Last Updated: January 31, 2025

Have you ever wondered what to do with the extra money you set aside each month—besides just letting it sit in your bank account? What if that money could work for you, growing over time and even paying you regularly? That’s where dividend investing comes in. It’s a way to build passive income—money that keeps flowing in, even when you’re not actively working. And who wouldn’t love the idea of one day replacing their salary with income from investments? Let’s dive into how dividends can help you get there!

What is dividend investing?

Most of us have just heard of the term investing in general which basically means that when we want to invest in something, we are believing that it will appreciate in value or worth more than what we bought it for, so that someday we may sell it at a profit. Most people who do this are looking at what we call capital appreciation. It is just like you attempting to buy a million dollar property looking to sell it for $1.2mil in say 5 years later. The $200k additional is capital appreciation.

On the other hand, some property owners may be less particular about capital appreciation but more focused on rental yield that they can collect every other month. These investors are seeking more of yield rather than price appreciation. In the financial markets, we term this as income investing or dividend investing.

Basically the process of dividend investing is very similar to growing your own cherry tomato plant or your own Kangkong if you have applied for the seeds from NParks before! Whenever your plant reaches the harvest stage, you get to enjoy the fruits or the vegetables. Once you harvest the plant, you leave the plant to grow up again before the next harvest.

If you like that idea of being able to regularly enjoy the ‘fruits of your labour’, you would probably love the idea of dividend investing. In dividend investing, you invest in stocks which have shown the ability to distribute regular dividends, usually in the frequency of 2 times a year or 4 times a year. Dividends can be in the form of cash distributions or distributions of additional shares of the company.

For the purpose of income investing, we are invested in the Singapore markets – the Singapore REITs in particular. REITs stand for real estate investment trusts.

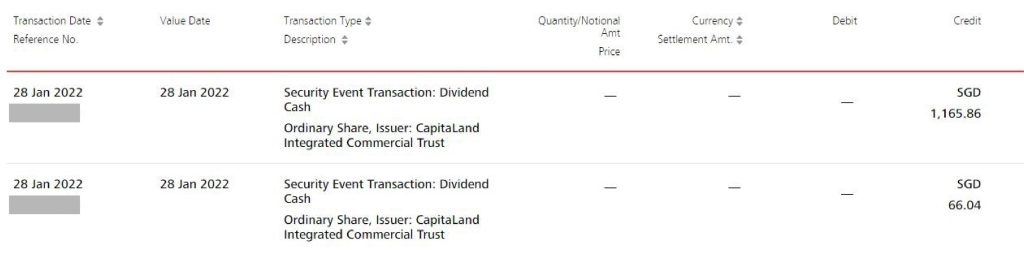

Here is a screenshot of the dividends we receive from 1 of the stocks in our REITs portfolio that we do hold, which is CapitaLand Integrated Commercial Trust.

So what is this REIT that we are paid dividends for?

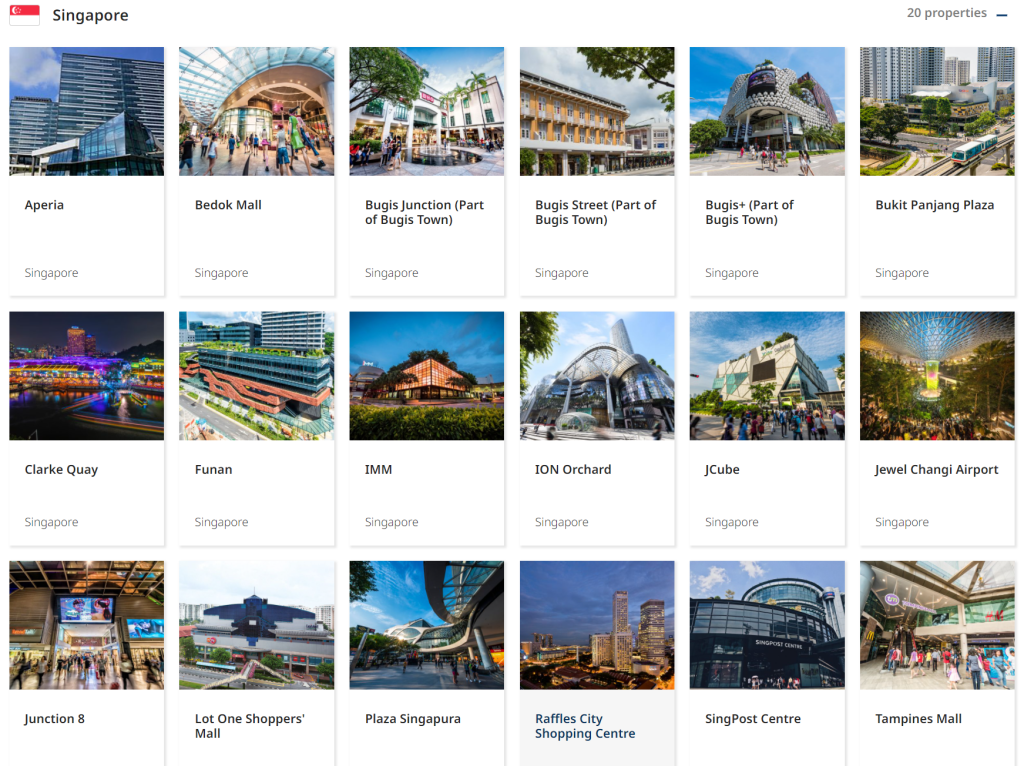

This is a REIT in fact most of us will be very familiar with. Singaporeans love to go shopping malls. Some of the malls that this REIT owns are Plaza Singapura, Tampines Mall, West Gate and Bugis Junction, just to name a few of them. Other than going shopping malls to shop, you can actually also go shopping for shopping malls and make money from the shopping malls that made money from you previously.

How cool is that right! Why not aim to collect more dividends from them than what you spend at their malls?

CapitaLand Integrated Commercial Trust (CICT) is the first and largest real estate investment trust listed on Singapore Exchange. CICT owns and invests in quality income-producing assets primarily used for commercial (including retail and/or office) purposes, located predominantly in Singapore. It is managed by CapitaLand Integrated Commercial Trust Management Limited, which is a wholly owned subsidiary of Singapore-listed CapitaLand Limited, one of Asia’s largest diversified real estate groups.

Screenshot from CapitaLand.com

If we like to find out our past dividends that were given for any particular REIT, we may also go to SGX website to see how much dividends have been paid based on the number of units we own. So from this, you can do the math and work out the dividend yield. Of course it varies slightly from each investor based on the entry price.

Key benefits of dividend investing in Singapore

You might have heard of people saying that if you want to invest for dividends, then you should focus on Singapore markets. But why is that so? Let’s explore some of the key benefits of dividend investing in Singapore.

1. Dividends are not taxable in Singapore

The first benefit is that dividends paid to shareholders by S-REITs and other Singapore companies are not taxable. This makes it really attractive and cost efficient for retail investors. In comparison, if you are investing in dividend aristocrats in the U.S, you will be subjected to a 30% withholding tax! The taxation rules vary from country to country, so do check out the taxation rates if you are thinking of investing in other countries for dividend stocks.

Let’s apply some numbers to a theoretical scenario and you will be able to see the difference.

Example:

You hold 10,000 shares of Company A. Company A declared dividend of 10 cents per share.

If the dividends are not taxable, you will receive the full $1,000 of dividends.

However, if you are taxed 30% on the dividends, the net take-home amount will be just $700.

Therefore, we prefer to focus on the Singapore stock markets when it comes to dividend investing as we get to keep our full dividend income.

Well, 30% may not sound a lot at first glance for some of you, but considering that the typical dividend yield on average is about 4%, a 30% reduction results in only 2.8% yield left for you to take home! Which means to say, you probably managed to only just slightly beat inflation, assuming average inflation rate of 2% a year. That doesn’t sound very impressive right? This is why we focus mainly on the Singapore REITs and the local banks for dividend investing.

2. S-REITs are required to distribute at least 90% of their taxable income to unitholders

The next advantage of investing in Singapore for dividends is that S-REITs are required to distribute at least 90% of their taxable income to unitholders if they want to qualify for tax transparency treatment by IRAS. This works in favour for investors who are investing in S-REITs for the dividends as it kind of helps investors ‘maximise’ the distributions we are going to get from the S-REITs.

What are the main goals that dividend investors are looking to achieve?

Now that you know more about dividend investing, what should our end goal be? Or put it this way, what objectives are investors looking to achieve when constructing a dividend portfolio? We would generally categorise into 3 different objectives.

The first objective is to retire and live completely on dividends. If you are also thinking of living off dividends, catch our upcoming post as we share how much you would ideally require to be able to achieve that.

The second is that some investors just like the idea of receiving regular cash payouts. While we would generally be able to get a higher investment return from growth stocks over dividend stocks, for some investors, they just value the cash inflows more than the paper gains. This is also one of the main reasons why there are some investors who prefer dividend investing over growth investing.

Lastly, there is another group of investors who allocate a portion of their funds to do dividend investing and that portion represents the defensive part of their overall investment portfolio. And for us, The Joyful Investors, we belong to this category. Dividend investing in the S-REITs provides us with some kind of reliability and stability in our portfolio, acting like the defenders of the soccer players lineup. If you wish to understand more about our methodology for portfolio construction, check out our blog post here.

The thing is though generally investors invest in dividend yielding stocks for the dividends, it does not necessarily mean that there will be no or little capital appreciation to enjoy. Typically for us, we want to be buying good REITs which give us 4-5% of yield. Anything less than 4% we will not be interested in. In fact we know some investors may be looking at at least 5%. That’s nothing wrong as well. It’s just that occasionally we are cool with 4% because some of the very good REITs may not have so high a yield, which they make up with capital appreciation over the long run.

Over at TJI, we prefer to look at the broader picture. A slightly lower yield over the long term in return for longer term upside is fine for us. This is because for us, we invest in the dividend stocks not because we need this stream of income to be perpetual in the sense that some retirees would like to. But for us, dividend investing forms the defensive portion of our overall investment portfolio. REITs being cyclical, we may consider to offload them when they are at the top of their cycle and to hold as just cash or to be redeployed to other markets. To us it is more of over time, how much money it would make us in general and being the defensive portion of our portfolio during times when the growth stocks are not pulling their weights.

With that, hope that our sharing has provided you with more context on understanding dividend investing. Stay tuned as we will be releasing more blog posts on dividend investing soon! (P.S. next up would be on how big a portfolio you need to live completely on dividends)

Do also follow us on our Telegram channel as we post some of our trades on the Singapore REITs from time to time when there are good opportunities.