Kathy

in Memos & Musings · 2 min read

Are geopolitical crises investable?

The ongoing crisis in Ukraine is top of mind for some investors and we have seen back and forth headlines surrounding the possibility of a Russian invasion on Ukraine. So how should we position our portfolio accordingly?

Understand what is at risk and learn from history

Firstly we take a look at the context where things are happening. The global indices have minute exposure to Russia and none to Ukraine. Russia only makes up 0.4% of the global stock market measured by the MSCI AC World Index.

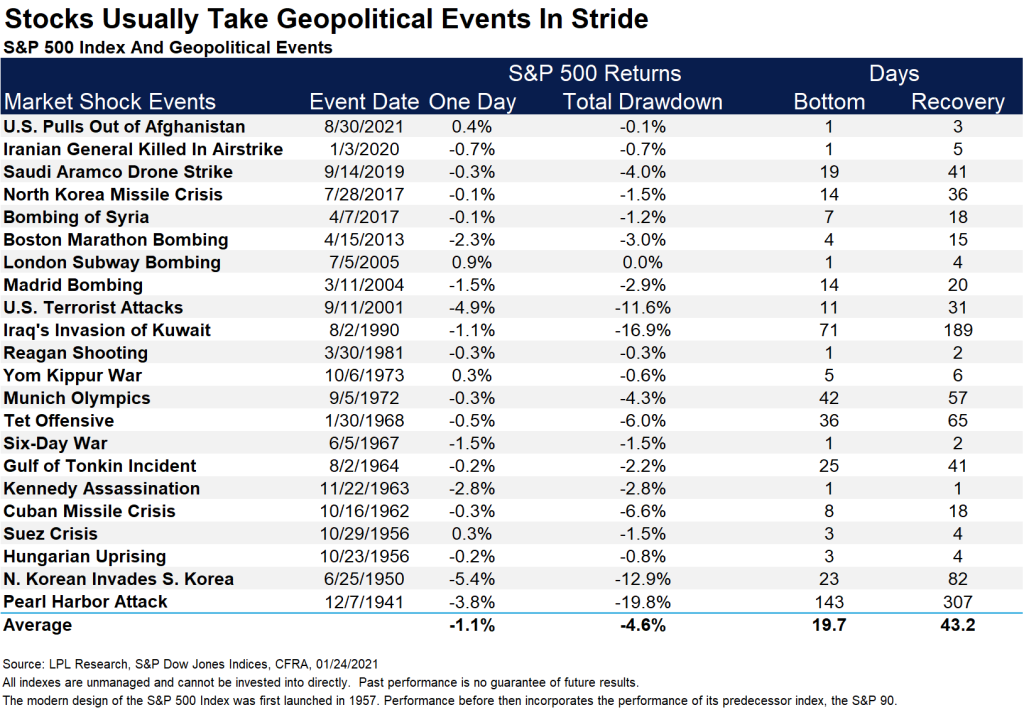

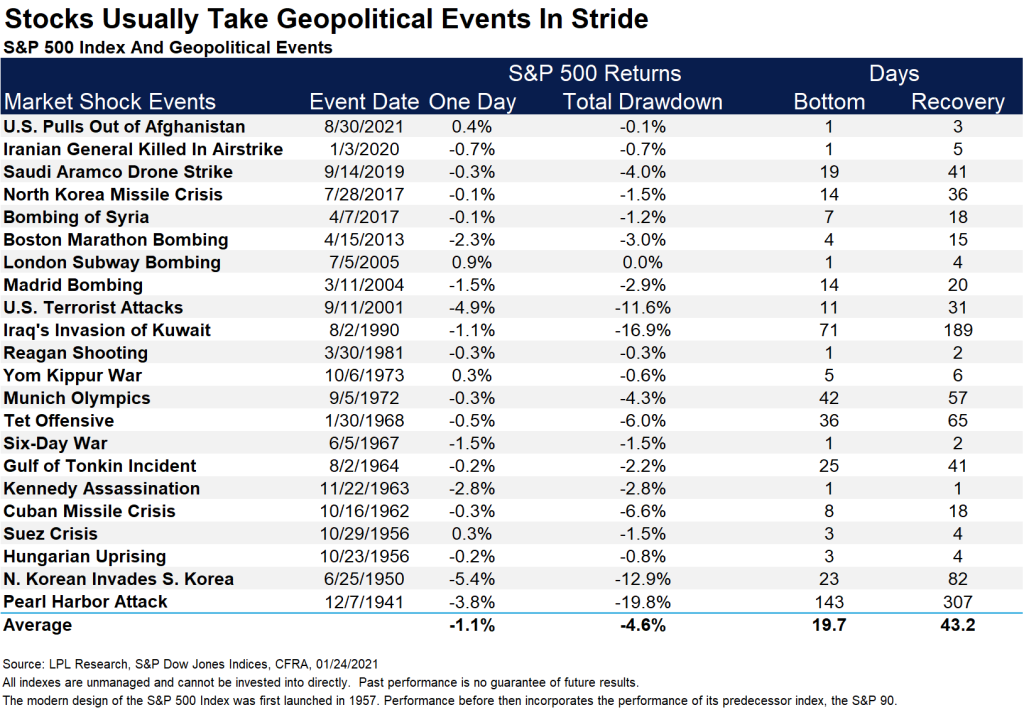

If history is any guide, the US stock market reacts with little or no measurable impact for an investor who is reasonably diversified during past incidents involving Russia. Most recently in 2014, the annexation of Crimea from Ukraine saw the S&P 500 dip less than 2% on the day it happened and rebound at least partially within a week. Zooming out in perspective, such incidents are just a small blip on the charts.

Sanctions to Russia will also not have much of an impact on the U.S. which is mainly agricultural. If anything, it would be the energy or commodities prices which would already have been baked in by now.

What’s the bottom line?

Simply put, events are only as important as how much they can affect the fundamentals of the stocks that we are invested in. Always ask yourself if any event is going to affect the investment thesis of the company that you believe in. If you are invested in. For example ask yourself how will this event eventually impact the earnings of your stock holdings, say Apple, Amazon, Nike or Netflix? It doesn’t take an analyst or number crunching exercise to derive answers to such questions.

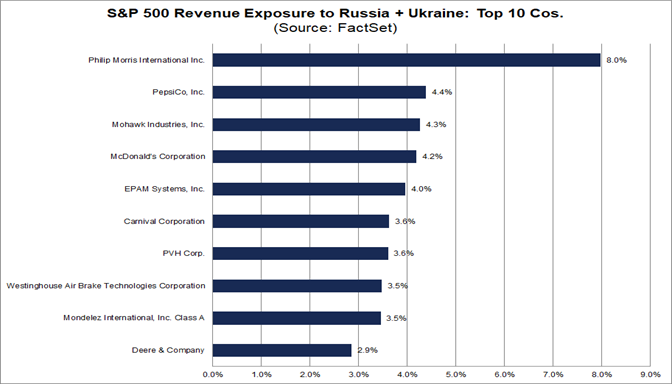

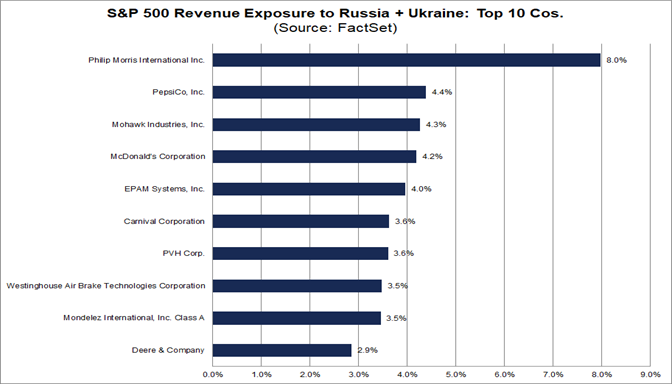

The majority of the S&P 500 companies overall have little revenue exposure to Russia and Ukraine. The combined revenue exposure of the S&P 500 to Russia and Ukraine is about 1%. Even for the top 10 companies in the S&P 500 that have the highest combined revenue exposure to Russia and Ukraine, their exposure are not particularly worrying. (with the exception for Philip Morris)

In the short term some panic selling is to be expected from jittery investors reading doom and gloom news. But we are of the opinion that well-diversified investors focused on the U.S. markets do not need to take much action to protect their portfolios from the geopolitical tensions tied to the current potential invasion in Ukraine.

About Kathy

Co-Founder of The Joyful Investors and Co-CIO of InvestingNote Portfolio. I graduated with a degree in Economics in National University of Singapore (NUS). My previous experience with traders at the Merrill Lynch enable me to realize many counter-intuitive truths about how the financial markets work and to uncover the challenges faced by many new investors. Investing can be astoundingly simple, and my goal is to make financial education accessible and easy to understand for everyone.

Important Information

This document is for information only and does not constitute an offer or solicitation nor be construed as a recommendation to buy or sell any of the investments mentioned. Neither The Joyful Investors Pte. Ltd. (“The Joyful Investors”) nor any of its officers or employees accepts any liability whatsoever for any loss arising from any use of this publication or its contents. The views expressed are solely the opinions of the author as of the date of this document and are subject to change based on market and other conditions.

The information provided regarding any individual securities is not intended to be used to form any basis upon which an investment decision is to be made. The information contained in this document, including any data, projections and underlying assumptions are based upon certain assumptions and analysis of information available as at the date of this document and reflects prevailing conditions, all of which are accordingly subject to change at any time without notice and The Joyful Investors is under no obligation to notify you of any of these changes.

· · ·

Have you enjoyed this article? We’d be grateful if you would share this useful content to your friends who may benefit from it as well.