Kathy

in Memos & Musings · 5 min read

Above: A photo of Ukraine before the Russian invasion in February 2022.

What’s going on in the markets?

Russian President Vladimir Putin has launched a full-scale invasion of Ukraine. Safe haven assets like gold and US Treasuries have rallied while equities fell sharply. Geopolitical events of such often get investors on the edge of their seats. Wars are never a good thing and as far as financial markets are concerned, they do have a short term impact on the market sentiments.

It is hard to predict how the crisis is going to unfold. Even the politicians or military leaders are uncertain themselves. The good news is, we don’t have to be certain about how things will develop in order to be a successful investor. The caveat is that we have done the necessary as an investor to be buying only good stocks that are fundamentally sound and to have a long investment time horizon. These are the things that will improve your odds for your battle in the financial markets.

A cloud of uncertainty for investors

This morning, I was scrolling through my newsfeed on Facebook and saw some investors remarking that financial markets were rallying on the invasion news and were wondering why. For some investors, they are either staying out or hesitating to add to their positions the last couple of weeks because they only want to do so when they are sure that the war is not going to start or when it ends. For some others, they might have sold in fear upon the invasion news and that things should only go downhill from here on.

At the US session open yesterday, Nasdaq was down by more than 3%. At the close QQQ rallied up by more than 3%, which allows it to hover just above bear market territory. The market staged a great comeback despite the start of the invasion. We can surely expect more volatility in the coming days as the events can just unfold unexpectedly in any direction. But what I am reading here is that perhaps one of the worst scenarios has been priced in since the start of the hostilities (barring the possibility of a nuclear war of course) and the market participants are now ready to move forward and become risk on as it is now a certain event and stocks are being priced in with a good discount. That is why it is important not to panic at a loss in the wake of such news as often we will not be able to get back in fast enough for the subsequent rally.

As long as the current situation stays contained and does not escalate further where more foreign troops are involved, there should be minimal spillover effects into the global markets.

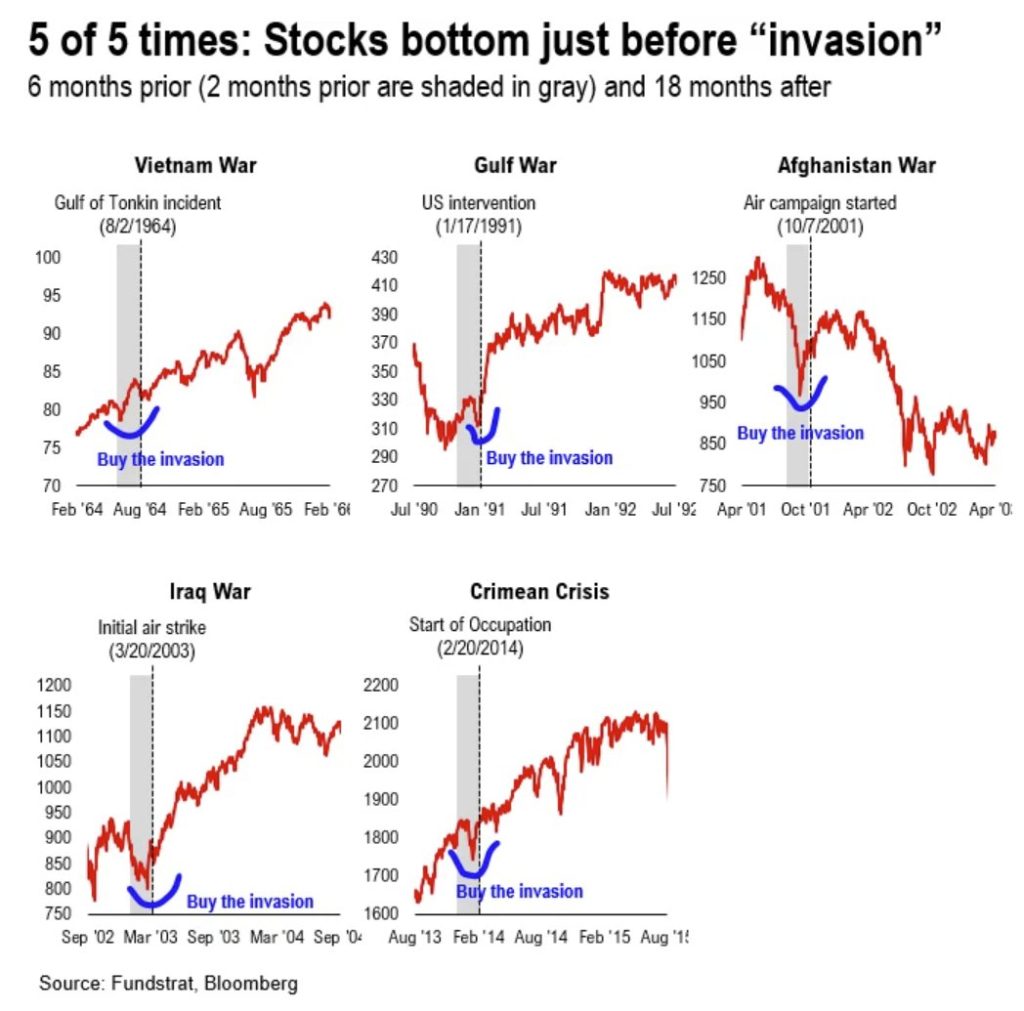

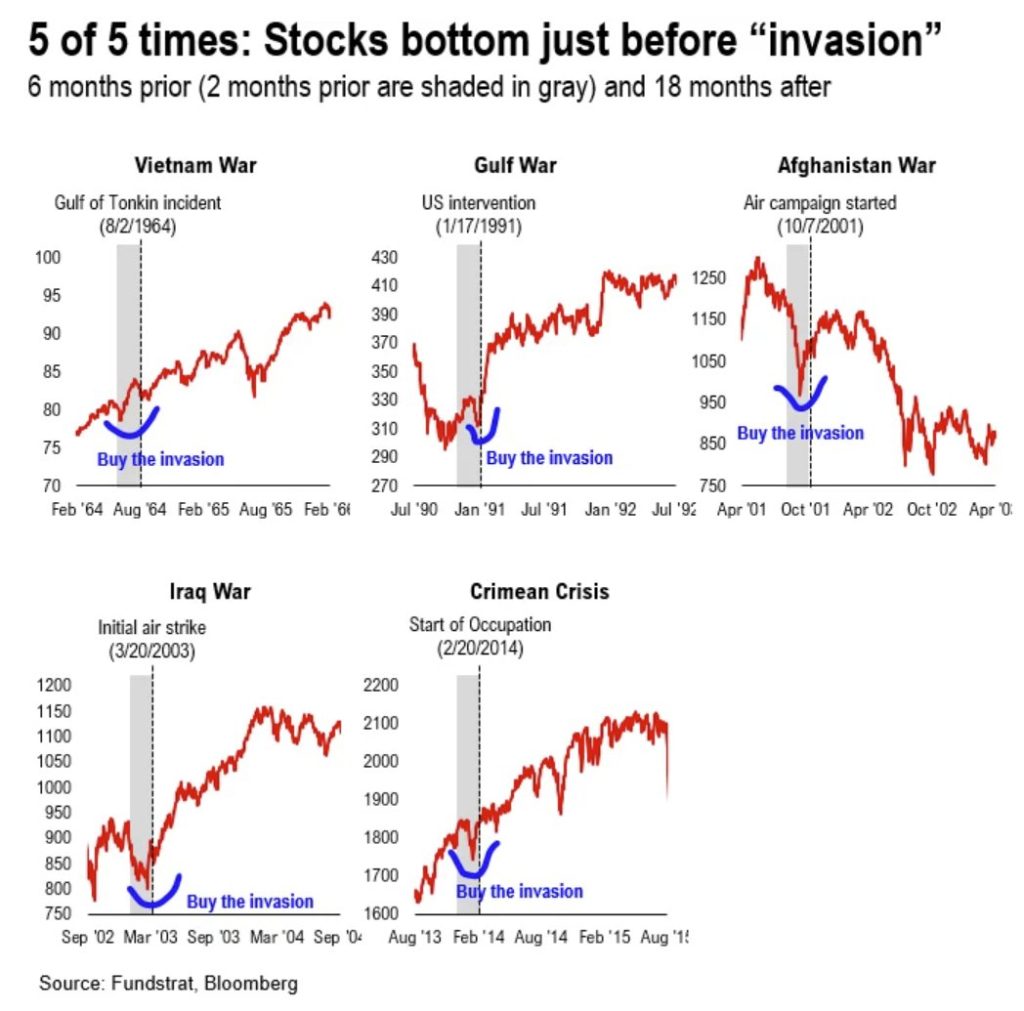

What we did and takeaway

We bought the invasion and took long positions in QQQ, an ETF that tracks the Nasdaq 100 index, at $326.00 last night as we believe the broad tech sector now presents a good long term buy for our Moneyball Investing Portfolio. Much of the worst possible scenarios should have been reflected in the stock prices and the peak of market fear could well be behind us. (See below chart)

Perhaps one of the best explanations for the rally is that the market is forward looking as always. Understand that the market does not have to wait for things to be clear or for the war to end in order to rally back up.

The market has been pricing in a war-like scenario the last couple of days. Initially there will be a sell-off leading to the invasion. But what happens soon enough, people will start to ask themselves how does all this affect the bottom-line of the companies they are invested in. This is why normally the market bottoms close to the actual invasion as more downside risks or future unknowns are now at a minimum to investors. Majority of the investors simply don’t like uncertainty and uncertainty is our friend when managed well.

And as they always say, time in the market is much more important than timing the market. While the short term impact on our portfolio is negative, the longer term outlook for markets remains bright. Fundamentally, this ongoing conflict has very limited impact on earnings and balance sheets of the developed markets corporates in the US market that we are invested in.

If you have only just begun investing, the current drawdowns may seem fearful. You are probably asking yourself why good companies are 20-30% off from their highs such as Adobe and Amazon. You might also be kicking yourself in the foot and thinking that you would be so much better by NOT learning to invest. I know how it feels, because I have been through all that many years ago.

But you know what’s the truth? For those that have yet to invest, they are unlikely to do so now anyway, and they will not be the ones that are going to enjoy the ride up when these sound stocks eventually go back to their ATHs (all-time highs). In the short term, the stock prices of these companies are divorced from their real worth. The stock market is a weighing machine only in the long run. In the short run, it is simply a voting machine of the collective emotions of the market participants.

You will eventually come to understand that it is a rite of passage that you have to learn to go through as an investor.

About Kathy

Co-Founder of The Joyful Investors and Co-CIO of InvestingNote Portfolio. I graduated with a degree in Economics in National University of Singapore (NUS). My previous experience with traders at the Merrill Lynch enable me to realize many counter-intuitive truths about how the financial markets work and to uncover the challenges faced by many new investors. Investing can be astoundingly simple, and my goal is to make financial education accessible and easy to understand for everyone.

Important Information

This document is for information only and does not constitute an offer or solicitation nor be construed as a recommendation to buy or sell any of the investments mentioned. Neither The Joyful Investors Pte. Ltd. (“The Joyful Investors”) nor any of its officers or employees accepts any liability whatsoever for any loss arising from any use of this publication or its contents. The views expressed are solely the opinions of the author as of the date of this document and are subject to change based on market and other conditions.

The information provided regarding any individual securities is not intended to be used to form any basis upon which an investment decision is to be made. The information contained in this document, including any data, projections and underlying assumptions are based upon certain assumptions and analysis of information available as at the date of this document and reflects prevailing conditions, all of which are accordingly subject to change at any time without notice and The Joyful Investors is under no obligation to notify you of any of these changes.

· · ·

Have you enjoyed this article? We’d be grateful if you would share this useful content to your friends who may benefit from it as well.