that are financially stable and sound.

On top of Fundamental Analysis, Technical Analysis (TA) is also important in the context of investing in S-REITs. The reason is that many of the S-REITs are cyclical in nature, hence buying them at the appropriate price levels is important. You do not want to end up buying at the top of the cycle just to go through the drawdowns in terms of capital losses. Dividend investors may not feel the pinch when they are still holding on the REITs and receiving the dividends, but at some point in time when you need to liquidate the REIT investments, you will suffer from the realised capital losses.

Conventional advice has been that investors should adopt a hands-off approach such as to do a Dollar Cost Averaging strategy. Considering the largely cyclical price movements of Singapore REITs, dollar cost averaging may not be as useful to be buying on the rally up.

Therefore, both FA and TA are important strategies to adopt in this context of investing in Singapore REITs for consistent dividends. This is the thought process to determine which investing strategies are most suitable based on your investment objective and the market or instrument that you are going to invest in.

Example: Investing in index ETFs such as ES3 and SPY

For an investor who invests in index ETFs, the conventional advice would be to simply do DCA on the index ETFs. The problem with such an advice is that it is simply too generic. For the purpose of comparison, let us take a look at 2 of the commonly invested index ETFs: ES3 which tracks the Singapore Straits Times Index and SPY which tracks the U.S S&P 500 Index.

The composition of the Straits Times Index is mainly made up of financial and real estate sectors. Given such nature, it is no surprise that the ES3 ETF is highly cyclical. As such, the DCA strategy is not the most ideal strategy to employ when investing in ES3.

On the other hand, an investor who invests into the SPY ETF for the goal of capital appreciation, may find that DCA works well in his case. This is because the S&P 500 is predominantly made up of growth companies that are poised to do well over the long term, thus the SPY ETF has a nice price uptrend over the long term. For a general upward trending market over the very long term, dollar cost averaging can work its magic.

So there you have two investors using the same DCA strategy, but one gets “lucky” in the U.S markets while the other doesn’t in the Singapore market. That’s simply because DCA into a suitable index ETF that goes up in the long term can work, but not necessarily for the cyclical ones we have like the STI.

Engaging in a debate solely about the viability of an investing strategy, without any context, serves little purpose. We cannot make a sweeping statement to say DCA is surely not workable or say that it is definitely workable and that even GOD can’t beat DCA. The truth is usually somewhere in between.

The problem is that investors tend to overvalue their own experience to decide if a strategy is good. Just like in the example of using DCA for ES3 and SPY ETF, most investors will condemn the first one and celebrate the second one, which totally disregards the underlying causes. This is known as the outcome bias where we tend to judge a decision based on the outcome rather than the quality of the decision when it was made. That is why investors are always on the mission of seeking the holy grail and the best investing strategy but fails to find one.

In a nutshell

To sum up, it is important to first establish your investment objective. Subsequently, you can ascertain which specific instrument or market merits your attention before you can identify which investing strategy aligns most effectively. When you have an overarching picture of what you want to achieve, the way to build wealth or achieve financial freedom can be very systematic.

If your goal is to achieve Financial Independence, Retire Early (FIRE) within a shorter span of 10-15 years, employing strategies that offer a competitive edge to outperform the markets becomes crucial for attaining higher risk-adjusted returns in less time.

Much like water, your investment strategy should fluidly adapt to circumstances. As Bruce Lee aptly stated, “Adapt what is useful, reject what is useless, and add what is specifically your own.” The most accomplished investors tend to extract insights from various investment strategies and create their own unique approach.