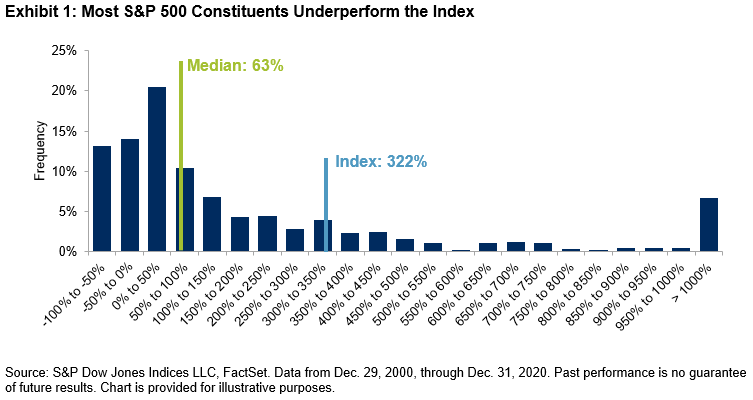

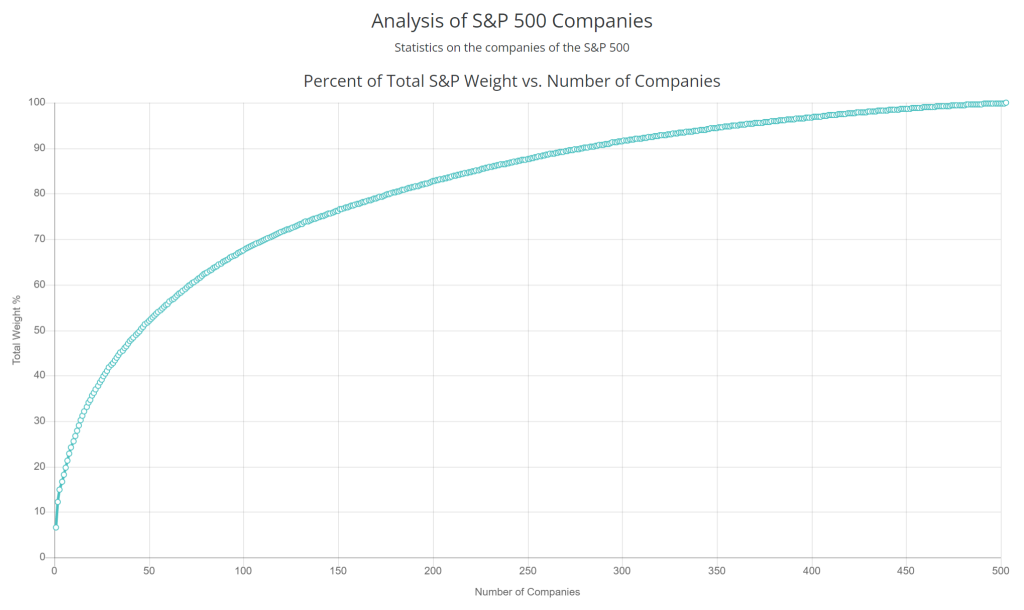

Picking stocks is tough and competitive. The odds are stacked against you. Simply picking a stock out of a hat means you have a 78% chance of underperforming the broad market index. Just like Pareto’s law, a minority of the stocks are responsible for most of the stock market’s gains.

The most talented investors in the world play this game and for a normal retail investor who tries to compete against them, it is like trying to play against the house in a casino. In the stock market, the most successful large investors such as the hedge fund managers, represent the house. Occasionally luck can be your friend, but eventually the house wins.

One of the most talented investors in the world, Ray Dalio, is fond of comparing stock market investing to a poker game and his description brings to mind the old saying that “if you sit down at the poker table and you don’t know who the loser is, then you’re the loser.” If you go into the stock market believing that you have no edge over others or cannot develop your edge, you will be rightly so.

The only way a retail investor will be able to win is to develop an edge over other market participants in his investing strategies. Here are some ways to do it!

1. Look for strong and sound stocks that are beaten down temporarily

Look for strong and sound stocks that are beaten down temporarily and are lurking around with better than 50/50 odds for you. Seek asymmetry. Look for opportunities where the probability and magnitude of an increase in price is greater than the chance and size of a decline. This is possible if you are able to recognize that the business it is still a fundamentally good one and that technically, the stock price is due for a strong rebound.

The way to go about executing this is to screen for businesses which are still growing their revenue and earnings and have a relatively unbreachable moat to keep off its competitors. Think of Adobe for instance.

Then, when their stock prices are beaten down, we can apply technical analysis to identify certain price levels to buy where we have 60/40 or even 70/30 odds of a price rebound, just like some of the analysis that we shared during our Zoom webinars and in our technical analysis workshop.

Once in a blue moon we may possibly have a 90/10 setup! Just like during the lows of March 2020. These are once in a lifetime opportunities. Okay, maybe not once, but 3-5 times in say a 30-year investment horizon.

The important thing is that during the middle of the crisis, ask yourself:

“Do you believe eventually things will get better?”

“Will this crisis be over eventually?”

“What can happen if things become better eventually?”

To take advantage of this asymmetry, we have to learn to look beyond what most investors cannot see now, get to it early, before the recovery is priced in by the majority of the investors. By the time most of them recognize that the recovery is in, it is often the time to lock in some partial profits.

The idea is to change investing from gambling, to a profession. To be able to consistently reap good overall returns because you have an edge.

2. Overweight and underweight in certain sectors of the economy

Tiling the odds in your favour will also mean that at any given time, we may be overweight and underweight in certain sectors of the economy based on whether we believe it is likely to outperform or underperform going forward.

There are 2 parts to this. The first part involves identifying the sector that has been beaten down recently due to temporary headwinds but is poised to rebound.

The second part involves identifying the sector that has been rallying and stock prices are overextended but may face a pullback soon. This is where we may rotate our capital from the sector that may soon underperform to the one that is poised to outperform moving forward. This way we tilt the odds in our favour because we have a position that we believe has better odds of winning.

3. Using options on stocks that are fundamentally sound

Using options on stocks that are fundamentally sound is another way where we can tilt the odds in our favour. Stock prices can only move in 3 directions, either go up or go down or move to the sideways. Hence, we can structure our portfolio setup such that if the stock price goes up, we will profit handsomely from the underlying by having the stock in our portfolio. However, if stock price stays range bound, we can still profit from selling put options to collect the premium. If stock price goes down instead, the option may get assigned and we will buy more shares of the fundamentally sound stock at the price that we are willing to buy. But do note that we only want to apply this strategy on good stocks!

Regardless of which scenario, you have already won as the game starts. That is how you can develop an edge over the majority of the retail investors. This is just one example of how investors can use options to complement their stock portfolio. If you want to learn more in detail on this strategy, you may check out the full option video here.

4. Prudent risk management strategies

You can also learn to tilt the odds in your favour with prudent risk management strategies. This is because we cannot perfectly time the market and there will be a few occasions of sudden huge drawdowns.

John Maynard Keynes, the famous economist, suffered from the market crash in 1929 and was almost wiped out despite having unrivaled access to economic information. Macroeconomics simply don’t work in the stock markets which is driven by irrationality and emotions in the short term.

Similarly there are no indicators that can always reliably predict the next market crash. Technical analysis and fundamental analysis can “fail” on news of negative earnings or black swan events and that can send stock prices plummeting in the short term.

The best safety net we can have is by having proper risk management strategies through position sizing or even option strategies. Ideally most retail investors should seek to have positions in at least 10 stocks or more and no single holding should make up more than 25% of the holdings even if you think that you understand the company really well.

If you are new to investing, for simplicity sake, approximately a cap of 10% for each stock can work as well. We can’t avoid the risk of market decline altogether, but we can mitigate them or limit the losses.

5. Understand the house and other market participants’ motivations

Lastly, to tilt the odds in our favour, we can also understand the house or other market participants’s motivations. Know what drives their behaviour. What are their incentives? What drives the retail investors or big boys from doing what they do so that you can be on the right side. You know that the house wins most of the time. Understand why most retail investors lose and how the house makes them lose. One of which is the taking out of stop losses by the market makers where stock prices are driven lower and bouncing back up quickly in the next few days.

During your investment journey, you will encounter a chunk of methods and perspectives that various investors use in their methodology. These are the different religious factions of the investing world. It can be fundamental analysis, technical analysis, behavioural finance, small cap, growth investing, momentum investing, value investing, market manipulation at play, just to name some.

Each of these segments has their own vote in the market and they move their capital based on what they believe in. You can say that they are simply a result of some self fulfilling prophecy. It is however irrelevant whether you believe in those as well and any disagreement that you have with them does not matter in the financial markets. It doesn’t change the fact that they continue to exist and play a part in the markets. So long it works, it works.

But if you understand why they do what they do, you can better gauge the demand and supply dynamics and collective decisions of the market, which are what drive stock prices.

Just like in the martial arts world, Bruce Lee also practiced various forms. He studied boxing, fencing, Tai Chi, Wing Chun, Judo, Taekwondo and learnt as much as he could. He would analyze other people’s footwork, attacks and blocks. He was probably not an expert in any of them alone, but eventually they all worked to better his personal fighting style.

Similarly to us as an investor, if you find that the methodology used by others are useful, use it yourself, if you find that it does not seem to add value to you, at least you know that it is something being watched by others and something to watch out for. Be relentless at pursuing your edge in the market and you will be there eventually!

We find that investing in the markets is pretty much like competitive sports such as soccer. The most important thing to do is to observe your opponents on the field, it is not to be listening to the commentators or reading the fans’ opinions. We learn to read the game and observe our opponents to know when to attack and when to defend. Similarly in investing, we read the markets, analyse the stock prices and fundamentals of stocks to tell when to buy, when to hold cash, when to deploy the cash and also to put in place risk management strategies.