Kathy

in Memos & Musings · 5 min read

I had the chance to reread one of the best selling classic personal finance books, “Your Money Or Your Life” by Vicki Robin during my weekend getaway at Kuantan. Here are some TL:DR for those of you who wish to know what the book covers.

What is the book about?

“Your Money or Your Life” by Vicki Robin is a self-help book that offers a step-by-step program for achieving financial independence and transforming your relationship with money. The book advocates for a frugal lifestyle, emphasizing the importance of saving money, reducing expenses, and investing wisely to build wealth and achieve financial freedom.

The book also emphasizes the importance of living a fulfilling life by aligning your spending with your values and focusing on activities that bring you joy and fulfillment, rather than simply accumulating more money and possessions.

Overall, Your Money or Your Life is a comprehensive guide for anyone who wants to take control of their finances, reduce their reliance on paid work, and live a more fulfilling and purposeful life.

Here are some takeaways and possible learning points:

Takeaway #1

Money is a finite resource.

The book introduces the concept of the “real hourly wage,” which calculates the amount of money you earn after accounting for all expenses associated with your job. By taking into account the time and energy you spend to earn money, you can assess the true cost of each expense in terms of the hours of your life energy required to earn the money for it.

Takeaway #2

Attaining financial independence is possible.

The book provides a roadmap for achieving financial independence by reducing your expenses and increasing your savings rate. By adopting a frugal lifestyle and investing your money wisely, you can eventually reach a point where you no longer need to work for a living.

Takeaway #3

Tracking your spending is essential.

The authors emphasize the importance of tracking your spending in order to understand where your money is going and make changes as necessary. By keeping track of every penny you spend, you can identify areas where you’re overspending and redirect your resources towards more fulfilling pursuits.

Takeaway #4

Mindful consumption leads to a more fulfilling life.

The book encourages readers to question the consumerist culture that promotes materialism and overconsumption. By focusing on your values and spending your money on things that truly matter to you, you can lead a more meaningful and fulfilling life.

Takeaway #5

Time is your most valuable resource.

Ultimately, the book argues that time is our most valuable resource, and that we should use our money in ways that allow us to maximize our time and live our best lives. By prioritizing experiences over possessions and focusing on activities that bring us joy and fulfillment, we can create a life that truly reflects our values and aspirations.

In summary, I also have some additional thoughts that you may benefit from:

Simply live below your means

Honestly I personally haven’t been tracking my expenses since my late twenties. It is too much work. And I know it is definitely enough. I think my attitude towards expenditure is much more relaxed ever since and gives me and my loved ones a better quality of life. I do not belong to the camp who believes that you have to be extremely frugal in order to attain financial freedom. That said, I don’t go to restaurants every other day or spend extravagantly. But being able to not always look at the menu when ordering your food and to travel occasionally to nice places are a nice luxury that I’m happy to allow myself.

Admittedly, I used to be very mindful of my personal expenses in the first five years of my working life until I realized that I was much more thrifty and careful than most people out there. So once I knew I had a good savings habit, I rather invest my time in learning how to grow my wealth instead of spending time to track my expenses. The amount of money one can save is limited but there is no cap to how much you can get by the value of the results you create.

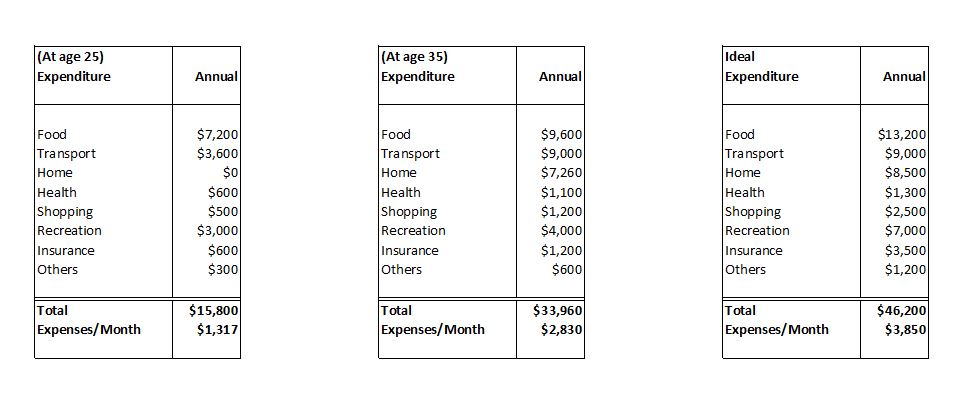

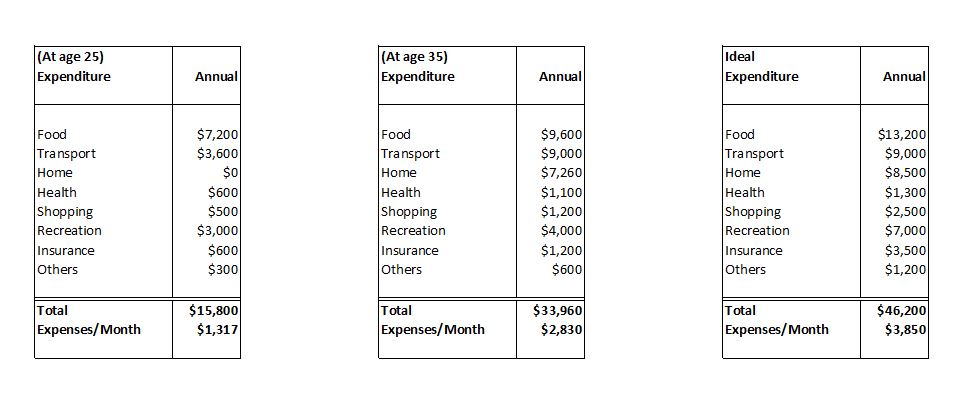

One important tip is to always live below your means. Here is a table where I worked out a rough estimate of my expenses that I would likely have incurred when I was at age 25 and at age 35. I am glad to say that I have been pretty disciplined and adapted my expenditure according to my income overtime.

Improving my standard of living within my means overtime.

Once you can conclude that you are someone who is fairly disciplined and pretty mindful with your spending you should no longer be so much fixated about having a budget because it focuses on a mindset of scarcity and takes up a lot of mental energy. Instead adopt a growth mindset that will reframe your approach to challenges and seeks to develop your skills that can propel you to even greater heights.

Focus on the big money

Achieving financial independence earlier is really about increasing your savings rate. But like most traditional financial advice, the focus in the book seems to be more of cutting expenses and living a simpler, more frugal lifestyle. There is no doubt that consumerism and materialism are traps that keep us stuck in a cycle of working and spending. I would agree that it is great to question your assumptions about what you really need and want in life, and to focus on the experiences and activities that bring you the most joy and fulfillment.

However there are examples in the book that go on to suggest if we might try to DIY skill-specific tasks that might help us to save money such as fixing a plumbing leak, building a bookshelf on our own and being a barber for our family members. To that I would say that if one is to spend so much time learning all these other skill sets, he would have no time or energy left to think about his finances or investments. This is especially so when you ask yourself how many times you need to fix a leaking pipe or build your own furniture. Haircuts can be more frequent but you have to ask yourself if your family members are comfortable with the end result just to save that amount of money. The amount of time spent learning may not justify the cost savings, even if the results are satisfactory. This is because one can probably earn much more by doing the job that they are already competent in to begin with.

Hence, I am of the opinion that trimming down on your expenses can only take you that far. Once that exercise is done, much of our mental energy should be directed to try to find ways to expand our income and earning potential.

Spending time on upskilling yourself and staying more relevant to draw a higher paycheck can be a viable way to improve your savings rate. Or if you own a business, think of how else you can add value to your customers and improve your bottom line.

If there is anything I learn from doing financial advisory for the last 17 years with my private clients, successful and wealthy people always focus on the bigger money. They didn’t save their way to riches. It is equally tiring to squeeze pennies out of the remaining pennies as opposed to putting in the effort to better yourself or your business but the upside is tremendous for the latter.

Investing in yourself

Lastly I would say that investing in yourself and your personal growth is just as important as investing in your financial future. I agree with the authors that it is equally important to pursue education, personal development, and meaningful work that aligns with your values and purpose.

The ultimate goal of achieving financial independence is to have the freedom to live a fulfilling and purposeful life, rather than being tied to a job or career out of necessity. All in all, this book offers a roadmap for achieving this freedom, through intentional spending, saving, and investing.

Joyful Reviews is a series by The Joyful Investors where we will be sharing our thoughts and insights on books or films that focus on personal development and investing knowledge to help everyone become a more confident and thoughtful investor. We believe that continuous education and self-improvement are key to success in any area of life, and especially in the world of investing.

About Kathy

Co-Founder of The Joyful Investors and Co-CIO of InvestingNote Portfolio. I graduated with a degree in Economics in National University of Singapore (NUS). My previous experience with traders at the Merrill Lynch enable me to realize many counter-intuitive truths about how the financial markets work and to uncover the challenges faced by many new investors. Investing can be astoundingly simple, and my goal is to make financial education accessible and easy to understand for everyone.

Important Information

This document is for information only and does not constitute an offer or solicitation nor be construed as a recommendation to buy or sell any of the investments mentioned. Neither The Joyful Investors Pte. Ltd. (“The Joyful Investors”) nor any of its officers or employees accepts any liability whatsoever for any loss arising from any use of this publication or its contents. The views expressed are solely the opinions of the author as of the date of this document and are subject to change based on market and other conditions.

The information provided regarding any individual securities is not intended to be used to form any basis upon which an investment decision is to be made. The information contained in this document, including any data, projections and underlying assumptions are based upon certain assumptions and analysis of information available as at the date of this document and reflects prevailing conditions, all of which are accordingly subject to change at any time without notice and The Joyful Investors is under no obligation to notify you of any of these changes.

· · ·

Have you enjoyed this article? We’d be grateful if you would share this useful content to your friends who may benefit from it as well.