Hazelle

in Memos & Musings · 4 min read

Microsoft just had its FY23 Q2 earnings released. During the opening bell for the U.S. stock markets, Microsoft stock price went down by more than 4% before clawing back from the steep losses.

Missed expectations on revenue but beat earnings expectations

Revenue for the second quarter came in at $52.7 billion which was slightly below the analysts’ expectations of $52.9 billion. Earnings on the other hand, managed to be ahead of the consensus ($2.32 per share, adjusted, vs. $2.29).

Slowest revenue growth since 2016

What was being magnified by the financial news is the slower revenue growth of Microsoft. Revenue grew by a mere 2% for Q2, the slowest since 2016.

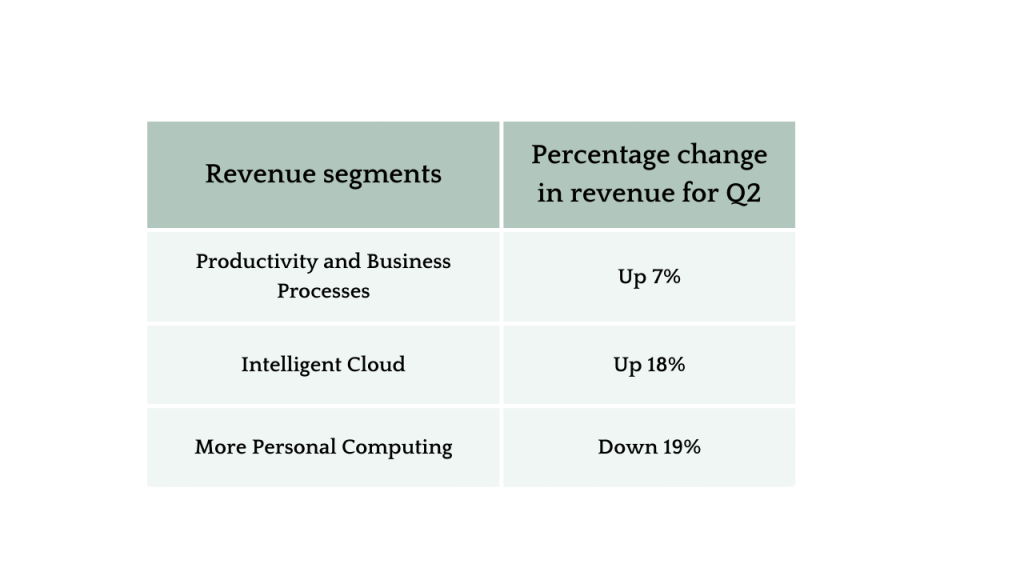

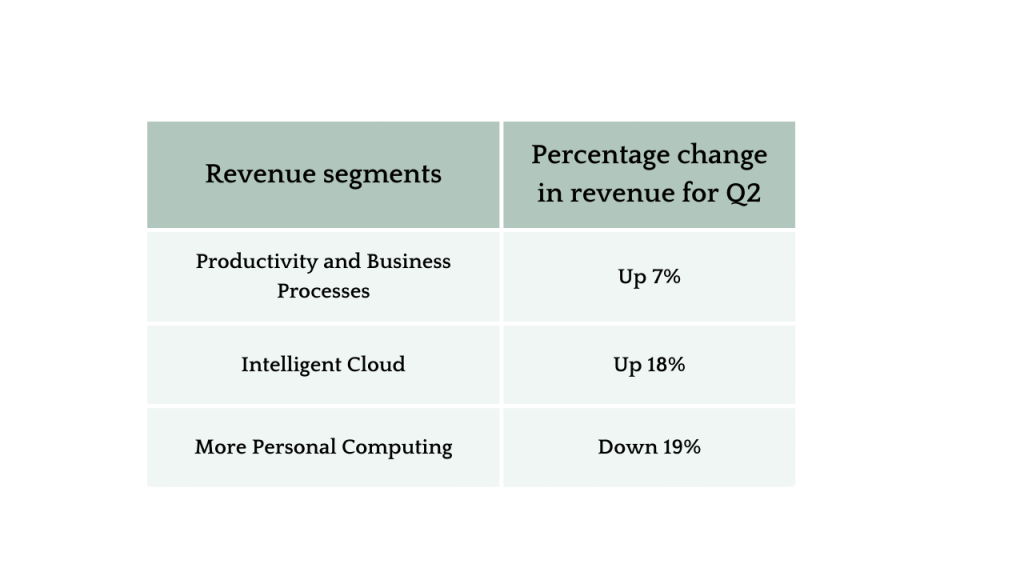

On closer look at the financials, the slower revenue growth is due to the 19% decline in revenue coming from More Personal Computing segment. This is offset by the 7% revenue growth from Productivity and Business Processes segment and 18% growth from Intelligent Cloud segment.

Source: Microsoft Earnings Release

More Personal Computing segment

What is driving the revenue decline for More Personal Computing segment is the reduction from Windows OEM and devices revenue. This could possibly be an effect of the renormalisation after the Covid outbreak in 2020 where we had unexpected surge in demand for the device purchases. As we resume our living with the Covid pandemic, it is reasonable to see the purchases levels renormalising. In fact, this is a phase which many other big tech companies are going through as well. Hence, in our opinion, though the numbers may seem alarming, we are of the view that this is a temporary setback for Microsoft.

Growth opportunities – Microsoft Azure (Cloud) and AI

The Intelligent Cloud segment continues to grow at a double digit of 18%. Despite a slowdown in growth as compared to previous quarters, it is no doubt a respectable and robust growth rate.

Microsoft has also been investing in AI where it recently announced that it made a multi-billion investment in ChatGPT-maker OpenAI. Previously, Microsoft had also acquired Nuance, a leader in conversational AI and ambient intelligence across industries including healthcare, financial services, retail and telecommunications.

As Satya Nadella, CEO of Microsoft says, “The next major wave of computing is being born, as the Microsoft Cloud turns the world’s most advanced AI models into a new computing platform.”

This presents another growth opportunity for Microsoft as it looks to integrate the AI capabilities with its current suite of product offerings.

Robust financials

Despite the slower revenue growth, Microsoft continue to deliver healthy margins where its net profit margin and operating income margin came in at 31% and 39% respectively. Profitability for Microsoft has been improving on a steady uptrend over the years.

Source: Microsoft

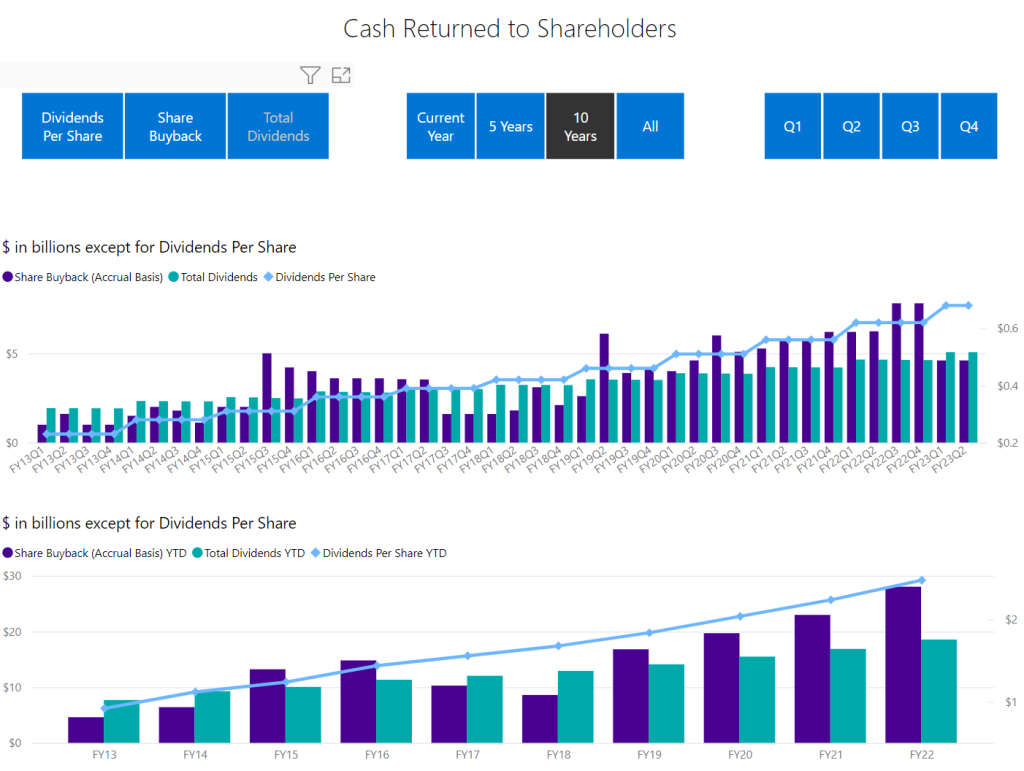

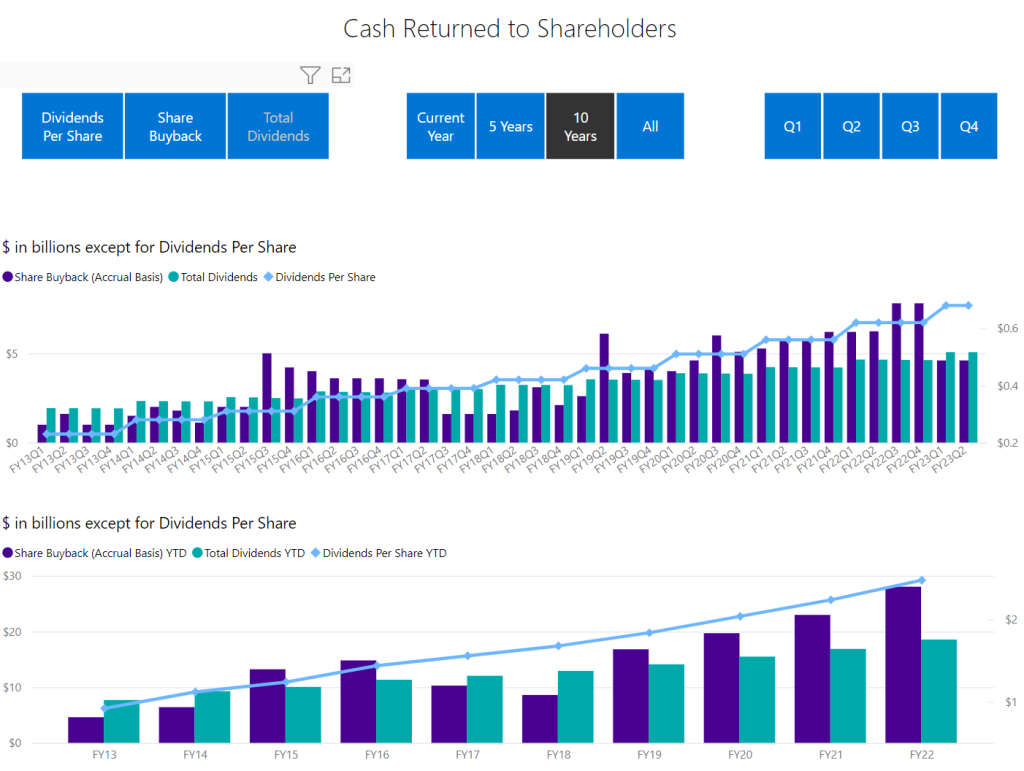

Capital return program

To sweeten things up, investors should also be pleased to know that over the years, Microsoft has been embarking on shareholder-friendly policies such as share buyback to return capital to its shareholders. This in turn boosts the share price and is a testament to the robust cash pile of Microsoft.

Source: Microsoft

Concluding thoughts

While we are facing lacklustre economic outlook, the good news is that all businesses are facing similar challenges. However, only quality businesses with robust balance sheet and healthy profitability would be able to overcome the economic headwinds and prove themselves relevant by riding on the strong secular trends. We believe that Microsoft is one such example. Microsoft has a diverse range of products and services which continues to stay relevant among consumers and with the strong financials, Microsoft can tap on their organic cash to make investments in developing new technologies to sharpen its competitive advantage.

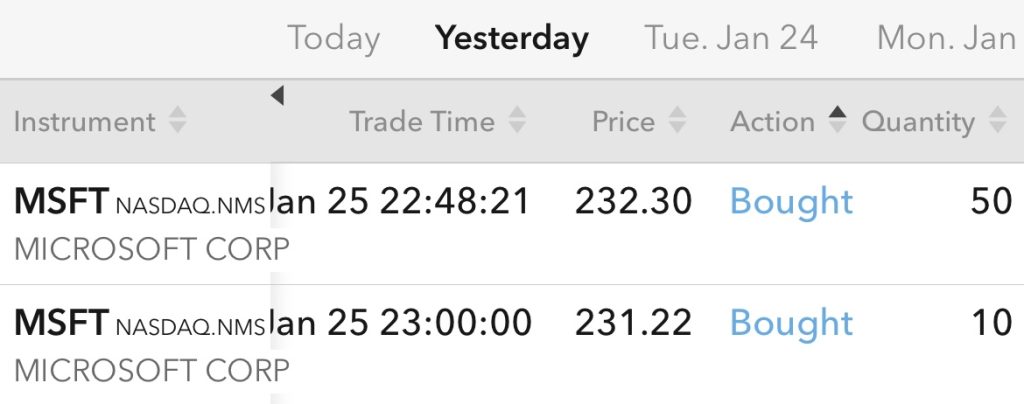

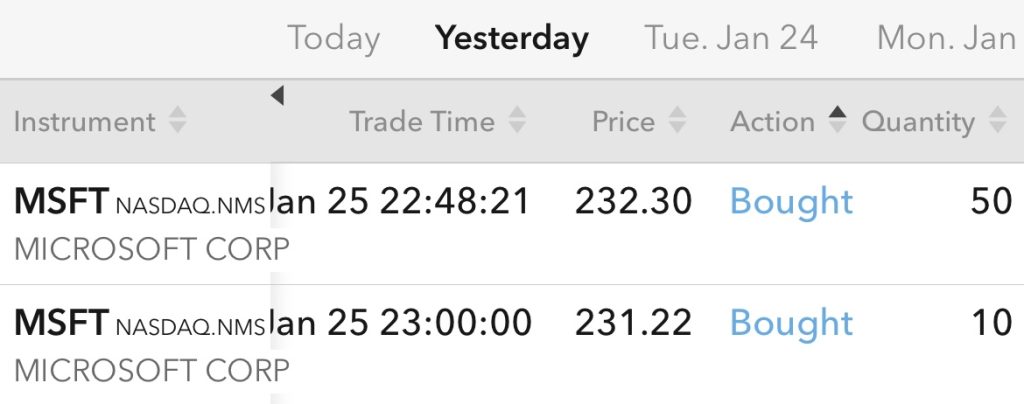

As such, we also took the opportunity to buy into more Microsoft shares.

Screenshot of recent purchase of MSFT shares

In the short term, businesses may continue to face temporary headwinds from the slower economic growth. What matters for investors is to always look at the bigger picture instead of focusing on the temporary, short-term events. These temporary headwinds are in fact, opportunities for investors to buy quality stocks at bargain prices.

About Hazelle

Chief trainer of The Moneyball Investors Playbook program and founder of The Joyful Investors, a financial education firm that seeks to help avid investors learn to invest better and make the journey a joyful one. I graduated with a first class honors in Bachelor of Accountancy from Nanyang Technological University (NTU) and started my auditing career in one of the Big Four. I believe that once we know how to build our wealth sustainably, we can then live our best lives ever.

Important Information

This document is for information only and does not constitute an offer or solicitation nor be construed as a recommendation to buy or sell any of the investments mentioned. Neither The Joyful Investors Pte. Ltd. (“The Joyful Investors”) nor any of its officers or employees accepts any liability whatsoever for any loss arising from any use of this publication or its contents. The views expressed are solely the opinions of the author as of the date of this document and are subject to change based on market and other conditions.

The information provided regarding any individual securities is not intended to be used to form any basis upon which an investment decision is to be made. The information contained in this document, including any data, projections and underlying assumptions are based upon certain assumptions and analysis of information available as at the date of this document and reflects prevailing conditions, all of which are accordingly subject to change at any time without notice and The Joyful Investors is under no obligation to notify you of any of these changes.

· · ·

Have you enjoyed this article? We’d be grateful if you would share this useful content to your friends who may benefit from it as well.