What Are The Core Principles Of

The Moneyball Investing Methodology?

We build our stocks portfolio pretty much the same way a football manager builds his team. Constructing an investment portfolio and putting together a football team share a lot more similarities than you might think. With the right types of players deployed in the right positions and doing what they need to do, you can build a winning team—or in our case, a winning portfolio.

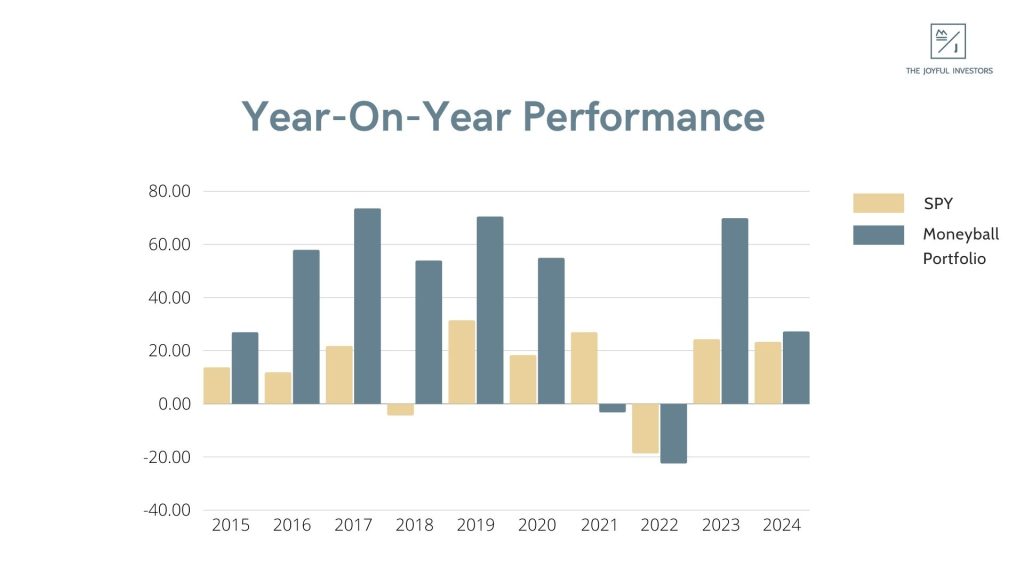

In this writeup, we’ll share how our unique “Moneyball Investing” approach has helped us beat the US and Singapore markets consistently by a fair margin for the past 10 years—delivering over 20% annualised returns on average, with more than a million dollars at work.

Let’s dive in.

The Moneyball Approach

Before we go on to explain our investing methodology, perhaps we should first share what the Moneyball approach is about. It originated from Billy Beane, the general manager of the Oakland Athletics, who turned their fortune around to build a winning baseball team using statistics despite the constraint of a limited payroll. Such principles can well be applied to portfolio management too. While Billy Beane is looking to buy runs, as investors we are looking to make a good return on our capital.

The thesis is simple. We overweight good companies that are out of favour with the crowd and underweight the ones that have become too crowded.

We focus on:

- Identifying companies with significant potential for outperformance

- Determining the optimal time to buy or sell

- Exploiting market inefficiencies through stocks (or their derivatives)

Scouting for the Right Players: It Starts With Data

Great teams don’t just find players—they scout them with data.

Likewise, we curate a watchlist of high-quality, large-cap stocks that show strong signals of potential future outperformance. We avoid being swayed by narratives or hype. Instead of grand stories, we look at hard metrics: sales growth, market share, competitive positioning. We don’t construct complex 10-year DCF models with guesswork. We favour qualitative reasoning that’s grounded and practical.

When you’re confident in your data and thesis, it’s easier to stay the course—and never panic-sell or slap on stop-losses during volatility.

Forming the Line-Up: Asset Allocation in Action

Every match has a line-up. And so does every portfolio.

In our methodology, asset allocation is like team selection. Each market phase is like a different opponent—and we rotate our line-up accordingly. Here’s our football-inspired mental model:

🧤 Goalkeeper = Cash

The last line of defence. Cash bails us out in downturns and lets us seize opportunity during chaos. It’s your dry powder.

🛡️ Defenders = REITs

These are the stable, reliable players in your portfolio—high-quality REITs that provide income and cushion downside during market corrections.

⚙️ Midfielders = Options

Options give flexibility. They can bolster offence or reinforce defence depending on the strategy. Fast-paced and tactical—just like a strong midfield.

⚽ Forwards = Growth Stocks

These are your goal scorers—stocks with high capital gain potential. They must have a track record of strong performance and momentum to continue delivering.

Such a line-up isn’t cast in stone — rather, it serves as a mental model for how asset allocation works within our Moneyball investing approach. The exact number of players we deploy on the attacking or defending half will vary depending on market conditions, much like how formations in soccer shift based on the flow of the game.

That said, it’s important to remember that investing is an infinite game. There is no finish line. The objective isn’t to chase the highest possible returns in a single year by punting on extremely speculative stocks. Outsized, one-off gains are rarely sustainable over time. What matters more is staying consistently above average — and staying in the game, year after year.

In our soccer analogy, this means playing in a way that qualifies us for the Champions League season after season, rather than chasing an all-or-nothing strategy that may win us the trophy one year but risks relegation the next. That’s why, when it comes to asset allocation, we’re comfortable rotating into sectors that may only bear fruit a few quarters down the road. In the short term, it might drag on performance — but over time, we find ourselves duly rewarded.

Tactical Plans: When to Attack and When to Hold Back

Good players and a good formation are only half the story.

The real alpha comes from our tactical decisions: when to go offensive, when to stay balanced, when to defend. We rely on our proprietary technical analysis methods to read the state of play.

Just as a manager makes real-time decisions during a game, we:

- Scale into or out of positions based on opportunity

- Know how to respond when a stock rallies, stagnates, or pulls back

- Assign specific expectations to every asset class

The goal? Create a system where the whole is greater than the sum of its parts. Reduce volatility (goals conceded) while enhancing returns (goals scored).

Our Style of Play: Risk-First, Returns-Follow

The type of style often refers to the risk taking approach of the manager. Most football managers’ philosophies are about producing goals on offense. For our Moneyball investing philosophy, it is pretty much the opposite. We don’t chase alpha. We chase risk control—because once that’s in place, we believe the upside will take care of itself.

We mitigate risk by diversifying our portfolio across three key markets—namely the US, China, and Singapore—to uncover attractive investment opportunities and generate returns that are less correlated, yet still carry a positive expectancy. Beyond geographic diversification, we also operate across different time frames within the same market or industry as a form of dynamic risk management. As market conditions shift, we scale in or out of our positions accordingly. These are examples of our confidence-weighted mean reversion strategies, where position sizing is based on the attractiveness of the opportunity.

More importantly, our focus is on reducing drawdown risk. While diversification is a common and valid approach, we believe that when you truly know what you’re doing, you don’t need to constantly spread your bets across every asset class or sector. Instead, we aim to structure our portfolio to achieve lower beta (market exposure) while extracting higher alpha (excess returns).

We view risk not just as volatility, but as the opportunity cost of not growing your capital over time. If you’re able to generate meaningful returns—even in a flat or sideways market—you’re actually reducing your risk, because you’re optimizing capital productivity. That’s the real edge.

In short, our playing style is closely similar to the idea of Cholismo which is the footballing philosophy behind the success of Atletico de Madrid since 2012—tight defence and precise counterattacks— It’s principles are rooted in defensive solidity, a team nimble in both transitions, detailed tactical organisation, pragmatism, aggression, and an unwavering desire to win.

In football, the idea of the counter-attack is to absorb the opponent’s advances with tight defence, then launch a sudden offensive. This strategy takes advantage of the fact that opponents need time to transition from an attacking to a defensive shape—often leaving them disorganized and undermanned at the back. In that moment of weakness, the counter-attacking side gains both numerical and positional superiority.

Bringing this concept to Moneyball investing, our version of the “counter-attack” is about capturing quick and meaningful returns during periods of irrational selloffs, pricing anomalies, or temporary inefficiencies in the market. To do this, we focus on identifying specific technical setups in real-time—rather than relying on outdated metrics like the P/E ratio. The goal is to buy fundamentally sound companies when they are unloved by the crowd—beaten down by temporary negative headlines or sector-driven pressures, but not by long-term structural issues.

To exploit these windows of opportunity, it’s critical to keep a portion of our capital liquid. This dry powder allows us to strike when the opportunity arises. Often, this liquidity is created by taking profits off the table periodically. After all, the best time to raise cash is when you don’t urgently need to.

Most retail investors, on the other hand, are typically in a fully loaded state—100% invested at all times. This exposes them to the full brunt of market drawdowns, which can erode gains and disrupt compounding. Worse, they may be stuck sitting on paper losses. To avoid realizing those losses, they’re forced to stay committed to those positions—leaving no room to pivot into better opportunities. These recovery cycles can be long and painful, and we prefer not to be trapped in them.

One of the keys to our portfolio performance at The Joyful Investors lies in our ability to turn over working capital multiple times sustainably. This is only possible by minimizing both the risk and time it takes for our investment theses to play out. We operate like a casino—our high turnover, paired with a statistical edge, lets our advantage compound over time. In our Moneyball Investing methodology, we treat capital the way a merchandising business manages inventory: agile, opportunistic, and always positioned for the next high-probability move.

Antifragility: Thriving From Volatility

Antifragility is a concept introduced by Nassim Nicholas Taleb, describing people or organizations that not only survive disorder or setbacks—but actually thrive from them. No football team wins every single year, and no investment portfolio can consistently outperform its benchmark all the time. Given our specific investment philosophies, we don’t expect to deliver outperformance consistently, especially over shorter time frames—just like any other actively managed fund.

An antifragile portfolio doesn’t mean it’s immune to large drawdowns. In fact, the very nature of antifragility means it might experience more volatility—for the same reason it can deliver more home runs. The reality is, much like football strategy, no investment approach is ever foolproof. Regardless of how compelling the data looks or how high our conviction is, we can still be wrong at certain points.

The bigger question is: What happens after the Black Swan event? Does the portfolio come back stronger with outsized gains, or does it suffer irreparable damage? Can your team bounce back after a defeat? Losing a few games now and then is perfectly acceptable—as long as you’re still on track to win the league.

One core trait we’ve built into our portfolio through the Moneyball Investing methodology is exactly that—antifragility. It’s not just designed to survive volatility and disorder, but to thrive in it. Our systematic approach focuses on setups with high upside and limited downside. Our strategies often consist of either a large number of less-correlated positions, or even mutually exclusive trades—meaning it’s practically impossible to lose on all fronts simultaneously. Every time a crisis hits, our portfolio not only recovers, but improves and evolves.

If we can agree that markets will remain uncertain for years to come, then building an antifragile portfolio gives us the best shot at sustaining strong performance over the long run.

Conclusion: The Joyful Investors’ Moneyball Way

Moneyball Investing is not a gimmick—it’s a disciplined, tactical and data-driven approach that has proven itself through both bull and bear markets.

By thinking like a football manager, we:

- Scout overlooked opportunities

- Build diversified, dynamic lineups

- Execute with tactical precision

- Embrace volatility as our ally

The result? A portfolio that has outperformed historically, stays nimble in chaos, and compounds capital far more efficiently than the average retail approach.

Just like how every successful football team plays with a clear identity—be it high-pressing, counter-attacking, or possession-based—the same applies to investing. You need an investment identity. There are many strategies that can work, but without a clear framework or philosophy, most retail investors end up being directionless and reactive, often buying high and selling low.

At The Joyful Investors, our identity is clear: we combine data-driven discipline with tactical agility to seek high-probability opportunities while managing downside risk.

We don’t rely on hope. We rely on strategy. Welcome to the Joyful way of investing.

Year-On-Year performance of the Moneyball Portfolio