Hazelle

in Memos & Musings · 6 min read

As we enter into a new year, are you thinking how you can invest smarter in 2023? Here are 5 tips that we have compiled for you!

1. Stay humble and diversify

The first tip is to stay humble and diversify! How you can do so is to first acknowledge that you do not know any company that much where it is enough for you to risk too much. Even if you think you have already done a lot of research.

Ken Fisher often calls the stock market, The Great Humiliator. Bear markets like the one we are having now can cause a lot of emotional damage to many investors for a long time.

Credits: thestreet.com

The way to stay humble is to not over concentrate your positions until you have 3 or less positions because anything can happen to a company. Many investors have taken a dent in their portfolio because they made outsized bets on just 1 or 2 positions.

Of course, we have renowned investors like Mohnish Pabrai and many others who are known to only have a few positions at any point in time. But sometimes they can do so because they may know things that we do not know of. Most of us do not have the informational edge and we are better off by being more diversified.

Hence ideally most retail investors should seek to have positions in at least 10 stocks or more and no single holding should make up more than 25% of the portfolio, even if you think that you understand the company really well.

For us, The Joyful Investors, we tend to have 15-20 positions at any point in time, spread across the 3 markets that we invest in, U.S., China and Singapore.

You see, sometimes doing well can be a curse. Whether in life, in our career or in the stock markets. It starts seducing us into thinking that we are invincible and we start making bigger bets.

When that happens, we can remind ourselves that we are not as great as we think. And probably there was some element of luck involved as well. Take a look to see if it is time to take some profits from an overextended run in the markets and raise cash, especially in a time you think you need it less.

2. Don’t be fooled by averages

It is probably a well known fact that the S&P 500 delivers an average annual return of 10% based on historical performance. However there are good years and there are bad years.

Most beginners are sold to this fact thinking that their investments can generally compound at 10% each year. However, a lot actually depends on whether you have a bull or bear market in your initial years of investing. If you happen to invest in bear markets, worse than average performance is definitely possible in the earlier years.

One reason why some of us are afraid of the bear markets is because if let’s say your portfolio is down by 50%, say from $10k to $5k, then to breakeven, we need 100% return. Since the U.S. markets are known to deliver 10% a year, you may think that you need close to 10 years with a compounded effect to make your money back?

But that’s not true!

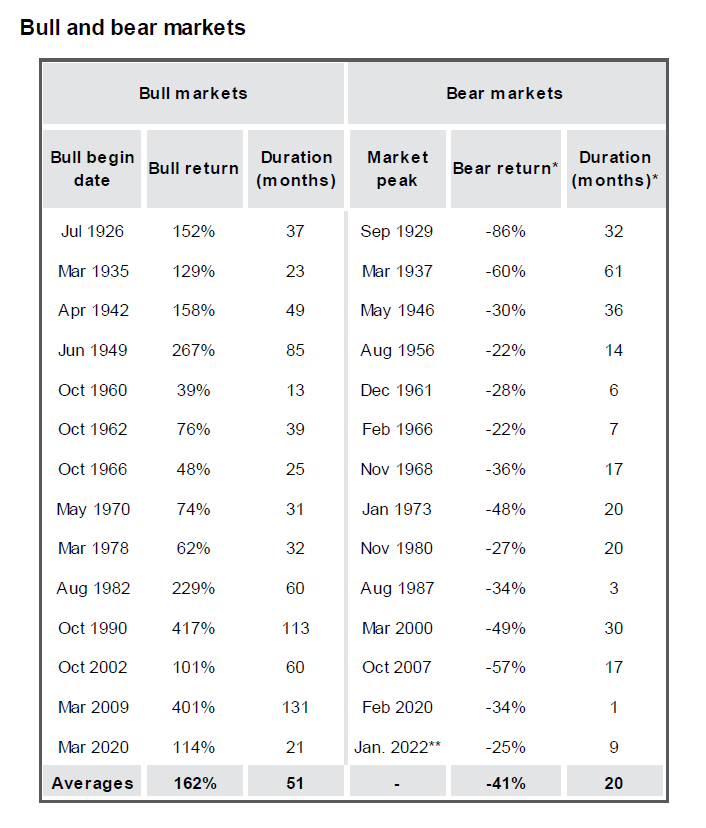

Bull market returns are way above average especially after a big bear market. This is to make up for the steep losses during the bear markets. Just like bear markets can come crashing down hard, stock prices can really fly in a bull market.

Source: JP Morgan

The point is to be able to see everything in entirety so that you do not get too upset during a bear market nor be too overconfident during bull markets. Both good and bad times don’t last forever and you should also be pleased to know that bull markets last much longer than bear markets.

Therefore we do not have to get overly upset even though we are in a bear market and that’s how we can continue to invest joyfully with the long term picture in mind!

3. Don’t risk what you need with what you want

Always ensure that you only invest the cash that you have and can set aside for the long term. Do not leverage your positions because when you do so, when the market is down by 5%, you could be down by 10%. That’s how scary it can be!

Over the years we have heard of people who are unable to pay for their housing loan, renovation expenses or school fees because they assumed that by the time the money is needed, a tidy profit would have been made.

It might not really improve your life that much to earn the 10% to 30% return, but it may mean the world to you when you no longer have the money to pay for your housing or for your bank loan, which can result in financial ruin.

Let’s not mention specific examples here, but by now you probably have seen that many have lost their life savings and emergency funds because they simply risk all that they need for something they could have done without.

Only invest with the money that you can hold for the long term. Investments in equities need to have strong holding power. There are many investors who lost money in the stock markets not because they bought the wrong stocks, but because they had weak hands due to their financial circumstances. Weak hands would mean that because the money meant everything to them, it was easy for them to liquidate their shares due to fear of further losses.

4. Don’t compare your investment returns with others

As investors, naturally we are inclined to compare investment returns. Returns in itself are meaningless without the context in which it took place, which includes the risks or volatility associated with it.

You may have once envied the investment returns of investors who had astronomical returns in a single stock. But for some of these investors who had incredible returns in that period of time, they could well suffer from massive losses when the tide is out.

Stock markets are known to perform differently at different points in time. Hence, we also do not sneer at the performance of our fellow investors in an underperforming market because we may have it worse when the market that we invest in underperforms in the future.

Investment returns could also be a direct result of the investment objective. An example is for investors who are invested in our local Singapore markets, in particular REITs, they are probably in it more so for dividends. Hence a 4-5% yield is reasonable while they just leave their money idling there. For capital appreciation, perhaps better markets to look at would be the U.S. and China which may offer better upside generally.

Know your own game plan and investment objective and stick to it. In short, different strokes for different folks.

5. Level up your investment knowledge

Eventually you would want to get smarter with money and come to realize that money management and investing is something that is going to stay with you for a long time. Or rather, as long as you live! It pays well to learn more about it because nothing is free in this world.

When we are more grounded in our knowledge, we can become less problem-minded but more opportunity-minded as an investor. No markets are good or bad, it is your thinking that makes it so.

As you progress you will also come to understand that the market is less about bookish, theoretical knowledge but more so about the practical application in the stock markets and the investor psychology and behavior.

In the financial markets, it also helps to be an all-rounder just like in cricketing. If you have more tools at your disposal just like a cricketer can play different strokes based on the situation, you can maneuver more flexibly as per the mood of the market. The options market for example, is a great way when it comes to income generation and risk mitigation for investors if they learn how to do it correctly.

These are just some things that financial advisory may have no interest in advocating because there is no good money to be made. They are in the asset gathering business and they would much rather do so in the simplest way of dollar cost averaging via regular top ups. They would often have you thinking that buying an ETF or unit trust is simply the best thing, rather than doing fundamental analysis to pick individual stocks and that timing the market is futile and that technical analysis is not purposeful.

Before you get us wrong, we are not criticising them and we are not saying that they are a bad choice for investors. I just hope to bring forth the idea that as investors, we have to decide for ourselves which is more suitable for our individual situation.

If you are totally new to investing and like to get something going with a total hands-off approach, it is definitely a viable path to seek advisory service for a fee. On the other hand, if you do not wish to be paying a recurring fee for the rest of your life because you see investing as a long term endeavor, then you may consider taking the time to learn more about how to become a better and independent investor.

And that’s where you can start learning through bite-sized investing contents just like the ones that we produce over here on our YouTube and TikTok. From time to time we also keep you abreast of the latest market developments and our investing insights through our Telegram channel and Zoom sharing. All these are free resources for you to get started on your investing journey and make better decisions in the markets.

For those of you who wish to take further action to learn more, you are also free to join our upcoming workshops at a very nominal fee.

Let’s see how the market unfolds in 2023 and may you have a great year in the stock markets!

About Hazelle

Chief trainer of The Moneyball Investors Playbook program and founder of The Joyful Investors, a financial education firm that seeks to help avid investors learn to invest better and make the journey a joyful one. I graduated with a first class honors in Bachelor of Accountancy from Nanyang Technological University (NTU) and started my auditing career in one of the Big Four. I believe that once we know how to build our wealth sustainably, we can then live our best lives ever.

Important Information

This document is for information only and does not constitute an offer or solicitation nor be construed as a recommendation to buy or sell any of the investments mentioned. Neither The Joyful Investors Pte. Ltd. (“The Joyful Investors”) nor any of its officers or employees accepts any liability whatsoever for any loss arising from any use of this publication or its contents. The views expressed are solely the opinions of the author as of the date of this document and are subject to change based on market and other conditions.

The information provided regarding any individual securities is not intended to be used to form any basis upon which an investment decision is to be made. The information contained in this document, including any data, projections and underlying assumptions are based upon certain assumptions and analysis of information available as at the date of this document and reflects prevailing conditions, all of which are accordingly subject to change at any time without notice and The Joyful Investors is under no obligation to notify you of any of these changes.

· · ·

Have you enjoyed this article? We’d be grateful if you would share this useful content to your friends who may benefit from it as well.