When we talk about Financial Independence Retire Early (FIRE), one frequently used rule of thumb for computing retirement spending is the 4% withdrawal rule. The 4% withdrawal rule can be used to calculate how big an investment portfolio you need to fund for retirement spending if you withdraw 4% a year from the investment portfolio during retirement years. Let’s find out how this rule works!

How does it work?

Here’s a short illustration.

Let’s say you need to spend $3k a month during your retirement years.

The projected annual expenses will be $3k x 12 = $36k.

Applying the 4% withdrawal rule, we take $36k divided by 4% to arrive at $900k. This means that you will need a $900k investment portfolio upon retirement to fund for your living expenses.

Subsequently for each year, the amount that you withdraw will be inflation-adjusted. Take for example if the inflation is 3%, then the amount you withdraw for the second year will be $36k x 1.03 = $37,080 and so on.

Wouldn't the investment portfolio run out of money?

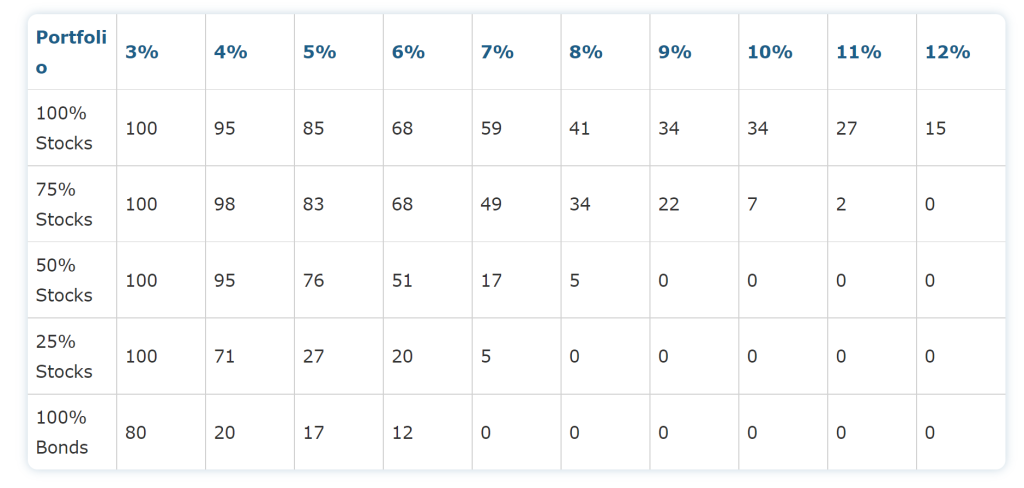

There have been studies and simulations conducted using historical stocks and bonds performances and they have shown that there is generally a higher chance that one would not run out of money using a 4% or lower withdrawal rate.

Source: thepoorswiss.com/trinity-study

Based on The Trinity study, it has been shown that for a 30-year retirement period, the chances of having sufficient funds to withdraw during the 30-year period can be as high as 95% for a 100% stocks portfolio.

The Trinity Study was conducted over a combination of investment portfolios across varying periods and withdrawal rates.

The mechanics behind this is that the investment portfolio will continue to grow while you are withdrawing from the portfolio to finance your expenses during the retirement years.

Just like an apple tree. We can pluck some apples from the tree to eat, but as long as the tree is still growing healthily, it will continue to bear more apples in time to come. But at the same time, we can’t pluck too many apples at one go, or else new apples can’t grow in time for our future consumption.

Limitations of the 4% withdrawal method

Nonetheless, there are some limitations for this 4% withdrawal rule that are less spoken about.

1. Withdrawing from the investment portfolio during a market downturn may not be the best idea for your investment returns.

This is because that will leave the portfolio with a smaller amount to compound when the market subsequently recovers. And we will be converting some of the unrealised losses to realised losses during the market downturn when we withdraw from the portfolio.

2. The conventional wisdom to hold a diversified portfolio made up of stocks and bonds does not always hold true.

For many years, it has been commonly advocated that investors should build a diversified portfolio made up of both stocks and bonds to reduce fluctuations. Likewise The Trinity Study was also conducted on different combinations of stocks and bonds.

The rationale behind this conventional wisdom is that equities and bonds are negatively correlated, which means that when equities do not do well, bonds do better and can cushion the downside fluctuations from equities.

However, based on the past 90 years of historical data compiled by Schroders, there have been periods where equities and bonds showcased both positive and negative correlation. In our current high interest rate environment, both equity and bond prices are depressed.

3. The safe withdrawal rate concept is built upon the assumption of a fixed spending pattern where we assume we will spend the same amount every month, which may not happen eventually.

4. The data used in The Trinity Study may be outdated. The first study was done using data up till 1995 and updated in 2011.

At the end of the day, we must learn to be more flexible as circumstances may change. We can use the 4% withdrawal rate as a benchmark to compute roughly how big a retirement portfolio we need but that would just give us a ballpark figure. We need to adapt to any changes in circumstances along the way. Or we could also use a withdrawal rate that is lower than 4% to provide some leeway.

How we are going to incorporate the 4% rule to plan for retirement spending

Taking into account the limitations of the 4% withdrawal method mentioned above, this is how we would like to allocate our wealth by retirement.

One of the luxuries of living in Singapore is that when it comes to investments, we have S-REITs which provide decent dividend yields and the dividend income is not taxable in Singapore.

Therefore, by retirement, we would like to construct a S-REITs portfolio where the dividends distributed would be sufficient to cover the living expenses. We have to do some calculations to determine how big the REITs portfolio has to be in order to support our living expenses during retirement. If you want to learn more, check out this video where we explain in detail.

Then, it is also important that we keep some cash for emergency uses (e.g. medical-related events). Or say if there is a sudden market downturn just like during COVID times where the REITs lower their dividend payout which we might then need to tap on this pool of cash to cover our spending.

For the remaining portion of money that we don’t need for the next 5 to 10 years of consumption, we would then allocate them into the U.S stocks portfolio. This is the pool of funds which we do not intend to withdraw in the near term so that the capital to continue to compound. Or in the event if there is a short term pullback in the U.S markets, we do not want to realise the paper losses because it would slow down the compounding effect as shared above.

Concluding note

To sum it up, we would use the 4% withdrawal rule to gain an understanding of roughly how much money we need to have by retirement.

Then when it comes to the actual allocation and execution, we would tap on the consistent and reliable dividends distribution of S-REITs to finance our living expenses during retirement.