Hazelle

in Memos & Musings · 3 min read

About a week ago, I shared in one of my live sharing sessions on Zoom on the inversion of the yield curves. Here are the main points I talked about.

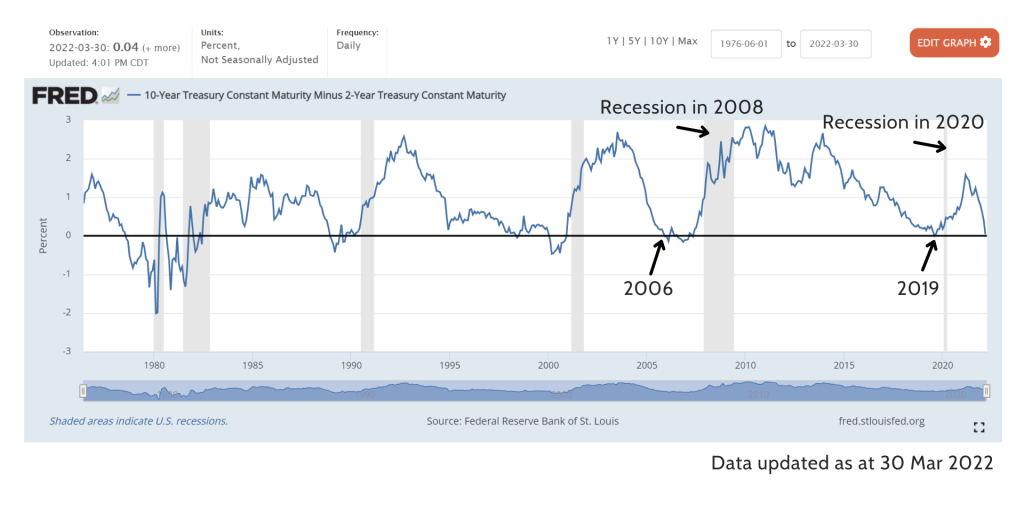

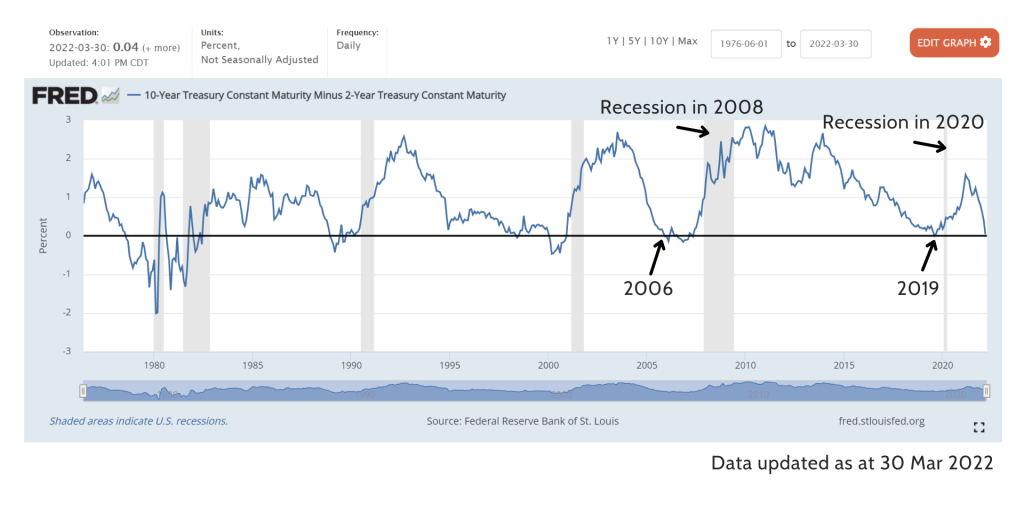

I shared that the spread between the 10Y and 2Y treasury yield was one of the indicators I was looking at. It has proven to be a rather good indicator for a possible recession as it had previously predicted the past recessions. How it works is that historically, economic recessions occur when the spread between the 10-year yield and the 2-year yield drops below zero.

The reason why a negative spread is undesirable is because the yield for a longer time period should generally be higher than the yield of a shorter time period to compensate taking up higher risks for the longer holding period. Hence generally under normal economic conditions, the 10Y yield minus off the 2Y yield should generally be positive.

The spread has dipped below zero briefly, is a recession coming?

Understand that the 10Y-2Y Spread on Treasury Yield is a leading indicator. That means even if today the spread drops below zero, recession does not have to happen immediately. It may take some time before a recession happens based on how it has played out for the previous recessions.

Closing thoughts

Regardless of whether a recession is imminent, our role as an investor is to learn how to navigate the markets based on what Mr Markets throw to us. It is perhaps more worthwhile to spend our time learning strategies to manage our investments under various kind of market conditions than to spend time panicking about a recession.

About Hazelle

Chief trainer of The Moneyball Investors Playbook program and founder of The Joyful Investors, a financial education firm that seeks to help avid investors learn to invest better and make the journey a joyful one. I graduated with a first class honors in Bachelor of Accountancy from Nanyang Technological University (NTU) and started my auditing career in one of the Big Four. I believe that once we know how to build our wealth sustainably, we can then live our best lives ever.

Important Information

This document is for information only and does not constitute an offer or solicitation nor be construed as a recommendation to buy or sell any of the investments mentioned. Neither The Joyful Investors Pte. Ltd. (“The Joyful Investors”) nor any of its officers or employees accepts any liability whatsoever for any loss arising from any use of this publication or its contents. The views expressed are solely the opinions of the author as of the date of this document and are subject to change based on market and other conditions.

The information provided regarding any individual securities is not intended to be used to form any basis upon which an investment decision is to be made. The information contained in this document, including any data, projections and underlying assumptions are based upon certain assumptions and analysis of information available as at the date of this document and reflects prevailing conditions, all of which are accordingly subject to change at any time without notice and The Joyful Investors is under no obligation to notify you of any of these changes.

· · ·

Have you enjoyed this article? We’d be grateful if you would share this useful content to your friends who may benefit from it as well.